Tag Archive: #USD

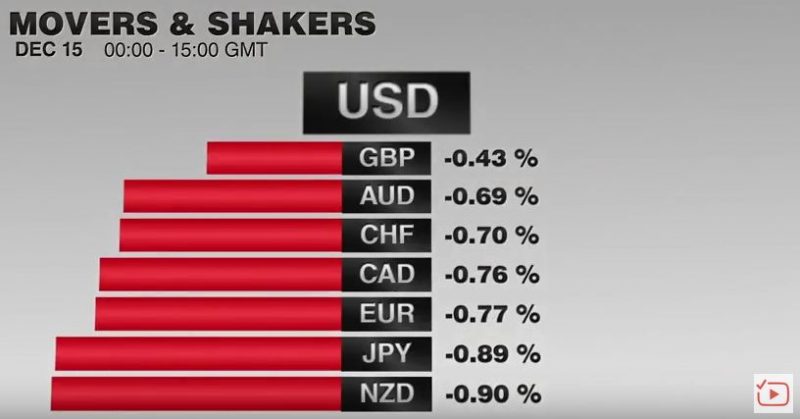

FX Daily, December 15: Greenback Extends Gains on Back of Fed

Sterling has made steady gains against the CHF over the past month and although the spike has levelled this week, the Pound has certainly gained a foothold. Yesterday’s decision by the US Federal Reserve to raise their base rate from 0.25% to 0.5% did little to shift the value of GBP/CHF but with investors still digesting the outcome, we may yet find it still has an effect.

Read More »

Read More »

Cool Video: Big Picture Dollar Outlook

I had the privilege of joining Scarlet Fu and Joe Wisenthal on the set of What'd You Miss on Bloomberg TV yesterday afternoon. It was within a couple of hours of the second Fed rate hike in a decade. The dollar rallied.

Read More »

Read More »

FX Daily, December 14: Markets Quietly Edge into FOMC Meeting

The Pound is entering mid-December in the same fashion it begun the month after having a very strong November as well. After being buoyed by Donald Trump’s victory and the High Courts ruling that parliamentary approval is needed before invoking Article 50, the Pound has been boosted further after economic data has also impressed, with yesterday being a good example of this.

Read More »

Read More »

FX Daily, December 12: Dollar and Yen Trade Lower to Start the Week

The US dollar and Japanese yen are trading lower. The tone is largely consolidative, and the foreign exchange market is not main focus today. Instead, the OPEC-non-OPEC agreement before the weekend is arguably the key driver today. Oil prices are up 4.5%-4.8%, lifting bond yields and supporting oil producers' currencies, like the Norwegian krone, Canadian dollar, the Russian ruble and Mexican peso.

Read More »

Read More »

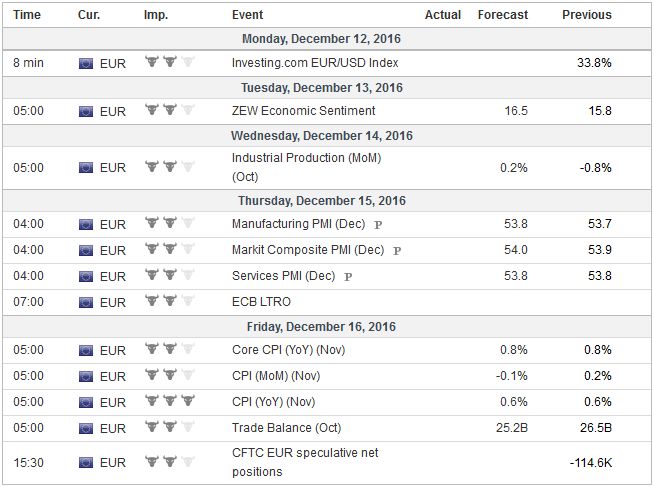

FX Weekly Preview: What the FOMC Says may be More Important than What it Does

FOMC meeting is the last highlight of the year. OPEC and non-OPEC producers strike a deal: optics good and that can lift prices further in near term. Italy will have a new Prime Minister, the fourth unelected PM.

Read More »

Read More »

