Tag Archive: Switzerland

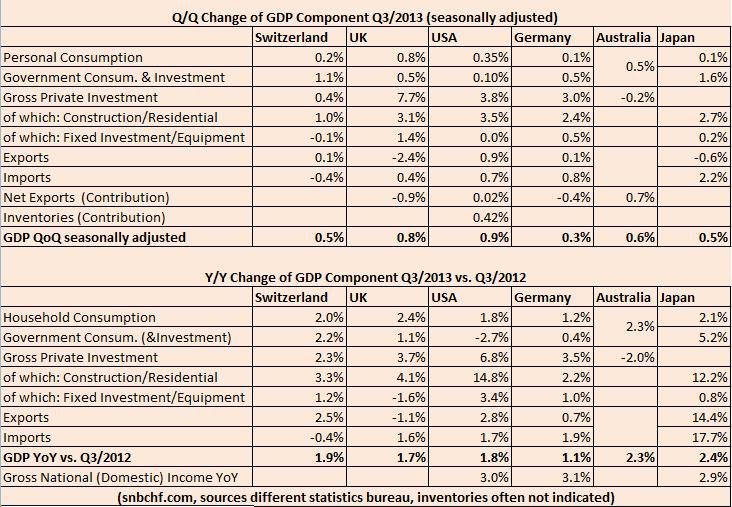

Swiss GDP Details Compared to UK, USA, Germany, Japan and Australia, Q3 2013

The Swiss GDP was again one of the strongest major economies. The quarterly growth rate in the third quarter was 0.5%, the yearly one 1.9%. U.S. GDP improved by 3.6% QoQ annualized. For comparison purposes, our figures are not annualized; hence the equivalent is 0.9% QoQ. In Japan and Switzerland private consumption rose by 0.1% … Continue reading...

Read More »

Read More »

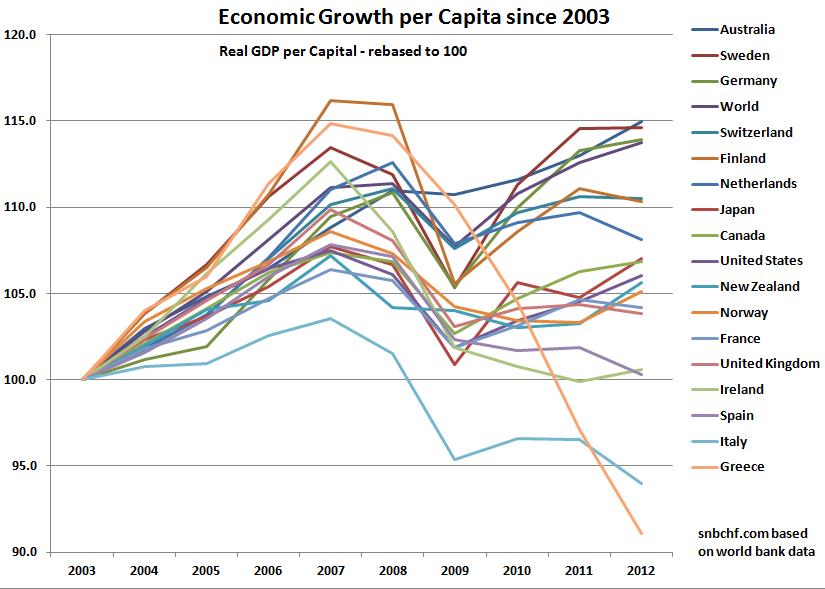

Japan Beats the United States in GDP Growth per Capita for Last Decade

GDP Growth per Capita in Developed Nations in the following order: Australia Sweden Germany Switzerland Netherlands Japan Canada United States France United Kingdom Ireland Spain Italy Greece

Read More »

Read More »

