The bellicose rhetoric from the US and North Korean officials is the main driver today. We would qualify that assessment by noting that first, the market moves are rather modest, suggesting a low-level anxiety among investors. Second, pre-existing trends have mostly been extended. Turning to Asia first, the Korea's equity market fell 1.1%. The Kospi has fallen for the past two weeks (~2.2%).

Read More »

Tag Archive: U.S. Unit Labor Costs

FX Daily, June 05: US Dollar Starts Important Week Mostly Stable to Higher

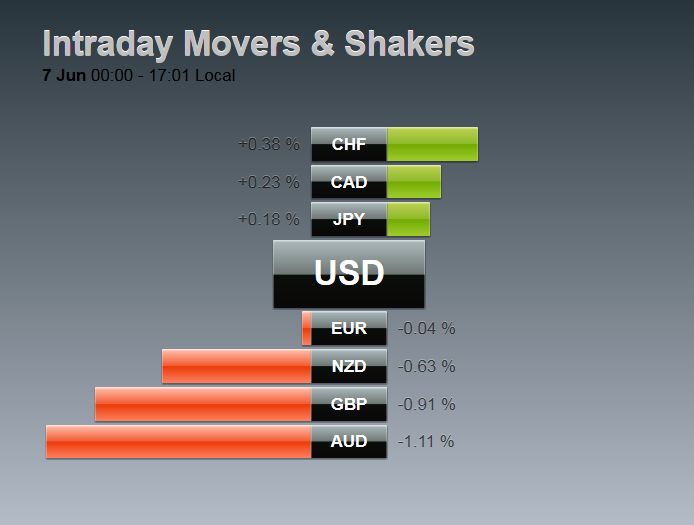

The US dollar is beginning what promises to be an important week on a steady to firmer note against most of the major currencies. It is a holiday in parts of Europe (e.g.,m Germany and Switzerland). Although excitement is not until Thursday's ECB meeting, UK election, and the testimony of former US FBI Director Comey, there are several developments today to note.

Read More »

Read More »

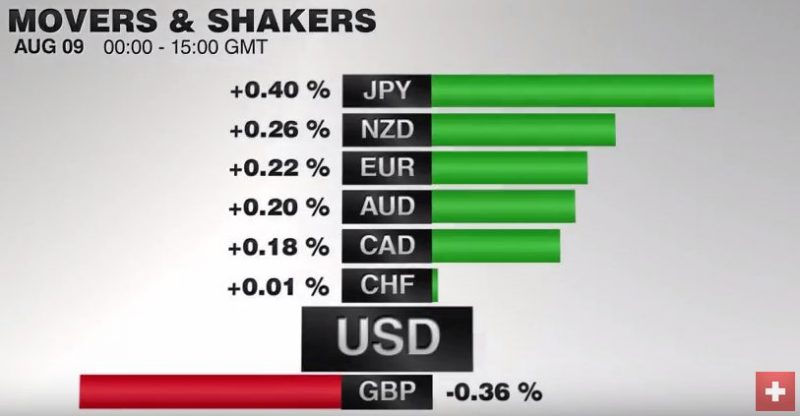

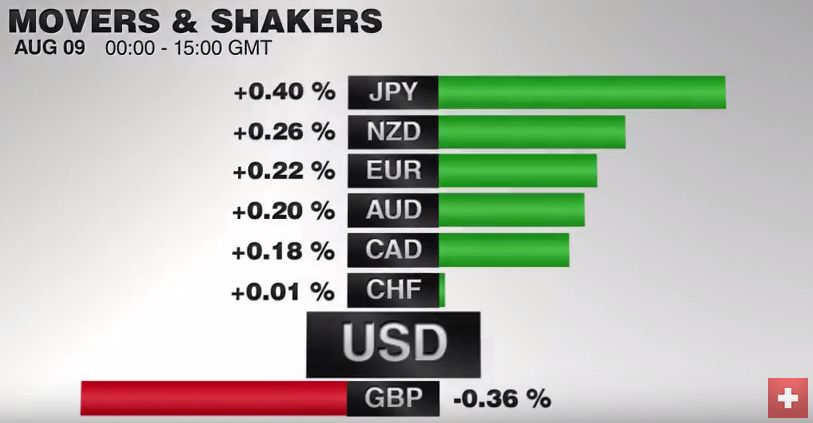

FX Daily, August 09: Sterling Slips to a Four-Week Low, EUR/CHF still trending up

In an otherwise uneventful foreign exchange market, sterling's slide for its fifth consecutive session is the highlight. It was pushed below $1.30 for the first time since July 12. Initial resistance for the North American session is seen near $1.3020, while the $1.2960 area corresponds to a minor retracement objective.

Read More »

Read More »

FX Weekly Preview: Macro Developments Will Not Stand in Way of Dollar Move Lower

Through the first part of the year, the swinging pendulum of expectations for the trajectory of Fed policy has been a major driver in the foreign exchange market. This is true even though the ECB and BOJ continue to ease monetary policy aggressively. The Australian and New Zealand dollars appear to influenced more by the … Continue...

Read More »

Read More »

Dollar Retreat Extends

The US dollar remains under broad pressure after yesterday's sharp decline. Neither dovish comments by ECB President Draghi, nor the Reserve Bank of New Zealand have managed to reverse the gains of their respective currencies. Similar, the rise in US yields and firm equities have failed to push the yen lower. Investors and policymakers are …

Read More »

Read More »