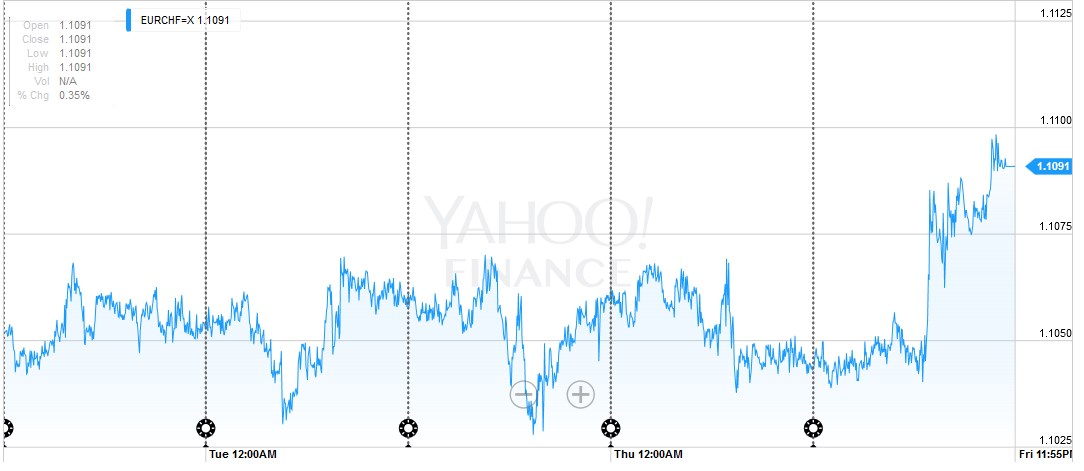

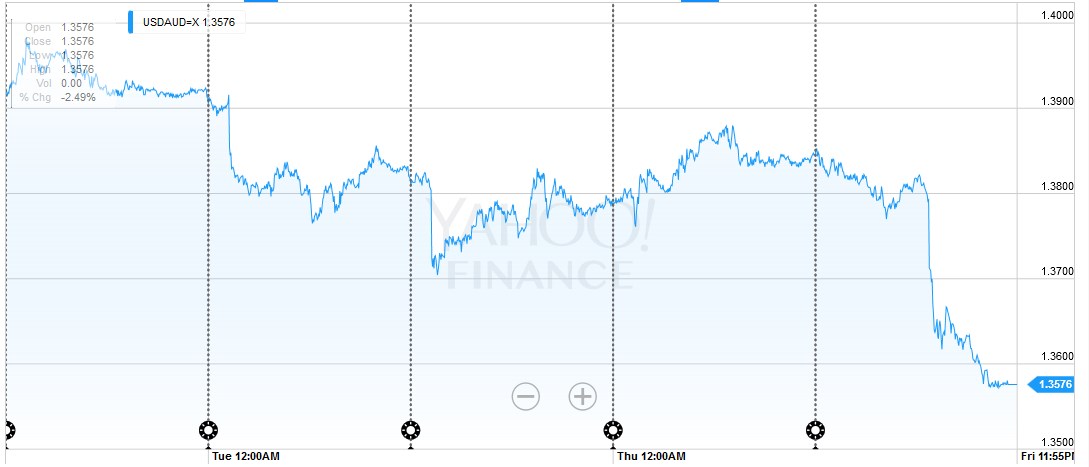

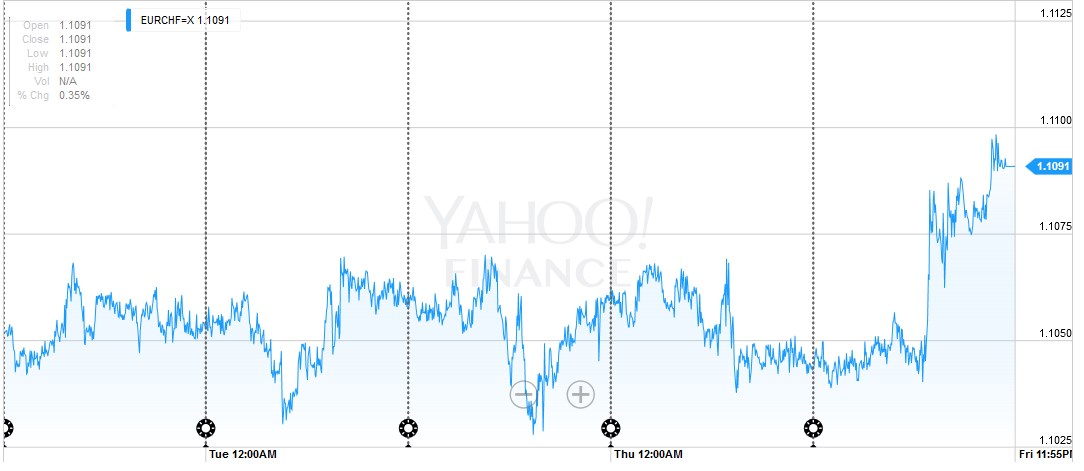

EUR/CHF

The massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank.

Consequently the biggest short speculative position is in the euro, while traders are long CHF against USD.

|

Click to expand |

USD/CHF

After a relatively steady week, the dollar lost 130 bips on Friday. |

Click to expand |

Continued by Marc Chandler:

