Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 05(see more posts on EUR/CHF, ) |

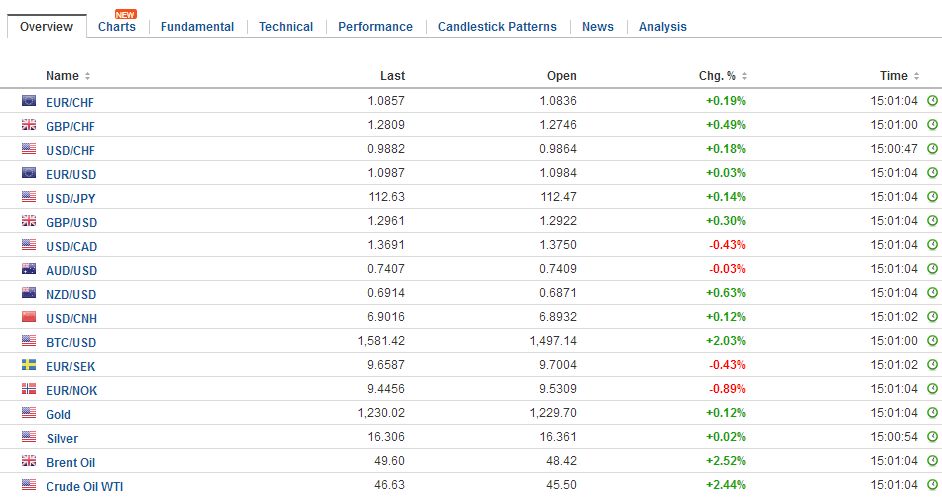

FX RatesThe US dollar is narrowing mixed as the employment data, and Fed speeches are awaited. Six Fed officials speak today, including Yellen and Fischer. Regional Presidents Williams, Rosengren Evans and Bullard also speak. It will be the first flurry of speeches since the FOMC meeting. Lastly, we note some chunky option expires today. In the euro, which has eased from approaching $1.10 sees 2.5 bln euros struck at $1.10, and another 666 mln struck at $1.0980 rolling off today. Between $1.0950 and $1.0965, another 2.2 bln euros expire. In the yen, the JPY112 strike has $706 maturing, and the JPY1125.50 has $700 mln rolling off. A strike at CAD1.3730 for $330 mln will be cut today. |

FX Daily Rates, May 05 |

| Part of those economic impulses is the weakness in commodities. Iron ore prices dropped almost 5% today in China to bring the weekly loss to 12%. Supply is particularly strong. Oil prices have steadied today after sharp (4.8%) yesterday. The June contract for light sweet crude oil is off 7.4% for the week with today’s small gain taken into account. It is the third consecutive weekly decline. During which time it has fallen by more than 15%. Gold is trying to snap a four-day drop, but it is unlikely to avoid the third consecutive weekly fall. Gold broke an uptrend line going back to the middle of last December. It is found now near $1241.

The market’s take away from the FOMC statement that was little changed was the characterization of soft Q1 growth as being driven by transitory factors. The odds of a June rate hike were marked up, even if not to the level of near-certainty that of Bloomberg’s calculation. |

