Swiss Franc |

EUR/CHF - Euro Swiss Franc March 03(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

GBP/CHFPrime Minister Theresa May is still committed to triggering Article 50 before the end of the month in spite of what happened this week with the House of Lords’ decision to challenge the Brexit bill. The House of Lords are primarily concerned with keeping the rights of EU citizens living and working in the UK and they also want to try and have a reciprocal arrangement for Britons living in Europe. The vote was 358 in favour and 256 against and this additional obstacle for Theresa May has caused the Pound to weaken vs the Swiss Franc. It appears as though the Swiss Franc’s strength is being driven by what is happening globally at the moment with the UK not knowing where to turn and with the Dutch and French elections due to start in the next few weeks the Swiss Franc is being used as a safe haven currency. Even with interest rates the lowest they’ve been in history in Switzerland as there is not a lot of interest available in other western economies investors appear to be playing safe rather than searching for higher yields. Sterling has also fallen to a 6 week low against the US Dollar and whilst this negative trend for the Pound continues I think we could see further losses for Sterling before the end of this month. Therefore, if you need to buy Swiss Francs during this period it may be worth organising this in the short term. |

GBP/CHF - British Pound Swiss Franc, March 03(see more posts on GBP/CHF, ) Source: Investing.com - Click to enlarge |

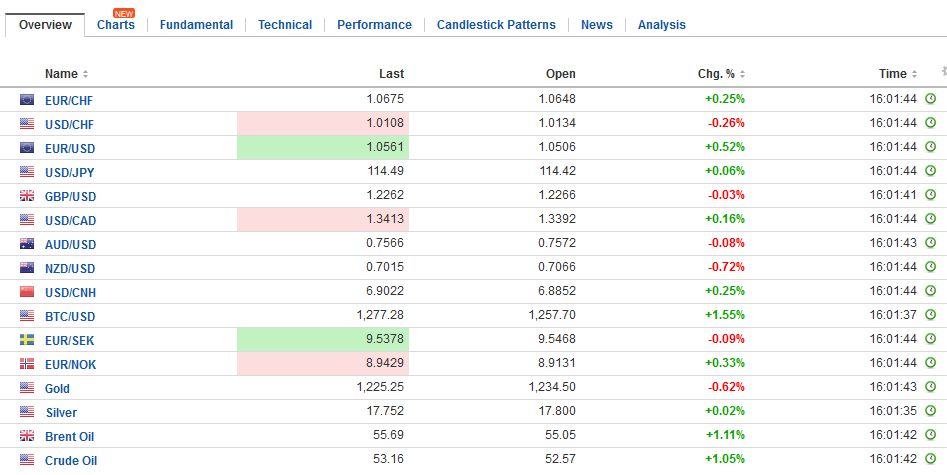

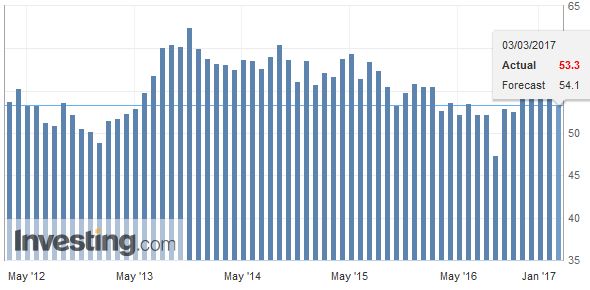

FX RatesThe US dollar is narrowly mixed as Yellen’s speech in Chicago is awaited. The greenback’s three-day advance against the euro and four-day advance against the yen is at risk. The dollar-bloc currencies, where speculators in the futures market had gone net long, continue to underperform. The dollar-bloc along with sterling are the weakest of the major currencies today. On the week, the Canadian and New Zealand dollars have lost about 2.5%, while the Australian dollar is off 1.6% and has broken out of the month-long $0.7600-$0.7700 range that had largely confined the price action. If Yellen (or Fischer) want to push against expectations for a hike on March 15, today may be the last opportunity. This seems unlikely, given the recent comments by Dudley, but also Governors Brainard and Powell. There appears to have been a relatively sudden change in the official rhetoric, and it has been seemingly without exception. |

FX Daily Rates, March 03 |

| We had thought the word cues in the minutes (“fairly soon”) did not imply March, given the previous signals before the December 2015 and December 2016 hikes. We thought June was too far but thought May was more promising and had the added advantage of giving the Fed greater degrees of freedom. The Fed will eventually need to have the flexibility to raise rates at half of its meetings that forecasts are not updated, and there is no press conference scheduled.