The US dollar was mostly firmer over the past week. There were two exceptions among the major currencies: Sterling and the Canadian dollar.

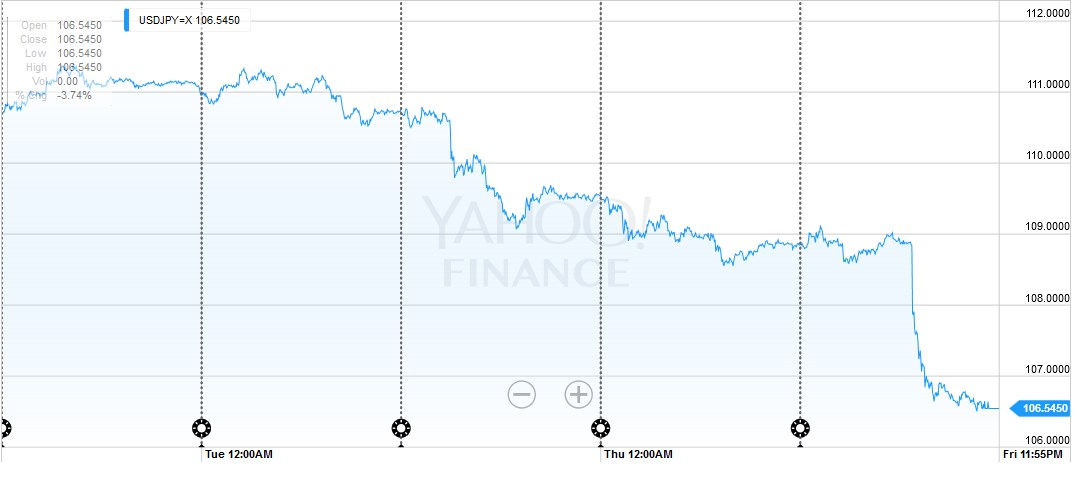

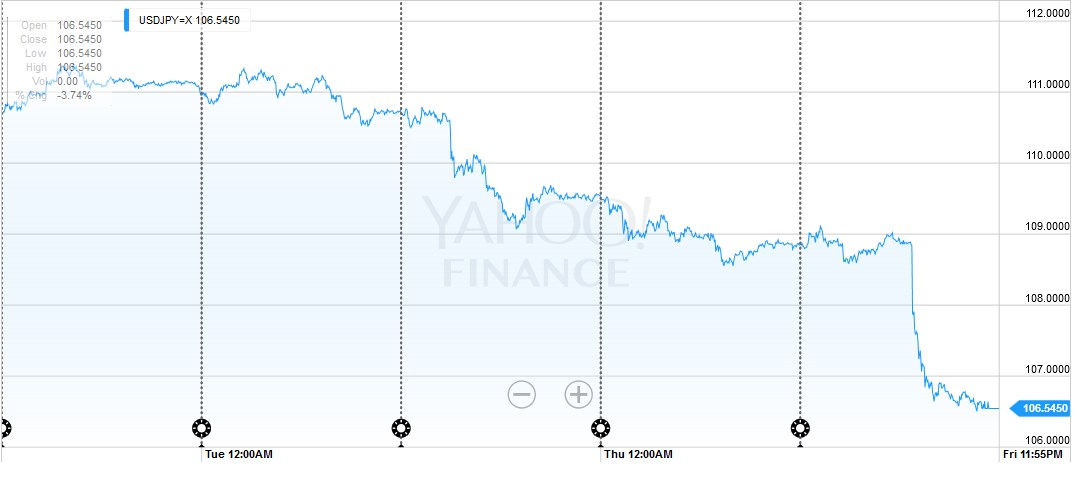

USD/JPY

The US dollar reversed higher on May 3 and trended higher. It peaked on May 30, but it was not clear until the poor US jobs report sent the greenback reeling on June 3. The fact that May 3-May 30 move is over is the most important technical consideration for the dollar’s outlook.

