Tag Archive: U.S. Retail Sales

Retail sales are an aggregated measure of the sales of retail goods over a stated time period, typically based on a data sampling that is extrapolated to model an entire country. Measuring consumer demand for finished goods, retail sales help gauge the pulse of an economy and its projected path toward expansion or contraction. As a leading macroeconomic indicator, healthy retail sales figures typically elicit positive movements in equity markets.

Tax Cuts And (Less) Spending

After being rumored and talked about for over a year, at the end of last year the tax cuts were finally delivered. The idea had captured much market attention during that often anxious period of political flirtation. Prices would rise or fall by turn based on whether or not it seemed a realistic possibility.

Read More »

Read More »

The Retail Sales Shortage

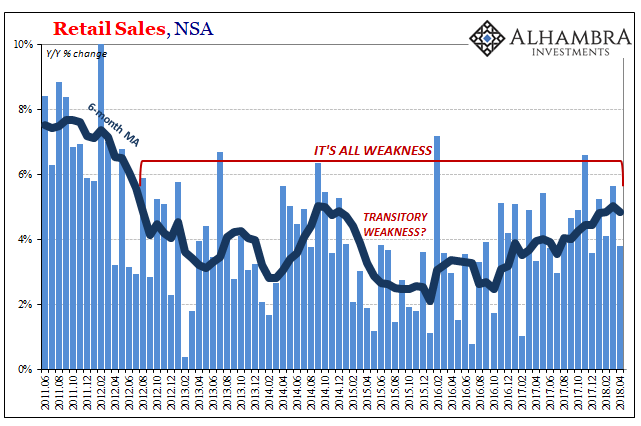

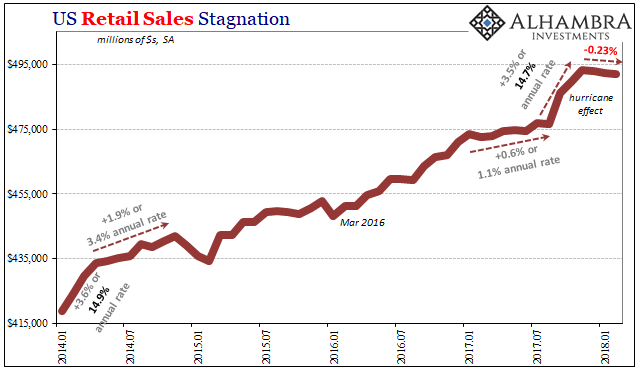

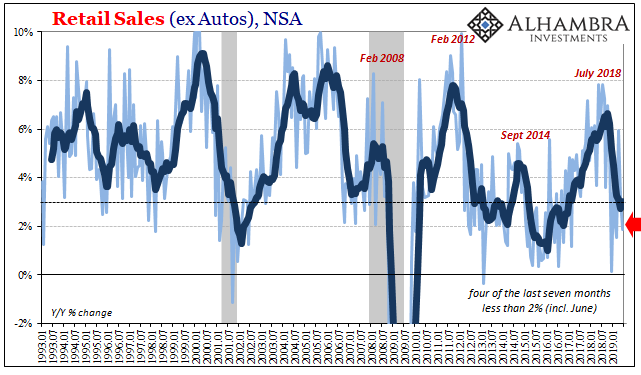

Retail sales rose (seasonally adjusted) in March 2018 for the first time in four months. Related to last year’s big hurricanes and the distortions they produced, retail sales had surged in the three months following their immediate aftermath and now appear to be mean reverting toward what looks like the same weak pre-storm baseline. Exactly how far (or fast) won’t be known until subsequent months.

Read More »

Read More »

FX Daily,April 16: Market Struggles for Direction

The Syrian strike over the weekend, and the official indication that "mission accomplished" and that was a limited one-off strike has spurred little market reaction. There is one more loose end, as it were, and that is that the US has indicated it will announce additional sanctions on Russia for its involvement in Syria's chemical weapon use. The ruble is volatile but slightly firmer to start the week, and while dollar-bond yields are firmer, the...