An important part of the shift in the rhetoric of Fed officials is that the rate hike is not tied to any specific trigger, such as stronger data or more improvement in the labor market. The general economic conditions and proximity to the full employment and price stability goals are sufficient, and officials are simply looking for appropriate opportunities. The broader context, including stronger world growth and a stable dollar (which eased on a broad trade-weighted basis in both January and February), is also conducive. The failure to raise rates would be potentially more destabilizing that raising rates. Investors, seeing the rising prices and improving labor market (with weekly jobless claims at new cyclical lows) would wonder at least two things: What does the Fed know that we don’t and is the Fed slipping behind the curve? It does not seem as if Fed officials have let expectations build to such a degree (nearly 90% by Bloomberg’s calculation and almost 80% in the CME’s estimate) without delivering. |

FX Performance, March 03 |

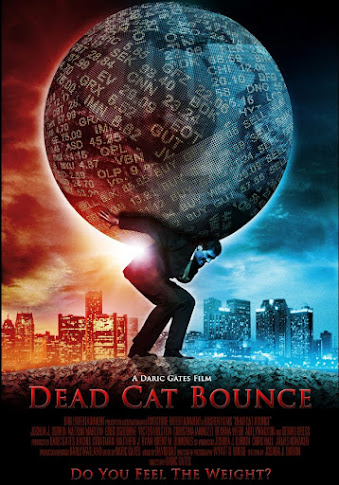

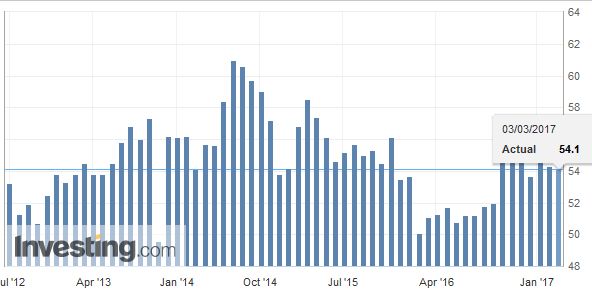

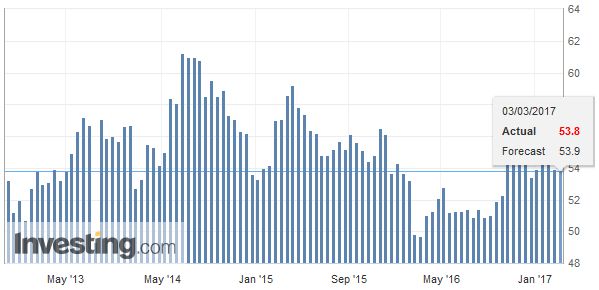

United KingdomSterling, however, is lower for the sixth session, following the weaker than expected service PMI (53.3 vs. 54.5 in January and 54.1 expected). |

U.K. Services Purchasing Managers Index, February 2017(see more posts on U.K. Services PMI, ) Source: Investing.com - Click to enlarge |

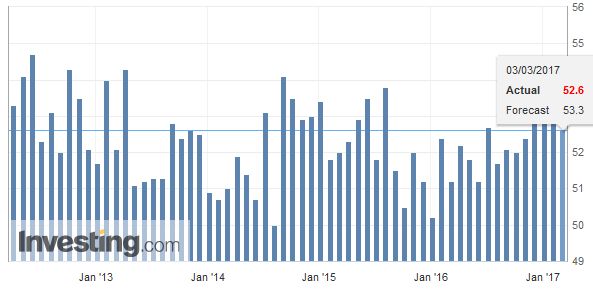

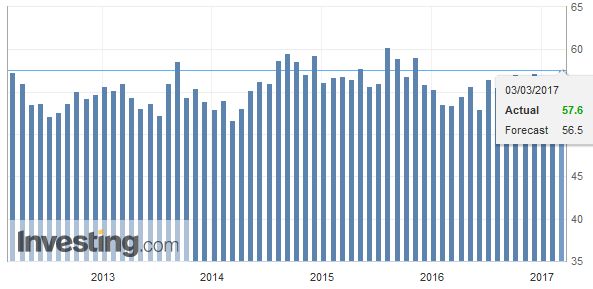

ChinaThe market’s focus is squarely on Yellen (and Fischer), with today’s economic data having little impact. Japan and EMU data were constructive, while as we noted the UK service PMI and China’s Caixin PMIs were not so strong. Caixin’s composite rose to 52.6 from 52.2, which reflects the gains in the previously reported manufacturing survey as the services PMI slipped to 52.6 from 53.1. The composite rose to 52.6 from 52.2. |

China Caixin Services Purchasing Managers Index, February 2017(see more posts on China Caixin Services PMI, ) Source: Investing.com - Click to enlarge |

