In the first part we identified the six major fundamentals that drive gold and silver prices. In this second part we speak about the relationship between gold and silver. We explain which fundamental factors speak for an increase of gold and silver prices and which don’t.

Since fundamentals are very difficult to grasp, many people trade gold and silver based on technical support and resistance levels and is far more subject to speculation.

Many investment advisers were and are moving out of gold. In February the Swiss Pictet decided to reduce its gold share after 10 years of success with their gold investment. The gold price is in a technical bear market.

Gold/silver correlation

Central banks do not buy silver, but gold. In response to central banks’ actions, silver prices only rise with the gold correlation. In crisis moments the gold/silver ratio increases, similarly as the gold/oil ratio.

The gold/silver ratio is particularly small when both emerging markets and the United States expand, but the growth of emerging markets is far higher, like between 2009 and April 2011. After that the European debt crisis and a slowing in emerging markets helped to increase the ratio again. Silver prices are more closely related to copper.

The six fundamental factors in a review

The six fundamental factors have for us the following future tendencies.

- Price movements of other commodities in combination with global commodity demand. We think that global growth, in particular in emerging markets, will resume once risk aversion and high inflation in emerging markets have calmed down. A recovery of the European economies, in particular of Germany, will help to improve global growth.

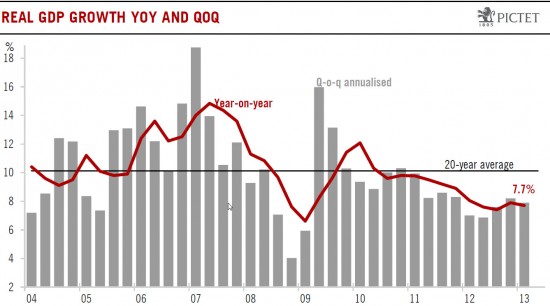

Brent oil prices seem to be currently depressed more because of seasonal Chinese demand weakness than due to the increased U.S. supply and the new fracking techniques.Chinese oil demand alone typically rises by 5-9% per year or an average of 1.0 million barrels per day (Mb/d), while shale oil in the U.S. could reach a maximum production of 2 to 3 Mb/d by 2035 and currently produces 0.9 Mb/d. The weaker Chinese GDP growth of 7.7% is still high enough to support 5-9% oil consumption increase. Hence over the long-term Brent oil prices should rise again. This is positive for gold, silver and other commodities. Non the less, we recommend gold investors to understand oil price cycles, the mechanisms of oil supply and demand.The U.S. housing market still shows some indications of an oversupply. Chinese authorities are trying to tame excessive demand, the PBoC keeps rates high, the government restricts possibilities of a buying a second home, apart from speculation these are signs of under-supply, while Chinese commercial properties show already an over-supply. This has a negative effect on construction activity and commodities like copper. Falling commodity prices, however will increase margins of home-builders and increase activity over the longer-term. In the U.S., however, the recent increase of home prices is often driven by investors and not families.

- Global money supply and inflation

With continuously rising wages in emerging markets and monetary expansion in many developed nations, we reckon that disinflation, the reduction of inflation, will end soon, even if the mainstream media currently and possibly for years have over-emphasized low inflation and low credit growth. Russian, Turkish, Indian and Brazilian and South African inflation figures are around 6% and more, not much less than during the peak of 2011.

Thanks to the stronger yuan and a high manufacturing share that correlates with commodity prices, Chinese inflation has dropped to 3.1%. While high inflation in developing nations did not matter much until the year 2000, the rising GDP share of these nations have an influence not only via the factor “global inflation” but also by “physical demand” (point 6) as inflation hedge.

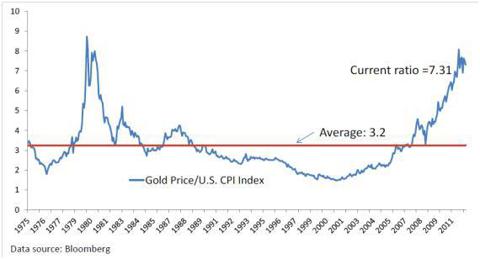

Similar as Bill Gross we judge that U.S. inflation might pick up in the coming years because the job market is structurally split in people “in the labor force” and the ones “out of the labor force”. Higher wages for the first group might lead to higher price inflation over the longer term, but the Fed will still be reluctant to hike interest rates because of the second group and high public debt. Core CPI inflation in both Europe and U.S. of nearly 2% despite high unemployment is a symptom of central banks flying blind into unscattered territory.Markets, however, did already anticipate high future U.S. inflation, visible in the increase of gold/US CPI ratio that has recently fallen under 7.

