There are two events that willset the tone for the North American session: the ECB meeting and US jobs data. The ECB meeting features new staff forecasts. Given the firmness of oil prices, with Brent again testing the $50 a barrel level, there may be some scope to revise up the staff’s 0.1% forecast for this year. The GDP forecast of 1.4% seems less subject to change.

We have argued that it is unreasonable to expect the ECB to launch fresh initiatives. This conclusion does not arise from any belief in a secret agreement, but rather it has not implemented all the measures announced in March, a fortnight after the G20 meeting in Shanghai. The corporate bond purchases can begin as early as next week while the new TLTRO is also to be launched this month. Even after implementation is underway, new measures are unnecessary until the impact of the existing program can be fairly evaluated. This will keep the ECB on the sidelines for at least Q3 and possibly Q4.

We suspect the ECB is not quite ready to reinstate a waiver to allow Greek bonds to be used as collateral. Technically the review of Greece’s progress may not be over until Athen’s makes some legalistic adjustments to some of its already approved measures. Greek 10-year yields have risen a few basis points this week. After briefly trading below 7% last week, Greece’s 10-year yield finished last week near 7.26% and is quoted near 7.30% today. A decision to include Greek bonds in the ECB’s sovereign bond-buying program may take more time (and the paydown of more debt owed to the ECB).

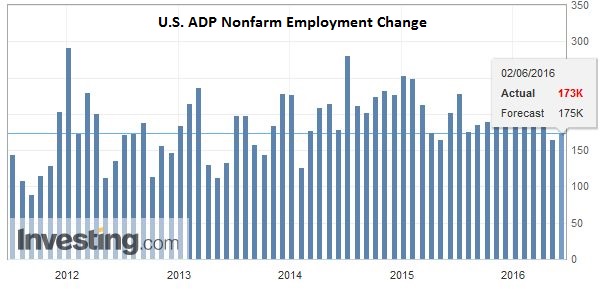

United StatesThere are two readings of the US labor market for investors today. First is the weekly jobless claims. This is the closest thing to a real-time check of US jobs. There has been some deterioration in recent weeks which is partly a function of strike activity. The four-week moving average has risen to 278k, its highest level since the end of January. Second, is the ADP estimate for private sector employment. The median forecast on Bloomberg is for an increase in ADP from 156k in April to 173k in May.

|

Note the ADP trend. The three-month average is 185k, while the six-month average is near 205k. While the weekly jobless claims are noisy, and may be distorted by a labor dispute at Verizon, the slowing trend of ADP cannot be simply dismissed. However, as full employment in the US is approached, slower job growth is anticipated, including by policymakers.

Meanwhile, three other developments have caught our attention. First, after reporting better than expected Q1 GDP yesterday, helped by exports, Australia reported a smaller April trade deficit earlier today. It is the fourth consecutive decline in the deficit. Weaker imports played a role, and this may, in part, reflect softer domestic demand. April retail sales disappointed with a 0.2% increase. The market had anticipated a slightly better report after a 0.4% rise in March. The Australian dollar is the weakest of the majors, off 0.6% today to trade near $0.7200, nearly a cent off yesterday’s high. Some link the Aussie’s weakness to unwinding cross positions against the yen.

Second, the PBOC fixed yuan higher (0.36%) by the most in three weeks. The weaker dollar offered the yuan a reprieve as it been near the year’s lows. The PBOC has denied press reports that it has abandoned market mechanisms. The fact that the yuan strengthened today demonstrates its point. However, the lack of transparency remains, and many suspect a selective tolerance of market forces. Separately, we note that Shanghai Composite bucked the regional bias to gain 0.4%. Nearly all industry sectors were higher but telecoms. The MSCI Asia-Pacific Index was off 0.8%, for the second day of declines.

Third, the German parliament is expected to pass legislation today condemning the 1915 Ottoman Empire slaughter of Armenians as genocide. This will bring Germany into alignment with several other European countries, including France, Netherlands and Sweden and Greece. It will no doubt put some additional strain on the German-Turkish relations. It has already been acknowledged that the end of June deadline for visa-free travel to Europe for Turkish passport holders will not be met, and this challenges the refugee deal that was recently struck.

Lastly, as we noted, oil prices are steady to firmer, as the OPEC meeting is underway. Although a formal freeze of output is unlikely, we warn that with a new Saudi oil minister, and the gains in oil prices, a new tone may be evident. The announcement of a new Secretary General for OPEC, when an agreement has been elusive in the recent past, may also reflect a new phase for OPEC.

Graphs and additional information on Swiss Franc by the snbchf team

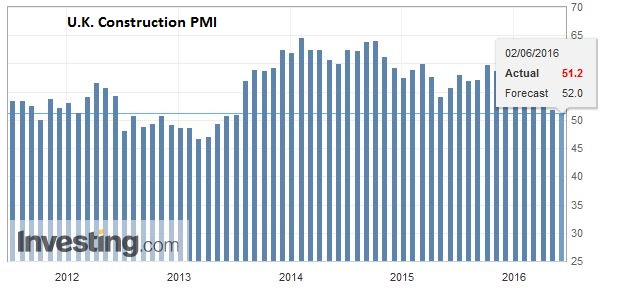

Tags: FX Daily,Japanese yen,newslettersent,U.K. Construction PMI,U.S. ADP Employment Change