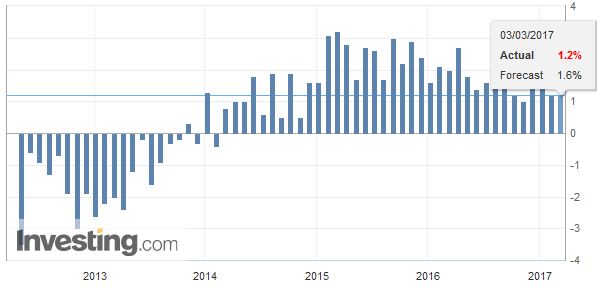

JapanJapan reported a slew of data. The most important were the CPI. The Japanese core rate, which excludes fresh food, rose 0.1% year-over-year in January. It was the first positive year-over-year reading since December 2015. Excluding food and energy, like the US core, consumer prices rose 0.2% after a 0.1% increase in December. |

Japan National Core Consumer Price Index (CPI) YoY, January 2017(see more posts on Japan National Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The unemployment rate also ticked lower to 3.0% from 3.1%. |

Japan Unemployment Rate, January 2017(see more posts on Japan Unemployment Rate, ) Source: Investin.com - Click to enlarge |

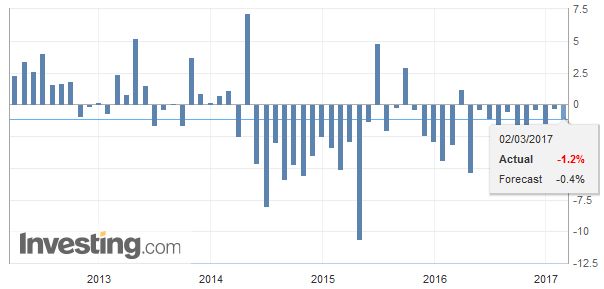

| That is where the good news ended for Japan. The services and composite PMI slipped (51.3 vs. 51.9 and 52.2 vs. 52.3 respectively). However, the more worrisome sign was the unexpectedly large 1.2% year-over-year decline in overall household spending. It was expected to have fallen 0.4% after a 0.3% contraction in the year through December. Purchases of homes and autos were particularly soft. |

Japan Household Spending YoY, January 2017(see more posts on Japan Household Spending, ) Source: Investing.com - Click to enlarge |

| Japan’s Topix gapped higher yesterday but retreated today to fill the gap and finished near the middle of the day’s range. The dollar moved above JPY114 in the middle of the week. It closed above there yesterday and is holding above there today as it consolidates. Optionality is thought to be discouraging a run to JPY115.00. |

Japan National Consumer Price Index (CPI) YoY, January 2017(see more posts on Japan National Consumer Price Index, ) Source: Investing.com - Click to enlarge |

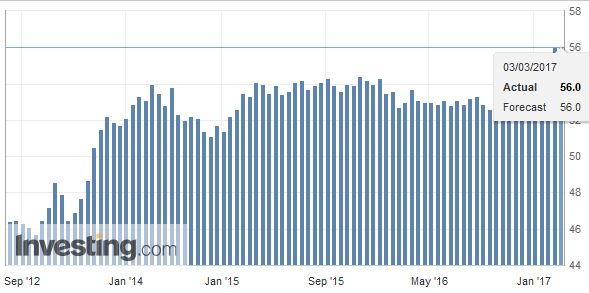

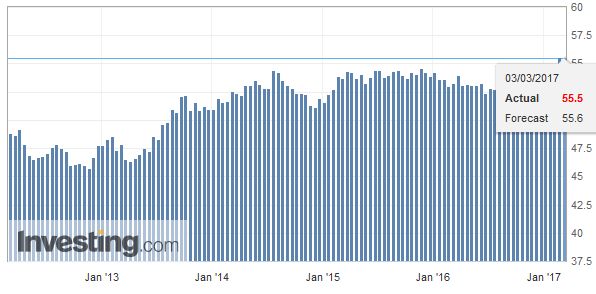

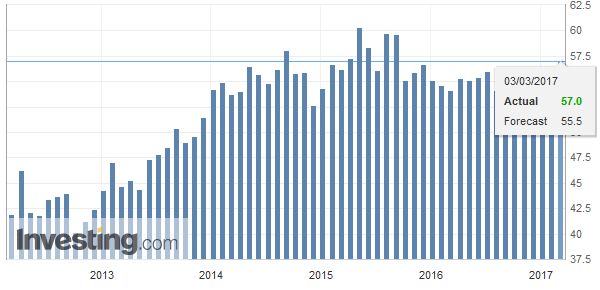

EurozoneThe composite eurozone PMI was unchanged from the 56.0 flash reading, which as you will recall, was a marked improvement from January’s 54.4, though the service PMI was a tad softer than the flash. The composite averaged 53.9 in Q4, which suggests some upside risk to growth. In the country reports, Germany was as the flash indicated, and both Italy and Spain surprised on the upside. That leaves France as the source disappointment. |

