Tag Archive: U.S. Trade Balance

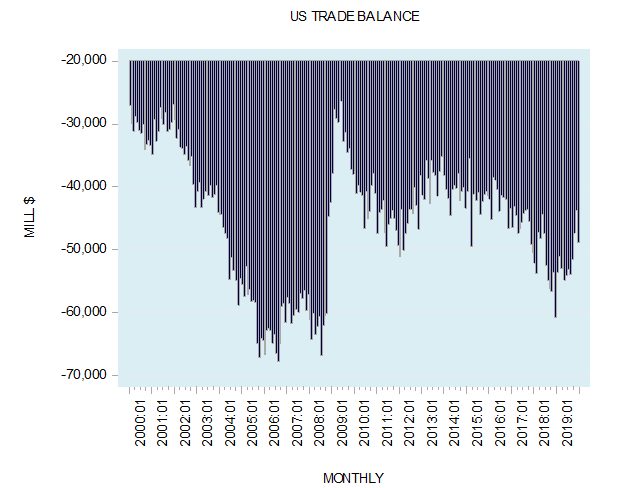

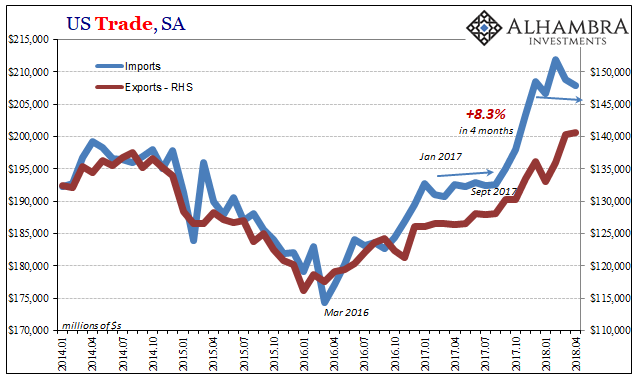

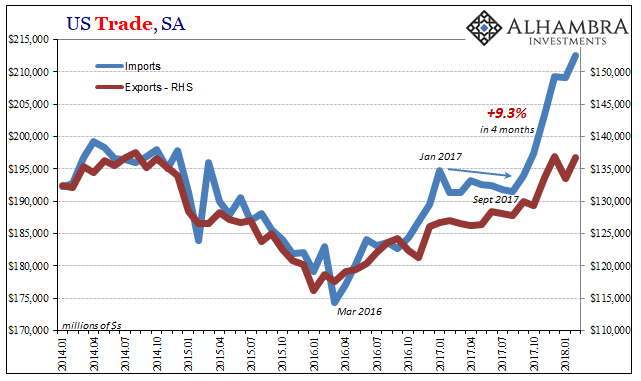

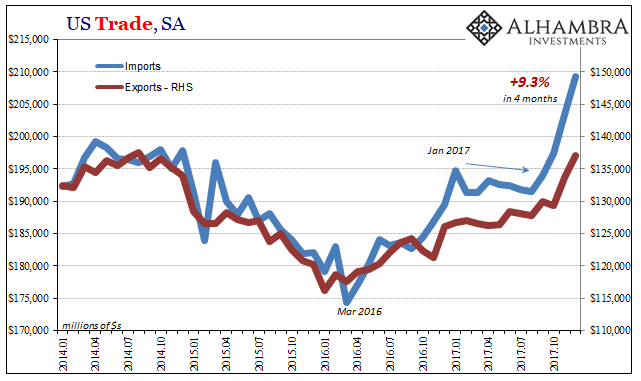

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation’s exports and imports over a certain period. Sometimes a distinction is made between a balance of trade for goods versus one for services. If a country exports a greater value than it imports, it is called a trade surplus, positive balance, or a “favourable balance”, and conversely, if a country imports a greater value than it exports, it is called a trade deficit, negative balance, “unfavorable balance”, or, informally, a “trade gap”.