It is interesting to recall that the dollar had bottomed a fortnight before the FOMC minutes and Fed comments had encouraged the market to re-price a summer hike. The dollar now has peaked prior to investors pushing out the rate hike once again.

The prudent first assumption is that the dollar is correcting its May advance. This simple approach can be used for all the major currencies, but the Japanese yen, which took out the retracement objectives. While the JPY106.25 area may offer the dollar some initial support, there is little stopping a return to the May 3 low of JPY105.55. A break of it would fan expectations of a move toward JPY100 (with JPY100.60 representing a 50% retracement of the Abe-Kuroda rally).

Given that many fund managers are barred from taking naked currency positions, a bullish yen view can be expressed by buying Japanese government bonds. Foreigners have been net buyers of JGBs for nine consecutive weeks, after selling in March. At the same time, others may conclude that the yen’s strength (even if actually dollar weakness) may increase the likelihood of additional easing by the BOJ. This may attract some foreign buyers or JGBs on ideas that yields still have room to fall.

|

click to expand |

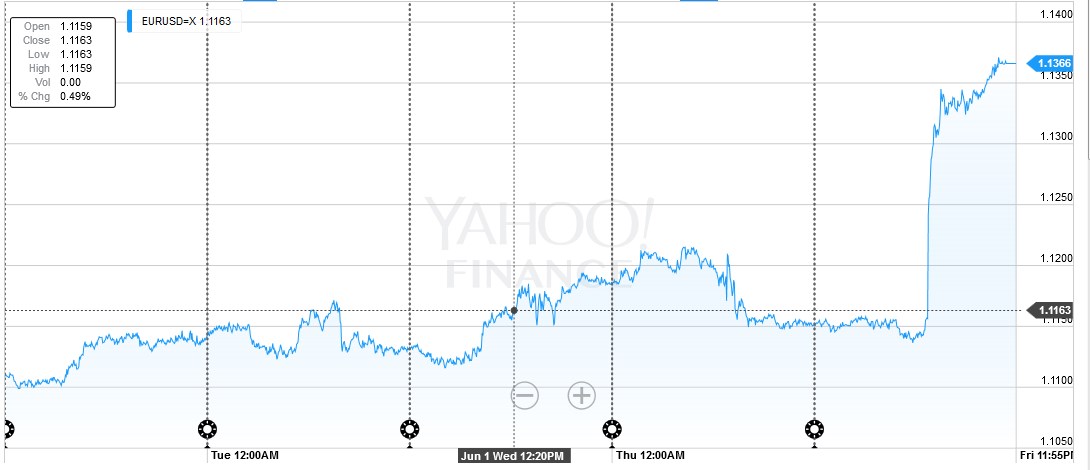

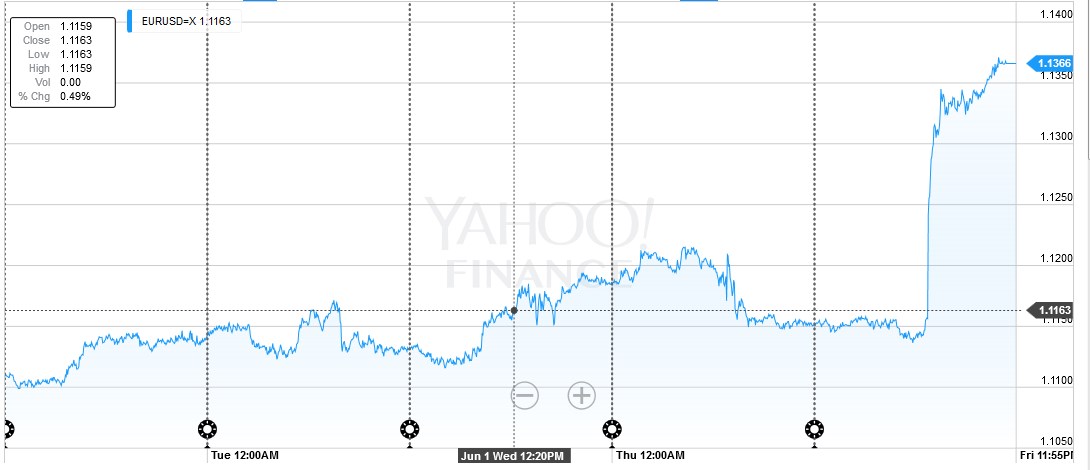

EUR/USD

The euro’s rally after the dismal US employment report was the third largest advance of the year. It shot through the 38.2% retracement near $1.13 to approach the 50% retracement at $1.1360. Above there is the 61.8% retracement objective ($1.1420) which is also near the upper Bollinger Band ($1.1440). The five moving average is likely to cross above the 20-day early next week, and this is a helpful proxy for trend followers. Technically, the euro should hold above $1.1250.

|

click to expand |

GBP/USD

Sterling was the only major currency to lose ground against the US dollar in the past week (~-0.6%). The culprit was not the economic data. In fact, the UK’s composite PMI for May was better than expected at 53.0, which is also above the three-month average. Fears of Brexit appear to have been rekindled based on some surveys, and sterling experienced its biggest weekly drop against the euro in a year.

The euro had trended lower against sterling from early-April through late-May. Over that period, the euro went from about GBP0.8115 to around GBP0.7565. That move effective retraced 50% of the euro’s advance from last November and is over. The next target for the euro is GBP0.7840 and then GBP0.7900. Against the dollar, the $1.4600 offer initial resistance with stronger cap a little above $1.4700.