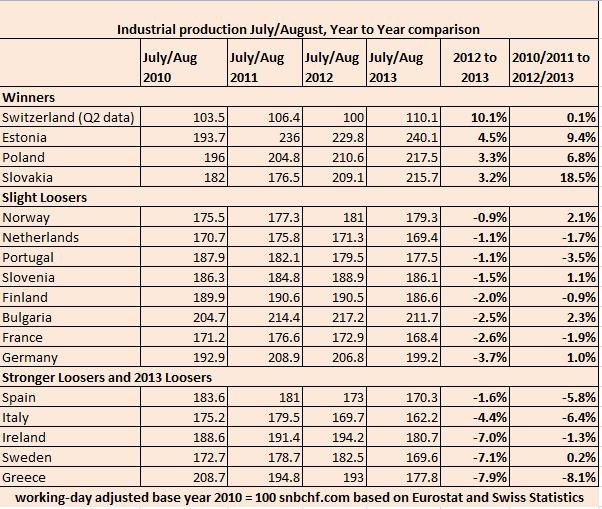

European Industrial Production Still Contracting, Switzerland Expanding Again

Swiss industrial production is rather insensitive to price changes and to the recent slowing of global demand thanks to the concentration on pharmaceuticals and luxury products. Based on Eurostat’s industrial production for July and August , we compared the values from 2010 to 2013 for these two summer months. This aggregated two-months comparison is …

Read More »

Read More »

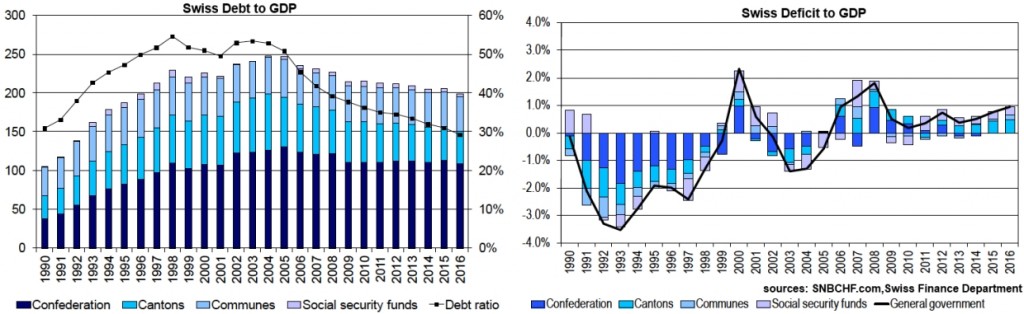

Debt Reduction, the new Financial Cycle, an Important Driver of EUR/CHF

In this analysis we describe why the long-lasting financial cycle of debt reduction is one key driver of the EUR/CHF exchange rate. We claim that EUR/CHF can rise more strongly only when the competitiveness of the European periphery increases. When this happens, then debt will be reduced and both public and private deficit spending will stop.

Read More »

Read More »