FX Daily, September 2: US Jobs Data–Higher Anxiety, Thank You Mr. Fischer

The US dollar is little changed ahead of the job report. Our near-term bias is for a lower dollar. Sterling is flat and is holding on to about a 1% gain this week. The Japanese yen is about a 0.3% lower and is off 1.7% this week. The euro was coming into today for the week.

Read More »

Read More »

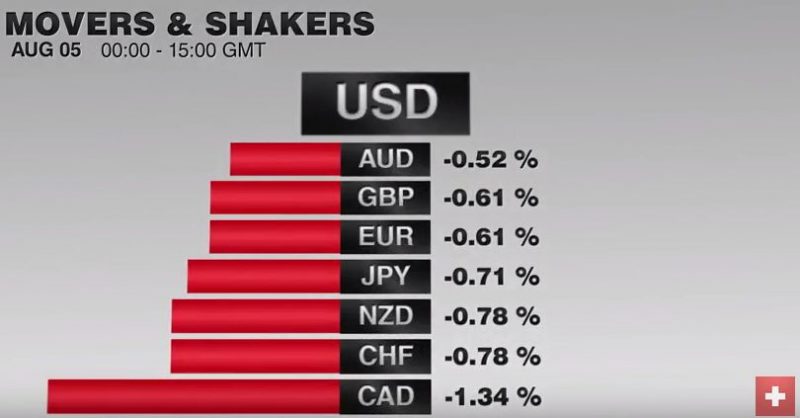

FX Daily, August 05: US Jobs Data on Tap, but Don’t Expect Miracles

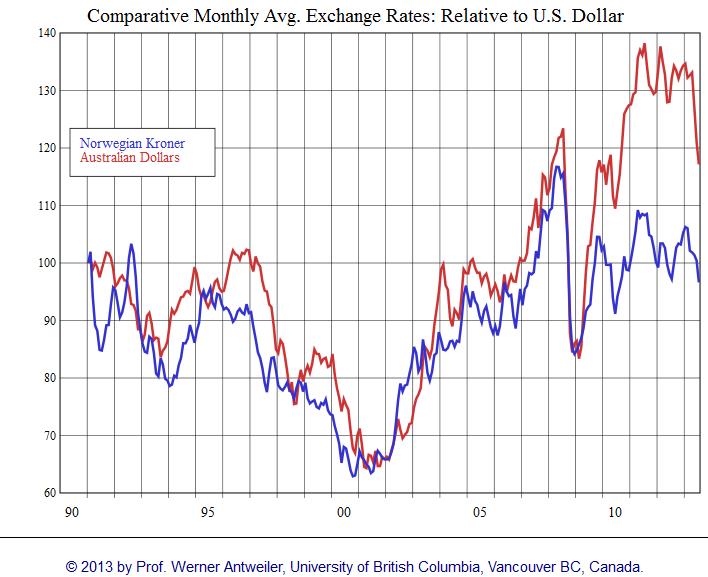

The focus is squarely on the US employment data today, ahead of which the capital markets are mostly consolidating yesterday's Bank of England inspired moved. The Australian and New Zealand dollars, alongside sterling, which is up about half a cent after losing two yesterday.

Read More »

Read More »

FX Daily, July 07: Sterling Bounces Two Cents, but Does not Appear Sustainable

Amid a better if not strong risk appetite, sterling has rallied two cents from yesterday's lows near $1.28 to poke through the $1.30 level in the European morning. It was helped by an industrial production report that was better than expected. Industrial and manufacturing output fell 0.5% in May. This was around half of the expected decline after a strong April advance (2.1% and 2.4% respectively).

Read More »

Read More »

FX Daily, July 06: Dollar and Yen Advance Amid Growing Investor Angst

What a difference a few days make. Many saw last week's equity market advance a sign that Brexit anxiety was overdone. However, quarter-end position adjustments appear to have been misread. Equity markets are falling now. Bond yields in the US, Japan, and Germany, are at new record low. Japan's 20-year bond yield briefly dipped below zero for the first time.