|

|

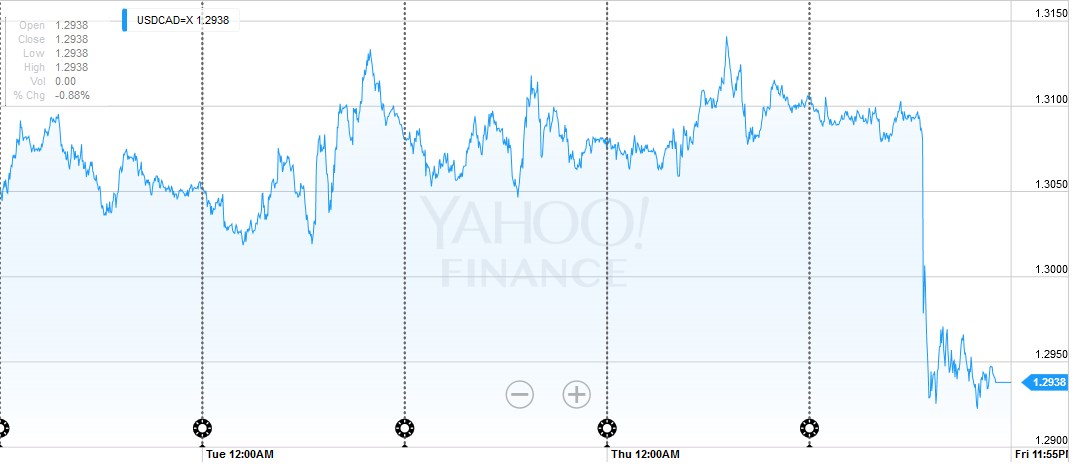

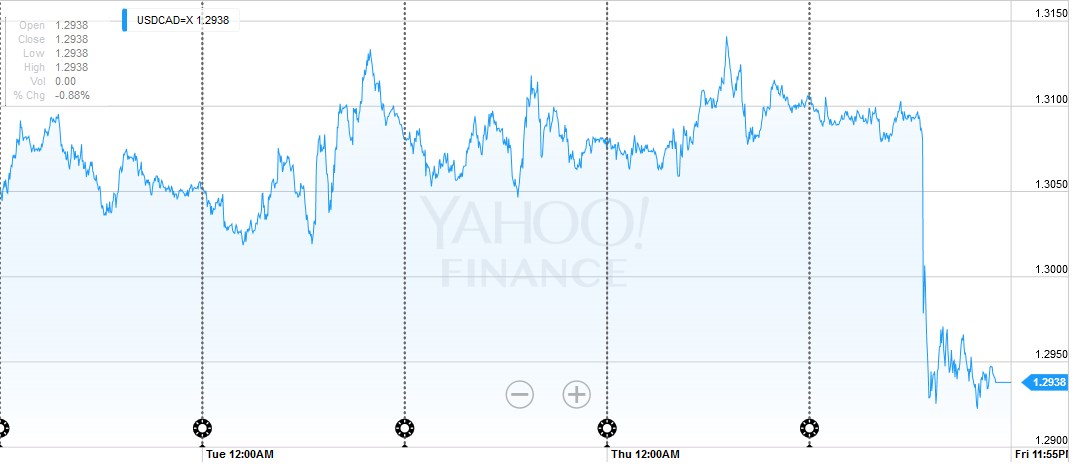

USD/CAD

The US dollar has shed 38.2% of its gains against the Canadian dollar that have been registered since May 3’s key reversal. The CAD1.2910 level was first seen on May 26, but the greenback recovered over the next several sessions to hit a high near CAD1.3145 on June 2. The technical indicators suggest a high probability that the CAD1.2910 will yield, which would allow for a move toward CAD1.2825, and possibly CAD1.2740.

|

click to expand |

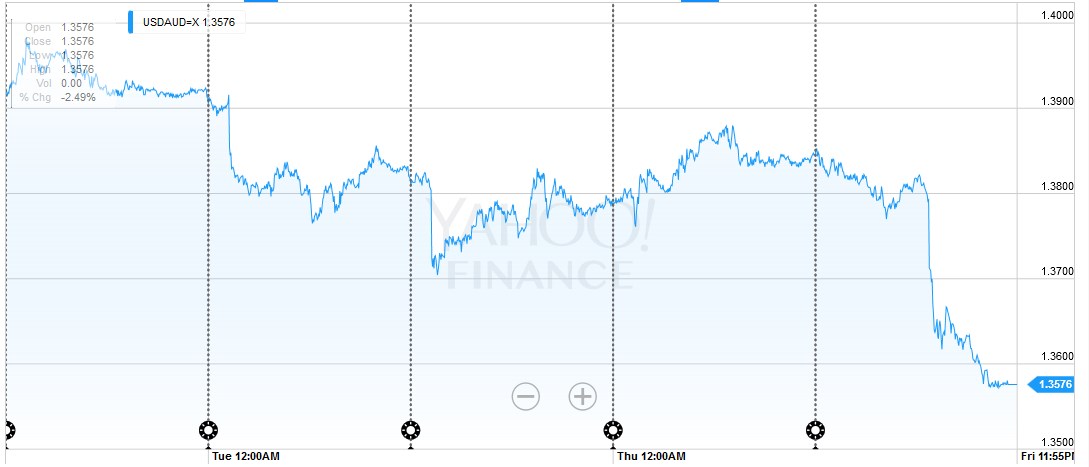

USD/AUD

.

Recently, the Australian dollar has been leading the other majors. The Aussie peaked on April 21 (~$0.7835), while the other majors did not peak until May 3. The Aussie bottomed on May 24 (~$0.7145). The other majors did not bottom until May 30. An upside