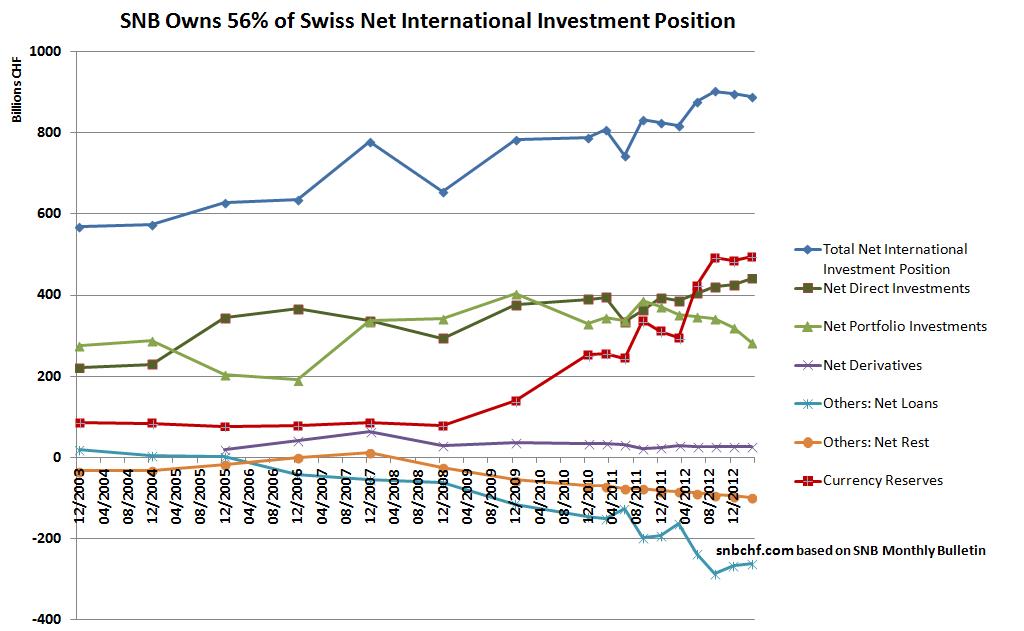

A Nationalization of Swiss Foreign Assets? SNB Owns 56% of Swiss Net International Investment Position

The SNB currently owns 56% of the Swiss net international investment position (“NIIP”). In the year 2007 this number was only 12%. Is the central bank implicitly nationalizing the Swiss international companies?

Read More »

Read More »

Swiss industrial production unimpressed by global slowing

Swiss industrial production rose by 3% in the first quarter 2013 compared with the same quarter of the previous year. Turnover rose by 3.7%. Details

Read More »

Read More »

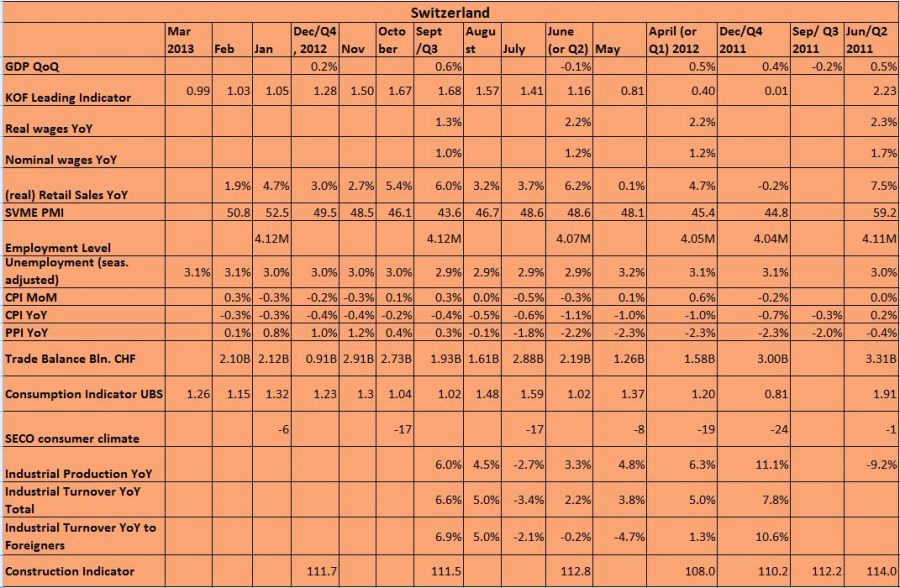

The End of Swiss Deflation

The yearly change of the Swiss consumer price index has risen from -0.5% to -0.1%, the end of deflation is near. Swiss inflation measured with the European standard HICP has even improved to +0.2% y/y. Details

Read More »

Read More »