Read More »

Read More »

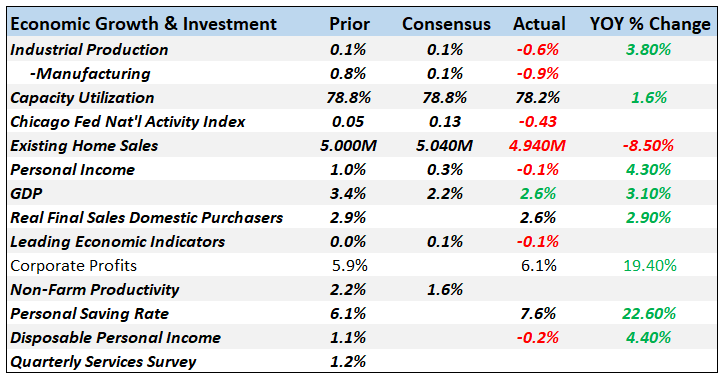

Employment Details Better than the Headlines

The US created fewer jobs than anticipated and the December gain was revised lower. However, the other details were favorable--better than expected. The unemployment rate ticked down to 4.9%, a new cyclical low, despite the rise in the participation rate (62.7% from 62.6%). Average hourly earnings were stronger than expected at 2.5%. The consensus expected …

Read More »

Read More »

Stocks and Commodities Higher, Bonds and Dollar Mostly Lower

Emerging market currencies are mostly lower, though the South African rand is slightly firmer. The Russian ruble's decline has been extended into the fourth sessions and brings its loss this month to 8.5%, the worst performing emerging market currenc...

Read More »

Read More »

(1) What Determines FX Rates?

The effects of so-called “currency wars” and other central bank actions are small compared to the long-term impact made by these five catalysts, which include credit cycles, trade balance, differences in economic growth, and more.

Read More »

Read More »

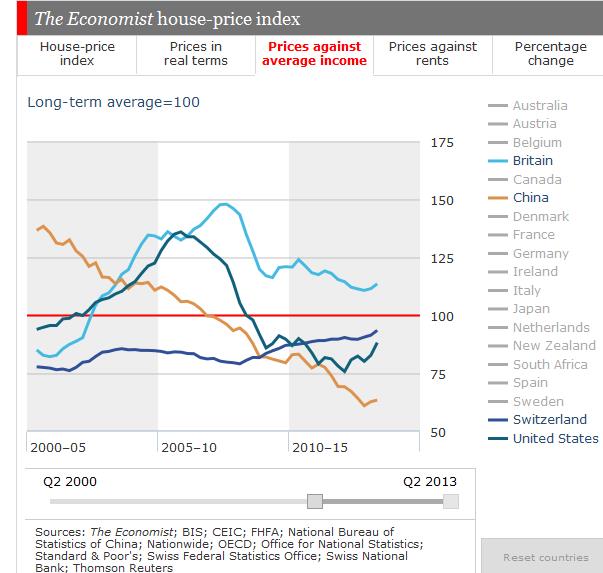

Will the Dollar Appreciate on higher U.S. Savings and a Smaller Trade Deficit?

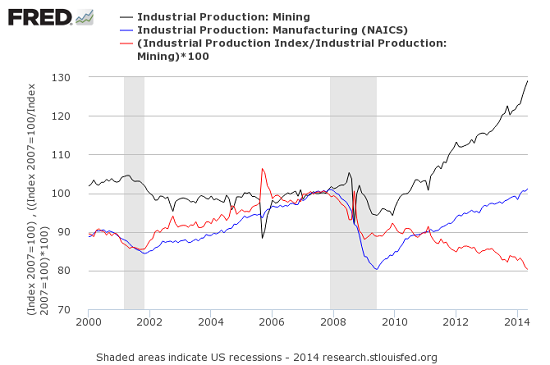

In summer 2013, even the sceptical and "gold-friendly" economist John Mauldin followed the mainstream thinking that fracking and other technology could reduce OPEC's and the Chinese advantage in global trade and reduce the U.S. trade deficit. Recently both claims got refuted: the first with WTI crude oil prices rising to nearly 108$ despite enhanced supply. Detailed data showed that rising U.S. industrial production was not caused by more...

