Swiss FrancThe euro is lower at 1.0854 (-0.06%). |

EUR/CHF - Euro Swiss Franc, June 05(see more posts on EUR/CHF, ) |

FX RatesThe US dollar is beginning what promises to be an important week on a steady to firmer note against most of the major currencies. It is a holiday in parts of Europe (e.g.,m Germany and Switzerland). Although excitement is not until Thursday’s ECB meeting, UK election, and the testimony of former US FBI Director Comey, there are several developments today to note. The most surprising of these events was the decision by a Saudi-led coalition (Bahrain, UAE, and Egypt) to severe diplomatic and economic ties with Qatar over its support for Iran and Islamist groups. Air and sea travel have been suspended and Saudi Arabia has closed its border. Oil prices jumped on the news, but Brent’s gains have been halved. Qatar’s equities slid around 7.5%, and most regional bourses were lower. Qatar is a rich country and holds stakes in a couple of European banks. The US forward headquarters of its Middle East Central Command is also located in Qatar. Japan and South Korea accounted for nearly 50% of Qatar’s exports in 2015. |

FX Daily Rates, June 05 |

| In another surprise, in the largest state election in Mexico, the PRI’s candidate Del Mazo appears to have won; turning back a challenge by the populist-Left Morena’s candidate Gomez. The peso has appreciated 1.8% in response, making it the strongest currency in the world today. The US dollar is holding a little above last month’s low (~MXN18.2420), which itself was the lowest since the US election when the greenback traded as last as MXN18.1635. It has traded near MXN17.90 briefly last August.

Sterling is holding below its 20-day moving average (~$1.2920), which it has not closed above since May 25. The opinion polls have generally tightened, but many investors still appear confident that the Tories will hold on to a majority. In the options market, implied volatility remains firm, and the premium for puts over calls is edging higher. The euro has been confined to about a quarter cent range so far today. It has drifted gently lower but has held above $1.1260. It had been trading closer to $1.1215 before the tepid US jobs report before the weekend. The dollar has been confined to about a 25 pip range on either side of JPY110.50. It has mostly held above JPY111.40. A move above JPY110.80-JPY111.00 will help stabilize the near-term technical tone. The dollar was trading near JPY111.50 before the US employment data. |

FX Performance, June 05 |

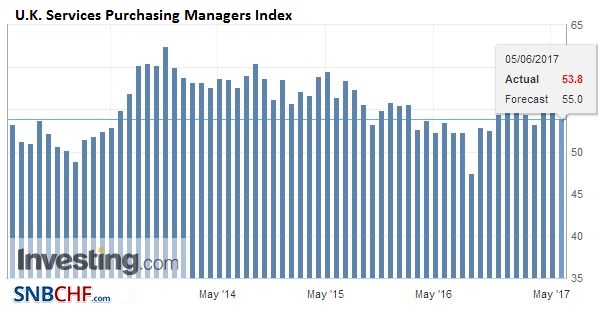

United KingdomSterling initially opened a little softer after the terrorist strike over the weekend in London. However, it has been resilient, even in the face of the poor service PMI (53.8 from 55.8), which returned to its lowest level since February. The composite PMI slumped to 54.4 from 56.2 in April. It averaged 54.6 in Q1, but Markit suggests that it is still consistent with a rebound in the UK economy after 0.2% expansion in Q1. |

U.K. Services Purchasing Managers Index (PMI), May 2017(see more posts on U.K. Services PMI, ) Source: Investing.com - Click to enlarge |

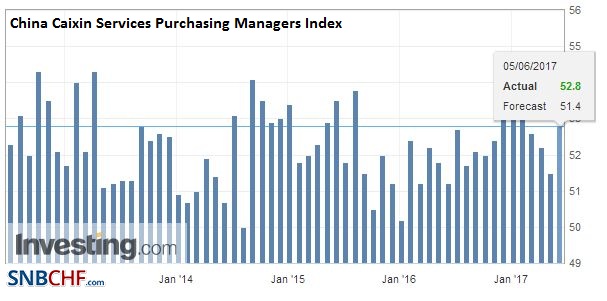

ChinaChina reported a rise in the Caixin services PMI. It rose to 52.8 from 51.5. It is the highest since January. The composite PMI rose to 51.5 from 51.2. It had averaged 52.3 in Q1 and 51.4 in 2016. While shares in the region eked out a minor gain, Chinese stocks were mostly lower, though shares in Shenzhen gained 0.7%, led by telecoms, energy, and materials. Financials and consumer staples were the only losing sectors. The yuan appreciated four weeks in a row coming into today. The onshore yuan edged higher, while the offshore yuan softened (for the third consecutive session). |

China Caixin Services Purchasing Managers Index (PMI), May 2017(see more posts on China Caixin Services PMI, ) Source: Investing.com - Click to enlarge |