Read More »

Read More »

Three Months Now of After-Harvey Retail Sales; or, The Boom Narrative Goes Boom

If indeed this inflation hysteria has passed, its peak was surely late January. Even the stock market liquidations that showed up at that time were classified under that narrative. The economy was so good, it was bad; the Fed would be forced by rapid economic acceleration to speed themselves up before that acceleration got out of hand in uncontrolled consumer price gains. On February 1, the Atlanta Fed’s GDPNow tracking model was moved up to...

Read More »

Read More »

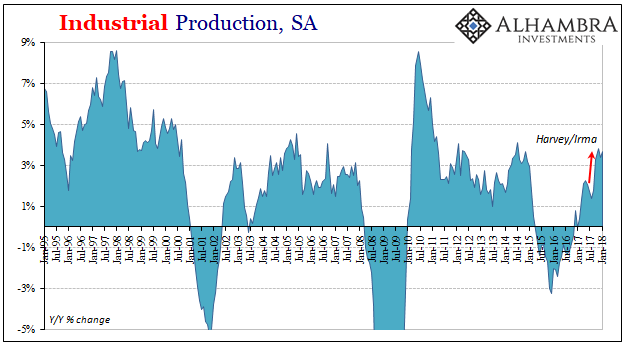

US IP On The Other Side of Harvey and Irma

Industrial Production in the US was revised to a lower level for December 2017, and then was slightly lower still in the first estimates for January 2018. Year-over-year, IP was up 3.7%. However, more than two-thirds of the gain was registered in September, October, and November (and nearly all the rest in just the single month of April 2017).

Read More »

Read More »

FX Daily, February 14: Investors Remain Uneasy even as Equities Stabilize

There is an unease that continues to hang over the market. It is as if a shoe fell last week, and most investors seem to be waiting for the other shoe to drop. It is hard to imagine the kind of body blow that the equities took last week without some kind of follow through and knock-on effects. Moreover, the focus today on US CPI may prove for nought.

Read More »

Read More »

Good or Bad, But Surely Not Transitory

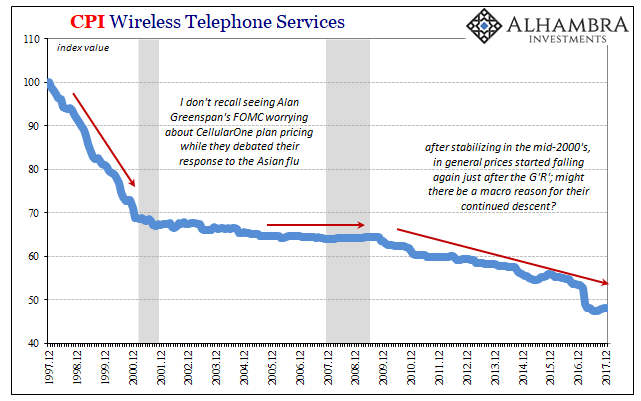

When Federal Reserve officials first started last year to mention wireless network data plans as a possible explanation for a fifth year of “transitory” factors holding back consumer price inflation, it seemed a bit transparent. One of the reasons for immediately doubting their sincerity was the history of that particular piece of the CPI (or PCE Deflator).

Read More »

Read More »

Retail Sales, Consumer Sentiment, And The Aftermath Of Hurricanes

Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past.

Read More »

Read More »

FX Daily, January 12: Euro Jumps Higher

There is one main story today and it is the euro's surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month's ECB meeting surprised the market with its seeming willingness to change the forward guidance early this year in a more hawkish direction. This spurred a 0.7% gain in the euro back above $1.20. The euro stayed bid in Asia, but took another leg up (~0.75%) in response to reports that a...