correction should be expected in the period ahead. The first target is a little above $0.7400 and then $0.7500. We do not expect the RBA to cut rates next week, but if it does, the Australian dollar needs to hold around $0.7270 to keep the constructive outlook intact.

|

click to expand |

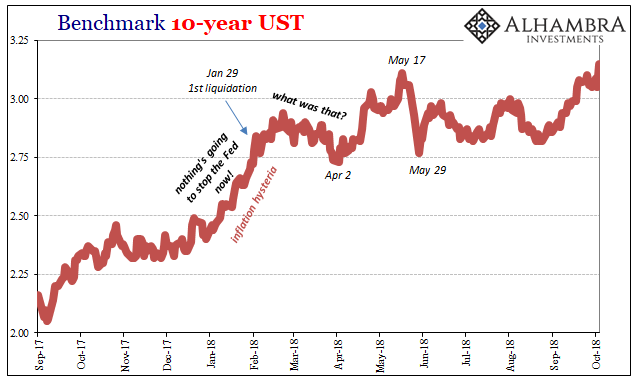

Bonds

Since late-February, the US 10-year note yield has held above the 1.70% level. The chief exception was April 7 when the yield slipped to 1.68%. The labor market disappointment saw yields return to their lows. Assuming that the jobs data may have exaggerated the weakness that the regional surveys have pickup in May, soft economic data should be seen in general for the rest of the month. This could see the 10-year ease toward 163%-1.65%. A move through there and the only thing to see is the 1.53% low on February 11.