Eurozone Markit Composite Purchasing Managers Index (PMI), February 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

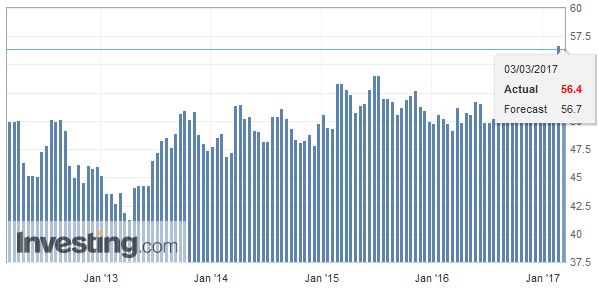

| The service PMI was revised to 56.4 from the flash’s 56.7. The French composite is at 55.9 rather than 56.2 that the flash estimate had it. |

Eurozone Services Purchasing Managers Index (PMI), February 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

| Retail sales for the eurozone fell 0.1% in January compared with expectations for a 0.3% gain after the 0.5% contraction in December, which were originally reported as a 0.3% decline. Eurozone retail sales have now fallen for three consecutive months and five of the last six. The disappointing consumption and the stable core CPI (0.9%) will give Draghi fodder to push back against some hawks at next week’s ECB meeting.

The French premium over Germany narrowed this week at both the two- and 10-year tenors. And it took place at higher absolute yields. In some sense, the French political picture is clearing. Fillon’s campaign is in trouble as reports suggest that the center-right Republicans are abandoning it. Macron’s support is increasing. Neither Macron nor Le Pen has a parliamentary coalition (Macron’s new party has no members in parliament, and the National Front has two seats). The first round of the presidential contest is April 23 and the second round is May 7. In June France goes back to the polls to vote for parliament (June 11 and 18). |

Eurozone Retail Sales YoY, February 2017(see more posts on Eurozone Retail Sales, ) Source: Investin.com - Click to enlarge |

GermanyDisappointment comes from the January retail sales. German retail sales were the likely culprit. They fell 0.8%. The Bloomberg survey produced a median forecast of a 0.3% gain. Recall December was flat and retail sales in November fell 0.7%. German retail sales have not grown since October (though fell in August and September too). |

Germany Retail Sales YoY, January 2017(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

Spain |

Spain Services Purchasing Managers Index (PMI), February 2017(see more posts on Spain Services PMI, ) Source: Investing.com - Click to enlarge |

Italy |

Italy Services Purchasing Managers Index (PMI), February 2017(see more posts on Italy Services PMI, ) Source: Investing.com - Click to enlarge |

France |

France Services Purchasing Managers Index (PMI), February 2017(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

United StatesOil prices are stabilizing after a three-day slide that brought the April light sweet futures contract to the lower end of its three-month trading range. Even though OPEC appears to have cut output for the second month in February, US output is rising, and at 9.03 mln barrels a day, it is the highest since last March. Moreover, US oil inventory continues to rise. The EIA estimates a 1.5 mln barrel build in the past week that raises the year-to-date accumulation to 41 mln barrels.

|

U.S. Markit Composite Purchasing Managers Index (PMI), February 2017(see more posts on U.S. Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| Lastly, we note that the S&P 500 gapped higher on Wednesday and did not enter the gap yesterday. US shares are trading lower in Europe, and the S&P 500 is expected to open lower. |

U.S. Services Purchasing Managers Index (PMI), February 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

| The gap is an important technical consideration now. The gap is found roughly between 2367.8 and 2380.1. The gap will likely be entered but is not necessarily bearish. A close below the bottom would likely be sufficient to be concerning for next week’s activity. |

U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), February 2017(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: China Caixin Services PMI,EUR/CHF,Eurozone Markit Composite PMI,Eurozone Retail Sales,Eurozone Services PMI,France Services PMI,FX Daily,gbp-chf,Germany Retail Sales,Italy Services PMI,Japan Household Spending,Japan National Consumer Price Index,Japan National Core Consumer Price Index,Japan Unemployment Rate,newslettersent,OIL,Spain Services PMI,SPY,U.K. Services PMI,U.S. ISM Non-Manufacturing PMI,U.S. Markit Composite PMI,U.S. Services PMI