Swiss Franc |

EUR/CHF - Euro Swiss Franc, December 02(see more posts on EUR/CHF, ) |

Federal ReserveThe capital markets are finishing the week amid speculation that the driving forces of the past three weeks are ebbing. Global equities and the dollar may be snapping three-week advances. The issue is whether it is a consolidation or trend change. The former is a more prudent assumption until proven otherwise. As a rough and ready signal, the 100.60 level in the Dollar Index, which corresponds to the lows November 22 and November 28 is reasonable. Earlier today, it was approached (100.70), and the Dollar Index recovered. For its part, the euro made a new two-week high just below $1.07 (~$1.0690) before being sold to session lows in the European morning, a half a cent lower. Above $1.0700, a sustained move through $1.0725 would also suggest a deeper correction to the three-week sell-off than a consolidative move. |

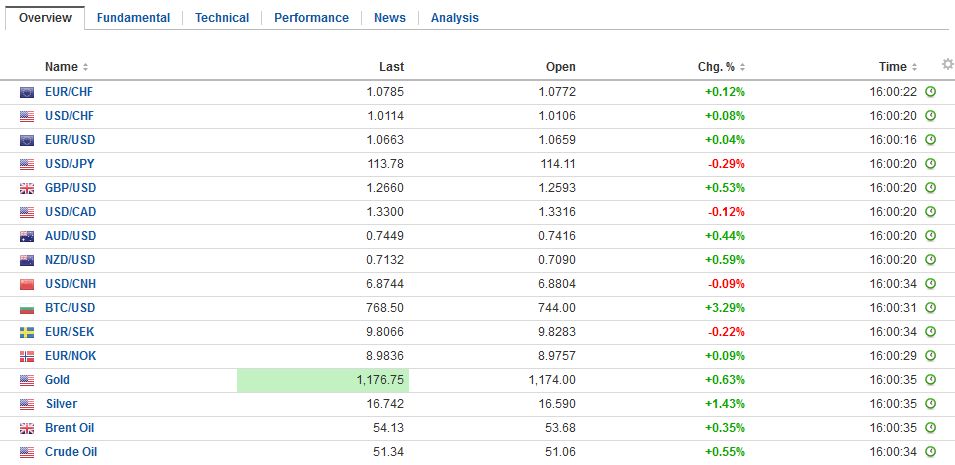

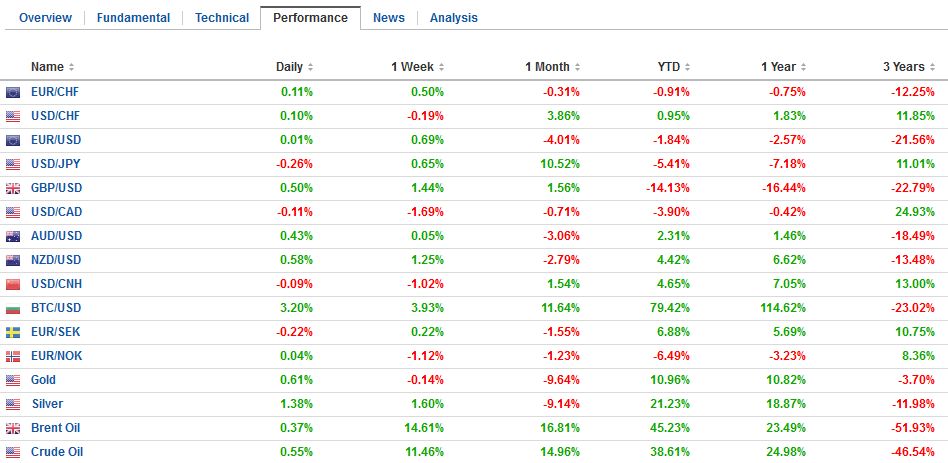

FX Performance, December 02 2016 Movers and Shakers . Source: Investing.com - Click to enlarge |

| The fact of the matter is that the US economy is growing above trend after a largely inventory-led, and manufacturing soft patch produced a few quarter of sub-par growth. The Federal Reserve’s has nearly achieved its mandate of full employment and price stability (as it defines it, which broadly similar to other major central banks). |

FX Daily Rates, December 02 (GMT 16:00) |

| The prospect of fiscal stimulus and the commitment by President-elect Trump’s economic team of 3%-4% growth has also influenced the long-end of the curve. The market is edging toward discounting two hikes next year. The December 2017 Fed funds futures closed yesterday with the highest implied yield since January (102.5 bp).

One trend that has been in place since the US election has been the underperformance large cap technology companies. Reports yesterday suggesting that Apple was reducing orders for iPhone 7 parts sent US chipmakers down yesterday by the most in five months (Philadelphia Semiconductor Index fell nearly 5% with all 30 members down). This has spilled over to the Apple ecosystem and weighed on Asian shares. The MSCI Asia-Pacific Index fell nearly 0.5%. |

FX Performance, December 02 |

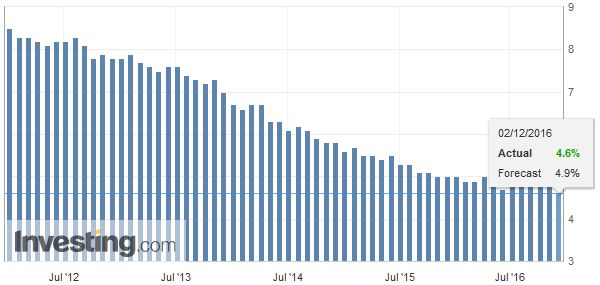

United StatesFollowing the recent string of robust US economic data, and strong hints and conviction that the Fed is poised to hike rates in a fortnight, it will take a significant downside surprise to be significant. Moreover, given economic backdrop, which has seen economists revise forecasts higher for Q4, a major disappointment, would likely be shrugged off after the headline effect. The underemployment rate may also be increasingly important going forward. This may still be a measure of labor market slack. In October, it had fallen to a new cyclical low of 9.5%, after having been stuck at 9.7% in six of the last eight months. |

