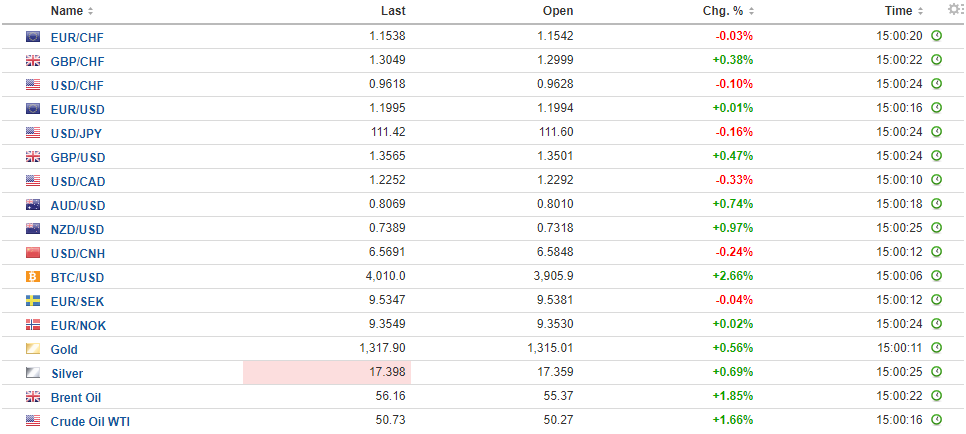

Swiss FrancThe Euro has fallen by 0.01% to 1.1541 CHF. |

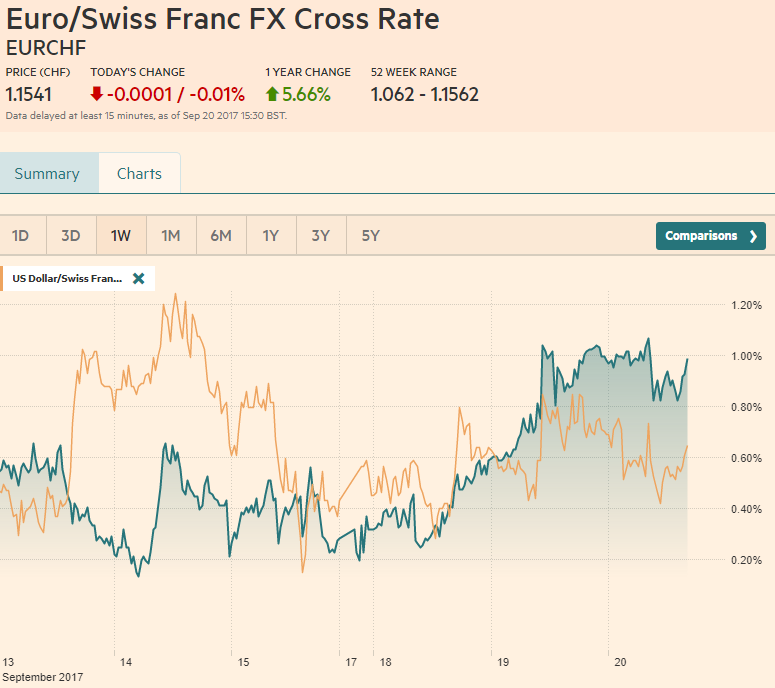

EUR/CHF and USD/CHF, September 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesAfter much anticipation, the FOMC decision day is here. Much of the focus is on the likely decision that the Fed will allow its balance sheet to shrink gradually. No other country who employed quantitative easing has is in a position to begin unwinding the emergency expansion of its balance sheet. The Fed’s experience in QE, communication, and now unwinding, will be part of the information set other central banks can draw upon. Initially, the idea of unwinding the central bank’s balance sheet seemed to entail the sales of securities. However, the FOMC’s strategy is not to sell a single security, but simply slow the reinvesting of the maturing issues. We suspect this is likely to be the main path for other central banks, eventually, as well. The reinvestment of maturing securities was roughly equivalent to 40% of the deficit last year. |

