Tag Archive: U.S. Consumer Price Index

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

FX Daily, 04/14: Greenback Steadies Against Majors, but Firmer vs EM After MAS Surprise

After initially extending its recent recovery gains against the major currencies, the US dollar began consolidating in the European morning. An unexpected shift by the Monetary Authority of Singapore, replacing a modest and gradual currency appr...

Read More »

Read More »

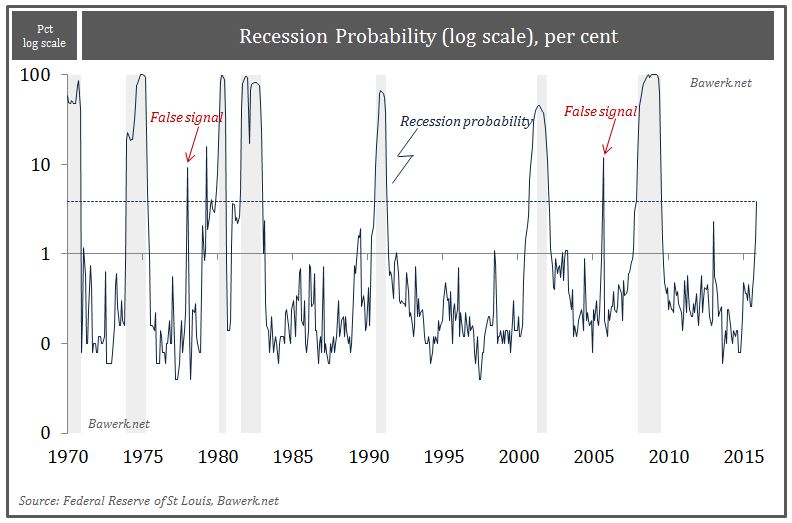

Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beg...

Read More »

Read More »

With the eyes of the chameleon the market turns deep red!

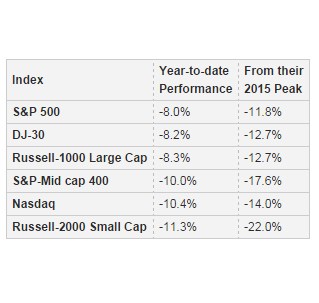

The S&P 500 now stands at 1880.33 points, only 31.97 points from its 2015 opening price of 1848.36; for the broad market, a year’s meager gains almost wiped clean. The index’s P/E ratio now stands at 19.81, and is still well above its historic average of 15.57.

Read More »

Read More »

Markets Resume New Year Slide

The market meltdown is extending into the third consecutive week. Once again, the attempt to stabilize has failed, and bottom pickers have been punished. It is easy to line up poor news developments, including IMF cutting world growth on the same day that the IEA warns of an extended glut in the oil market, the … Continue reading »

Read More »

Read More »

Week Ahead: What Will It Take to Stabilize the Capital Markets?

Two weeks into the year and most investors are nursing sizable drawdowns. The recovery in the US equities on January 14 looked like a potential turning point. However, the coattails proved non-existent, and the bull trap was sprung with new downside momentum established before the weekend. The obvious takeaway is that the current driver is not …

Read More »

Read More »

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments fr...

Read More »

Read More »

The Six Major Fundamental Factors that Determine Gold and Silver Prices

Gold and silver are the most complicated assets to price. Stocks, currencies, commodities mostly depend on their fundamental data, supply and demand. Gold and silver, however, are priced indirectly.

Read More »

Read More »