Many gold bears use the high gold/CPI ratio as counter-argument. They ignore that the gold/CPI ratio for many emerging markets did not increase that much. Indian prices are five times higher than in 1993, but the gold price quoted in Indian Rupee has risen by the factor 9.

In summary, we see inflation rising in the U.S. and continuing higher inflation levels in emerging markets over the longer term. - Trade and growth imbalances, the U.S. twin deficits and the “fear factor”

Global imbalances are partially reduced, thanks to high wage increases in emerging markets and slower demand in developed nations. Recession fears have greatly diminished and have been replaced by a “fear of dropping gold prices.”The US current account deficit has halved since 2007. Between December 2011 and December 2012 WTI oil prices fell from levels around 100$ to 88$. WTI oil is mostly an appropriate benchmark for imported US oil due a higher share of cheaper Canadian and Mexican oil. This depreciation had as effect that energy made up only 33% of the U.S. deficit instead of 42%.Due to high import costs of oil, the surplus countries are less and less Asian economies, like China, South Korea or Japan, but increasingly European economies like Germany, Switzerland or Sweden. This is partially bad news for gold and silver, because those countries will not spur so many commodity-intensive investments like China did.

The Chinese and Japanese, however, are the ones that will profit most on the decrease of Brent prices from 120$ to 100$ since last year. We judge that in some months China will see a trade surplus again and possibly even Japan. This will support gold and silver prices.

The increasing public debt, however, is another reason to buy the yellow metal. - Central bank’s activities like money printing or gold purchases and sales

Smaller current account surpluses of emerging markets due to weaker commodity prices and higher wages will lead to smaller gold purchases by central banks. Thanks to smaller differences between emerging markets and US growth, Fed non-conventional easing measures might diminish over time. Both points are bad news for gold and silver prices. - Real interest rates, in particular in the United States and “financial repression”

Seven years after the start of financial crisis, the typical length of a weakness period in a credit cycle, a U.S. recovery seems to be possible, especially because emerging markets had high inflation and lost some competitiveness. We think that oil prices will rebound with stronger global growth, which is negative for the U.S. On the other side, a main argument for U.S. blue chips was and is their sales to emerging markets. U.S. firms cannot lead the global economy any more as they did until the 1960s and during the 1990s until the dot com bubble; the U.S. are similar to many German firms a slave of the global expansion.

We reckon that the U.S. housing market might have recovered thanks to implicit purchases by the Fed and other state organizations. An exit from QE3 and a rate hike would be detrimental for US home owners. Therefore we do not believe in US rate hikes in 2015, like many members of the FOMC do. As long as the Fed does not hike rates, gold and silver prices will remain strong. - Physical demand and supply

We think that growth of emerging markets will be slower, but still high enough to support continuing purchases of physical gold and silver. More and more people will be able to purchase precious metals, last but not least as protection again inflation (factor 2). This is long-term positive for prices.

For the supply side see the comments in the first parts or the comment below.

Summary and Outlook

For us, most fundamental factors (items 1, 2, 5 and 6) speak for an appreciation of gold and silver prices, while factor 4, smaller future central bank interventions, favor a further weakening. Point 3 is rather neutral. We give factor 5, the “financial repression” the highest importance: Despite improvements in the US economy, we do not see a rate hike coming in the next 5 years, but countries like China are still competitive enough to replace American manufacturing with cheap imports. In factor 2 we disagree with mainstream media: we see global inflation rising again.

Many factors like weaker growth of emerging markets might not have been priced in correctly in commodity prices and – as the gold-silver correlation shows – even less in the price of gold. One example, Chinese growth rates between 12% and 18% in 2007/2008 combined with low U.S. rates drove the oil price up to 150$, while growth of 2-4% let it fall to 30$ a barrel in 2009. The current price of 100$ for Brent oil does it point to a future Chinese growth rate of rather 6% (rather oil and gold-bearish) or better 8% (oil and gold-bullish)?

We think that Chinese authorities will offer more easing measures if Chinese GDP growth is really in danger to fall under the the promised 7.5%. This will sustain gold prices.