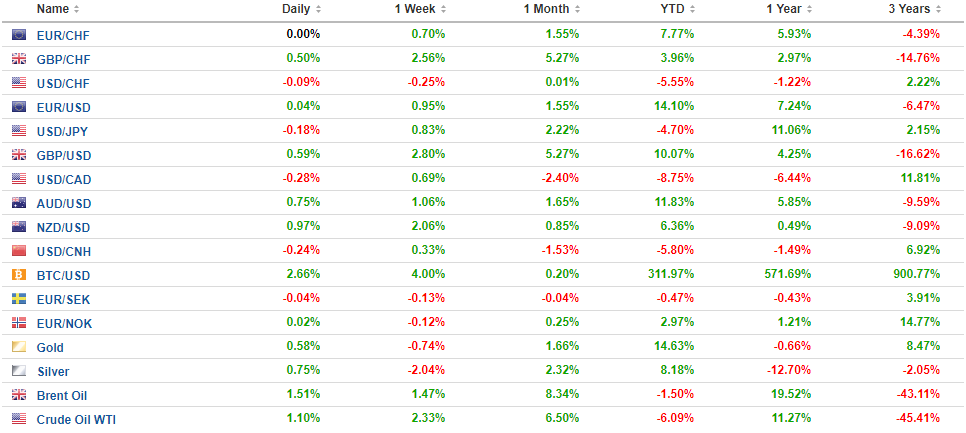

FX Daily Rates, September 20 |

| Many worry that if the Fed is absorbing the supply, the market will, and the key is the price that is does this. However, much of the thinking seems confused because many insist that interest rates are low because the central banks have been buying bonds. The story is more complicated. Remember, US yields typically rose while QE was active and fell when the buying ceased. We argue that the real reason rates are low is that growth and inflation are low, and that the supply of capital exceeds its effective demand.

The impact of the gradual unwinding of the Fed’s balance sheet is not known. Many, like us, expect the very low starting point ($10 bln a month for the first three months), is unlikely to be disruptive. The signaling impact has also been modest. Surveys have shown that majority have expected that today’s meeting would be the forum for the policy announcement. It did not prevent the 10-year yield from falling to new lows of the year a couple weeks ago. The US dollar is going into the FOMC meeting offered. The euro is at the upper end of this year’s range, straddling the $1.20 area. There is a 500 bln euro option struck at $1.1950 and 1 bln euros struck at $1.20 that are cut in NY today. |

FX Performance, September 20 |

United StatesAnother way to say this is that there is a myriad for factors that drive US interest rates. Fed actions are important but there are other factors that could overwhelm. For example, this year, as China’s reserves have begun growing this year after falling. As China’s reserves grow, its demand for Treasuries has grown. According to US data, and not doing what seems to be the popular thing, attributing other financial center’s holdings of Treasuries to China, China’s holdings of Treasuries have risen by $108 bln through the first seven months of the year. While the focus is on the Fed’s balance sheet and its unprecedented initiative, we suspect the market’s reaction to today’s meeting will not come so much from that–which has been so highly anticipated. Rather we suspect that the new economic projections will be more important. It will be the first time that it extends the forecasts through 2020. This is important because it will give investors a better sense of where the Fed may see the terminal rate for Fed funds. The question is will the dot plots point to Fed funds peaking in 2019 and flat in 2020 The Fed could slow its projected trajectory so that it shows rates still peaking at the same level but taking longer to reach it. Alternatively, it could show rates continuing to rise in 2020 so the peak or equilibrium level is higher. |

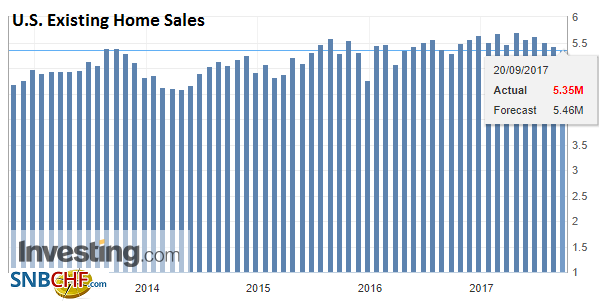

U.S. Existing Home Sales, Aug 2017(see more posts on U.S. Existing Home Sales, ) Source: Investing.com - Click to enlarge |

| Another underlying issue is the significance of the projects when the composition of the Fed’s Board of Governors is going to change so profoundly in the coming quarters. We think that continuity at the Fed will be greater than the partisanship suggests. Moreover, we suspect the market continues to under-estimate the likelihood that Yellen is reappointed. We are sensitive to the precedent of two terms and appointment by presidents of both parties (Volcker, Greenspan, Bernanke). |

