Tag Archive: #USD

Dollar Weakness and Fed Expectations

Dollar weakness does not line up with increased perceived risk of Fed hiking rates. Frequently the rate differentials lead spot movement. Some now turning divergence on its head, claiming too expensive to hedge dollar-investments so liquidation. TIC data, though, shows central banks not private investors, were the featured sellers in June, the most recent month that data exists.

Read More »

Read More »

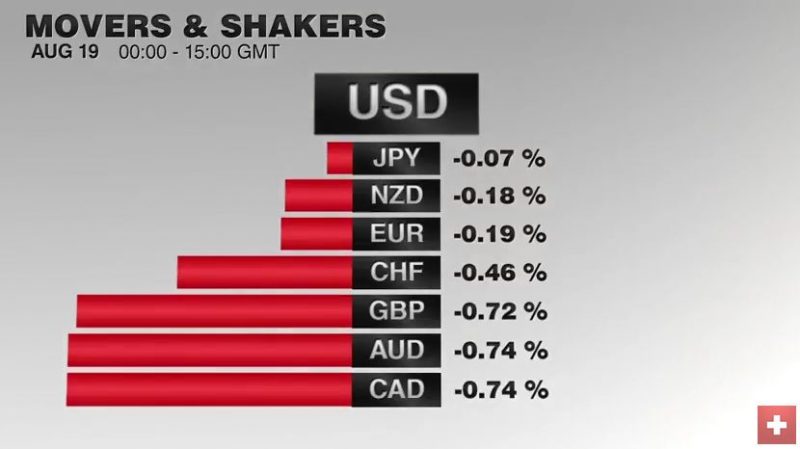

FX Daily, August 19: Dollar Recovers into the Weekend

The US dollar is trading firmly ahead of the weekend as part of this week's losses are recouped. The euro is trading within yesterday's range, holding to a little more than a half-cent above $1.13. However, as we have noted, the Asia and European participants appear more dollar-friendly than Americans

Read More »

Read More »

FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting.

Read More »

Read More »

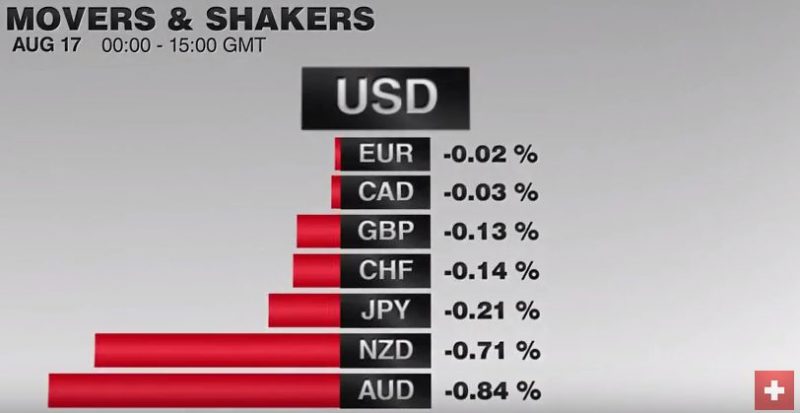

FX Daily, August 17: Dollar Snaps Back

The US dollar is enjoying a mid-week bounce against all the major currencies. It appears that participants in Asia and Europe are giving more credence to NY Fed Dudley's comments yesterday. Although many in the market have given up on a rate hike this year, Dudley reaffirmed his belief that the economy was accelerating in H2 and that the market was being too complacent.

Read More »

Read More »

FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think.

Read More »

Read More »

FX Daily, August 15: Dollar Eases to Start the New Week

The US dollar closed the pre-weekend session well off its lows that were seen in response to the disappointing retail sales report. It has been unable to sustain the upside momentum, and as North American dealers prepare to return to their posts, it is trading lower against most of the major currencies. The notable exceptions are the Scandi-bloc, which are consolidating last week's gains, and sterling, which remains pinned near $1.29.

Read More »

Read More »

Bretton Woods: RIP

Some romanticists want to have another Bretton Woods fixed exchange rate regime. Bretton Woods had difficulty from nearly the day it went operational. It is misguided to think a new rigid regime is needed or is appropriate.