Read More »

Read More »

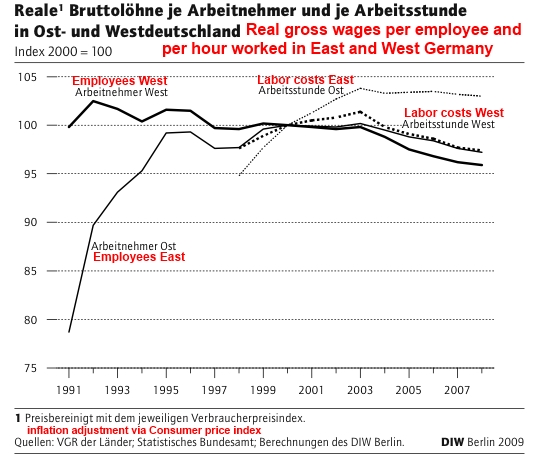

Swiss Franc History: Weak German and Swiss growth between 1996 and 2004

A critical Swiss Franc History: Between 1996 and 2004 Switzerland and its main trading partner and FX proxy Germany saw slower growth compared to other European countries. We explain the reasons

Read More »

Read More »

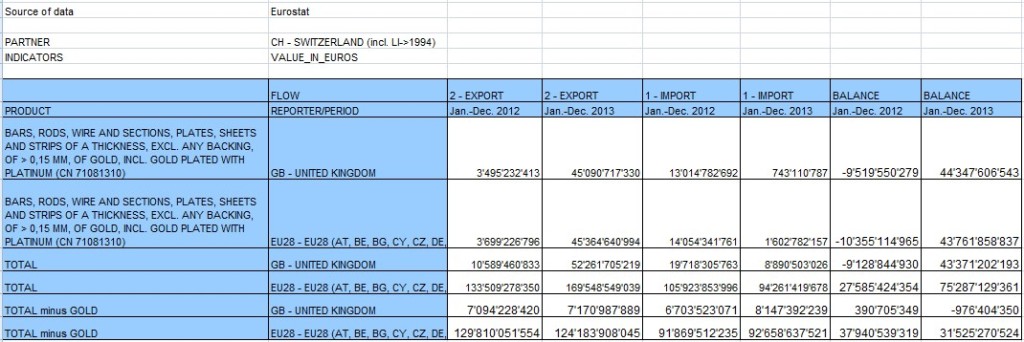

Official Eurostat Trade Balance Massively Distorted by UK Sales Of 1464 Tonnes of Gold To Switzerland

In 2013, private investors from the UK sold net (!) 1464 tons of physical gold (and similar) for a value 44.3 billion EUR. This was 1 464 000 kilograms each at the current price of 30254€ per kilo

Read More »

Read More »

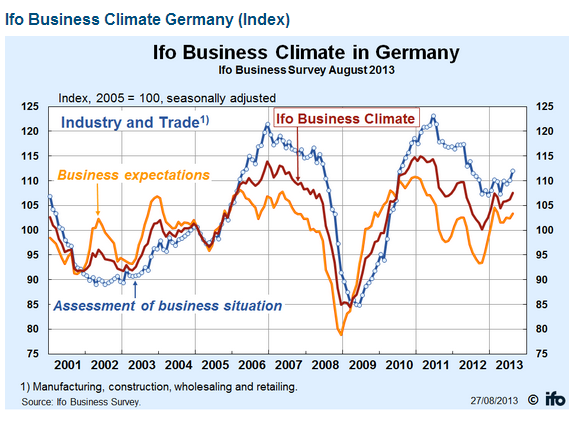

Fundamentals, FX, Gold and CHF: Week October 21 to 25

Major Fundamental Events The week contained a lot of important fundamental events, in particular Non-Farm Payrolls and preliminary “flash” PMI readings. Highest importance for FX rates Non-Farm Payrolls (NFPs) weakened to 148K, private NFPs to 126K, both against 180K expected. Especially the private NFPs were disappointing. The decrease in the unemployment rate from 7.3% …