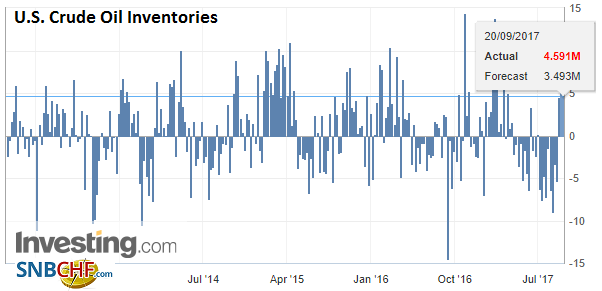

U.S. Crude Oil Inventories, September 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

| Yet, we are also well aware that President Trump shows no particular fondness for tradition or precedent. Nevertheless, the re-appointment of Yellen may serve the President’s interest. It is an easy appointment. It will not antagonize his base which appears focused on other things. Although Yellen has endorsed a strong regulatory environment, would any other person with the requisite experience to get the job, do otherwise. Even Greenspan has delivered a mea culpa over the belief that financial institutions would regulate themselves. Cohn’s chances to replace Yellen have seemingly been downgraded, and former Governor Warsh’s candidacy may look more promising, but in PredictIt, Yellen is seen by the gamblers, as the more likely, but odds are still seen only slightly better than 1 in 4. |

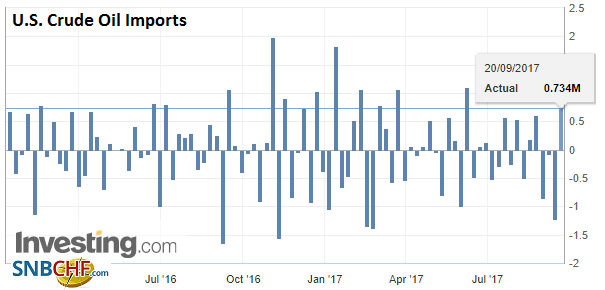

U.S. Crude Oil Imports, September 20 2017(see more posts on U.S. Crude Oil Imports, ) Source: Investing.com - Click to enlarge |

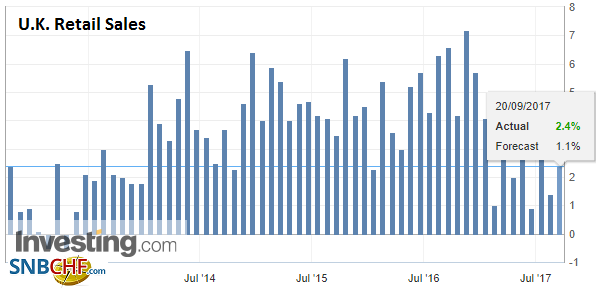

United KingdomStrong UK retail sales report and anticipation of May’s speech at the end of the week has lifted sterling back toward $1.36. The recent peak was near $1.3620. It had found a bid a little below $1.35. The Financial Times reports that May will offer to pay into the EU budget through 2020, at a cost of about GBP20 bln. This reportedly will be discussed in a cabinet meeting ahead of May’s speech in Florence on Friday. Retail sales jumped 1% in August, with and without petrol, and the July figures were revised higher. |

U.K. Retail Sales YoY, Aug 2017(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

Japan |

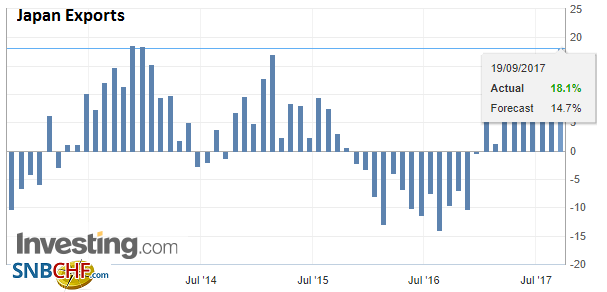

Japan Exports YoY, Aug 2017(see more posts on Japan Exports, ) Source: Investing.com - Click to enlarge |

