The following article by David Haggith was first published on the Great Recession Blog.

Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic thrills:

- Britain voted to exit the EU, and a handful of other nations are talking openly along similar lines. One major crack in the European Union just happened, and others are forming. (Brexit is the name of this new Earthquake ride near the gates of Wonderland.)

- Italy’s oldest bank (also the world’s oldest bank, Banca Monte dei Paschi di Siena) faces bankruptcy unless it gets bailed out. The bank that has survived the greatest tests of time (founded in 1472 before Columbus sailed the ocean blue) is going down unless it finds a savior! Italy’s prime minister is screaming for tax-payer bailouts. At the same time, one of Germany’s oldest banks and one of the largest — Deutsche Bank — has just about become a penny stock and faces the likelihood of imminent collapse if not bailed out, too. (Welcome to Wonderland’s zombie freak show of the world’s oldest walking-dead banks dying again.)

- Gold and silver have been soaring as though people are fleeing to safety (in Wonderland’s Bouncy House of Coins).

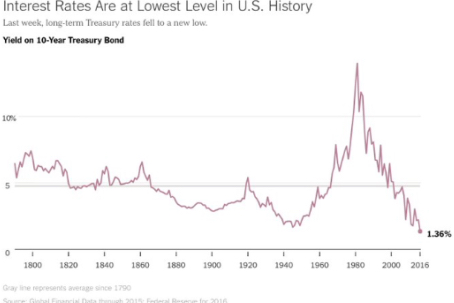

- People are also fleeing to safety in bonds, bringing the US 10-year bond down to a 1.318% yield, its lowest yield in history. (Hit me on the head with a hammer like a pop-up gopher, and watch me smile.)

- In many nations around the world, government bonds have been selling hotter than bombs in Syria even with negative interest rates, meaning you lose money every day you hold them. (The bonking game of bigger gophers for the near-sighted so that Wonderland remains handicap accessible.)

- In Switzerland, people are cuing up in the ticket line to give the government their money to hold for a fifty year ride now that the Swiss 50-year bond has turned negative. (Wonderland’s biggest gopher for the totally blind. You don’t just hit this one; it takes you the ride of your life for the rest of your life. We call it “Gopher Broke.”)

- US jobs crashed in May, causing stocks to drop, but rebounded in June, causing stocks to rise, so that May is now seen as an unexplained anomaly. (Welcome to Ripley’s House of Unexplained Economic Mysteries.)

- The Great Britain Pound crashed to a thirty-year low against the dollar. (Enjoy your ride on the currency bumper cars!)

- Japan’s decade of quantitative wheezing has accomplished so little that they’re going to cough up more of the same all over again because it was so much fun the first five times. (House of Bodily Humors and Horrors.)

- Central banks in Europe say they need to and will crank their own quantitative easing back up, so effective have all previous rounds been. (And, so, the merry-go-round spins and the calliope plays its happy music in Euro Dizzyland.)

- Falling oil prices, which contributed significantly to January’s spectacular stock market plunge, are going back down the pipeline while oversupply is building rapidly at the bottom again with the buildup reaching its highest point in ten weeks. (Wonderland’s log ride through oil with more than one crude splash.)

- Venezuela and Brazil are collapsing into economic chaos. (It’s more fun than that bungy-jumping vehicle for two at the carnival.)

- Etc. (I know, darn! Just as he was on a roll. Well, hang on…)

Yet, the S&P 500 and Dow have soared to all-time record highs! Whoohoo! Hold onto your safety harness and try not to choke on your popcorn for the fun never ends in Bankster Wonderland!

What’s up with stocks and down with bond yields?

US Stocks are flying high at the same time demand for sovereign bonds is soaring and precious metals are experiencing a bull market. That says to me that money is fleeing to safety, and the apparent irrational exuberance in the stock market, considering all the flights to safety, is partially fueled by foreign investors fleeing to US investments now that Europe’s cracks are showing like Frankensteins body seams.