Read More »

Read More »

The Conspicuous Rush To Import

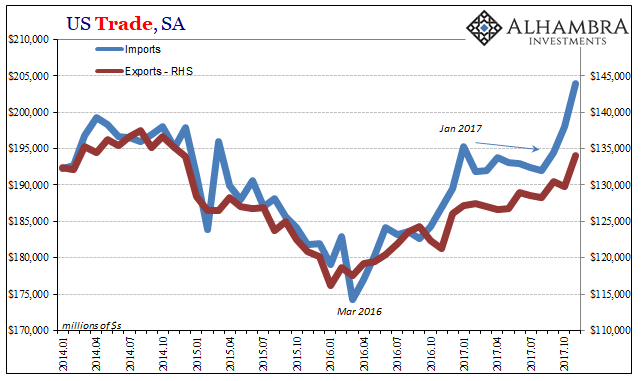

According to the Census Bureau, US companies have been importing foreign goods at a relentless pace. In estimates released last week, seasonally-adjusted US imports jumped to $204 billion in November 2017. That’s a record high finally surpassing the $200 billion mark for the first time, as well as the peaks for both 2014 and 2007.

Read More »

Read More »

Retail Sales Bounce (Way) Too Much

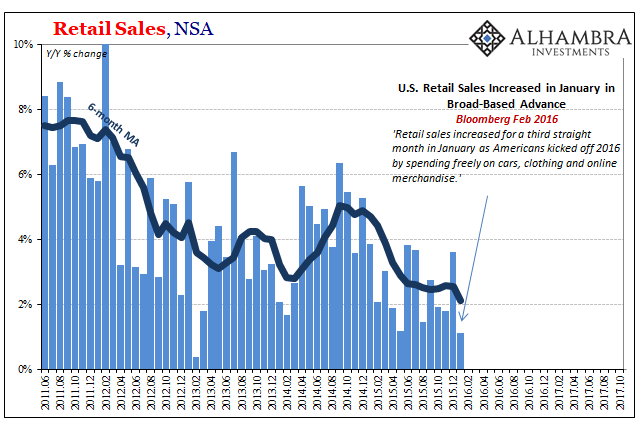

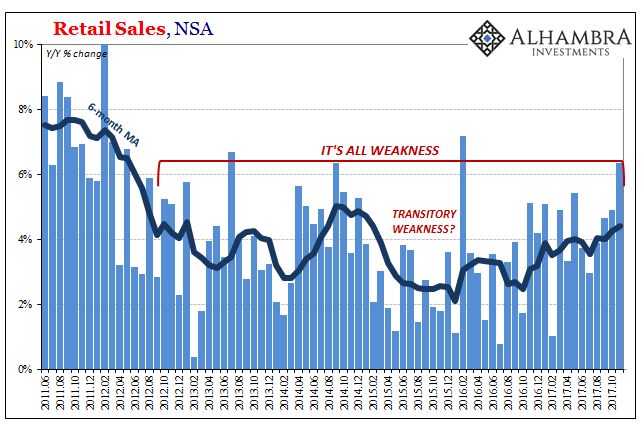

Retail sales had a good month of November, or at least what counts as decent over the last five and a half years. Total retail sales (unadjusted) rose 6.35% last month, up from 4.9% (revised higher) in October. It was the highest rate of growth since the 29-day month of February 2016. For retailers, what matters is that it comes at the start of the Christmas shopping season.

Read More »

Read More »

FX Daily, December 14: US Rates Bounce Back, but Dollar, Hardly

US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment forecasts. Yet its interest rate trajectory and inflation forecasts were largely unchanged. Yellen, as her recent predecessors have done, played down the implications of the flattening of the yield curve.

Read More »

Read More »

Less Retail Jobs, More Amazon Robots: Get Used To It

When it comes to job creation in the United States, President Trump will be displeased to hear the latest findings from Quartz: 170,000 fewer retail jobs in 2017 - and 75,000 more Amazon robots. In November, we explained that while everyone likes to point the finger at Amazon, America’s retail apocalypse can’t be tied to just one catalyst (see: A Look At America’s Retail Apocalypse In Charts), however, fierce competition in the industry has induced...

