The US dollar is well bid in the Europe and is poised to start the North American session with the wind to its back. Despite firmer equity and industrial metal prices, most emerging market currencies are also succumbing to the rebounding greenback.

The US dollar is well bid in the Europe and is poised to start the North American session with the wind to its back. Despite firmer equity and industrial metal prices, most emerging market currencies are also succumbing to the rebounding greenback.The euro has yet to convincingly breakout of the range that has confined it this month. That would require a break of the $1.1300 area. However, as we have noted the two-year interest rate differential between the US and Germany, which does a fair job tracking the euro-dollar exchange rate, has been recovering in the dollar’s direction for several days, setting the stage for euro setback after repeatedly trying to convincing push through the $1.1450. It may require a break of the $1.1270 area to lead more into thinking the euro has put in a top of some importance.

The US dollar is also pushing higher against the Japanese yen. The seven-day losing streak was snapped yesterday and today the greenback is trading at a four-day high, above JPY109. The JPY110 area is the next target. The two-day gain for the dollar could be the largest since February and would seem to undermine the case for intervention. It is a better two-way market. However, as the decline in Japanese producer prices (-3.8% in March from -3.4% in February), serious challenges for the Japanese economy remain. A couple of government advisers have called for more fiscal and monetary action.

Global equities are advancing for the fourth sessions. The MSCI Asia-Pacific Index rose for the sixth consecutive sessions and the 1.8% gain today is the most in the streak. It gapped higher today and closed at its best level since the start of the year. News that China’s exports and imports fell less than expected helped provide additional impetus. Iron ore prices were up the daily limited in China and have now risen 11% over this week.

China’s March trade surplus was reported at $29.86 bln, down from $32.59 bln in February. The median forecast was for a larger surplus. Exports, which reportedly fell 25.4% in February, rose 11.5% year-over-year in March, the most in a year. The median guesstimate was for a 10% increase. Imports fell 7.6% in March. In February, they had fallen 13.8%. The median forecast was for a 10.1% decline.

The trade data provides another piece of data suggesting that the Chinese economy may be stabilizing. China is expected to report Q1 GDP figures later this week. The median forecast is that growth slowed to a 6.7% year-over-year pace from 6.8% in Q4. Note that although the IMF revised down its forecast for world growth in its updated World Outlook, it did revise up its estimate for China’s GDP to 6.5% from 6.3%.

Leaving aside the accuracy of Chinese data, one bone of contention may be the sharp increase in China’s steel exports. The 9.98 mln metric tons exported represents a 30% increase from a year ago. There is a concern in the US and Europe that China will seek to “dump” its excess steel capacity onto world markets, further depressing the industry, which has experienced both falling prices and jobs losses. This is one factor that makes officials wary of yuan depreciation.

Against the dollar, the yuan was fixed higher today, for the third consecutive session. The dollar has moved broadly sideways against the yuan here in April and remains near its lowest level for this year. That said, the dollar’s firmer tone against the majors and most emerging market currencies today warns of a weaker yuan tomorrow.

The news stream in Europe has been light, and largely limited to the February industrial output report. The 0.8% decline was a little more than expected and the January series was revised to show a 1.9% rise rather than 2.1%. However, investor interest is in the more than 2% rise in the Dow Jones Stoxx 600, which if sustained would be the biggest gain in a month. It is the fourth day of the advancing streak. The gains are led by financials and materials, including energy.

Comments about Italy’s new attempt to address the bad loan problem and recapitalization of several banks were whipsawed by the price action yesterday. Italian bank shares had suffered mightily this year but rallied at the end of last week and Monday in anticipation of details of the government’s newest effort. Bank shares opened higher yesterday, and comments were constructive, but as bank shares sold off, market commentary turned negative. Italian bank shares are moving higher today.

Although we too expressed doubts over the initial sketches of the program, we see much in the commentary that suggests too much pessimism. For example, the reports have emphasized the roughly 360 bln euros of bad loans, but hardly a comment notes that Italian banks have made provisions for some 40%-45%. Moreover, it is easy to scoff at the five bln euro backstop fund as too small, but it is likely to be levered, and the extremely bad loans may be closer to 30-40 bln euros. The Bank of Italy will issue its new quarterly bulletin next week, and there will be updated numbers.

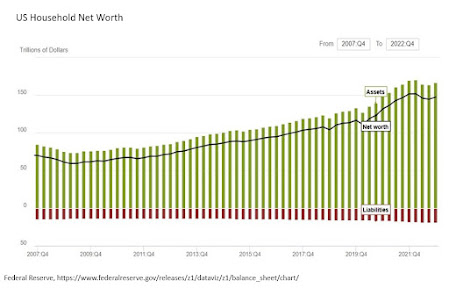

The North American session features US retail sales and PPI, the Bank of Canada meeting, and the Beige Book later in the session. After yesterday’s unexpected 6.2 mln barrel oil build according to API, the official DOE estimate will be anxiously awaited. US headline retail sales may be dampened by softer auto sales, but excluding autos, a 0.4% gain is expected. The GDP component is expected to by up 0.4%, which if true, would be the best since last November. The much smaller than expected rise in import prices reported yesterday warns of the risk of a soft PPI report, but the retail sales data is more important. Retail sales are about 40% of US household consumption, which in turn is roughly 70% of GDP.

The Bank of Canada is widely expected to keep rates on hold. Its economic assessment is more the focus. Recent data has been encouraging, and the central bank’s outlook may be lifted. However, the strength of the Canadian dollar has much good news discounted.

Tags: Bank of Canada,Bank-Recapitalization,Japanese yen,newslettersent,U.S. Retail Sales