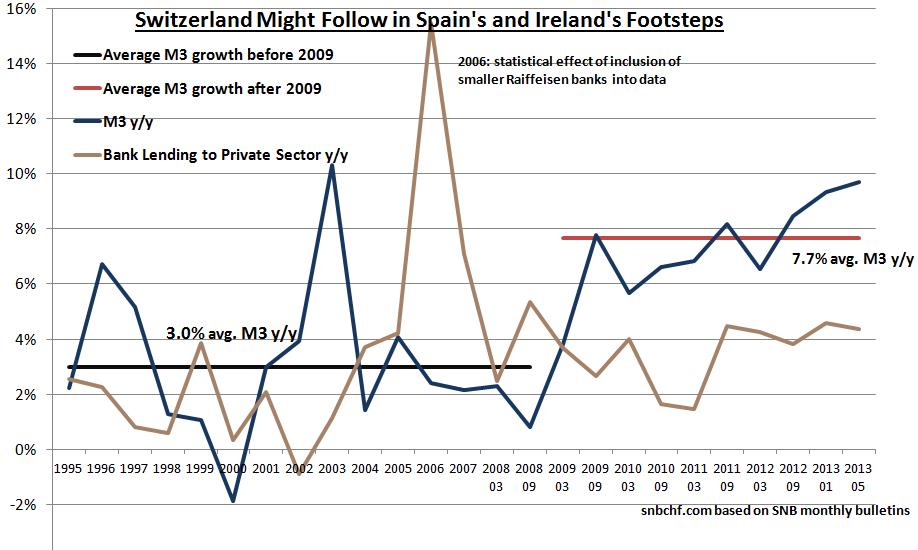

Excessive Money Supply: Switzerland Could Follow in Spain’s and Ireland’s Footsteps

In the Euro zone bank lending is contracting, M3 is rising very slowly. As opposed to that, Swiss bank lending is currently rising by 4.4% per year, M3 is increasing by 10% per year.

Read More »

Read More »

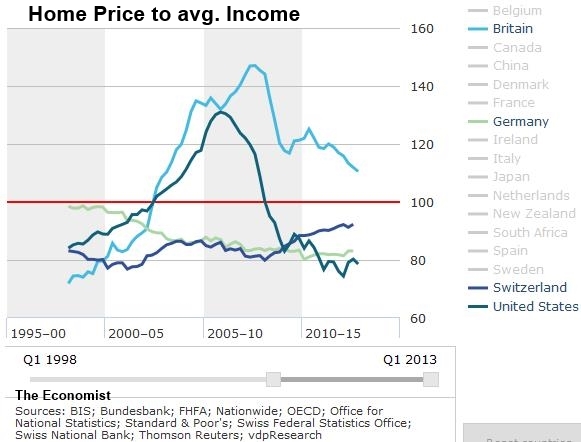

Swiss home price to income ratio small in historic and global comparison

Based on four different data source, we find out that Swiss home price to income ratio is small in global comparison. Therefore we wonder why the SNB must contain home price rises, but the Fed must artificially increase them.

Read More »

Read More »

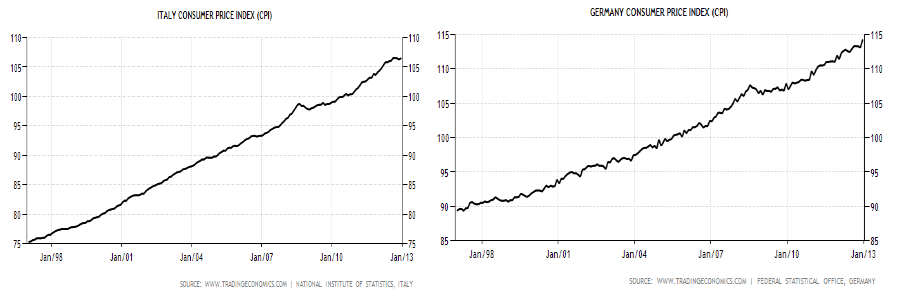

Italian Retail Prices Remain close to Switzerland, Germany Far Cheaper

Disinflation Finally Starting in Italy The Swiss site preisbarometer.ch is run by the Swiss Consumer Association. Their price data shows that a food basket is 46% more expensive when compared between the German “Kaufland” shop and the Swiss “Coop”. Going to France into “Leclerc” gives you an advantage of 38% against Coop. However, for a …

Read More »

Read More »