Having identified the 6 fundamental price factors previously we speak about the gold-silver ratio. We explain which fundamental factors speak for an increase of gold and silver prices and which don't. - Click to enlarge

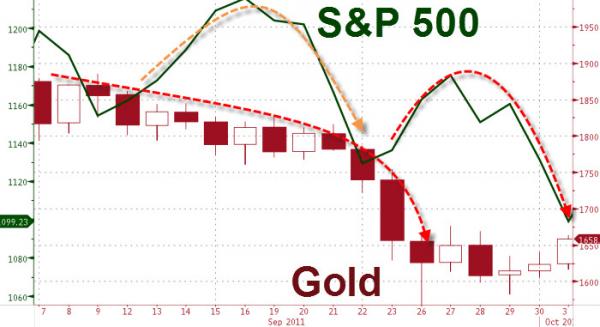

Technical movements might further depress gold and silver similarly as many investors might follow the bearish technical trend in gold and sell the metal. Gold and silver prices currently show similar high volatility like stocks in bearish markets like in 2008/2009 and August/September 2011. Prices are mostly driven by short futures, put options, margin calls and day traders, that sooner or later will exit the market again (see details). Volatile times, however, are the best periods for long-term investors to buy.

Having identified the 6 fundamental price factors previously we speak about the gold-silver ratio. We explain which fundamental factors speak for an increase of gold and silver prices and which don't. - Click to enlarge

Investment recommendation

On several occasions in October 2012 we recommended to sell gold and metals – here or here. In the current bear market gold and silver are getting interesting again; long-term fundamentals are mostly positive.

Our strategy would be to echelon gold and silver purchases at different entry levels, like a gold price level in the lower 1300s and at 1200. Due to the high gold-silver ratio and supply issues (see comment) we prefer to invest in silver instead of gold. In a US recovery helped by cheaper oil and gas prices, silver will advance first. If, however, stock markets follow the gold price plunge, then silver prices might fall with stocks, while gold will remain rather stable.

See more for

4 comments

Skip to comment form ↓

Benjamin Cole

2013-04-19 at 13:43 (UTC 2) Link to this comment

I think gold is dead for many years to come.

DorganG

2013-04-19 at 14:40 (UTC 2) Link to this comment

Just because gold took a hit, this does not mean that gold is dead. Stocks were beaten similarly in 2008/2009 or in September 2011 with. Gold took its last big hit in December 2011, everybody like you was disappointed. Warren Buffet typically uses the weak and volatile moments to buy equities, “when people think that equities are dead for many years.” We do the equivalent for gold.

Gold is similarly to stocks an investment that is driven by fundamentals over the longer-term and not by sentiment. Algorithms drive asset prices on day to day basis so that they react to fundamental data (e.g. trade balances, GDP growth). If the fundamentals are good for gold then gold rises, if they are bad then it falls.

Still one point: Given low global growth, stocks are overvalued. Given inflation risks, bonds are overvalued. What does remain?

Whisper

2013-04-21 at 00:02 (UTC 2) Link to this comment

This article is certainly an improvement compared to your rather weak article on the so called gold initiative. With all due respect, this blog offers great insight on the CHF and the SNB, but in terms of monetary metals it needs to do more homework.

First I wanna give some input on the gold initiative article: The gold initiative has it’s intellectual roots in the book “Gold Wars” by Ferdinand Lips, a former executive for the Banque Privee de Rothschild Suisse. It contains of whole chapter on the stupidity of the Swiss federal government and the SNB apparatchicks. In your article, you missed the point about repatriation which would mean that the SNB can no longer lease gold into the market via the NY FED, the BOE in London and their private sector partners JPM and HSBC. Leasing (or even selling) is the only reason to “store” gold abroad in the post cold war age. It’s also the only reason why the German Bundesbank needs 7 years to repatriate a few hundred tons form the NY FED. The impact of a de facto gold standard (at least 20% of reserves in gold, all the time) on the IMF membership of Switzerland was also not understood in that article. If the IMF interprets it’s own charter strictly, Switzerland would have to be expelled. IMF members are not allowed to run a gold standard, thanks to the Keynesian mindset of the IMF. You also didn’t properly explain the impact of potential gold purchases on the EUR/CHF exchange rate in my humble opinion. If the SNB would just use it’s abundant fx reserves, especially EUR, there would not be an impact on EUR/CHF but rather just on XAU/EUR and XAU/CHF, ie gold would go up in both of these currencies.

——-

Moving over to the current article:

CPI/gold correlations aren’t very close, as you stated. Gold is not so much a hedge against inflation, but rather against financial repression, ie negative real interest rates. The correlation with the US debt ceiling derives from that, because debt couldn’t grow that much without negative real interest rates. Interest rate costs would limit deficit growth. The FED has now ensured that interest rates can’t be positve in real terms for a long time, because it would mean an imminent debt crisis for the US government otherwise. They’ve taken a one way street called ZIRP and there’s no way to turn arround without blowing up the system. If ZIRP isn’t enough to keep real rates negative, they resort to QE/printing money.