Read More »

Read More »

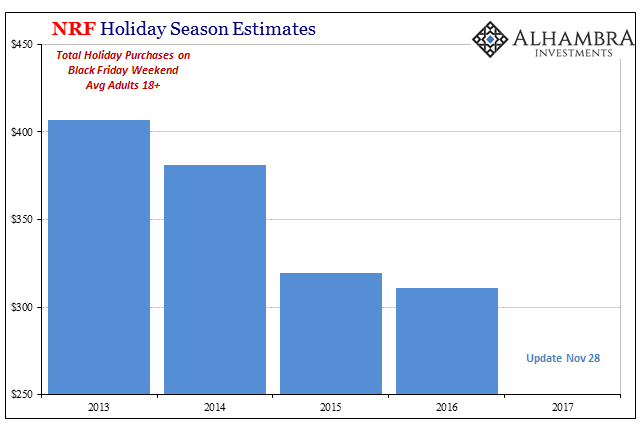

Fading Black Friday

Black Friday was once the king of all shopping. A retailer could make its year up on that one day, often by gimmicking its way to insane single-day volume. Those days, however, are certainly over. Though the day after Thanksgiving still means a great deal, as the annual flood of viral consumer brawl videos demonstrate, it’s just not what it once was.

Read More »

Read More »

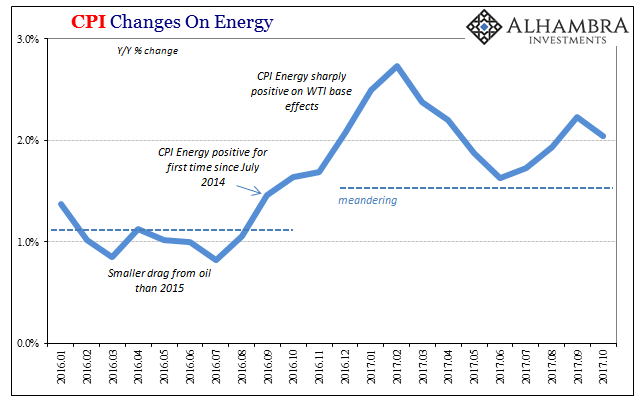

Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found.

Read More »

Read More »