Weekly fixed income fund flowsThis chart from David Stockman’s Contra Corner shows how people are piling into bonds right now: |

Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic thrills: - Click to enlarge |

Interest Rates Are at Lowest Level in U.S. HistoryAs a result, US bond interest rates are the lowest they have been in the history of this nation! Here’s another chart from Contra Corner: Whoohoo! Two massive records in one week. Highest stock market prices and lowest bond rates in the history of the United States! Does it get any better than this? Geez, I love this place! |

Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic thrills: - Click to enlarge |

We have never seen anything like this

Stocks are setting all-time record highs, and interest on US bonds is hitting all-time record lows. Money is running to gold and silver. Money is running to long-term sovereign bonds. And money is running to the US stock market all at the same time. Heck, money is running all over the place! What is there not to be happy about?

However, before you think, Whoo! the stock market is going up; there’s no crash happening, ask yourself what the heck is happening. We’ve never before seen either of these two extremes where stocks are free of all bondage and all bonds are free of their stocks. Only during the years of quantitative easing and zero-interest-rate policy have we seen bonds and stocks play together, but never to this extreme. So, when all the gauges on the instrument panel are pegging their needles past the red zone, including the one that says “We’re going super fast now,” you might want to say, “Whoa! What’s going on?” Maybe the engineer on this train has fallen dead over the throttle.

As Jesse Felder said on Contra Corner, “We’re witnessing the greatest dichotomy in the history of financial markets.” Interest rates on bonds have now gone below any low of any recession … ever. Far, far below. We’re digging out the sub basement to find where the money is buried. If you were to gauge the economy’s future based on where bonds have gone, you’d have to say, “This must be the scariest future ever because there has never been such a flight to presumably safe vehicles at any cost.”

At the same time, stocks have never been more overpriced than they are today. They hit their highest price ever during a period in which earnings have been flagging for many months. So, they’re not rising because, “Woohoo! Businesses are making bank!” No, they’re making new heights in spite of the fact that sales are down, profits are down, and wholesale inventories have remained locked in a highly backed-up position that is comparable only to the Great Recession and the dot-com crash … and while things are not looking generally good in the world economically. So, there is not a lot of reason to think sales will grow to fit the high stock values. In other words, median price-to-sales ratio (price of stocks compared to sales of the businesses) has also hit an all-time record high.

Three all-time records in one week! This is the funnest place in the universe!

Is this irrational euphoria among investors? Is it even people who are buying the bonds? Is it people who are buying the stocks? Or is it entities like central banks and their proxies — not buying them as investments, but buying them in mass to shore up the entire global economy and stop the crash that started right after Brexit … or that started right after December 16, 2015? (It’s just one crash right after another here at Wonderland’s National Demolition Derby.) Are central banks firing up all engines to stop a crash in its tracks with a massive coordinated salvo of purchases?

So, what is happening as central bankers watch each other in mutual admiration?

Says Jeff Cox of CNBC,

The reason anyone would buy negative-yielding debt is actually pretty simple: Because they have to. They are central bankers looking to help promote economic growth. They are insurance companies, pension funds and money managers who have to match liabilities with assets. They are not, by and large, retail investors who are so afraid of risk that they’re willing to pay for the privilege of lending money to a government. Together, those buyers have helped build a nearly $12 trillion funnel of negative-yielding sovereign debt — unprecedented in world history.

Gee, there are a lot of things breaking historic world records this week. That must mean it’s a great week!

Cox thinks the big buyers of bonds are central banks, pushing down interest rates to stimulate the economy. No surprise there. Central banks have been going pedal-to-the-metal to hold interest rates to the floor for almost a decade, so why not continue? The record highs in bond sales (with corresponding lows in interest) and high in stock sales most likely are due to rapid pressure being applied to the accelerator as a counter-measure to the concerns governments and bankers have had about Brexit.

