Tag Archive: Switzerland

What Happens Next (In Europe)?

A year ago today, European equities hit their highest levels ever. But, as Bloomberg reports, the euphoria about Mario Draghi’s stimulus program didn’t last, and trader skepticism is now rampant. The Stoxx Europe 600 Index has lost 17% sinc...

Read More »

Read More »

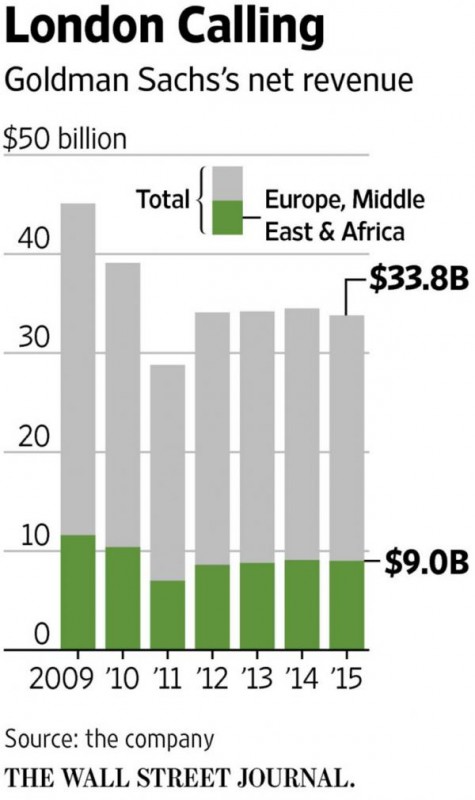

Guess Which Major Bank Loses The Most From Brexit?

Banks have been lobbying intensively against Brexit. Among those leading the charge is Goldman Sachs. For three years, the bank’s executives have publicly warned about the downsides of leaving the EU... and now we know why (hint - it's not concern fo...

Read More »

Read More »

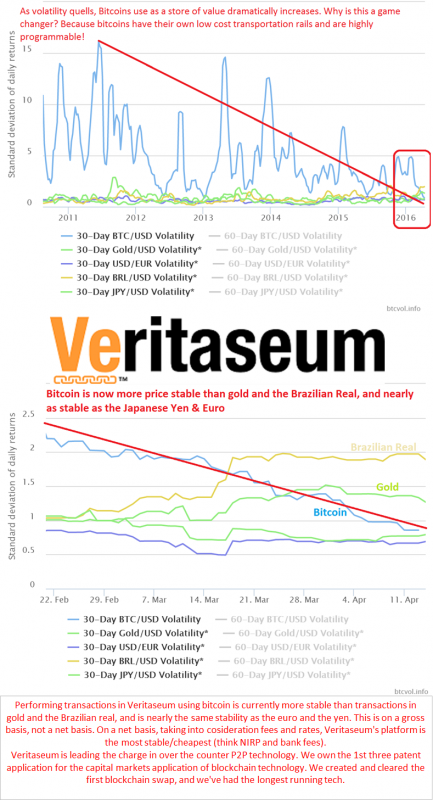

A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swis...

Read More »

Read More »

Inside The Most Important Building For U.S. Capital Markets, Where Trillions Trade Each Day

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into...

Read More »

Read More »

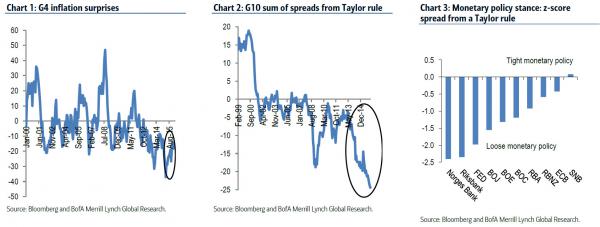

Bank Of America Reveals “The Next Big Trade”

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as th...

Read More »

Read More »

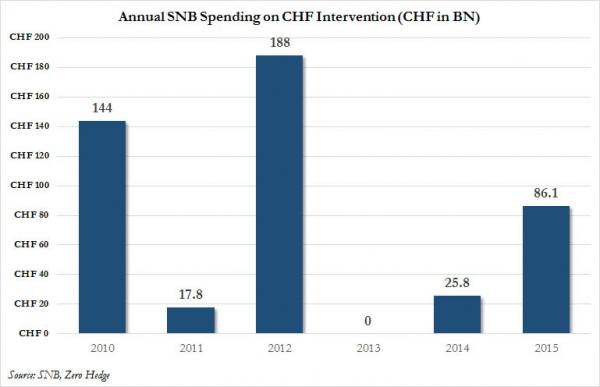

Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woef...