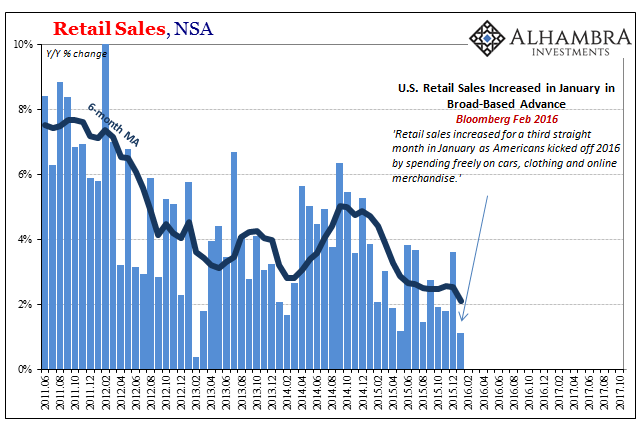

Retail Sales (US) Are Exhibit #1

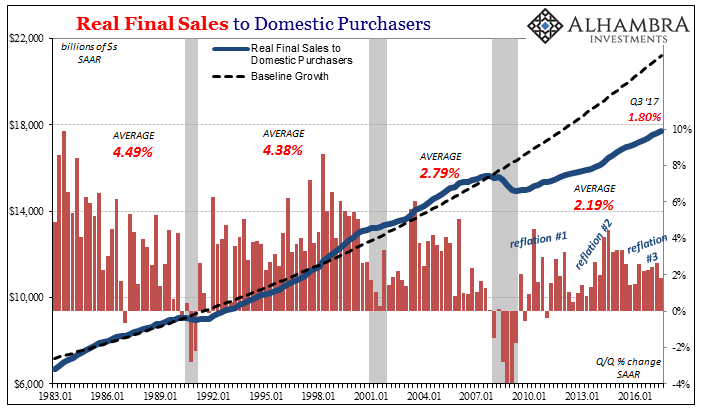

In January 2016, everything came to a head. The oil price crash (2nd time), currency chaos, global turmoil, and even a second stock market liquidation were all being absorbed by the global economy. The disruptions were far worse overseas, thus the global part of global turmoil, but the US economy, too, was showing clear signs of distress.

Read More »

Read More »

FX Daily, November 15: Dollar Slides

The euro and yen are extending their gains, casting a pall over the US dollar. The euro is extending its advance into a sixth consecutive session, which is the longest streak since May. It is approaching last month's highs in the $1.1860-$1.1880 area. As was the case yesterday, a consolidative tone in Asia was followed by strong buying in the European morning. There does not appear to be a fresh fundamental driver.

Read More »

Read More »

Consumer Credit Both Accelerating and Decelerating Toward The Same Thing

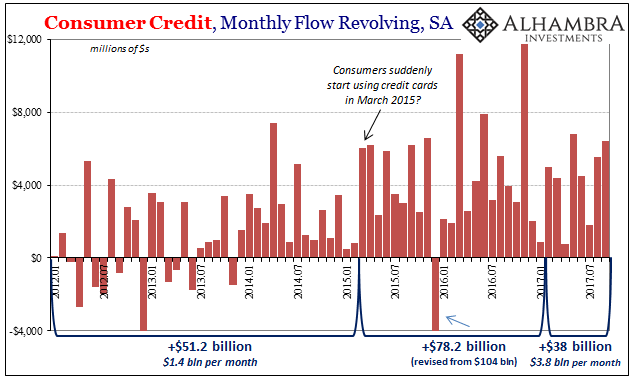

Federal Reserve revisions to the Consumer Credit series have created some discontinuities in the data. Changes were applied cumulatively to December 2015 alone, rather than revising downward the whole data series prior to that month. The Fed therefore estimates $3.531 trillion in outstanding consumer credit (seasonally-adjusted) in November 2015, and then just $3.417 trillion the following month.

Read More »

Read More »

Aligning Politics To economics

There is no argument that the New Deal of the 1930’s completely changed the political situation in America, including the fundamental relationship of the government to its people. The way it came about was entirely familiar, a sense from among a large (enough) portion of the general population that the paradigm of the time no longer worked. It was only for whichever political party that spoke honestly to that predicament to obtain long-term...

Read More »

Read More »

Four Point One

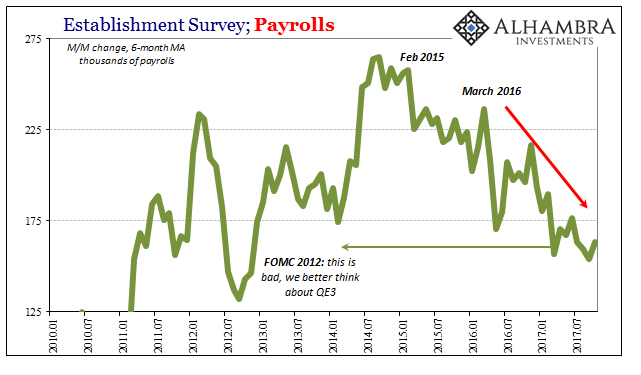

The payroll report for October 2017 was still affected by the summer storms in Texas and Florida. That was expected. The Establishment Survey estimates for August and September were revised higher, the latter from a -33k to +18k. Most economists were expecting a huge gain in October to snapback from that hurricane number, but the latest headline was just +261k.

Read More »

Read More »