Emerging markets (EM) that were crashing at the start of 2016 offloaded assets to raise funds to keep the home front running at the start of the year. That contributed to January becoming the worst January in the history of the US stock market — worse than any start of a year in the Great Depression or the Great Recession. The central Bank of Japan and the European Central Bank increased their buying of those assets to offset that fall, and both recently announced they are going to apply a lot more stimulus.

Cox goes on to write,

Ostensibly, the global race to the bottom was supposed to stimulate growth, and it may just well keep pushing risk assets [stocks in particular] higher. But what awaits on the other side is adding to the worries of investing professionals. “Ultimately, there will be a day of reckoning,” said Erik Weisman, chief economist at MFS Investment Management…. There remains a pervasive feeling on Wall Street that the risk rally is built on sand, with a price to pay in a world where owning government debt no longer pays but rather costs.

Even central banksters who create money out of nothing cannot create a free lunch. Somebody pays, but probably you, not them. It’s an ominous feeling really — a sense that there is no underlying reality anymore — that the sands are shifting under your feet.

“There’s no doubt that there are and will continue to be unintended consequences, and the further we move away from something conventional into unconventional, the ratio of unintended consequences to intended consequences will rise,” Weisman said.

We’re seven years on since stimulus responses to the Great Recession began. These have also been the greatest stimulus measures in the history of the world. (No wonder these rides are so thrilling as they reach new world records multiple times a week.) However, outside of flying stocks, we still have a global economy that seems endlessly stuck in the dog days of summer. Or, to change to my old winter metaphor (now that summer has turned abnormally cold here where I write), the longer and harder the snow plows push the snow straight ahead, the more it piles up as an impossible obstacle ahead of them. The louder they get with chained tires clawing and engines roaring and smoking, the less snow they push. The plows are now grinding away at full throttle in the lowest gear they have, and it is looking like they are going to remain stuck in that gear for a very long time — maybe another decade … unless they simply give up the battle.

The world is buried under the highest mountains of the cheapest debt ever imaginable, and nothing is moving in the overall economy (except financial instruments that are trading places). And that is where I said we would wind up when I wrote my very first articles in my Downtime series on government bailouts and stimulus back at the start of the Great Recession. I said they were pushing all the snow straight ahead, instead of off to the side, so (quite a ways down the road) they would have a mountain of snow so high in front of them that all the plows in the world could push it no further. We are now quite a ways down the road.

The European banks that are screaming for bailouts are buried in bad debt they pushed forward from the Great Recession. They never wrote it off then because the damage to their balance sheets would have been so severe. As I said back then, such policies only meant the damage to their balance sheets in the future would be even more severe. The problem of bad debt owned by banks in Italy is now four times worse than it was at the bottom of the Great Recession.

Why did I know that would happen? Because nothing about this “recovery” is recovery. It has all been a forestalling of problems, “kicking the can further down the road,” with the inevitable pay-back time becoming worse the longer we forestall the inevitable write-off of bad debt. My Downtime articles years ago sounded many warnings that everything governments and central banks were doing was making a very bad situation worse just so we could avoid the pain at the time. Such actions resolved none of the true underlying problems that are built right into the foundation of our debt-based economy. Until we stop thinking we can build true monuments of wealth over ever-growing chasms of debt, we will solve nothing at all.

Europe’s banking troubles are now far deeper than they were at the belly of the Great Recession Part One. Europe endlessly scrambles to solve banking troubles that become harder to solve with each new phase. The snow plows I talked about in my Downtimeseries have not only stopped pushing the snow ahead, but the drift is now avalanching back onto them and pushing the plows backward, even as their wheels are spinning and screeching forward.

(This is what we do in the parking lots here in Winter Wonderland.)

Why else would the entire financial world be upside down?