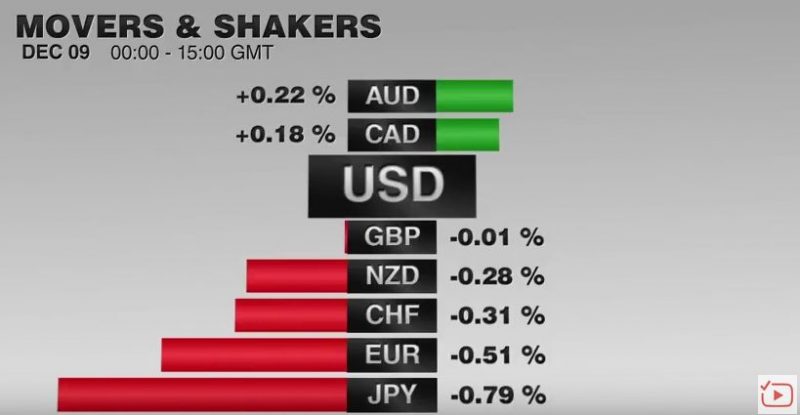

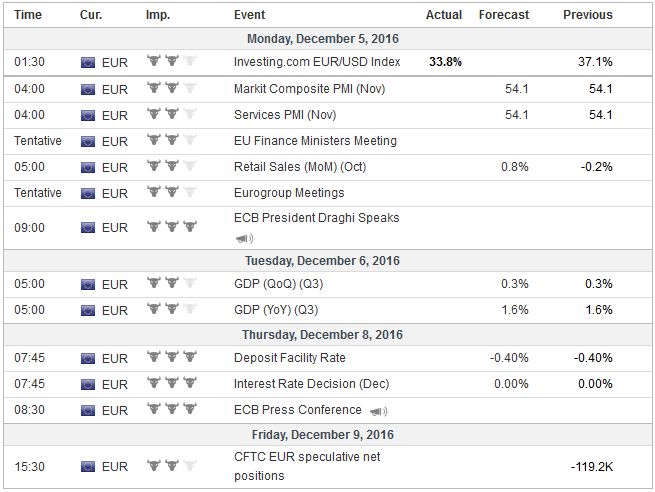

FX Daily, December 09: Euro Chopped Lower before Stabilizing

The euro has stabilized after extending yesterday's ECB-driven losses. The euro's drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650 area offering initial resistance. In the larger picture, this week's range, roughly $1.05 to $1.0850 likely will confine the price action for the remainder of the...

Read More »

Read More »

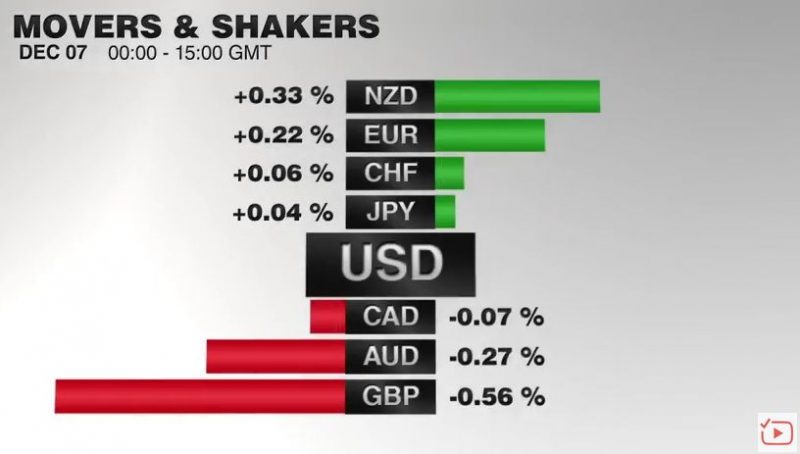

FX Daily, December 07: Greenback is Broadly Steady While Sterling Slides

The US dollar is little changed against most of the major currencies. Sterling is the notable exception, losing about 0.75% to trade at three-day lows. It was on the defensive in early European turnover but got the run pulled from beneath by the unexpectedly poor data. UK industrial output fell by 1.3% in October. The median forecast was for a small increase.

Read More »

Read More »

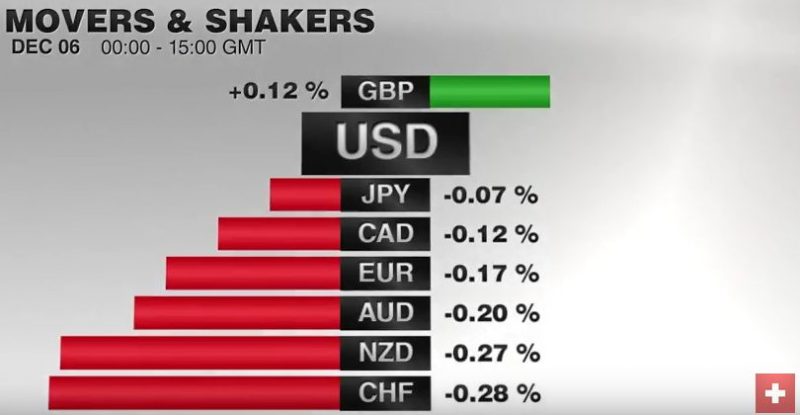

FX Daily, December 06: You Can Almost Hear a Pin Drop

The foreign exchange market is quiet. Ranges are narrow, with the US dollar mostly consolidating against the major currencies. Given the push lower yesterday, the shallowness of its recovery warns of the greenback's downside correction after strong gains last month may not be complete.

Read More »

Read More »

Great Graphic: Dollar Index Update

The Dollar Index's technical tone has deteriorated. It is corresponding to the easing of US rates and a narrowing differential. The risk is that the correction can continue in the coming days.

Read More »

Read More »

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »

FX Weekly Preview: Focus Shifts toward Europe

US developments have driven the dollar rally and bond market decline over the past three weeks. Attention shifts to European politics and the ECB meeting. Bank of Canada and the Reserve Bank of Australia meet but are unlikely to change policy.

Read More »

Read More »

What Would Make This Dollar Bull Nervous

USD had a large rally in November. We had been looking for a short and shallow pullback. Here are thoughts about what would signal an outright correction.