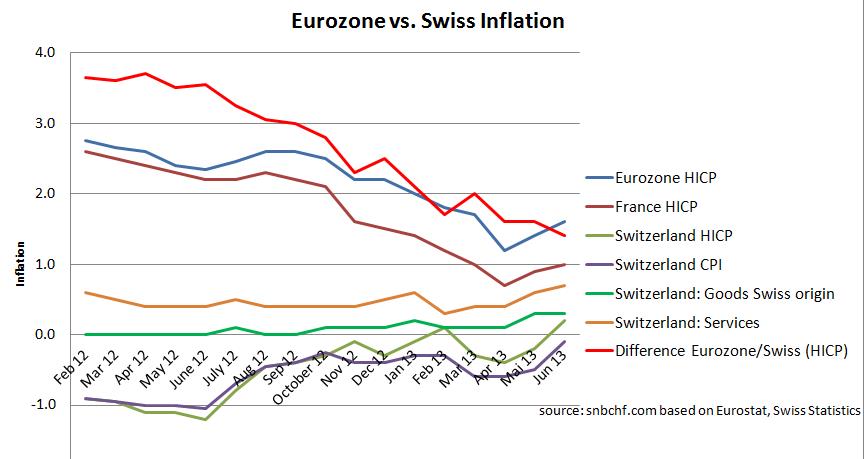

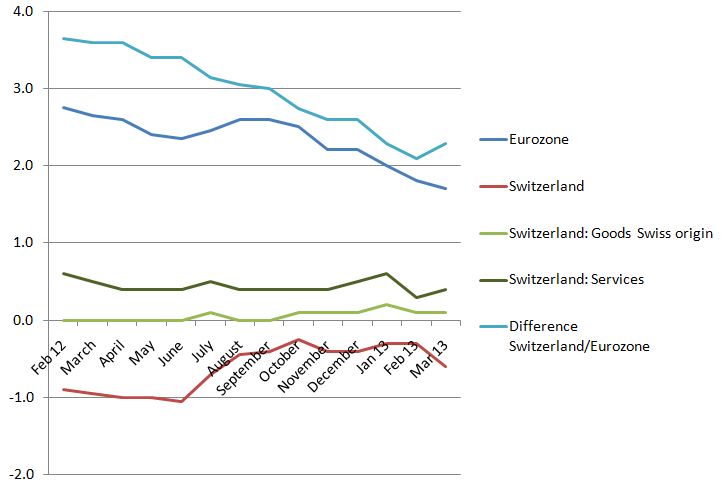

Swiss Inflation Rises, Services Up 0.6 percent YoY, Goods Swiss Origin +0.3 percent, Energy Tames

Cheaper energy prices and long-lasting contracts help against inflation. Swiss inflation increased by 0.1% against April. According to Swiss Statistics, on a year basis, the CPI fell by 0.5%. Major reasons for lower figures were the 6.3% YoY decrease in energy prices, 4.5% YoY lower clothes and footwear price and technological improvements in communication that caused … Continue reading »

Read More »

Read More »

