Tag Archive: SPX

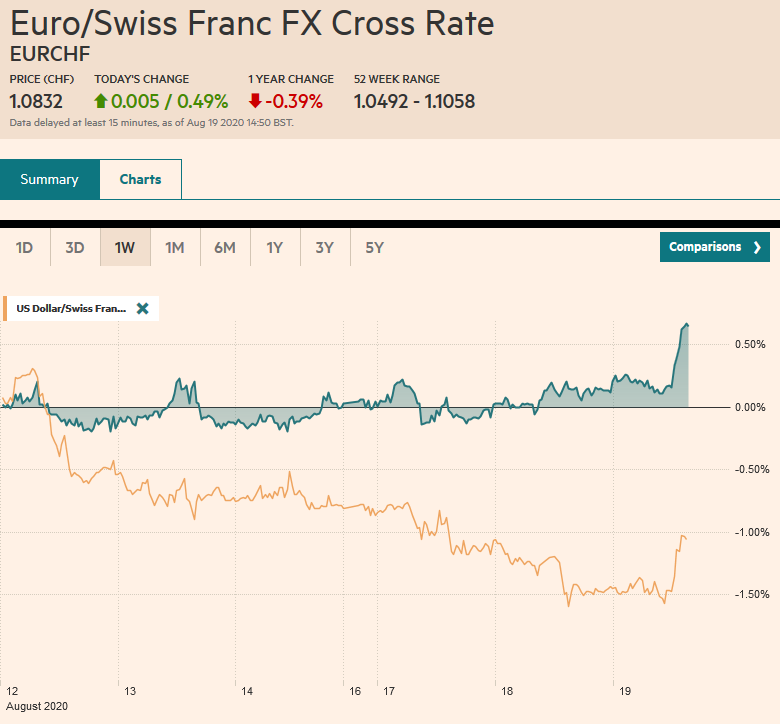

FX Daily, August 19: US Equities Outperform but Does Little for the Heavy Greenback

Overview: The S&P 500 and NASDAQ set new all-time highs yesterday, but the continued outperformance of US equities have failed to lend the dollar much support. It was sold to new lows for the year yesterday against the euro, sterling, the Swedish krona, and the Australian dollar.

Read More »

Read More »

FX Daily, July 20: Markets Yawn, Deal or No Deal

Overview: While there are signs that Europe has reached a compromise on the grant/loan issue, the spillover into the markets is quite limited. China, with Shanghai's 3.1% gain, led a few markets in the Asia Pacific region higher, including Japan and India. Most markets were lower, and Europe's Dow Jones Stoxx 600 is a fractionally firmer, recovering from initial losses.

Read More »

Read More »

Cool Video: TD Ameritrade-Stocks, the Dollar and the Trap Laid by the German Court

Here is a nine-minute clip of a chat I had with Ben Lichtenstein at TD Ameritrade. Ben captures futures traders' energy and breadth of vision. Often in institutional settings, one develops a specialization, but in my experience, futures traders are more likely to look across the markets and asset classes. It is one of the lasting lessons learned early in my career on the floor of the CME.

Read More »

Read More »

New Month, New Trends?

The dollar fell against all the major currencies and most of the emerging market currencies last week. The Dollar Index fell by 1.3%, the biggest loss since the last week of March, and posted its lowest close in nearly three weeks ahead of the weekend. There seemed to be a change in the market after key equity benchmarks, like the MSCI ACWI Index of both emerging and developed markets put in a recovery high in the middle of last week.

Read More »

Read More »

FX Daily, January 29: Escaped from a Crocodile’s Mouth, Entered a Tiger’s Mouth

Overview: This colorful Malay saying captures the spirit of the animal spirits. Narrowly escaping an escalation of a trade war between the world's two largest economies, the outbreak of a deadly virus has spurred moves, especially the sell-off in stocks and rally in bonds, for which many investors seemed ill-prepared. Even though the virus contagion has not peaked, the recovery in US equities yesterday points to a break the fear and anxiety.

Read More »

Read More »

FX Daily, January 7: Geopolitical Angst Eases, Helps Equities and Underpins the Greenback

Overview: Without fresh escalation, investors cannot maintain a heightened sense of geopolitical anxiety. The recovery of US shares yesterday set the tone for today's rebound in Asia and Europe. All the equity markets in the Asia Pacific region rallied today, led by a 1.6% rally in Japan and a nearly 1.4% advance in Australia, with the exception of Taiwan.

Read More »

Read More »

FX Daily, September 25: Risk Appetite Stymied: Dollar Recovers while Stocks Slide

Overview: Global equities and fixed income reacted to the large moves yesterday in the US when the 10-year note yield fell eight basis points, and the S&P 500 fell by 0.85%. Investors have focused on three separate developments and two of which came from President Trump's speech at the UN. He dismissed the likelihood of a short-term trade deal with China and was critical of the large social media platforms.

Read More »

Read More »

FX Daily, August 29: Johnson Faces Legal Challenges and Conte may be Given an Extension

The capital markets are calm today, though there does seem to be some optimism creeping back into the market. The Chinese yuan strengthened, snapping a ten-day slide and Italian bank shares index has risen by more than 1% for the fourth consecutive session.

Read More »

Read More »

FX Daily, August 20: Marking Time Ahead of PMI and Powell

Overview: Global equities and bonds are firmer in quiet turnover, and the dollar is narrowing mixed in narrow ranges. The big events of the week, the eurozone flash PMI and Powell's speech at Jackson Hole still lie ahead. The MSCI Asia Pacific Index rose for the third consecutive session, led by Korea and Australia's 1%+ gains.

