Tag Archive: U.K. Services PMI

The Service PMI release is published monthly by Markit Economics. The data are based on surveys of over 400 executives in private sector service companies. The surveys cover transport and communication, financial intermediaries, business and personal services, computing & IT, hotels and restaurants.

FX Daily, October 04: Consolidative Tone in FX Continues

The US dollar has a softer tone today, and it was that way even for the European PMI. The greenback eased further after the upside momentum faded yesterday. The heavier tone in Asia seemed spurred by a hedge fund manager's call that Minneapolis Fed President, and among the most dovish members of the FOMC, Kashkari would be the next Fed chair.

Read More »

Read More »

FX Daily, August 03: Dollar-Bloc Currencies Turning, but Euro Downticks Limited

The high-flying dollar-bloc currencies may be a preliminary sign market change. The US dollar is gaining on the Canadian dollar for the fourth consecutive session. It is probing resistance we identified in the $1.2620 area. The US dollar has not traded above its 20-day moving average since the Fed hiked rates on June 14. It is found today near CAD1.2625.

Read More »

Read More »

FX Daily, July 05: Dollar Firm as Investors Await Fresh Directional Cues

The US dollar is enjoying a firm tone today. Yesterday's two weakest major currencies, the Australian dollar and Swedish krona are the strongest currencies, but little changed on the session. After a strong rebound in the greenback to start the week, it mostly consolidated yesterday.

Read More »

Read More »

FX Daily, June 05: US Dollar Starts Important Week Mostly Stable to Higher

The US dollar is beginning what promises to be an important week on a steady to firmer note against most of the major currencies. It is a holiday in parts of Europe (e.g.,m Germany and Switzerland). Although excitement is not until Thursday's ECB meeting, UK election, and the testimony of former US FBI Director Comey, there are several developments today to note.

Read More »

Read More »

FX Daily, May 04: Greenback Struggles to Sustain Upticks, Though Odds of June Hike Rise

The US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation estimates the market is discounting around 70%-75% chance of a hike.

Read More »

Read More »

FX Daily, April 05: Dialing it Up on Hump Day

he dollar is practically unchanged against the euro and yen in the first two sessions of the week. The pace can be expected to pick up starting Wednesday. Although the euro slipped through $1.0650, it was not sustained, and on Monday and Tuesday, the euro finished near its highs.

Read More »

Read More »

FX Daily, March 03: Yellen and Jobs Report Last Two Hurdles to US Hike

The US dollar is narrowly mixed as Yellen's speech in Chicago is awaited. The greenback's three-day advance against the euro and four-day advance against the yen is at risk. The dollar-bloc currencies, where speculators in the futures market had gone net long, continue to underperform.

Read More »

Read More »

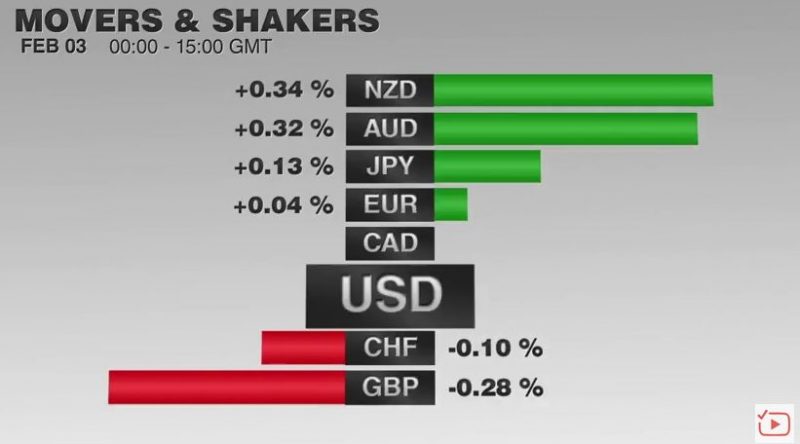

FX Daily, February 03: US Jobs Trump Europe’s Service PMIs

Ahead of the weekend, there are two series of economic reports. The first are Europe's service PMI reports and the second is the US employment report. Neither report is likely to alter views significantly, but the latter has greater potential to move the market.

Read More »

Read More »

FX Daily, January 05: Dollar Slide but Resilience Demonstrated while Yuan Squeezed Higher

There are two main developments. First, the high degree of uncertainty expressed in the FOMC minutes and the repeated references to the strong dollar spurred a wave of dollar selling. The dollar retreated in Asia, but European participants saw the pullback as a new buying opportunity.