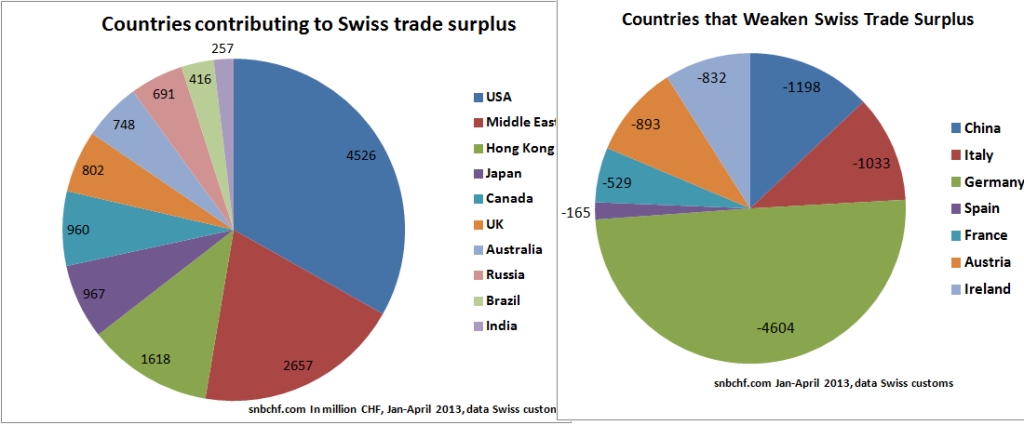

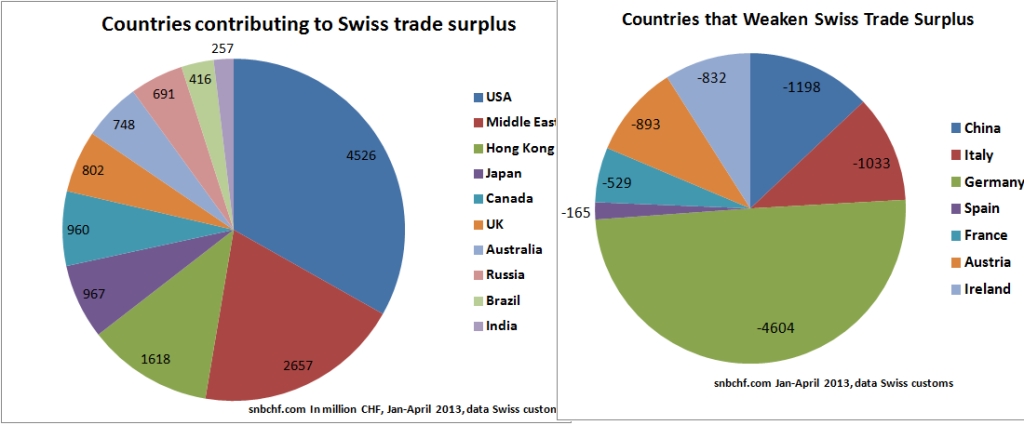

The Swiss Trade Surplus: A Really Global Economy

The Swiss trade balance for goods clearly indicates its global orientation. Switzerland has a trade surplus with the US, Canada, the UK and many emerging markets. Swiss exports are mostly luxury products and pharmaceuticals. The total surplus for the 4 first months in 2013 was 7.7 billion CHF, about 1.2% of GDP, annualized around …

Read More »

Read More »

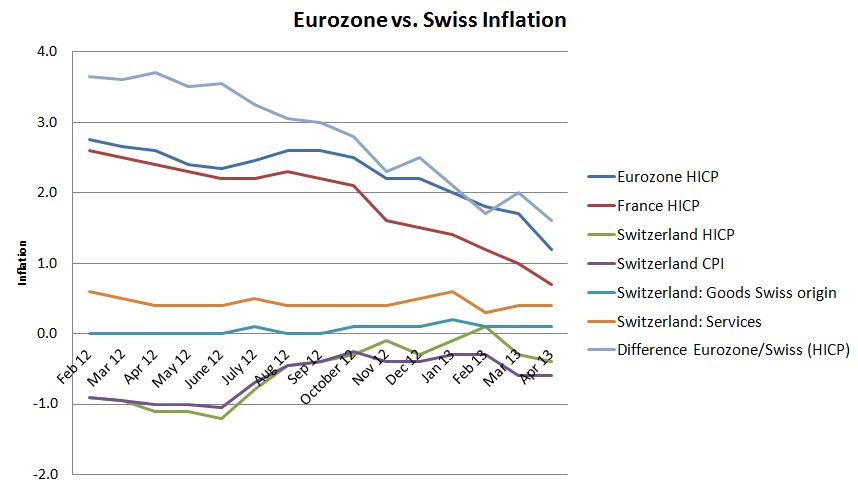

Swiss Inflation Unchanged, HICP Difference Euro Area to Switzerland Down to 1.6 percent

Swiss inflation unchanged in April against March. The inflation difference between the Euro area and Switzerland on a new low. While in early 2012 it was near 4%, if has shrunk now to 1.6%. Details

Read More »

Read More »

