Producer prices and “real mean reversion” for currencies show that the yen is currently fairly valued. Many momentum factors could, however, speak for some further weakening, while seasonality favours an appreciation. For us, the US dollar is back as the preferred funding currency.

The real mean reversion for currencies

Some economists, like Goldman’s O’Neill, in the case of the Swiss franc think: “what strongly falls or rises must come back to mean again”.

This is perfectly valid for stocks as they must come back to average due to the Shiller Price Earning Ratio (or possibly a slight rise over time with rising productivity and a survivor-ship bias). But it is not valid for currencies: currencies with low inflation and current account surpluses must appreciate over the time, pairs like USD/CHF or USD/JPY must follow a descending channel over the long-term.

This is valid under the condition that there are no expectations for big interest rate differentials, that could lead to a carry trade. Effectively the yen was depressed, especially between 2003 and 2007, due to a carry trade, while rate differentials between the USD and JPY in 2013 are nearly not existent.

The Yen’s overshooting in the financial crisis

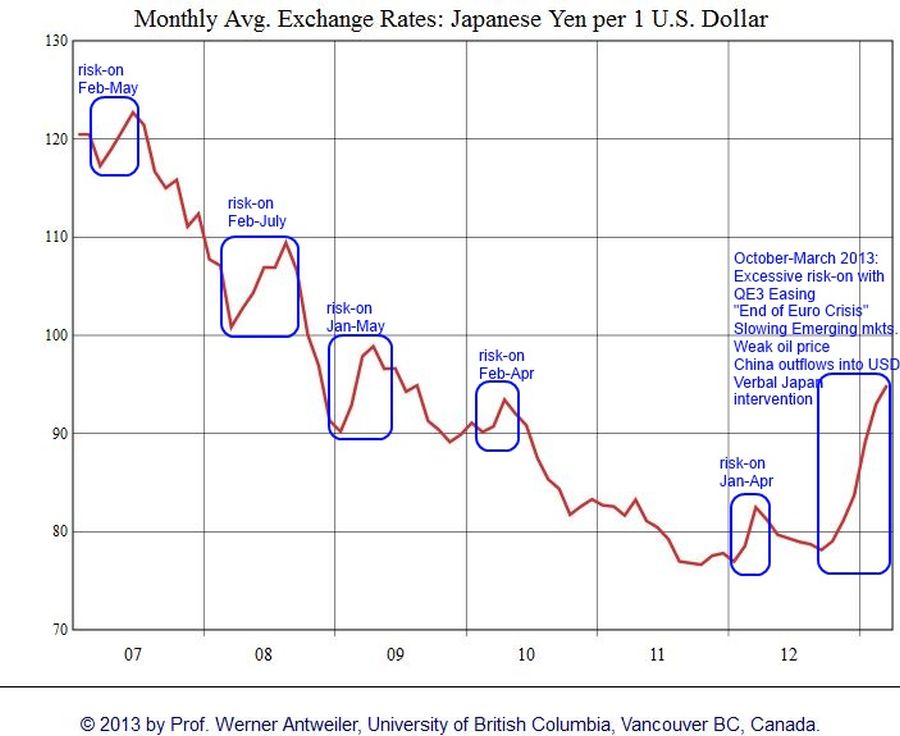

The yen overshot during and after the financial crisis. The USD/JPY fell from 120 in 2007 to lowest levels of 74 in 2011.

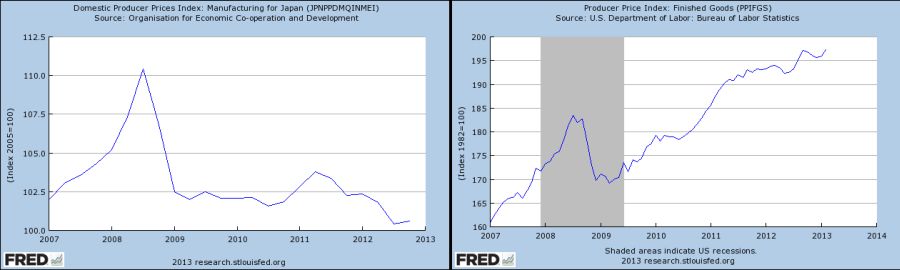

In terms of producer prices the yen should have appreciated by 22% = 197/160 = US Producer Price Index 2013 divided by US Producer Price Index 2007. See this ratio in the graph below; in 2013 the Japanese price index should come back the 2007 level of 102.5 with the recent yen devaluation and will be therefore unchanged.

