Tag Archive: U.S. Producer Price Index

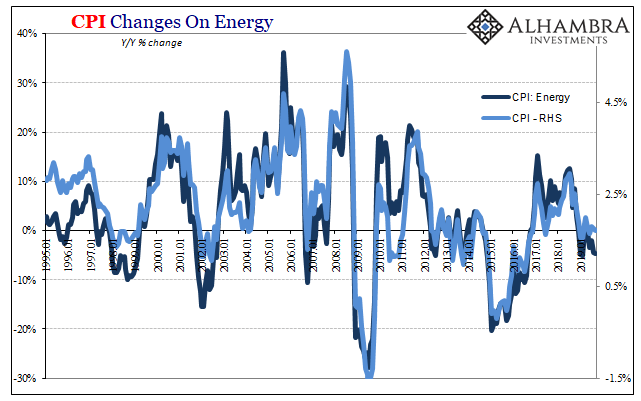

A Producer Price Index (PPI) is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

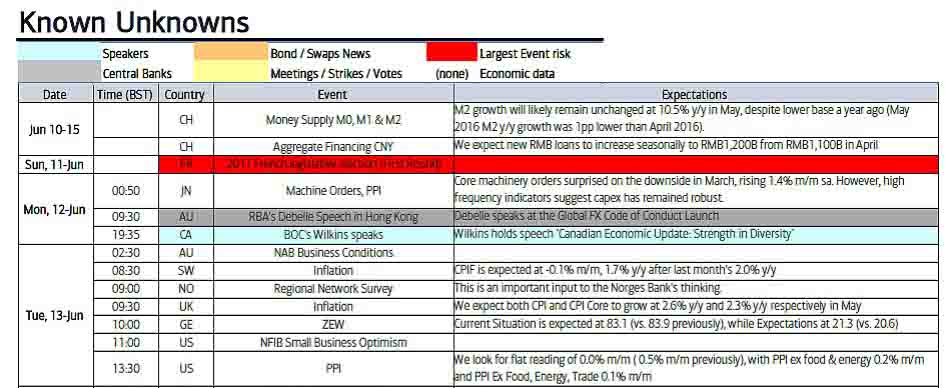

FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected.

Read More »

Read More »

FX Daily, May 11: Canadian and New Zealand Dollars Get Whacked, While Greenback Consolidates

The US dollar has been mostly confined to about a 30 pip range against the euro and yen in Asia and the European morning. Sterling is under a little pressure after a series of poor data, including larger than expected falls in manufacturing and construction output, and a sharp widening of the trade deficit.

Read More »

Read More »

FX Daily, April 13: Greenback Stabilizes After Trump Induced Slide

The US dollar slid after US President Trump complained about its strength. The sell-off extended into early Asian activity, before stabilizing. It is mixed in late morning European turnover, which is already lightening up due to the extended Easter holiday.

Read More »

Read More »

FX Daily, March 14: Brexit Takes Fresh Toll on Sterling, While Dollar Firms more Broadly

UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which voted to remain, might be allowed to rejoin the Republic of Ireland.

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

FX Daily, December 14: Markets Quietly Edge into FOMC Meeting

The Pound is entering mid-December in the same fashion it begun the month after having a very strong November as well. After being buoyed by Donald Trump’s victory and the High Courts ruling that parliamentary approval is needed before invoking Article 50, the Pound has been boosted further after economic data has also impressed, with yesterday being a good example of this.

Read More »

Read More »

FX Daily, November 16: The Greenback Remains Resilient

The US dollar remains bid. It is at its year high against the euro and five-month highs against the Japanese yen. Sterling, which has performed better recently, remains in the trough around 30-year lows. It surge since the election reflects three considerations. The first is December Fed hike. Prior to the election, the market was assessing around a two-thirds chance. Now both the CME and Bloomberg's WIRP estimate the odds above 90%....

Read More »

Read More »

FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

The US dollar is firm against most of the major currencies, but within yesterday's ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the only majors to gain.

Read More »

Read More »

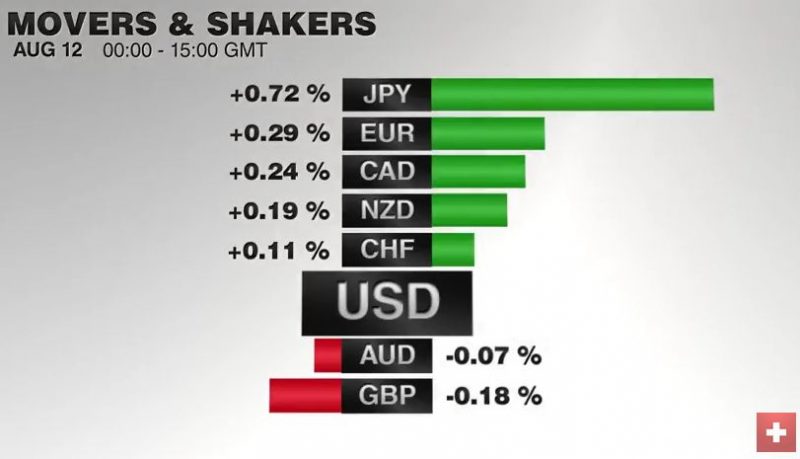

FX Daily, August 12: Summer Markets Grind into the Weekend

There is a general consolidative tone in the capital markets as the week draws to a close. The US retail sales report may offer a brief distraction, but it is unlikely to significantly shift expectations about the trajectory of Fed policy. Indeed, it might not really change investors' information set.