Read More »

Read More »

FX Weekly Preview: Thoughts on the Significance of Ten Developments

The GDP deflator may be just as important as overall growth for BOJ considerations and the possibility of fresh action next month. Falling UK rates and a weaker pound are desirable from a policy point of view.

Dudley's press conference may be more important than FOMC minutes.

Two German state elections that will be held next month comes as Merkel's popularity has waned.

Read More »

Read More »

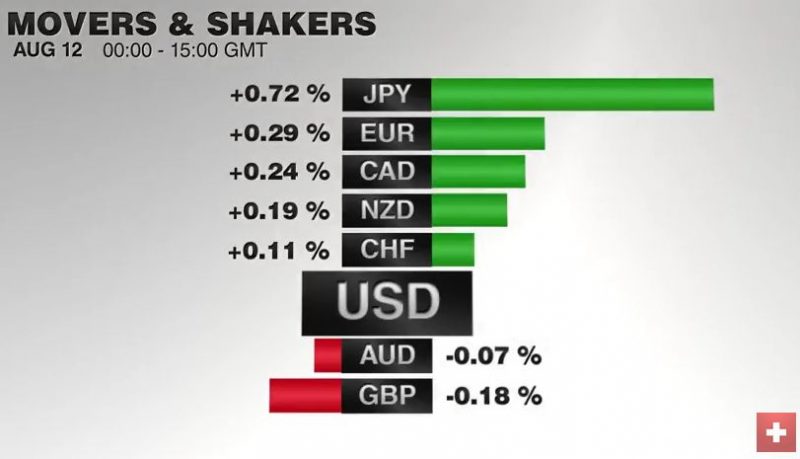

FX Daily, August 12: Summer Markets Grind into the Weekend

There is a general consolidative tone in the capital markets as the week draws to a close. The US retail sales report may offer a brief distraction, but it is unlikely to significantly shift expectations about the trajectory of Fed policy. Indeed, it might not really change investors' information set.

Read More »

Read More »

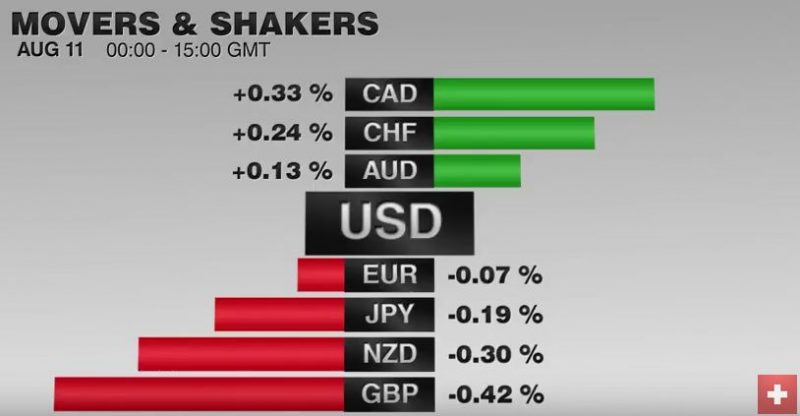

FX Daily, August 11: Sterling Struggles to Find a Bid, While RBNZ Can’t Knock Kiwi Down

Once again, EUR/CHF reverses in the middle of the week. A part from technical reasons, the weak French CPI (+0.4% YoY) and Italian CPI (-0.2% YoY) exercised downwards pressure on the euro. The US dollar has found steadier footing today after trading heavily yesterday. There are two main themes. The first is sterling’s heavy tone.

Read More »

Read More »

Two Things I Learned Looking for Something Else

LIBOR continues to rise. The relative calm of the markets will likely end next month. The last four months of the year are jammed with key events that have potential to disrupt the markets.

Read More »

Read More »

Cool Video: CNBC Asia–Mostly about the Redback and Greenback

I was invited to appear on CNBC Asia Rundown show with Pauline Chiou. We discuss the Chinese yuan on the anniversary of last summer's unexpected devaluation. I suggest that most of the things that get observers excited, like the internationalization of the yuan, or the Hong Kong-Shanghai link or, perhaps by the end of the year,a Hong Kong-Shenzhen link are really Chinese machinations that are the result of its contradictions.