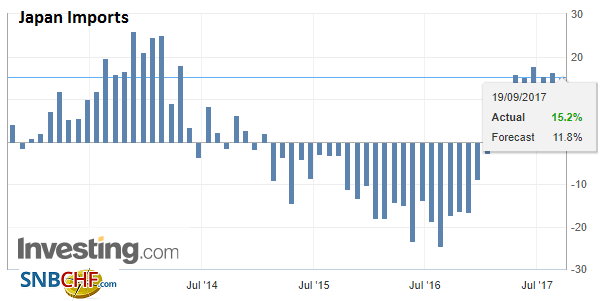

Japan Imports YoY, Aug 2017(see more posts on Japan Imports, ) Source: Investing.com - Click to enlarge |

|

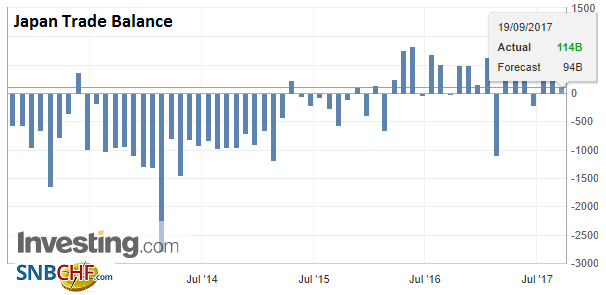

Japan Trade Balance, Aug 2017(see more posts on Japan Trade Balance, ) Source: Investing.com - Click to enlarge |

|

Germany |

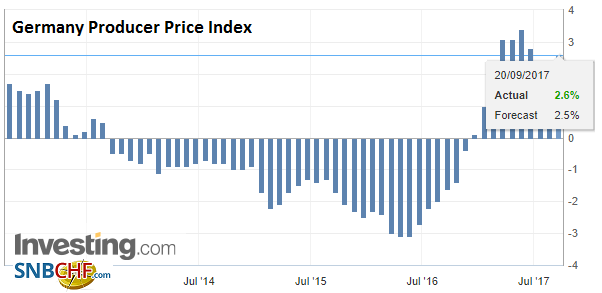

Germany Producer Price Index (PPI) YoY, Aug 2017(see more posts on Germany Producer Price Index, ) Source: Investing.com - Click to enlarge |

There is some suggestion that foreign consumers may have flattered the sales by taking advantage of the weak sterling to buy jewelry and watches, while sales of clothing, footwear, and household goods were softer. Regardless of the details, the optics have fanned rate hike expectations and the implied yield of the Dec short-sterling futures contract has edged higher to its best level since February.

The dollar peaked shy of JPY112 yesterday, briefly surpassing the 61.8% retracement of the drop from the July high near JPY114.50. The dollar is trading slightly heavier today. The last session that the dollar fell against the yen was last Thursday, and it also corresponded with a decline in US 10-year yields. US 10-year yields have risen seven of the last eight sessions coming into today, and yields are a little softer after reaching almost 2.25% yesterday.

The dollar-bloc currencies are bid. Comments by the Deputy Governor of the Bank of Canada had seemed to signal that a follow up rate hike at next month’s meeting is unlikely. We did not attribute a strong chance that the Bank of Canada would have hiked rates at three consecutive meetings, and with the help of the guidance, the market has reduced the odds. However, another hike before the end of the year is nearly fully discounted (OIS) which means the December meeting. The US dollar traded higher against the Canadian dollar when the comments were made on Monday and has since been trading in narrow ranges with a softer bias.

The Aussie and Kiwi are a firm. New Zealand reported a smaller than expected Q2 current account deficit and this may bode well for the Q2 GDP report that will be released in early Thursday in Wellington. The Nationals seem to be doing a little better in the polls ahead of the weekend election. The Kiwi is at its best level since early August. Initial resistance is now seen ahead of $0.7400. For its part, the Aussie is trading quietly, holding above $0.8000.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,$JPY,$TLT,EUR/CHF,FOMC,Germany Producer Price Index,Japan Exports,Japan Imports,Japan Trade Balance,newslettersent,U.K. Retail Sales,U.S. Crude Oil Imports,U.S. Crude Oil Inventories,U.S. Existing Home Sales,USD/CHF