Read More »

Read More »

FX Daily, June 15: Key Data and FOMC

The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar.

Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduce the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again.

Read More »

Read More »

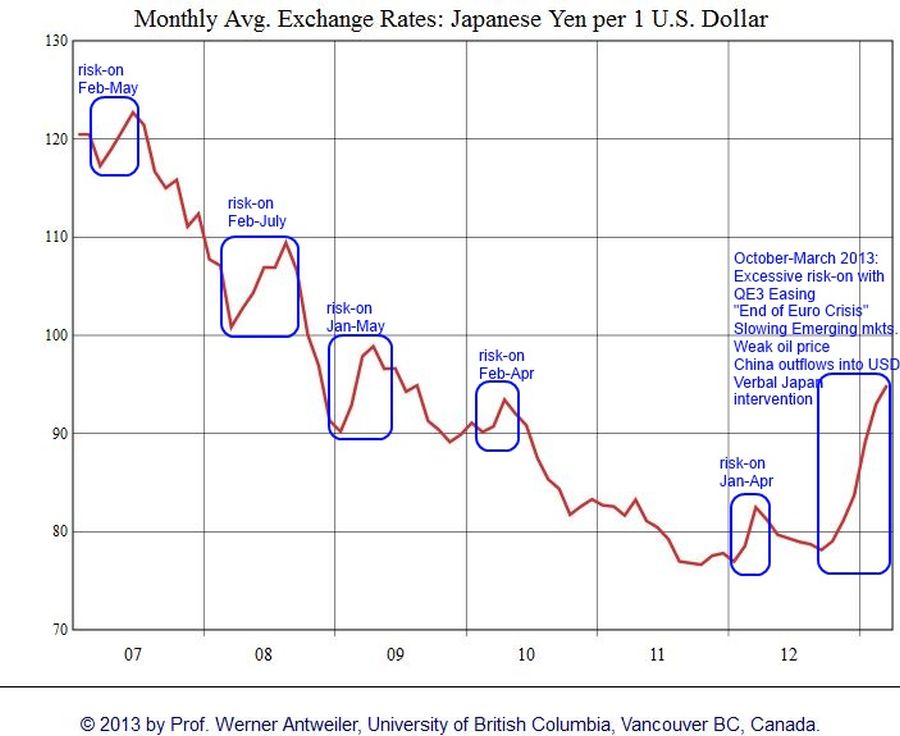

(8.1) Yen Weakness: Risk-Off Environment, Abenomics or Trade Deficit?

The yen overshot during and after the financial crisis. The USD/JPY fell from 120 in 2008 to lowest levels of 74, by 62%, but rose to 102 again. What are the reasons?

Read More »

Read More »

Why the Yen Is Now Fairly Valued, USD back as Preferred Funding Currency

Producer prices and “real mean reversion” for currencies show that the yen is currently fairly valued. Many momentum factors could, however, speak for some further weakening, while seasonality favours an appreciation. For us, the US dollar is back as the preferred funding currency. The real mean reversion for currencies Some economists, like Goldman’s O’Neill, in the case …

Read More »

Read More »

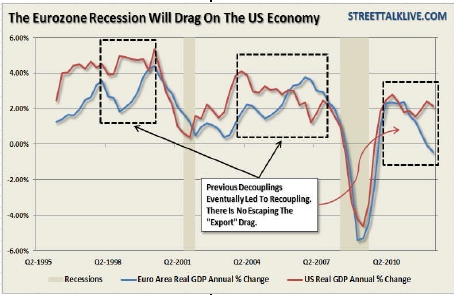

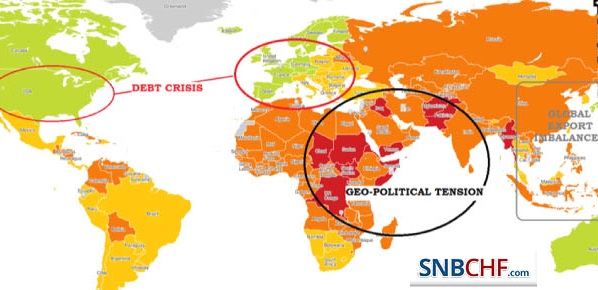

Same Procedure as Every Year: Analysts Shouting “The Great Recession is Over!” But It Is Not!

Or why we do not believe in the American economy. Like every year in Q4, analysts proudly present the end of the great recession: 2009: The big picture: The Great Recession is Over! Long Live the Ordinary Recession …. 2010: Mish Global Trend Analysis: The Great Recession is Over; Bad News: It Doesn’t Feel Like … Continue...

Read More »

Read More »