Read More »

Read More »

FX Daily, December 02: Is it About US Jobs Today?

The capital markets are finishing the week amid speculation that the driving forces of the past three weeks are ebbing. Global equities and the dollar may be snapping three-week advances. The issue is whether it is a consolidation or trend change. The former is a more prudent assumption until proven otherwise. As a rough and ready signal, the 100.60 level in the Dollar Index, which corresponds to the lows November 22 and November 28 is reasonable.

Read More »

Read More »

Mixed Jobs Report, but Unlikely to Deter Expectations for Fed Hike

The US dollar has slipped lower in response to the jobs data, but quickly recovered. The details are mixed, but is unlikely to change views on the outlook for Fed policy. The headline job creation was in line with expectations at 178k. Job growth of the back two months were shaved by 2k, concentrated in October. The unemployment rate dropped to 4.6%, the lowest since 2007.

Read More »

Read More »

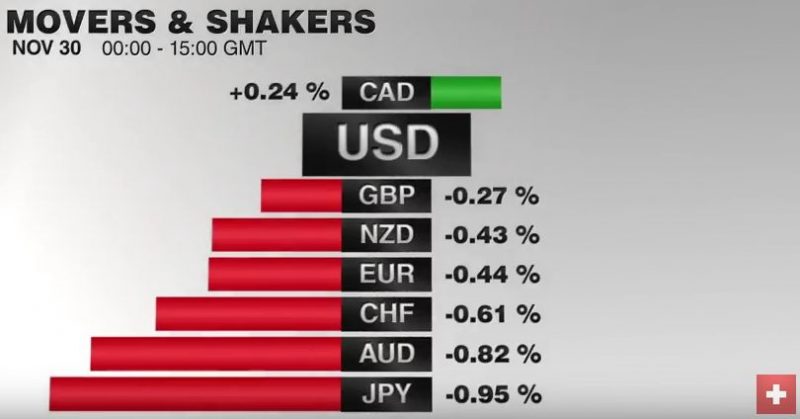

FX Daily, November 30: Renewed OPEC Hopes and Month End Featured

Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked government document titled Have cake and eat it, the markets and sterling were largely unphased.

Read More »

Read More »

FX Daily, November 29: Dollar Comes Back Mostly Firmer, but Focus is Elsewhere

The US dollar correctly lowered yesterday, but most of the selling was over by the end of the Asian session, and the greenback steadied in Europe and North America. The dollar is firm against the euro and yen but within yesterday's broad trading ranges. The Australian and Canadian dollar's gains from yesterday are being pared.

Read More »

Read More »

FX Daily, November 28: Corrective Forces Seen in Asia, Subside in Europe

As soon as markets opened in Asia, the greenback was sold, and corrective forces that had been nipping below the surface took hold. The euro, which had finished last week below $1.0590, rallied nearly a cent. Before the weekend, the greenback had pushed to almost JPY114, an eight-month high, before closed near JPY113.20. It was sold to almost JPY111.35 in early Asia. Sterling extended last week's gains and briefly poked through $1.2530, to reach...

Read More »

Read More »

FX Weekly Preview: Shifting Portfolio Preferences Continue to Drive Capital Markets

Forces emanating from the US and Europe are driving the capital markets. The moves may be stretched technically, but the market adjustment has further to run as not even two Fed hikes are discounted for next year. European political concerns and an ECB expected to continue its asset purchases have driven German 2-year yields to new record lows.

Read More »

Read More »

Short Summary on US Thanksgiving

Euro fell to new 20-month lows before steadying. The dollar extended its recovery against the yen. Emerging markets remained under pressure, and Turkey's central bank surprised with a 50 bp hike in the repo rate.

Read More »

Read More »

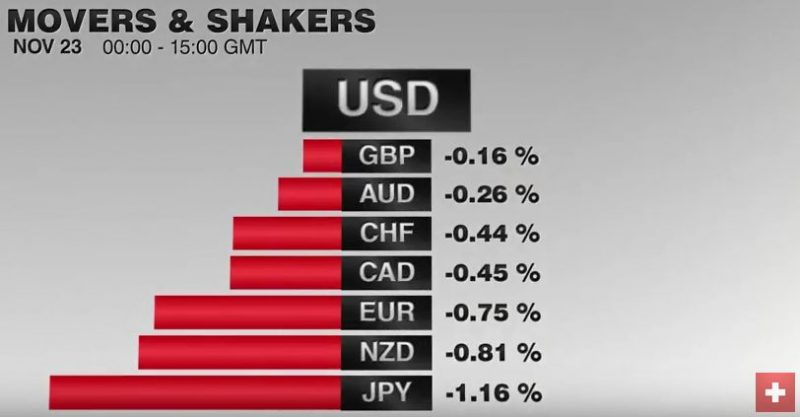

FX Daily, November 23: Dollar Sees Flat Consolidation while the Equity Advance Fizzles in Europe

The US dollar is trading inside yesterday's ranges against the euro and yen. The dollar's tone matches the consolidation in the debt market ahead of today's slew of US data and tomorrow's holiday. Tokyo markets were on holiday.

Read More »

Read More »