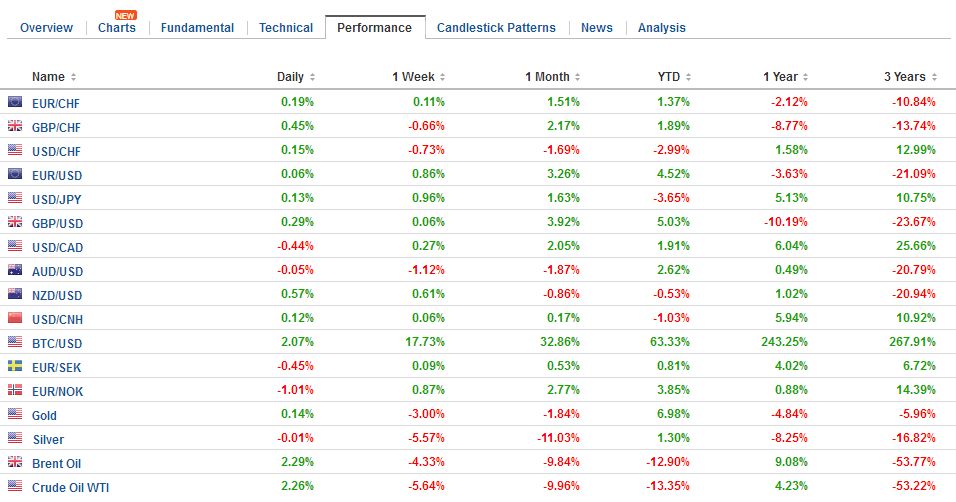

FX Performance, May 05 |

Eurozone |

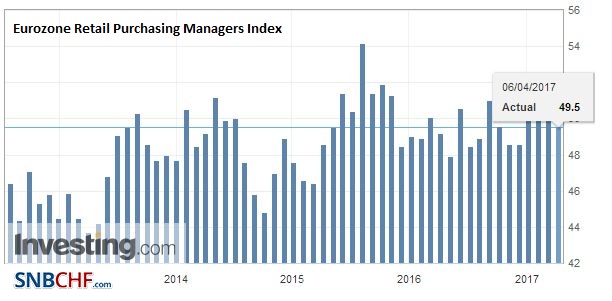

Eurozone Retail Purchasing Managers Index (PMI), April 2017(see more posts on Eurozone Retail PMI, ) Source: Investing.com - Click to enlarge |

Spain |

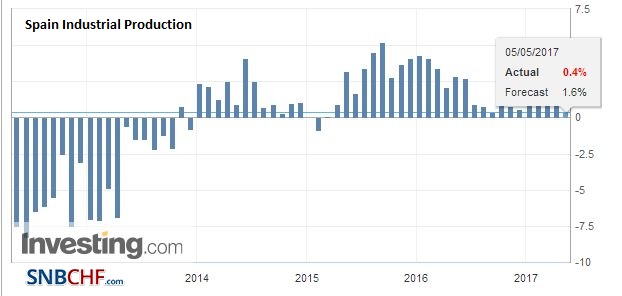

Spain Industrial Production YoY, March 2017(see more posts on Spain Industrial Production, ) Source: Investing.com - Click to enlarge |

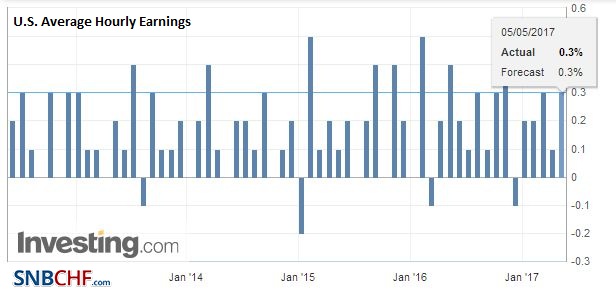

United StatesEarnings growth needs to be 0.3% to keep the year-over-year rate at 2.7%, which while unimpressive historically, is near the cyclical high. |

U.S. Average Hourly Earnings, April 2017(see more posts on U.S. Average Earnings, ) Source: Investing.com - Click to enlarge |

| Ideally, the underemployment rate continues its downward course. It fell to 8.9% in March from 9.2% in February. Last April it stood at 9.7%, which bears out the Fed’s point that there was still cyclical slack in the labor market; that it was not all structural. |

U.S. Unemployment Rate, April 2017(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

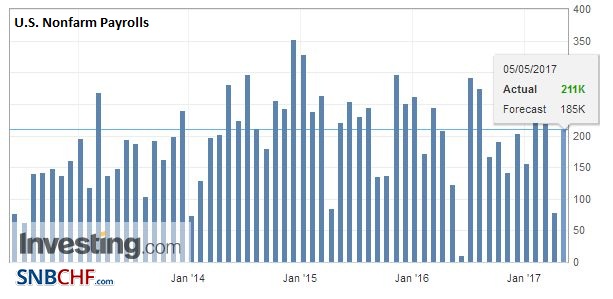

| The April employment report is expected to recover from the weather-induced slowed down in March. However, the PMI and ISM were not particularly encouraging, though weekly jobless claims are supportive. Of note, Linkedin reported earlier this week that its jobs report showed April was the strongest month for hiring since June 201, yet it noted narrow breadth: three sectors — manufacturing; aerospace, automotive and transport; and software — were responsible while the other 10 industries showed slower job growth.Anything above 187k non-farm payroll growth, which was last year’s average must be considered reasonably good given the maturing of the expansion. |

U.S. Nonfarm Payrolls, April 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