Read More »

Read More »

FX Daily, August 10: FX Consolidation Resolved in Favor of Weaker US Dollar

European bourses are mixed, and this is leaving the Dow Jones Stoxx 600 practically unchanged in late-European morning turnover. Financials are the strongest sector (+0.4%), and within it, the insurance sector is leading with a 0.8% advance and banks are up 0.4%. The FTSE's Italian bank index is up 1.4% to extend its recovery into a fifth session.

Read More »

Read More »

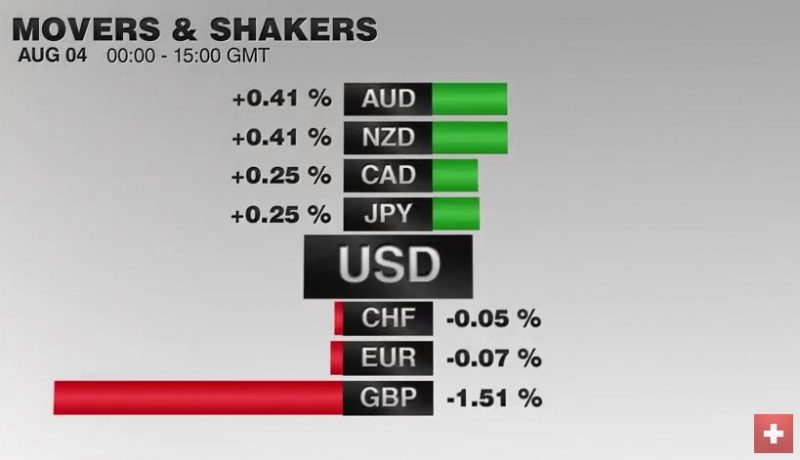

FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak - reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week's sight deposits.

Read More »

Read More »

FX Daily, August 03: Consolidation Featured

The US dollar is consolidating yesterday's losses. The greenback's upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week's RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week.

Read More »

Read More »

Gorilla or Elephant, Chinese Surplus Capacity is the Challenge

China's excess capacity is one of the most formidable challenges the China and the world face. Unexpectedly, China's steel industry reported a profit in H1 16. M&A for industry rationalization and foreign markets seem to be the main ways China is trying to address the excess capacity.

Read More »

Read More »

FX Daily, August 02: Greenback Slides Despite RBA Rate Cut and 7-year Low in UK Construction PMI

The US dollar is offered against the major currencies, but appreciating against many emerging market currencies, include the South African rand and Turkish lira. Oil prices are trying to stabilize with Brent near $42 and WTI near $40, but the recent losses continue to weigh on the Malaysian ringgit and the Mexican peso.

Read More »

Read More »

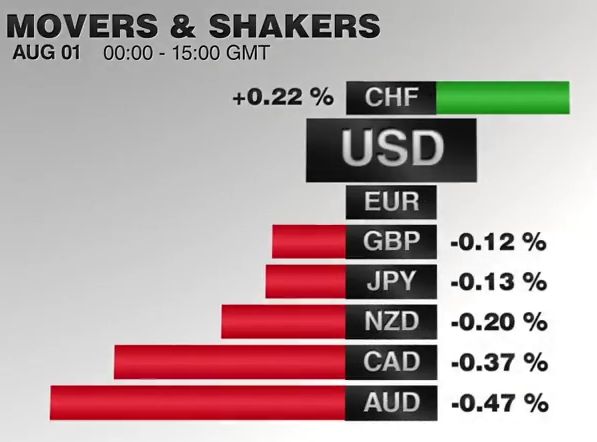

FX Daily, August 01: Dog Days of August Begin

The US dollar is trading with a small upside bias in narrow trading ranges. The main news has consisted of PMI reports, while investors continue to digest last week's developments. In particular the BOJ's underwhelming response to poor economic data and a missed opportunity to reinforce the fiscal stimulus, and the dismal US GDP.

Read More »

Read More »

Great Graphic: Real Broad Trade-Weighted Dollar

The real broad trade-weighted dollar index rose in July for the third month. It peaked in January above trendline drawn through the Reagan and Clinton dollar rallies. Expect the trendline to be violated again before the end of the year.

Read More »

Read More »

FX Weekly Preview: After this Week, Does August Matter?

RBA meeting is a close call. BOE meeting consensus on rate cut, maybe new QE and lending-for-funding. More details of Japan's fiscal policy. U.S. jobs data. After this week, and outside of RBNZ rate cut, August may be uneventful.

Read More »

Read More »