EurozoneThe eurozone services PMI edged higher from the flash reading primarily due to Germany. The Markit services reading stands at 56.3 up from 56.2 in the preliminary estimate. It was 56.4 in April and averaged 55.1 in Q1. |

Eurozone Services Purchasing Managers Index (PMI), May 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

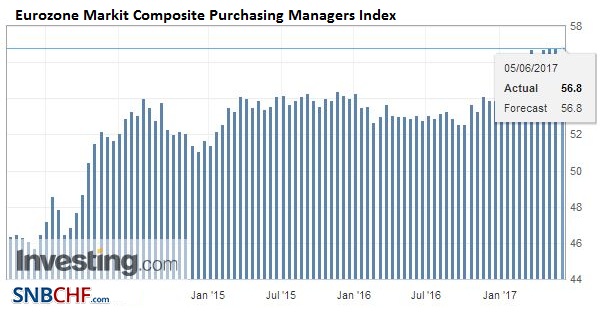

| The composite was unchanged from the initial estimate of 56.8. That matches the April reading and compares with the Q1 average of 55.6 |

Eurozone Markit Composite Purchasing Managers Index (PMI), May 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

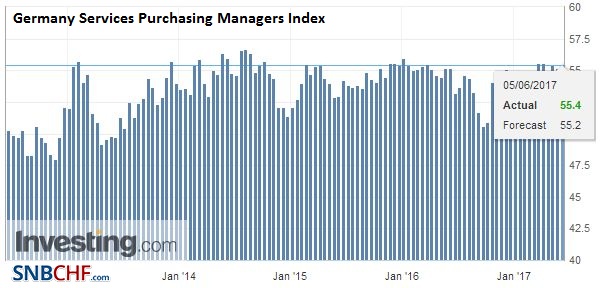

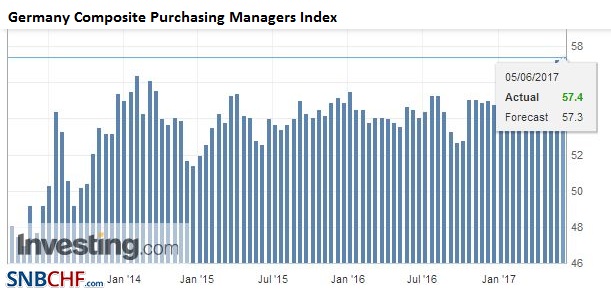

GermanyThe German services PMI was revised to 55.4 from the preliminary estimate of 55.2. |

Germany Services Purchasing Managers Index (PMI), May 2017(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

| It was sufficient to lift the composite to 57.4 from 57.3. This represents a new cyclical high. |

Germany Composite Purchasing Managers Index (PMI), May 2017(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

FranceOn the other hand, the French services PMI was revised to 57.2 from the flash reading of 58.0. It is disappointing but above the 56.0 average from Q1. The composite fell to 56.9 from 57.6 preliminary estimate, which is still a modest improvement from the 56.6 reading in April. |

France Services Purchasing Managers Index (PMI), May 2017(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

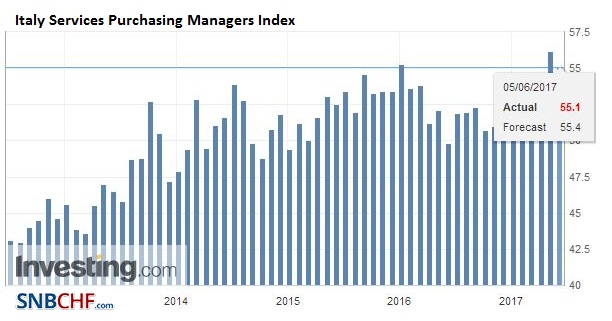

ItalyBoth Italy and Spain reports were disappointing. Italian services PMI fell to 55.1 from 56.2. The composite also fell back (55.2 from 56.8), but both readings are still above Q1 and 2016 averages. |

Italy Services Purchasing Managers Index (PMI), May 2017(see more posts on Italy Services PMI, ) Source: Investing.com - Click to enlarge |

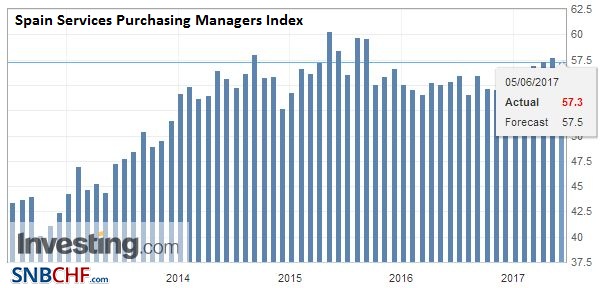

SpainSpain’s PMI also softened. The services PMI slipped to 57.3 from 57.8. It is below its three-month average, but its above the 56.4 average from Q1. The composite slipped to 57.2 from 57.3. It too remains elevated. |