Read More »

Read More »

How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8

Submitted by Ronan Manly of Bullionstar Blogs

Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exporte...

Read More »

Read More »

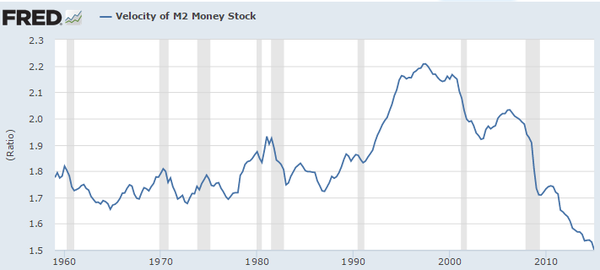

Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thi...

Read More »

Read More »

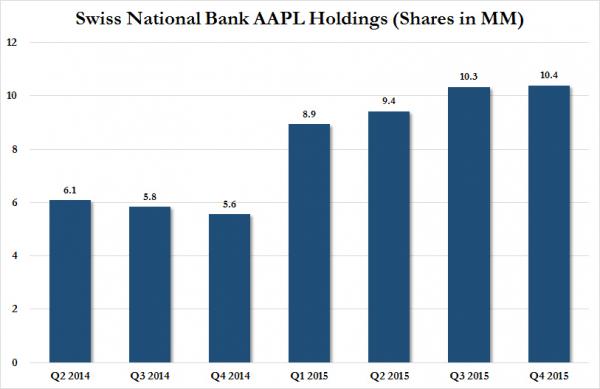

The Swiss National Bank Doubled Its Apple Holdings in 2015

In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled - in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions...

Read More »

Read More »

BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is...

Read More »

Read More »

Square Holes And Currency Pegs

Submitted by Raul Ilargi Meijer via The Automatic Earth blog,

When David Bowie died, everybody, in what they wrote and said, seemed to feel they owned him, and owned his death, even if they hadn’t thought about him, or listened to him, for years....

Read More »

Read More »

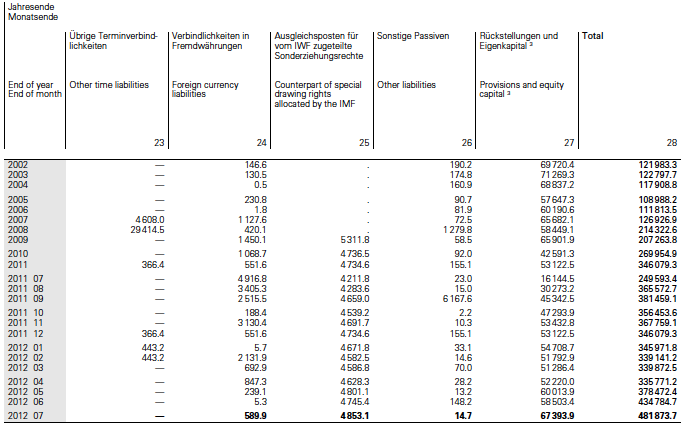

SNB’s history of balance sheet and Monthly bulletin

The SNB monthly bulletins contain all important data of the SNB and the Swiss economy as of the latest quarter.

Read More »

Read More »

SNB & CHF, the blog on a beleaguered central bank, its currency, on gold and astute investments

SNBCHF.com tracks Swiss macro-economic news and the Swiss National Bank. The SNB finally gave up the euro peg and agreed with the authors of this blog. Over years this blog expressed opposition against the EUR/CHF peg in about 900 different pages. They track the strong Swiss economic performance over these years. They explain all logical and fundamental Forex background why this peg did not have any reason to exist or, at least, why it was doomed...