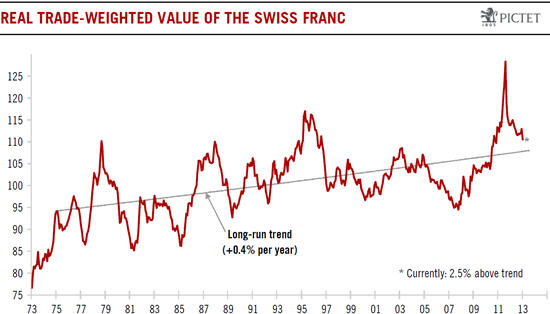

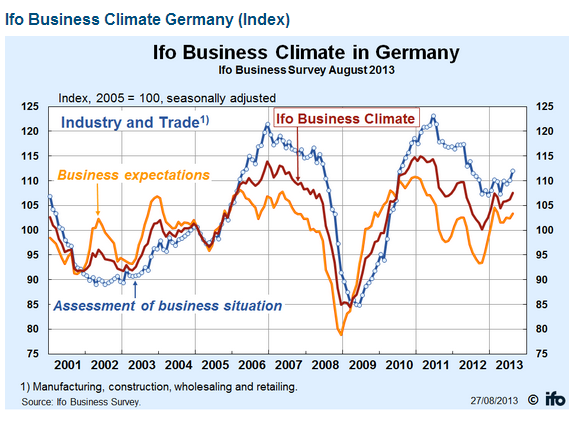

Swiss Franc and Swiss Economy: The Overview Questions

Before the upcoming SNB monetary policy assessment meeting on June 19th, rumors started the SNB could follow the ECB and set negative rates on banks' excess reserves. We would like to deliver the whole background, starting with the question why Swiss inflation has been so low in the past and why CHF always appreciated.

Read More »

Read More »

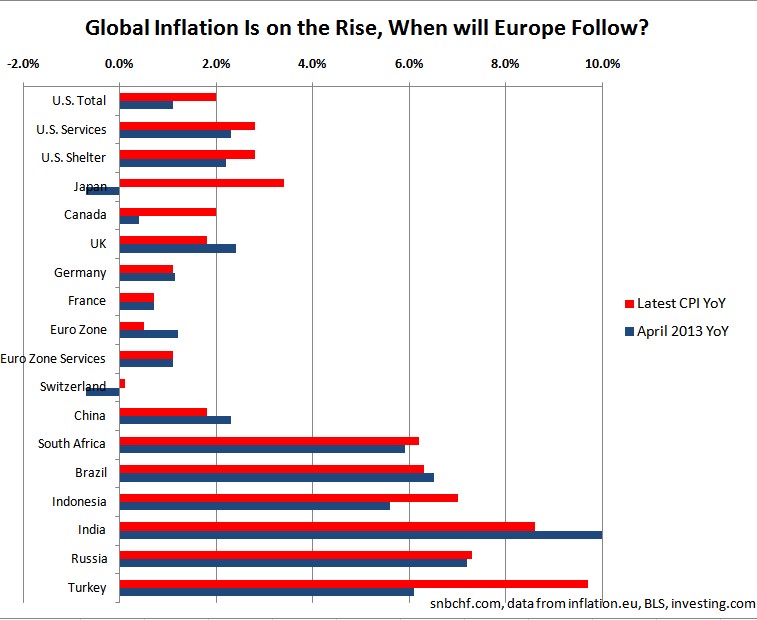

Global Inflation Spikes Up, Are You Sure About What You Are Doing Mr Draghi?

The European Central Bank (ECB) has the habit of reacting late. As seen in July 2008 and July 2011, the ECB is often the last major central bank to hike rates. They hike rates at the moment when others prepare for a recession or a significant slowing. Currently we are witnessing the opposite movement: The world is getting … Continue...

Read More »

Read More »

The Inflation Lie? Why and When Inflation Will Come Back

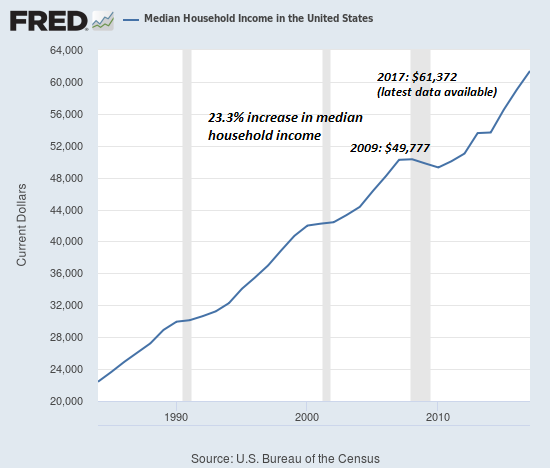

The so-called "inflation lie" : money printing does not create inflation. The cyclical slowing in emerging markets shows that it actually did cause inflation, just not in developed economies yet.