Spain Services Purchasing Managers Index (PMI), May 2017(see more posts on Spain Services PMI, ) Source: Investing.com - Click to enlarge |

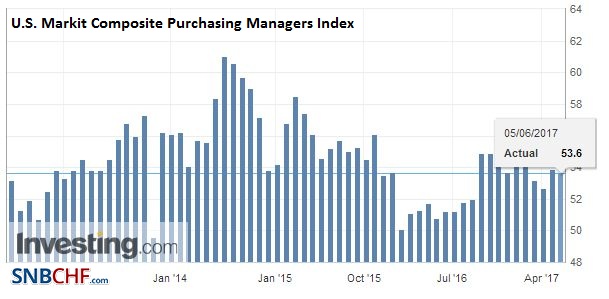

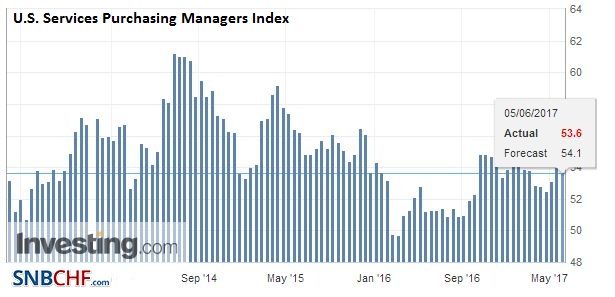

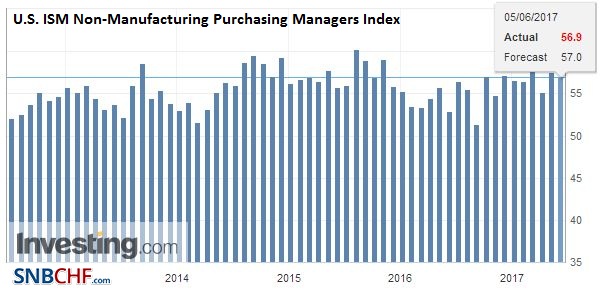

United StatesThe US reports Markit and ISM service reports, factors and durable goods for April. |

U.S. Markit Composite Purchasing Managers Index (PMI), May 2017(see more posts on U.S. Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

U.S. Services Purchasing Managers Index (PMI), May 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

|

U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

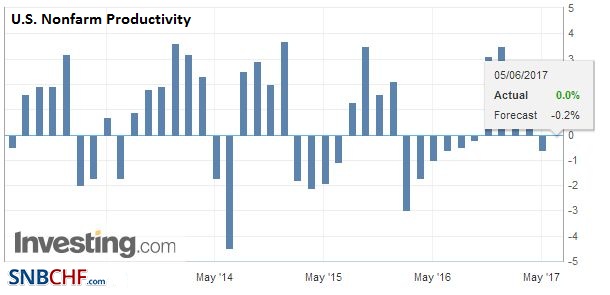

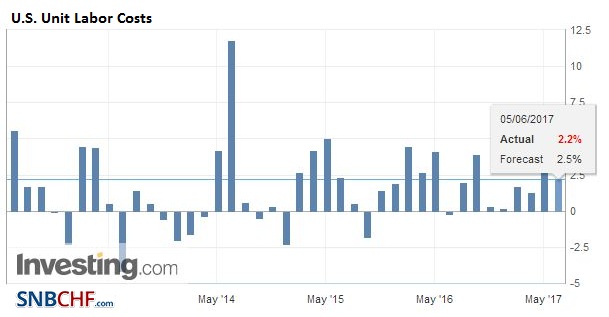

| Non-farm productivity and unit labor costs are derived from the GDP report and the upward revision to growth point to upward revision to productivity and downward revision to unit labor costs. |

U.S. Nonfarm Productivity, Q1 2017(see more posts on U.S. Nonfarm Productivity, ) Source: Investing.com - Click to enlarge |

| The Fed’s new Labor Market Conditions Index does not draw much attention. It stood at 3.5 in April (3.6 in March). These are the strongest readings since May-June 2015. It is expected to have slipped to 3.0 in May. |

U.S. Unit Labor Costs QoQ, Q1 2017(see more posts on U.S. Unit Labor Costs, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$CNY,$EUR,$JPY,China Caixin Services PMI,EUR/CHF,Eurozone Markit Composite PMI,Eurozone Services PMI,France Services PMI,FX Daily,Germany Composite PMI,Germany Services PMI,Italy Services PMI,MXN,newslettersent,Spain Services PMI,U.K. Services PMI,U.S. ISM Non-Manufacturing PMI,U.S. Markit Composite PMI,U.S. Nonfarm Productivity,U.S. Services PMI,U.S. Unit Labor Costs