I’m missing the primary reason why neither gold nor silver prices are going to fall substantially over an extended period of time in your article, though: it’s production costs. It’s hard to believe it after a straight 12 year run, but gold mines have been spending arround $1200-1250/oz last year on average. The high cost producers (top 10% of mine supply) are already deeply underwater right now. Costs had a CAGR of 16.7% over the last five years, rising faster than spot prices. Out of the major gold miners, only Agnico Eagle had positive free cash flow in 2012, with average gold prices way above $1600 (read Hinde Capital’s research on that). The two biggest companies in the industry, Barrick and Newmont were cash flow negative in 2012. The major silver miners had costs arround $23.5 in 2012 (read a great seeking alpha series on that). That explains why the mining shares have underperformed the metals since 2008. They are not making money, because cost inflation is outpacing price appreciation. Even for stable profits yoy, miners need either rising prices or increased production. On the other hand, mining industry participants with fixed cost structures like royalty and streaming companies (FNV; RGLD; SAND; SLW) have outperformed the metals. The diversion between the perfomance of the miners vs the royalty and streaming companies is the best proof for my thesis.

Now one might say that costs could go down. I don’t think so (watch Pierre Lassonde’s 2012 presentation at the Denver Gold Conference for the following):

1.) Granted, oil prices could fall. Oil makes up about 25% of costs. That could lower costs. But oil production costs have risen, too. Some say $60/b is the floor. Many OPEC countries, including Saudi Arabia, Iran and Venezuela would collapse socially at $60, though. The ruling classes in these countries can’t maintain their dictatorships with 30-40% lower oil revenue.

2.) Ore grades (grams of metal per ton mined) will not rise. They have been falling from about 2g/t of gold in 2000 to 0.5g/t currently. This means it takes four times the material to mine the same amount of oz.

3.) Lower ore grades means bigger projects, means longer development and permitting, means higher IRR/p.a. required to attract capital, because investment horizons are longer and take longer to produce profits.

4.) Gold exploration during the last decade was one huge desaster. The industry spent record amounts of capital on exploration and yielded minimal discoveries. Replacing depleted reserves is going to very difficult.

5.) Many major projects are located in developping countries with rampant wage inflation. South Africa is just the tip of the iceberg. Wages are weighing heavily on mining costs. Populists might also nationalisze mines and disrupt production due to their incompetence in running a corporation.

With regards to your preference for silver over gold: That is a dangerous bet. It has pros and cons.

a. Cons: Silver is a hybrid. It’s not just a precious/monetary metal, it’s also an industrial metal, too. This is the reason for it’s intensifying correlation with copper. Both copper (LME, COMEX) and silver (COMEX) inventories have grown substantially over the last year. The copper market is on the verge of a breakdown below $3. The chart pattern looks like classical head and shoulders formation. Economic indicators have signalled a global slowdown for a while. If Dr. copper breaks down, it’s gonna drag silver with it. The high silver inventories are going delay the effect of the fact that silver would be trading below production costs.

b. pros: If gold turns higher due to record physical demand whiich is already recognizable in rising premiums and a flattening forward curve at the LBMA, silver tends to follow with leverage. Speculative short (COMEX futures) positions are relatively high which could trigger a short squeeze.

If you trade options, you could open a straddle trade (1 atm call AND 1 atm put) in silver, ie bet on volatility rathen than just on rising prices. The risk/return profile seems to be much better on that one. I’d use a 9-12 months duration and Amercan options for the sake of

flexibility.

Anyway, thanks for writng this blog and have a nice weekend.

DorganG

2013-04-21 at 08:01 (UTC 2) Link to this comment

Thank you, for the first comment on the IMF see https://snbchf.com/2013/03/swiss-gold-referendum/.

As I state in the summary, factor 5 – I call it now explicitly “financial repression” – is the most important factor. Still I insist that the inflation hedge in emerging markets has an often overlooked importance on demand.

Thank you for the insights on production costs. I already added before some details to the first part of the article. https://snbchf.com/swissgold/gold/gold-silver-prices/ citing sources that the minimum is around 1000$, but the price could fall temporarily under production costs.

As for your investment recommendation, I also think that volatility will be continue to be high. In times of high volatility, options are more expensive. The point when you should buy the volatility was maybe earlier.