Read More »

Read More »

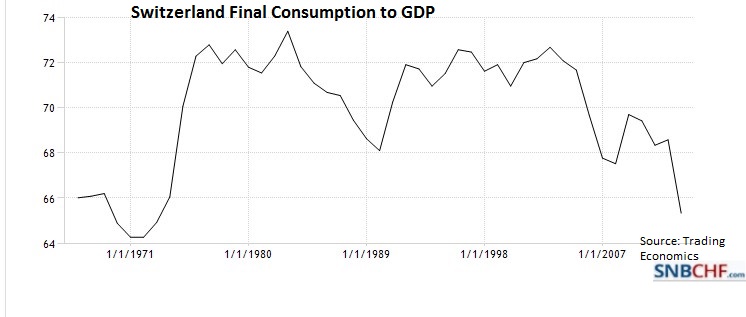

Q1/2015: Swiss Real GDP Rises by 15 percent … in Euro Terms

George Dorgan shows that Gross Domestic Product (GDP) is a measurement in the local currency. Effectively, Swiss real GDP rose by 15% in Euro terms, but fell slightly in CHF. He also emphasizes that Switzerland needs a big rebalancing of its economy, away from exports towards consumption. The Swiss National Bank was right to remove the euro peg. The move towards consumption is only possible when the Swiss franc is stronger because consumers will...

Read More »

Read More »

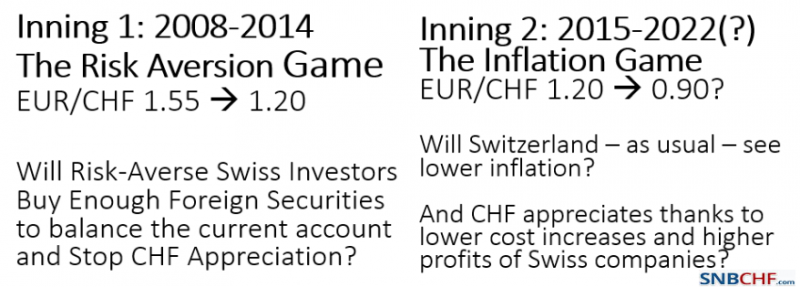

The two phases of CHF appreciation… and what is in between

We show the two phases or "two innings" of Swiss franc appreciation: The risk aversion phase and the high inflation phase.

With the weakening of emerging markets and the strengthening of the United States in 2013/2014, the Swiss National Bank (SNB) had won the first battle in the war against financial market, the "risk aversion game", the first inning in two-part match. Risk aversion is lower because the United States recovered with weaker oil...

Read More »

Read More »

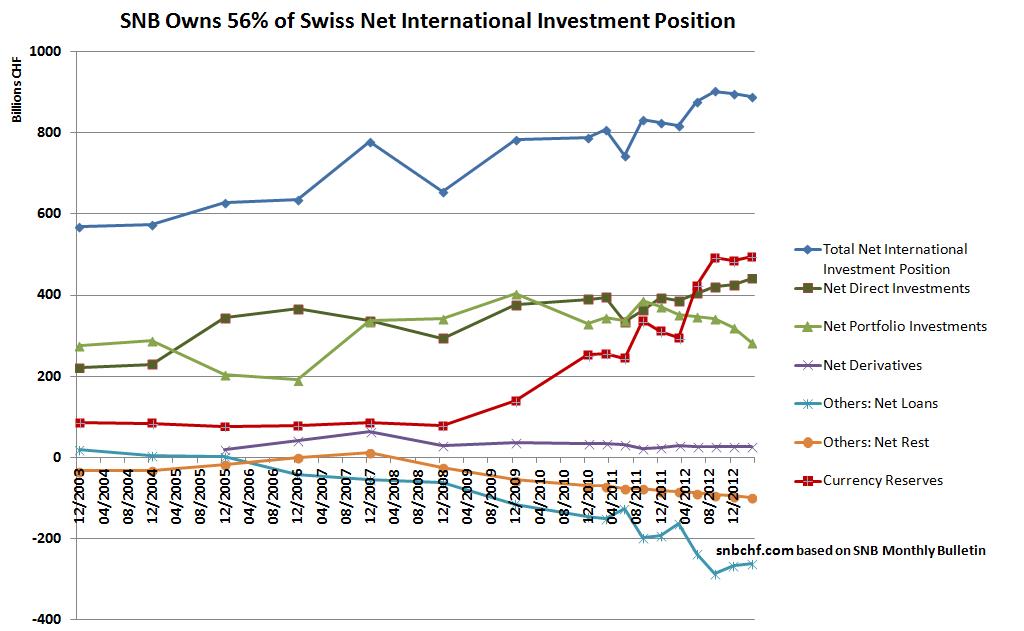

(10.1.2) Net International Investment Position Switzerland and Italy

We compare aspects of the Net International Investment Positions for Italy and Switzerland

Read More »

Read More »

(2.3) Differences in global CPI baskets

Typically poorer countries have a basket with a higher weight for food and other consumption goods, but richer states give them a smaller weight. Here the full details over different countries

Read More »

Read More »