By March 2013, the strong yen tendency was reversed and the yen did the “real mean reversion” to producer price parity: USD/JPY fell from 120 in January 2007 to 96 in March 2013, by 25%.

The IMF’s Jerry Schiff confirms our view:

“In our previous assessment in the External Sector Report, which was published last summer, our various methodologies had shown moderate overvaluation of the yen,” Jerald Schiff, deputy director of the IMF’s Asia and Pacific Department, said through email exchanges with MNI. “Since then, the currency has depreciated by over 15% to 20% in trade weighted terms, bringing the yen back to its long-run average,” said Schiff. “At least a temporary weakening of the yen could be expected to result from a successful reflation,” he said, referring to Abe’s policy to stimulate the economy by boosting money supply. But he warned that such weakness without reform would create issues. In June last year, the IMF said in its 2012 Article IV Consultation Discussion with Japan that “the yen is moderately overvalued from a medium-term perspective.“

The yen typically appreciates in the months between January and the beginning of May, when the seasonal effect of weaker oil prices in Q4 and stronger US demand in Q1 leads to the “Sell in May, Come Back in October effect”.

Between October 2012 and March 2013 seven factors led to a very strong momentum against the yen:

- The Fed’s “unlimited” quantitative easing helped to increase U.S. home prices and consumer confidence. This heavily increased risk appetite.

- The perceived “end of the euro crisis” with the promise of unlimited interventions by the ECB.

- A slowing in the emerging markets.

- Weaker oil prices: US gas prices rose only modestly between October and January.

- Outflows of Foreign Direct Investments from China and other emerging markets sustained investments in the US dollar.

- A weakening of the Japanese trade balance due to European austerity, some conflicts with China, less nuclear energy produced and relatively strong Japanese consumer spending.

- Verbal intervention by Japanese officials additionally suppressed the currency. They wanted to end Japanese deflation.

Mainstream media called the combined effect of these seven factors, especially the last one a bit innocently, “currency wars”, albeit they have nothing to do with currency wars in the sense of strong investment flows like in the 1970s into Germany or after QE2 in 2010 into emerging markets.

With the upcoming higher VAT, currency depreciation, positive consumer and business climate and potentially rising home prices, the CPI could effectively go up to 1.5 or 2%. Japanese officials have realized the exchange rate has only a temporary effect, wages must rise, too, but they fell by 0.7%, mostly driven by weak sales and therefore weak bonuses.

On the other side, the USD/JPY rate has risen over the levels of 90 that Japanese companies wanted to achieve to become competitive.

Remaining momentum versus seasonality

There seems to be still momentum in these admittedly strong factors and an apparent willingness by Japanese officials to further weaken their currency. But seasonal factors like higher oil prices and the (still to be published) strong Japanese current accounts in February and March – after the US spending rebound in December to February – speak against a weaker yen.

One thing remains clear for us, Japan will be one of the strongest G8 economy in 2013 as for GDP growth thanks to strong spending, higher salaries, a hype in the stock market, a (in 2013) still positive GDP deflator effect and a competitive exchange rate.

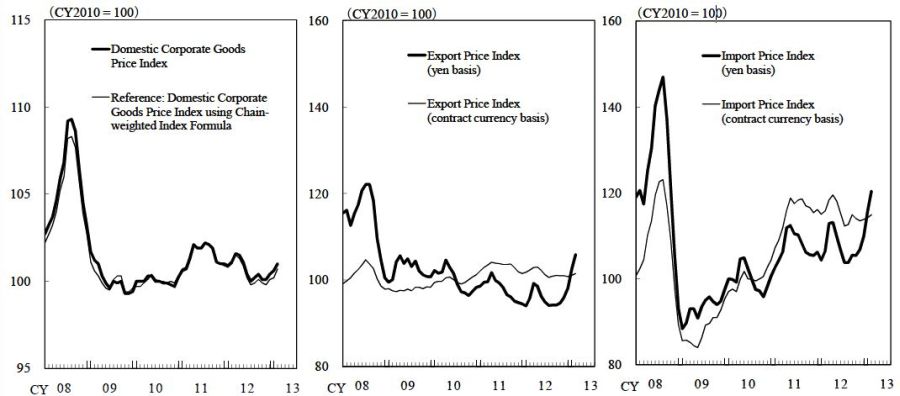

Still, upcoming inflation could speak for a weaker yen, but the move from deflation to inflation will be very slow in a closed economy with an 18% import share like Japan, visible in the slow upwards movement of the Domestic Corporate Goods Price Index:

(click to expand) Corporate Goods Price Index Japan (CGPI) February 2013, Source

Japanese pension funds: The big unknown

With the new Japanese fiscal year, some pension funds are said to be removing their yen hedge for foreign currency positions. We doubt if this will really happen in April; it could have happened already in the course of October to December 2012. For us, the exceptional moves against algorithmic pricing rules (available here) were far too strong during that period and might not be reasoned only by some astute hedge funds.

Abe’s measures to weaken the yen were well known in Japan, pension funds were maybe the first group the Japanese government consulted. We cannot imagine that the government deliberately wanted to void the hedges of pension funds and weaken their financial position in favour of some US hedge funds and FX traders.

For us all the stories of pension funds being upset about inflation, selling JGBs and moving in foreign stocks might be just a part of a big Japanese theater play to enhance the Japanese terms of trade.

In the end, the principal question for Japanese pension funds will be: What is better?

- Investments in Japanese stocks that improve profits based on a more competitive yen and stronger consumer spending, despite well known demographic issues.

- Investments with an already weaker yen in overvalued emerging market stocks, bonds and currencies that face high inflation.

- Into stagnating Europe and the United States, most of them with high structural unemployment and despite that chronically high inflation. Countries that will face the same demographic issues just a bit later than Japan and where the declining participation rate tells us that better demographics do not help against rising public spending, fiscal deficits and – as opposed to Japan – a weaker and weaker international investment position.

US inflation currently too high for a strong dollar

The rising American CPI data with 2% core inflation, 2.6% increases in services and 3.9% in medical services that only got saved by a limited 1.1% price increase in car sales led by record sales for Japanese car makers tells us the solution to this puzzle.

In the coming years the Japanese will not beat the Americans in terms of inflation and most Japanese money will fear foreign inflation similar as Japanese inflation.

This will continue until new steady-state age distribution, when finally the Japanese current account might show a current account deficit similar to the one of the U.S. For many years the Japanese current account has done far better.

Investment recommendation

In summary, the US dollar is back on the cards as a funding currency for the slowly fading risk rally that will stop when the core CPI rises above 2.5% (which is thanks to the stronger dollar in the March CPI reading certainly not before May). The Fed’s gauge “core PCE deflator ” will still be far lower than 2.5% then.

We are long CHF (FXF), EUR (FXE), NOK, SEK, AUD (FXA), NZD and short USD until May, when we will add some more JPY (FXY) longs. We take any bounce of USD/JPY above 96.50 to add more yen and close these positions on profit below 93.50, i.e. we go for range trading.

Are you the author? Previous post See more for Next post

Tags: Abenomics,Bank of Japan,Fair Value,Quantitative Easing,U.S. Producer Price Index,USD/JPY

4 comments

Skip to comment form ↓

Domenico Laruccia

2013-03-16 at 12:55 (UTC 2) Link to this comment

can you please clarify, how did you get the numbers 197/160 and how did you get that 22% = 197/160 as it’s 1.23 as result??? : “In terms of producer prices the yen should have appreciated by 22% = 197/160 between January 2007 and March 2013.”

Domenico Laruccia

2013-03-16 at 14:27 (UTC 2) Link to this comment

when did you get long on eur and jpy ? is that possible to have a time when you indicated that?

DorganG

2013-03-17 at 13:52 (UTC 2) Link to this comment

In terms of producer prices the yen should have appreciated by 22% = 197/160 = US Producer Price Index 2013 divided by US Producer Price Index 2007. See this ratio in the graph ; in 2013

the Japanese price index should come back the 2007 level of 102.5 with

the recent yen devaluation and will be therefore unchanged.

DorganG

2013-03-17 at 13:55 (UTC 2) Link to this comment

@facebook-1253989720:disqus Thanks to Cyprus, you got still a bit time to go long EUR/USD and get it cheaper, but do not forget CHF, NOK, SEK. You never know which news arrive from Europe. Please always check the technical set-up. My analysis are only fundamentals