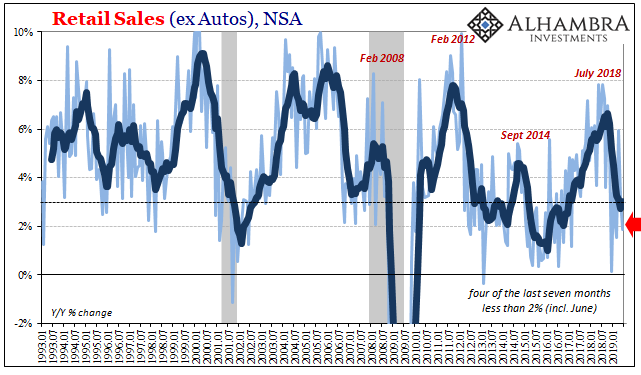

Tag Archive: U.S. Retail Sales

Retail sales are an aggregated measure of the sales of retail goods over a stated time period, typically based on a data sampling that is extrapolated to model an entire country. Measuring consumer demand for finished goods, retail sales help gauge the pulse of an economy and its projected path toward expansion or contraction. As a leading macroeconomic indicator, healthy retail sales figures typically elicit positive movements in equity markets.

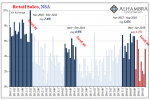

Double Whammy Economics

What’s up with U.S. consumers? They seem to have come to their senses at the worst possible time. They can no longer be counted on to push economic growth up and to the right. Specifically, they’re not spending money on stuff.A little public service on etymology: “Double whammy” was reportedly first used in a 1941 Oakland Tribune article related to boxing. It means a devastating blow, setback or catastrophe. In today’s economy, it often means...

Read More »

Read More »

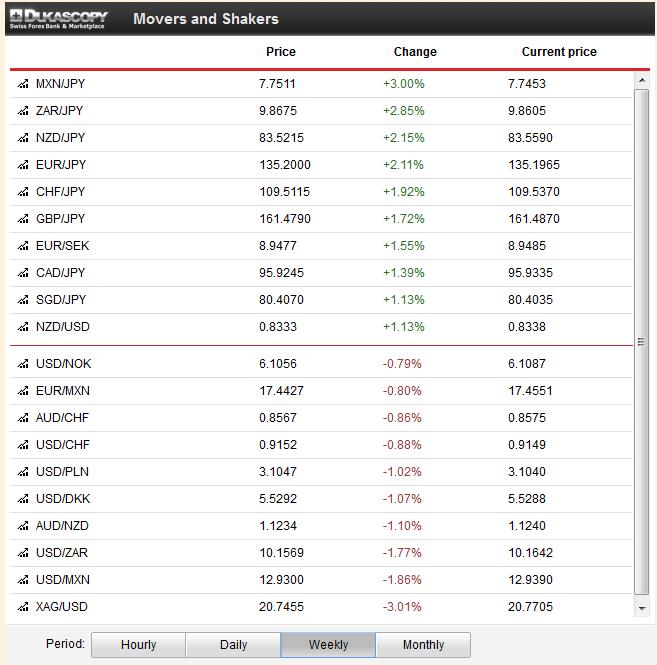

FX Daily, April 13: US Dollar Comes Back Bid

The US dollar is well bid in the Europe and is poised to start the North American session with the wind to its back. Despite firmer equity and industrial metal prices, most emerging market currencies are also succumbing to the rebounding greenback. The euro has yet to convincingly breakout of the range that has confined … Continue reading »

Read More »

Read More »

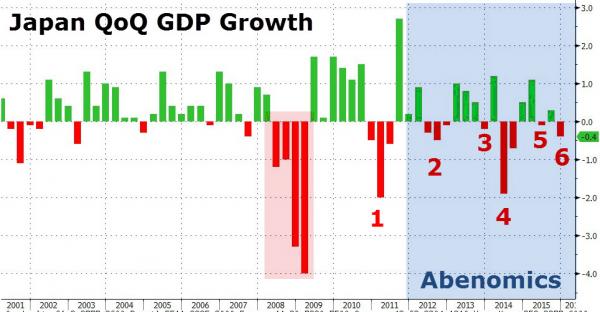

Global Stocks Soar On Stimulus Hopes After Miserable Chinese, Japanese Data; Short Squeeze

Bad news is once again good news... for stocks that is.

After a month and a half of markets unable to decide if they should buy or sell on ugly data, over the weekend, People’s Bank of China Governor Zhou Xiaochuan expressed faith in the economy, ...

Read More »

Read More »

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments fr...

Read More »

Read More »

Commodity Weakness takes a Toll, Rand Fall Continues, US Retail Sales Awaited

The US dollar is confined to narrow ranges against the euro and sterling after pushing higher yesterday. The greenback is staging stronger upticks against the yen but is struggling to resurface above previous support in the JPY122.25 area. Weak commodity prices and the loss of upside momentum has seen profit-taking in the Australian and New …

Read More »

Read More »

Greenback Recovers, but Antipodeans Advance

There are two broad themes among the major currencies today. The first is the pullback in the euro and yen after yesterday's run-up. Position adjustments with the help of stop losses seemed to be the key consideration. Both the euro and yen extended the recovery seen in the second half of last week. Year-end considerations, …

Read More »

Read More »

Dollar Bloc Remains Soft, but Euro, Sterling and Yen Firm

The US dollar continues its mixed performance. The fragile stability of commodity prices today is not lending much support to the Australian and New Zealand dollars though the Canadian dollar is flat after yesterday's slide.

The euro has pushe...

Read More »

Read More »

Fundamentals,FX,Gold and CHF:Week November 18 to November 22

Fundamentals with highest importance: The HSBC Flash Purchasing Manager Index (PMI) for China weakened from 50.8 to 50.4. In particular, new export orders, output prices and employment started to decrease again, while output increased. The preliminary Markit manufacturing PMI for the United States edged up to 54.3 (vs. 52.3 expected), a 9-month high after the …

Read More »

Read More »

Fundamentals,FX,Gold and CHF:Week November 11 to November 15

Fundamentals with highest importance: In Janet Yellen’s hearing at the Senate Banking Commission, the future Fed chair emphasized the need to provide support to the economic recovery and to overcome low inflation. Her speech supported equities, gold and US Treasuries. GDP in the Euro zone rose by 0.1% QoQ in line with expectations, but less …

Read More »

Read More »

Fundamentals and FX Movements, Week September 9 to Sept. 13

The weekly summary of global fundamental news with focus on CHF and gold price movements. Friday, September 13:The leading news came from U.S. retail sales and the Michigan consumer sentiment. Retail sales were up +0.2% instead of 0.5% expected, sales excluding autos and gas +0.1% (vs +0.3% exp.) The Michigan consumer sentiment disappointed at 76.8 …

Read More »

Read More »

Currency Positioning and Technical Outlook August 12: Corrective Pressures Dominate

Submitted by Marc Chandler, Global Head of Currency Strategy, Brown Brothers Harriman The main tension in the foreign exchange market is between positions adjusting pressures, which are US dollar negative, and widely held ideas that the trajectory of growth and interest rate differentials favor the US, which is dollar positive. There are some important economic data due …

Read More »

Read More »