The US 10-year yield has been confined to a narrow five bp range between 1.85% and 1.90%. A trend line drawn off the March and April high yield levels comes in now a little below 1.90%. A full calendar of economic reports next week, culminating with the May jobs data, means that the narrow range will likely be broken. On balance, we looking for continued range trading, albeit a slightly larger range. We are concerned that a soft jobs report (partly due to strike activity) may discourage ideas of a June hike (with the Fed opting for July instead), and this could see the yields in the short-end ease.

Equities

There are conflicting impulses for equities. On one hand, a delay in Fed tightening is positive, but on the other hand, the reasons for the delay, weaker labor market, is negative. The S&P 500 was softer after the employment report but steadily recouped its initial losses, and remains in the upper end of the recent range.

The day before the jobs data, the S&P 500 closed at its highest level since last November. The market has been resilient, and it seems to take at least a break of 2085, or 2050 before having much conviction that a high is in place. At the same time, the global environment does not appear particularly encouraging.

With the yen’s sharp rise (including to its best level against the euro since April 2013) the Nikkei may gap lower. Several different technical indicators highlight the importance of the 16000 area, which is about 4% below the June 3 close.

The Dow Jones Stoxx 600 posted an outside down day session before the weekend, which leaves in an a vulnerable position come the new week. Ever since the sharp fall to begin the year, the area around 350 capped advances. The Stoxx 600 was turned back from there at the start of last week. The recovery in the US after European markets closed could be neutralized if Asia falls sharply. The lower end of the 3-month+ range is around 327.

Chinese stocks look interesting, though the risk is disappointment if MSCI does not include A-shares in its review later this month. The Shanghai Composite rallied 4.2% last week to snap a six-week losing streak. It rose above the downtrend drawn off the mid-April and mid-May highs. The technical indicators appear supportive. It finished the week a little below 2940 and may have space toward 2980-3000. A weaker dollar environment may also make Chinese shares more attractive.

The constructive outlook for Chinese shares is consistent with a further recovery in the MSCI Emerging Market Index. The pre-weekend 1.3% advance meant that index retraced a little more than 50% (818) of the leg down that began on April 21 (856). The 61.8% retracement is found near 827, above there and the April high comes into view.

The S&P 500 recovered from below 2050 to approach 2100. The technical indicators are supportive for a re-test on the year’s high set in April near 2111. Last November’s high was about 2116, and the record high was set last May at almost 2135.

Oil Prices

The July light sweet crude oil futures contract slipped marginally last week, snapping a three-week advance. No one really expected OPEC to agree to a freeze as realpolitik considerations were powerful disincentives. Nevertheless, as we surmised, a new Saudi oil minister, coupled with the recovery in oil prices created a better atmosphere. The new effort to regroup was reflected by the agreement on a new Secretary General for OPEC.

The July contract has been tracking the 20-day moving average, which is now found a little above $48. It closed once since April 7 below this moving average. The broad sideways trading, mostly between $47 and $50 a barrel has seen momentum indicators weaken, but the market does not appear to have given up on pushing it higher, especially in a soft US dollar environment.

The firmer US dollar has not derailed the recovery in oil prices. The July contract flirted with the $50 barrel level but the market could not sustain the initial thrust. The pullback was shallow. Supply disruptions (and the drawdown in US inventories) appear to be the fundamental catalyst. OPEC is unlikely to reach an output freeze agreement. The RSI and MACDs suggest the market is stretched, but have yet to turn down. We will be on the lookout for a reversal pattern after the strong run-up.

Originally Posted by Marc Chandler on Marc to Markets, Charts and CHF data added by George Dorgan and the snbchf team

Full story here

Are you the author?

He has been covering the global capital markets in one fashion or another for more than 30 years, working at economic consulting firms and global investment banks. After 14 years as the global head of currency strategy for Brown Brothers Harriman, Chandler joined Bannockburn Global Forex, as a managing partner and chief markets strategist as of October 1, 2018.

Previous post

See more for 4.) Marc to Market

Next post

Tags:

Japanese yen,

newslettersent,

SPY,

usd-jpy