Read More »

Read More »

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »

FX Daily, November 03: Political Angst Drives Markets

GBP/CHF rates are trading below 1.20 on the exchange, providing those clients holding CHF with some of the best rates they’ve seen in the past six years. The Pounds woes have been well documented but with a key day of economic data releases ahead, is it all about to change?

Read More »

Read More »

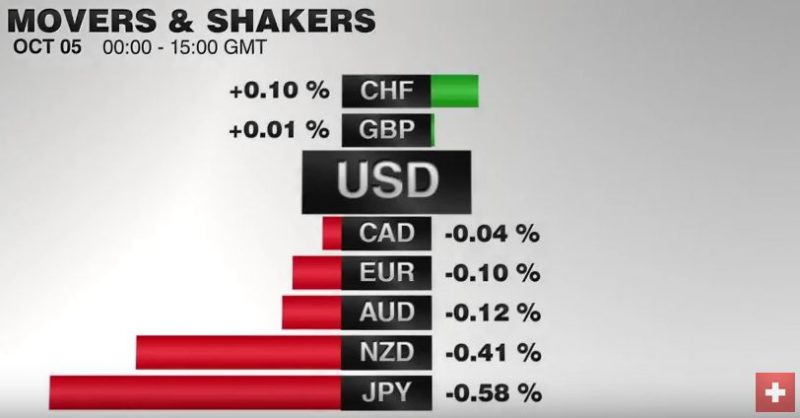

FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

After the sudden rise to 1.0973 the EUR/CHF is falling again. The volatiliy is related to the CHF speculative postion, that suddenly was Short CHF. Traders that moved with the SNB Window Dressing for Q3 are closing their shorts again.

Read More »

Read More »

FX Daily, September 5: While Americans were Celebrating Labor Day

There were several developments that took place while US markets were closed for its Labor Day holiday. Most of the economic news was favorable. This included a strong snap back in the UK service PMI, more evidence that the moral suasion campaign to lift wages in Japan is yielding some success and a rise in the Caixin's China's service PMI.

Read More »

Read More »

FX Daily, August 03: Consolidation Featured

The US dollar is consolidating yesterday's losses. The greenback's upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week's RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week.

Read More »

Read More »

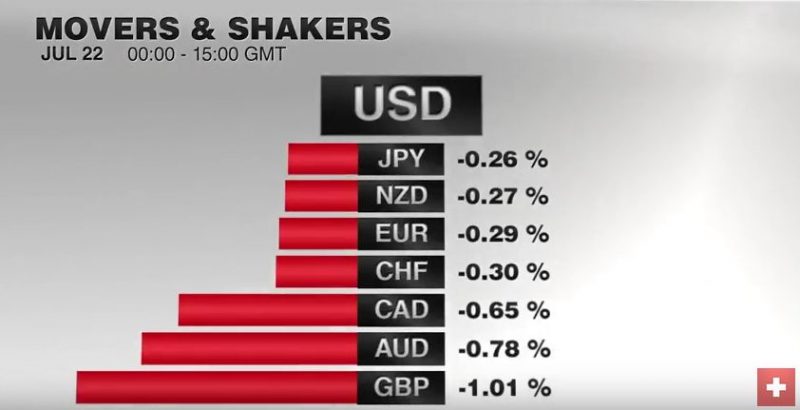

FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US equities yesterday has continued in Asia and Europe today. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 in Europe are both off around 0.5%.

Read More »

Read More »

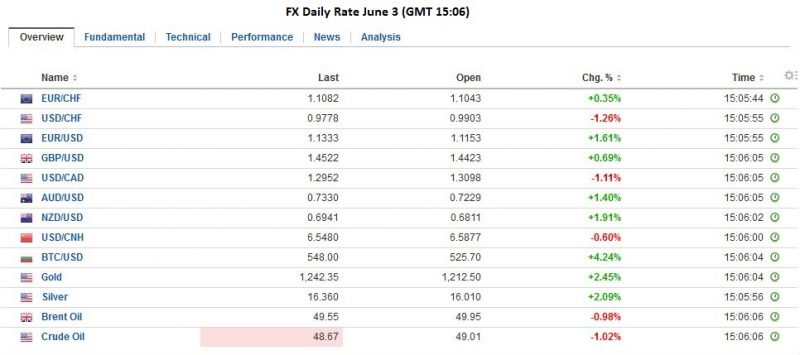

FX Daily, June 3: FX Market Shocked by Non-Farm Payrolls

Massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank. The dollar lost 2% against the yen, 1.6% against the euro and 1.3% vs. the Swiss franc.

Read More »

Read More »