U.S. Unemployment Rate, November 2016(see more posts on U.S. Unemployment Rate, ) . Source: Investing.com - Click to enlarge |

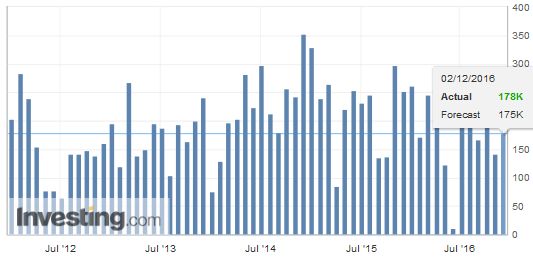

| Although net new jobs grab the headline, the market may be more sensitive to the details, especially the hourly earnings, understood as a measure of wage inflation and the tightness of the labor market. The 2.8% year-over-year increase in October was the most in seven years. Over time, the many economist’s models will show that headline inflation converges to core inflation, and core inflation converges to wage inflation. To be sure the hourly earnings is a nominal, not real measure. |

U.S. Nonfarm Payrolls, November 2016(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

EurozoneThere is much focus on the Italian referendum this weekend (though we are practically alone in warning that the populist-nationalist forces do not win in Italy regardless of the outcome of the referendum, whereas in Austria the far-right Freedom Party could capture the presidency), yet Italian assets continue to not simply hold their own, but do well. The Italian 10-year yield is off eight bp today and 10 for the week. It is the best week for BTPs in two months. Spain’s 10-year yield, by comparison, is off six bp today and one on the week. Italian stocks are off today with the rest of Europe’s markets but the loss in Italy is more modest than most, and it the only major market advancing on the week (3.3%). Italian bank shares have rallied a little more than 5% this week. |

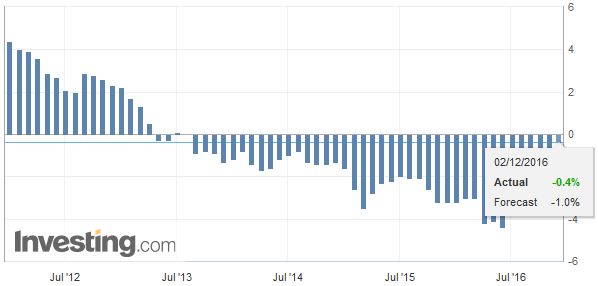

Eurozone Producer Price Index (PPI) YoY, November 2016(see more posts on Eurozone Producer Price Index, ) . Source: Investing.com - Click to enlarge |

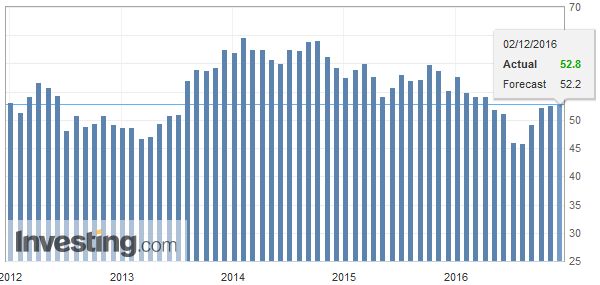

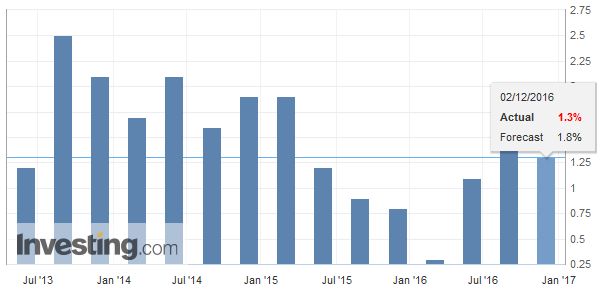

United KingdomWhile there have been several economic reports, they are not moving markets today. Of note, the UK construction PMI came in at 52.8, an unexpected improvement over October’s 52.6. The Swiss economy unexpectedly stagnated in Q3 after a 0.2% expansion in Q2. There were poor domestic economic impulses, with household spending increasing be a mere 0.1%. The 0.5% rise in capex is notable, but also illustrates that that sector is too small in Switzerland, and other industrialized countries, to carry the modern economy. We note that Australia’s retail sales rose 0.5% in October, which is a bit better than expected and follows some disappointing building approvals, new home sales, and capex. Lastly, Hong Kong and Switzerland signed a memorandum of understanding for mutual recognition, which will allow funds to be distributed in each other’s markets. |

U.K. Construction PMI, November 2016(see more posts on U.K. Construction PMI, ) . Source: Investing.com - Click to enlarge |

Switzerland |

Switzerland Gross Domestic Product (GDP) YoY, September - December 2016(see more posts on Switzerland Gross Domestic Product, ) . Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$EUR,$JPY,EUR/CHF,Eurozone Producer Price Index,FX Daily,newslettersent,Switzerland Gross Domestic Product,U.K. Construction PMI,U.S. Unemployment Rate