Another explanation for the greatest dichotomy in financial history that is now happening in the US is that money is exiting European markets and fleeing to anything in the US because the US remains the best looking corpse in the cemetery; so, if you want to dance with stocks, do so with Stockzilla, bride of Bankenstein. What appears completely irrational is in part a flight of money from one part of the world to the last safe place on earth. (Safe for the moment, but moments count when you’re fleeing an avalanche.)

Central banks have become the biggest bullies in the playpen. With the biggest bullies pushing their weight around as much as they possibly can, there is no safe place for small investors in the playpen. So, individual investors around the world are fleeing to the safest investments they can think of. With Europe in such volatile flux and China being such an unknown with its own massive upheavals, what more readily comes to mind right now as a final resting place than the good ol’ US of A?

Naturally, the US will be the last major economy affected by the second avalanche of bank failures, which this time has started in Europe. Brexit isn’t likely to trigger anything in the US directly, other than the immediate panic selling that was seen in stocks right after the vote. Once it was clear that Brexit wasn’t going to destroy the United States, some euphoria within the US probably kicked in and helped push the stock market up rapidly past its long-standing ceiling because that euphoria was accompanied by even larger money flows from outside the nation as people ran for cover.

Brexit appears to be triggering the failure of banks that were too fat to fail, lest they flounder upon us and squish us all — some of the world’s most established banks. As things fall apart to this unprecedented degree in Europe, money has to run somewhere, and the US casino still has pretty lights that can be seen as far away as the growing darkness in Europe.

The United States will not remain immune to what is happening in Europe forever, but the hot air coming out of Europe’s balloon may fill the US sails for awhile. For the moment, the US is the beneficiary of Europe’s decline.

This could be a brief moment, however, as there are likely to be surprising connections (black-swan events) between Europe’s failing banks and US banks that materialize faster than anyone expects. We’re sailing in uncharted territory that looks nothing like anything we’ve seen before, so who knows what comes next in a world where stocks soar in the face of generally gloomy economic news while bond sales also soar at the lowest interest rates in history? (Welcome to our Pirates of the Caribbean boat ride where Mario Draghi plays the part of Jack Sparrow!)

With Europe reaping the whirlwind as its banks turn out the lights, with China looking lost and confused and sometimes spinning erratically, with Japan ecstatically voting to start its umpteenth round of unsuccessful quantitative easing, with South America breaking into greater anarchy every day of its pitiful, starving life, and with the US in longterm manufacturing decline with corporate profit growth also in continual decline, one cannot seriously think the world is just going to pull out of this!

That means those who are buying stocks because they believe there’s a new 30% rising bull market just beginning are taking euphoria to new heights, too. They are, in the very least, taking a perilous ride.

“Investors are buying bonds for capital appreciation and stocks for income. The world has turned upside down,” said James Abate, chief investment officer at Centre Asset Management LLC. The shift, according to Abate, has been fueled by central-bank stimulus inflating government-bond prices across the world, pushing yields on nearly $12 trillion of government debt into negative territory. And as bond yields tumble, more and more equities are yielding more than government bonds, spurring demand for companies offering sustainable income in the form of dividend payments. “It is a poison brew that central banks keep serving us,” Abate said. (MarketWatch)

In other words, central banks have taken all rationality out of all financial markets … at least in one sense. Everything everywhere now is contingent upon what central banks are doing. The contagion of their poison is ubiquitous. There is another sense, however, in which this is all rational. I call it the new rationality: central banks have all the money, and money follows money. So, individual investors are doing the best they can in following the money. So, in terms of global economics and politics, its irrational; but in terms of following the makers of money who run the show, it makes perfect sense. It has is own mad mindset.