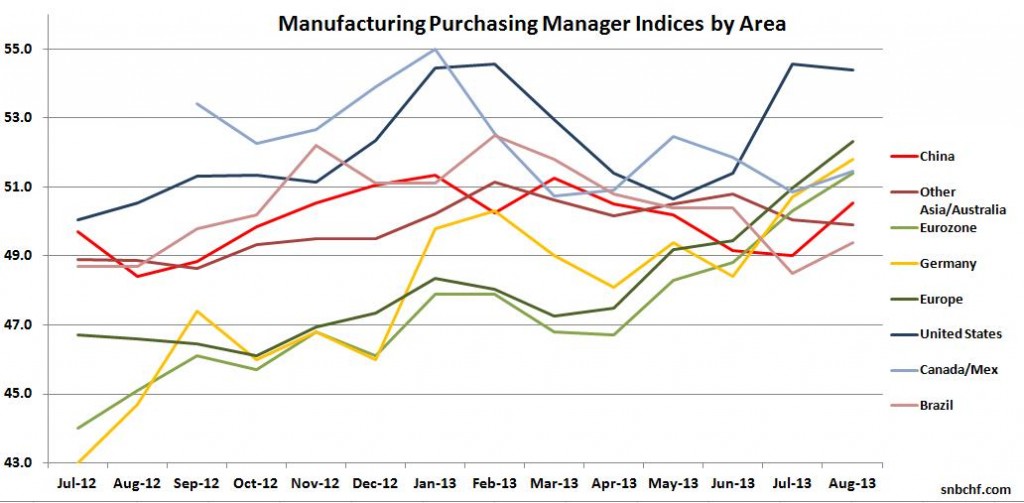

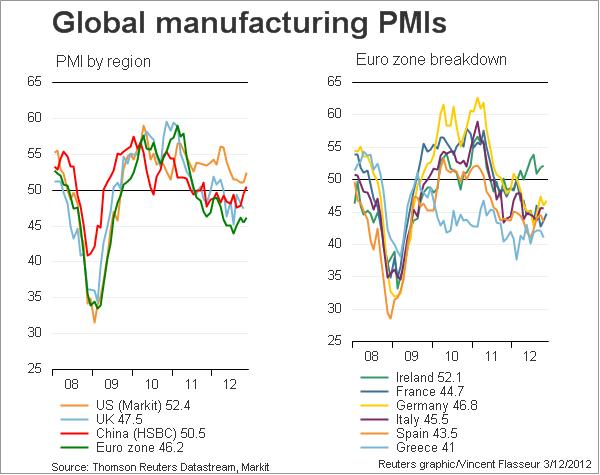

Global Purchasing Manager Indices

Manufacturing Purchasing Manager Indices (PMIs) are considered to be the leading and most important economic indicators. August 2013 Update Emerging markets: Years of strong increases in wages combined with tapering fears have taken its toll: Higher costs and lower investment capital available. EM Companies have issues in coping with developed economies. Some of them …

Read More »

Read More »

March Swiss Inflation Up 0.2 percent MoM, Down -0.6 percent YoY

Swiss inflation edged up 0.2% MoM when seasonal effects on clothes and footware were corrected. On a year basis, the CPI fell by 0.6%. Major reason were the falling energy prices, details

Read More »

Read More »

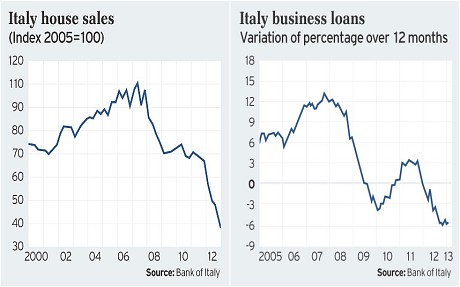

European Wealth Reports: Why “Median” Italians are Far Richer than Germans

We explain why according to the European wealth reports "median" Italians are more wealthy than Germans. The main reasons are high savings and accumulation of wealth for the average family until the 1990s, often invested in homes and real estate. Low ECB interest rates finally let the value of the home rise strongly.

Read More »

Read More »

IMF (2013): Sees Considerable Risks on SNB Balance Sheet

The International Monetary Fund (IMF) judges "that the SNB’s net revenue is subject to large fluctuations, and sizeable losses could occur if an appreciation of the Swiss franc was to take place before foreign exchange interventions were unwound."

Read More »

Read More »