Read More »

Read More »

Why There Won’t Be A Strong Dollar, Even If The Financial Establishment Thinks So

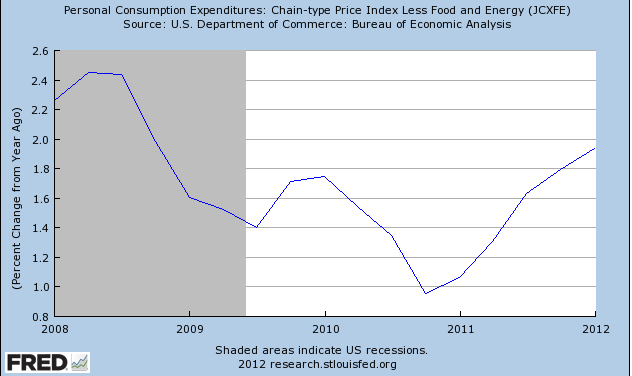

In this second part of our series we provide arguments why the widely expected strong dollar period might not come. We look at the most important economic indicators that might justify a stronger dollar: the ISM manufacturing index and the interest rate differences between the U.S. and Europe.

Read More »

Read More »

Who Has Got the Problem? Europe or Japan?

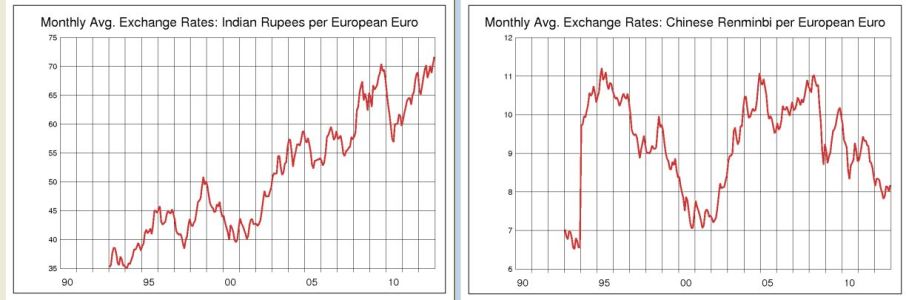

A couple of months ago the euro traded close to EUR/USD 1.20 and the whole world was betting on its breakdown. Once the euro downtrend ended thanks to QE3, OMT and euro zone current account surpluses, the common currency did not stop to appreciate against the yen and reached levels of EUR/JPY 104 and above. … Continue reading...

Read More »

Read More »

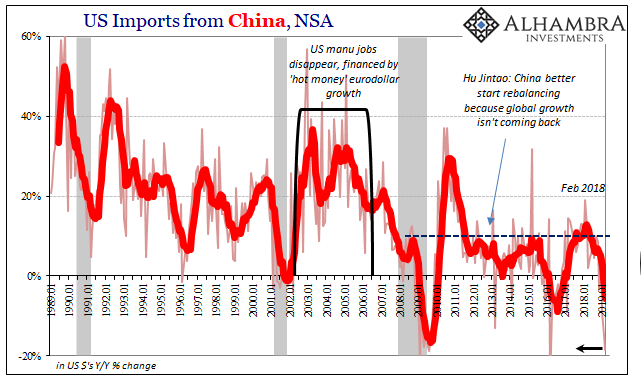

The vicious cycle of the US economy or why the US dollar must ultimately fall again

Just some simple words about the vicious cycle of the US economy and the consequences on the US dollar: A stronger USD will not rescue the US economy, quite the contrary. US companies will not hire in the US, but outsource or hire overseas. If they hire in the US, due to the high number …

Read More »

Read More »