“There’s a perception there’s a greater fool behind you,” Kohli said, pointing to the strategy of buying a bond with the intention to sell later at a higher price. But the main forces behind the rally, Kohli added, are central-bank purchases that keep fueling demand and propelling prices higher.… What’s more, the recent divergence between the main U.S. equity indexes and benchmark Treasury yields has been flashing “mind the gap” signals that fuel fears of a sharp correction…. So, despite popular belief, the decline in interest rates “should be viewed as a bad sign,” noted BAML’s Global Rates and Currencies Research team, in a report released Monday. “Too often we have heard how declining interest rates are good news and are used as a justification for investors being pushed out the risk spectrum. We disagree and argue this time is different and the decline in rates should be interpreted as a bad sign,” the analysts noted. (MarketWatch)

If Kohli’s first statement doesn’t sound like the definition of a Ponzi scheme, what does?

In terms of everything that once made sense financially, central banks’ transformation of this world into Wonderland is now complete. In this topsy-turvy world, Mad Hatters may not be so mad as they look. Everyone is simply trying to maneuver around the biggest bullies in the playpen by finding the safest place to play. It’s the new rationality of a world intentionally turned on its head — at last, by nearly everyone’s recognition — even more than it is euphoria. The irrationality has become obvious. What is not so obvious is the rationality of the irrationality.

In terms of everything that once made sense financially, central banks’ transformation of this world into Wonderland is now complete. In this topsy-turvy world, Mad Hatters may not be so mad as they look. Everyone is simply trying to maneuver around the biggest bullies in the playpen by finding the safest place to play. It’s the new rationality of a world intentionally turned on its head — at last, by nearly everyone’s recognition — even more than it is euphoria. The irrationality has become obvious. What is not so obvious is the rationality of the irrationality.

In other words, if investors take the bullish gamble on a rising stock market in the US at a time when most of the world is falling apart, they may be right for all the wrong reasons … for now. In Central Bank Wonderland, they have nowhere to fall but up. On a short-term basis (probably very short-term) market bulls could be right only because all the other circling drain holes around the world are dumping into sovereign bonds, precious metals … and the US stocks as the last casino open for business. Everything is now flowing into the extreme zone at the same time.

You can bet on the wild ride in US stocks, or you can bet on bonds that guarantee you almost nothing (or even less than nothing), or you can bet on precious metals. All three markets are rising together right now. The question is which one is likely to continue rising as Europe disintegrates, the oldest banks in the world crash, China teeters between crashes and stimulus while running the world’s most notoriously cooked books, Japan takes the governor off the throttle and flies with full-hot afterburners blazing into the rarified nozone, and South American economies implode into social chaos?

This is the crazy new zombie economy I call “The Epocalypse” — a world of economic collapse everywhere, apocalyptic in scale, epic in that it already exceeds the greatest extremes in history, and epoch in that it will come to be known as its own period in time. One word that says it all.

You have witnessed the beginning of this hideously convoluted world, and it only gets more distorted from here because nothing has been done to right the essential problems that are creating this grotesque chaos while ungoverned greed rules the day.

The children are no longer asking, “Are we almost there yet?” We’ve arrived, and they’re now asking if they can go home. Welcome to Central Bank Wonderland where Janet Yellen is the Queen of Hearts and all the little carnival riders are Mad Hatters whose moves are rational if you live in a world with irrational rules created by truly mad leaders. Dinner is served in our Zombie Epocalypse Room where only zombie banksters get to dine … and dinner is you! You see, if you were ever able to walk out the back door of Wonderland and look over your shoulder, the sign above the door says “Hotel California.” You are always welcome here … and can never leave.

Doest it get any more fun than this?

Sure it does. Wait till you see Act Two, which could be as early as next week!

Full story here Are you the author? Previous post See more for Next postTags: Bank of Japan,Ben Bernanke,Bond yield,Brazil,central-banks,China,Deutsche Bank,ETC,European central bank,European Union,Fail,Global Economy,Great Depression,Insurance Companies,Janet Yellen,Japan,newslettersent,None,Precious Metals,public debt,Quantitative Easing,Reality,recession,recovery,Switzerland,Wholesale Inventories