Read More »

Read More »

Which Of The Six Major Fundamental Factors For Gold And Silver Are Still Positive? Which Are Not? (April 2013)

Having identified the 6 fundamental price factors previously we speak about the gold-silver ratio. We explain which fundamental factors speak for an increase of gold and silver prices and which don't.

Read More »

Read More »

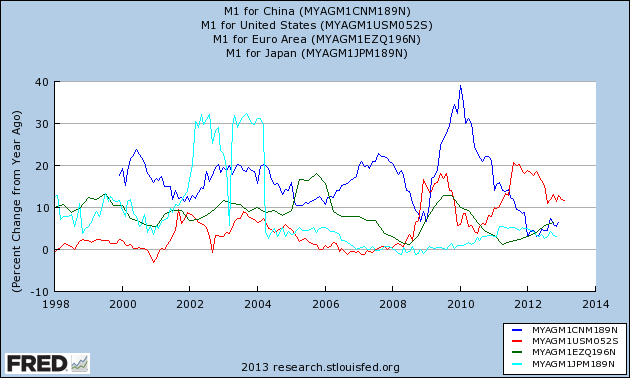

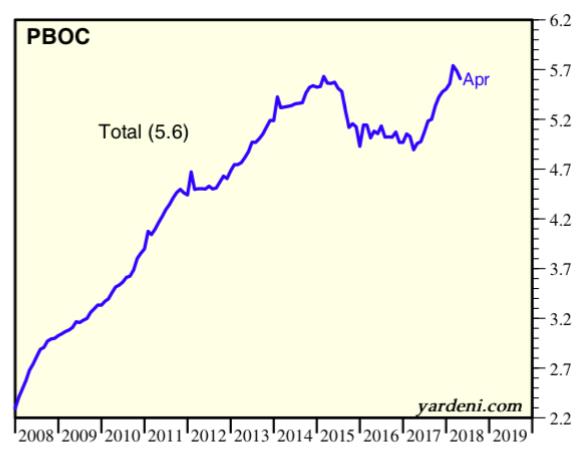

Quantitative Easing, Gold and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis, but even more, the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and of Quantitative Easing. This will push down the dollar, and safe-havens like the CHF, gold or the Japanese Yen up. … Continue reading »

Read More »

Read More »

Quantitative Easing: The Fed Wants Americans to Continue Deficit Spending

The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This usually pushes down the dollar and inflation hedges like the Swiss franc and …

Read More »

Read More »

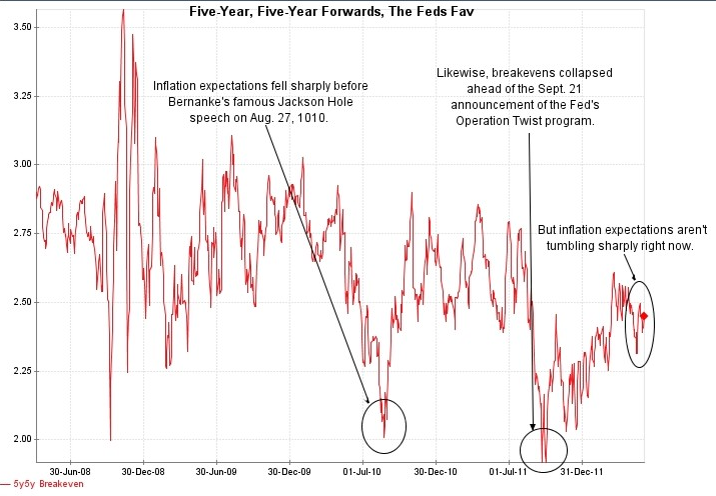

Fed Violates its Own Inflation Targets. Should QE3 Be Postponed?

At this year’s Jackson Hole symposium, Ben Bernanke promised to help the economy via further easing if needed. We doubt his promises because because the Fed might contradict their inflation targets. Current levels of around 2 % for the consumer price inflation excluding food and energy (“core CPI“) and the deflator of the GDP …

Read More »

Read More »