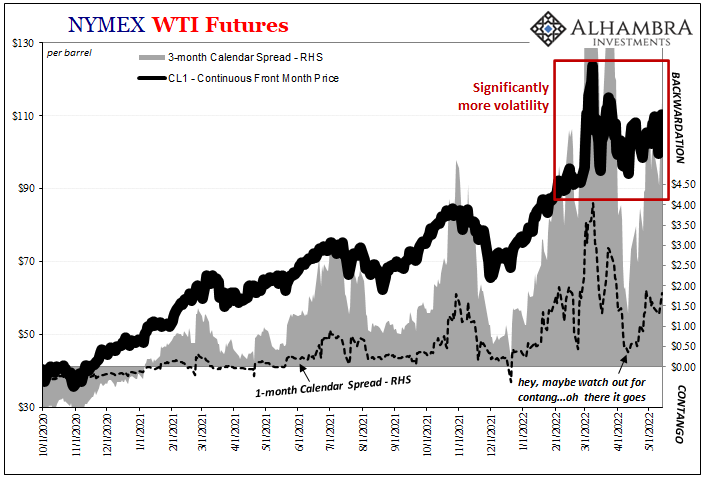

Swiss Franc Currency Index

|

Trade-weighted index Swiss Franc, April 29(see more posts on Swiss Franc Index, ) Source: markets.fx.xom - Click to enlarge |

Swiss Franc Currency Index (3 years)The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 33% of the SNB portfolio and 25% of Swiss exports (incl. countries like China or Arab countries that use the dollar for exchanges). Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar (and yuan) strongly improved. |

Swiss Franc Currency Index (3 years), April 29(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge |

USD/CHFOften the US dollar, as the numeraire, seems to be the main actor in the foreign exchange market. Other times, the dollar appears to be at the fulcrum between European currencies on one hand, and the dollar-bloc currencies on the other hand. Another way expressing this is whether there is a dollar-move underway or is it really more about the crosses.

|

US Dollar/Swiss Franc FX Spot Rate, April 29(see more posts on USD/CHF, ) Source: markets.ft.com - Click to enlarge |

US Dollar IndexThe Dollar Index gapped lower to start the week and chopped back and forward between around 98.70 and 99.30. The gap is unfilled. It is found between 99.33 and 99.65. The important technical question is what kind of gap is it? Some technicians are arguing that it is a break away gap or a measuring gap, which would be a bearish read. If it is a normal gap, it should be filled shortly. The MACDs and Slow Stochastics appear poised to turn higher, and given our fundamental outlook, we lean toward the gap being filled over the next week or so. If our leaning is wrong, the next downside target would be near 97.85, the 50% retracement of the rally since last May. The 38.2% retracement is (wouldn’t you know it?) near 99.30. |

US Dollar Currency Index, April 29(see more posts on U.S. Dollar Index, ) Source: markets.ft.com - Click to enlarge |

EUR/USDThe euro, which is the biggest component of the Dollar Index, has seen similar action.

It gapped higher in response to the French election. It is a large gap between $1.0738 and $1.0821. The gap takes on additional technical significance because it is on the weekly charts as well as the dailies. The euro’s gains were extended into an important technical area.

The $1.0935 area corresponds to a 61.8% retracement of the euro’s losses since the US election, while the $1.0980 area is the 50% retracement of the euro’s down leg that began nearly a year ago. The 61.8% retracement is near $1.1130, which is around where the euro was trading before the election spike. It is also near the objective if the gap is a measuring gap and appears around the half way point of a move.

The technical indicators we use have not turned yet, but they are getting stretched, the euro is pressed against its upper Bollinger Band.

The Slow Stochastics can turn down in the coming days. The MACDs may turn down toward the end of next week. Many are watching the 200-day moving average, which comes in around $1.0835.

|

EUR/USD with Technical Indicators, April 29(see more posts on Bollinger Bands, EUR/USD, MACDs Moving Average, RSI Relative Strength, Stochastics, ) |

USD/JPYThe dollar rose in four of last week’s five sessions against the yen.

It rose a little more than 2% last week, its second consecutive weekly advance and the largest weekly advance here in 2017. The dollar has build a small shelf now in the JPY110.80-JPY111.00 area. The JPY112 area that has been approached corresponds to the 61.8% retracement of the sell-off since the start of the year.

The five-day moving average moved above the 20-day average for the first time since mid-March. The technical indicators are constructive.

A move above JPY112.00 could encourage a test on the falling trend line drawn off the January and March highs and comes in near JPY113 by the end of the week ahead.

In terms of portfolio flows, we note that the last data through the April 21, showed Japanese investors sold what appears to be a record amount of foreign bonds over a three-week period (~JPY4.2 trillion or ~$37 bln).

|

USD/JPY with Technical Indicators, April 29(see more posts on Bollinger Bands, MACDs Moving Average, RSI Relative Strength, Stochastics, USD/JPY, ) |

GBP/USDAfter consolidating the gains scored in the wake of Prime Minister May’s surprise election, sterling took another leg higher in recent days to approach the $1.30.

The $1.3055 area corresponds to the 38.2% retracement of sterling drop from the pre-referendum high to last October’s low. It goes into the May 1 bank holiday with a four session advancing streak. It has risen in four sessions in each of the past three weeks and is up in six of the past seven weeks.

While sterling can have another push higher, the technical indicators are warning that a top may be near. The Slow Stochastics are flat lining before turning down, and the MACD’s are poised to cross lower in the coming days. Support is seen in the $1.2850-$1.2870 area.

|

GBP/USD with Technical Indicators, April 29(see more posts on Bollinger Bands, GBP/USD, MACDs Moving Average, RSI Relative Strength, Stochastics, ) |

AUD/USDThe Australian dollar continues to fall out of favor.