U.S. Participation Rate, April 2017(see more posts on U.S. Participation Rate, ) Source: Investing.com - Click to enlarge |

|

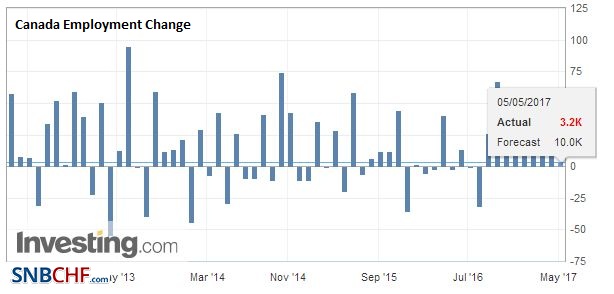

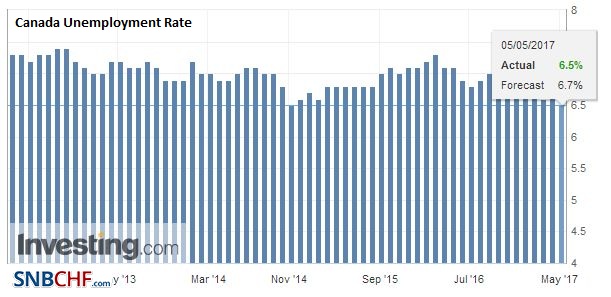

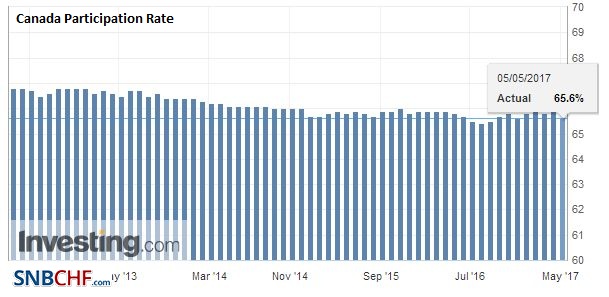

CanadaCanada also reports April employment data today. The Bloomberg median calls for a 10k increase after 19.4k in March. It created 18.4k full-time positions in March and an average of 46.4k over the last three months, but that is skewed by the outsized 105krise in February. Given the respective proportions, this would be as if the US created over a million jobs one month. |

Canada Employment Change, April 2017(see more posts on Canada Employment Change, ) Source: Investing.com - Click to enlarge |

Canada Unemployment Rate, April 2017(see more posts on Canada Unemployment Rate, ) Source: Investing.com - Click to enlarge |

|

Canada Participation Rate, April 2017(see more posts on Canada Participation Rate, ) Source: Investing.com - Click to enlarge |

There are two other impulses today. The first is politics. Early results of the UK local elections indicate, as expected, a strong showing for the Tory Party. They appear to be gaining seats against all the other parties. One early takeaway is that UKIP voters are joining the Tory ranks. That the Tories are doing well is hardly surprising.

This is, after all, why May called for a snap election, circumventing another Cameron-era move (to fix the election schedule). Labour, the main opposition party, has not managed to attract many of the people it claims to be representing. The Tory majority in Westminster is expected to swell after the June 8 election.

If May was not bound by Cameron’s fiscal policy or the fixed election schedule, why was she bound to take the narrow victory of Brexit as a binding commitment as he did? It was offered as a non-binding referendum. It passed by the narrowest margins. And what we have seen in other important referendums, such as in Scotland or the recent PD primary in Italy, the franchise extended to younger cohorts, though not in the UK. Now quite possibly, May finds she is over her head. That is what the press reports about Juncker and Merkel’s comments from the recent summit with May indicate. One might take exception as some of the languages, but the common thread was that the UK was not realistic about what was involved and the asymmetry of power once Article 50 was triggered.

The second round of the French presidential election is this weekend, and again results should be known before the open of Asia-Pacific markets on Monday. There is little doubt that Macron will win. However, the microscopic look at Macron’s policy proposals is distracting the focus. The French president is not a figurehead, but its main power lies in foreign policy. Domestically, Macron is a micron. He does not have a party in parliament. He was part of the pro-business wing of the Socialist Party (really social democrat in practice).

If one is confident that Macron is the next French President, attention must turn to next month’s parliamentary election. Yes, Le Pen and the nationalist-populists will be defeated in the fourth consecutive European election (Finland, Austria, the Netherlands), but the course of French policies will be determined by the configuration of parliament.

The second impulse in the market is economic in nature. The highlights include monetary policy statement from the Reserve Bank of Australia, which was optimistic on growth, and disappointing March industrial output for Spain (-0.4% while median in the Bloomberg survey expected a 0.3% rise. It was the second consecutive decline and the third in four months.

Graphs and additional information on Swiss Franc by the snbchf team

Tags: #USD,Canada Employment Change,Canada Participation Rate,Canada Unemployment Rate,EUR/CHF,Eurozone Retail PMI,France,FX Daily,jobs,newslettersent,OIL,Spain Industrial Production,U.K.,U.S. Average Earnings,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Unemployment Rate