It lost about 1.2% last week and fell to its lowest level since mid-January. It fell in three of the four weeks in April. The convincing break of $0.7470 warns of scope for another 1% fall toward $0.7400.

However, over the longer term, the measuring objective of the potential double top (February and March) near $0.7740-$0.7750, projects toward $0.7250. The technical indicators are consistent with additional losses, though the lower Bollinger band is seen near $0.7450.

|

AUD/USD with Technical Indicators, April 29(see more posts on Australian Dollar, Bollinger Bands, MACDs Moving Average, RSI Relative Strength, Stochastics, ) |

USD/CADLast week, we suggest the Canadian dollar appeared to be the most vulnerable of the major currencies on a risk-reward basis. It fell 1.3%, though the yen and New Zealand dollar were weaker. The US dollar reached 14-month highs, largely on the back of heightened trade tensions with the US as unresolved issues-lumber and dairy-saw it move in the cross-hairs of the Trump Administration. We also note that the US dollar may have drawn support from the roughly 10 bp widening the two-year yield differential to 55 bp. The multi-year high was set around 60 bp early last year. Some are citing resistance near CAD1.3735, but we think the next important technical target s in the CAD1.3800-CAD1.3845. |

USD/CAD with Technical Indicators, April 29(see more posts on Bollinger Bands, Canadian Dollar, MACDs Moving Average, RSI Relative Strength, Stochastics, ) |

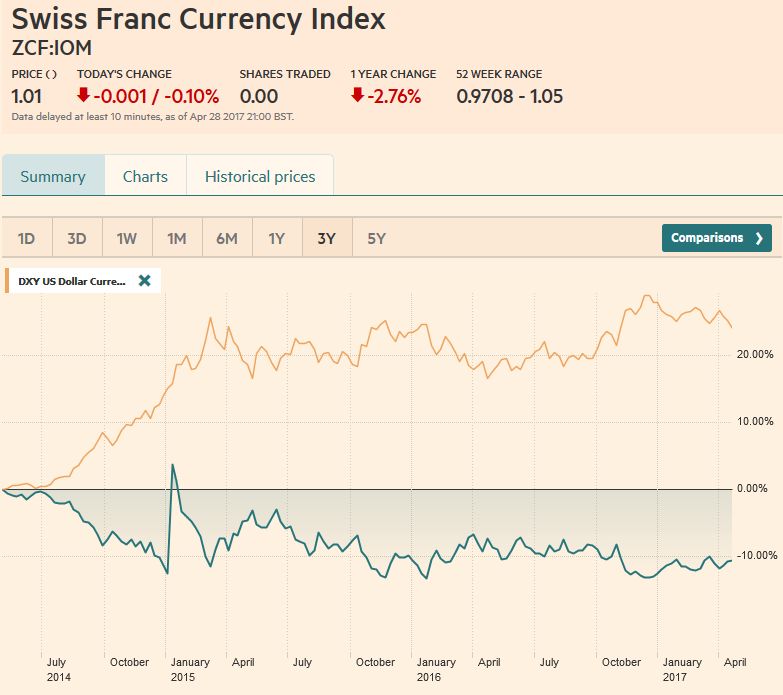

Crude OilOngoing supply concerns weighed on the energy complex and the June light sweet crude oil futures contract fell to nearly $48, the lowest in a month. Technical indicators warn of additional downside risks, though the Slow Stochastic may be set to turn higher earlier next week. Support extends toward $47.60, the lows from March and below there is $47. On the upside, a move above $50 is needed to stabilize the tone. |

Crude Oil April 2016 - April 2017(see more posts on Crude Oil, ) Source: bloomberg.com - Click to enlarge |

U.S. TreasuriesThe June 10-year note futures gapped lower to start the week, as risk-off positions unwound following the French election results. It is a small gap (125-27 to 125-29). However, it remains open. Yet the market has not managed to push the contract below around 125-05. The MACDs and Slow Stochastics point to downside risks, which is consistent with our expectation for stronger US economic data in the days ahead. The five-day moving average is set to move below the 20-day for the first time in a month. A break of 125-03 (38.2% retracement since the mid-March Fed hike) signals a move toward 124-20 and maybe 124-05. That could put the 10-year yield back near 2.40%. |

Yield US Treasuries 10 years April 2016 - April 2017(see more posts on U.S. Treasuries, ) Source: bloomberg.com - Click to enlarge |

S&P 500 IndexIn an unusual development the S&P 500 gapped higher both last Monday (2356.18-2369.19) and last Tuesday (2376.98-238.15). It then chopped around in narrow ranges. The equity market took the Trump Administration’s broad tax proposals in stride. The continued fight within the Republican Party over national health care gives a taste of what is likely over tax reform as the deficit hawks will likely resist plans that could see US deficit and debt grow dramatically. The 1.5% gain last week was the most since mid-February. Although the technical indicators see scope for additional gains, we are concerned, especially with the weak close before the weekend downside gaps may draw prices. |

S&P 500 Index, April 29(see more posts on S&P 500 Index, ) Source: markets.ft.com - Click to enlarge |

Are you the author? Previous post See more for Next post

Tags: Australian Dollar,Bollinger Bands,British Pound,Canadian Dollar,Crude Oil,EUR/CHF,EUR/USD,Euro,Euro Dollar,GBP/USD,Japanese yen,MACDs Moving Average,Mario Draghi,newslettersent,RSI Relative Strength,S&P 500 Index,Stochastics,Swiss Franc Index,U.S. Dollar Index,U.S. Treasuries,usd-jpy,USD/CHF,USD/JPY