Read More »

Read More »

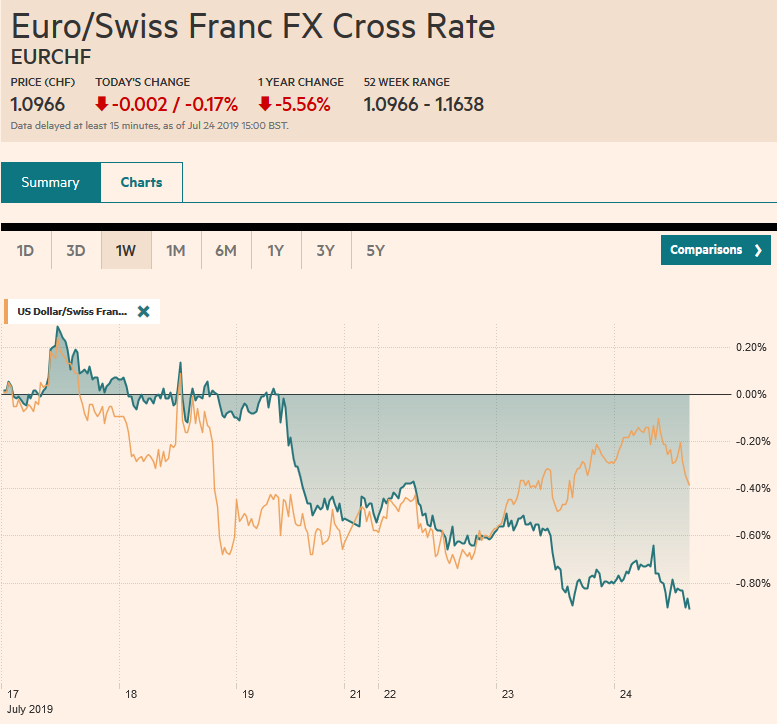

FX Daily, July 24: Poor PMI Weighs on Euro Ahead of ECB

Overview: Disappointing flash PMI pushed an already offered euro lower ahead of tomorrow's ECB meeting. European bonds rallied and equities, amid a rash of earnings, is trying to extend the advance for a fourth consecutive session. Italian and Spanish 10-year benchmark yields are off four-six basis points, while core bond yields are off two-three basis points.

Read More »

Read More »

Cool Video: End of Tariff Truce Spurs Over Correction

The S&P 500 recorded a key reversal on May 1, and the end of the tariff truce ensured follow-through selling. With today's early losses, it is off nearly 3.5% this month. In my brief chat with Stuart Varney at Fox Business, I suggest that the stretched technical condition left the market vulnerable to a "buy in May and go away" scenario.

Read More »

Read More »

FX Daily, May 10: Waiting for the Other Shoe to Drop

Overview: Contrary to hopes and expectations, the US made good on the presidential tweet and raised the tariff on around $200 bln of Chinese goods from 10% to 25%. Trump indicated that the process that will levy a 25% tariff on the remaining Chinese imports has begun. Also contrary to expectations, Chinese officials did not detail their response, though it is expected to be forthcoming.

Read More »

Read More »

FX Daily, March 26: Semblance of Stability Re-Emerging

Overview: The sell-off in equities seemed to peak yesterday, and US indices were narrowly mixed. Traders found comfort in that performance, even though the S&P 500 finished a little below 2800, and took the markets in the Asia-Pacific region higher, except in China, where the Shanghai Composite fell 1.5%.

Read More »

Read More »

FX Daily, March 25: Monday Blues: Equities Pare Quarterly Gains

Overview: Global equities have soured after the US shares dropped the most since very early in the year before the weekend. Asia's sell-off was led by the 3% decline in Nikkei, while Malaysia fared among the best, surrendering 1%. Europe's Dow Jones Stoxx 600 is off for a fourth session. It lost 1.2% at the end of last week and gapped lower today but stabilizing after the better than expected German IFO survey.

Read More »

Read More »

FX Daily, March 14: Another UK Vote, but No Closure

Overview: The Brexit drama continues to play out, and the Withdrawal Bill that has been twice defeated is ironically not dead yet. Today's vote, in fact, is predicated on another "meaningful vote" before seeking an extension. Sterling remains firm near yesterday's highs, which were the best levels since last June.

Read More »

Read More »

FX Daily, March 11: Greenback Starts New Week Decidedly Mixed, with Brexit Anxiety Weighing on Sterling

Overview: Asian shares recovered from opening losses to finish mostly higher, with the Shanghai Composite up nearly 2% and India tacking on 1% after the election was called, starting April 11. European markets, led by energy, communication, and materials sectors, is up about 0.5% through midday. The S&P 500, which closed lower every day last week is looking a little firmer.

Read More »

Read More »

FX Weekly Preview: Brexit Comes to a Head, and while Europe and US Data Rebound, the Equity Rally Falters

Brexit comes to a head. By nearly all reckoning, the Withdrawal Bill will be resoundingly defeated in the House of Commons on March 12. The margin of defeat may not match the first rejection, but it will be the death knell to the path that had been negotiated for a year and a half.

Read More »

Read More »

FX Daily, March 08: Equities Slump on Growth Concerns ahead of US Jobs

Overview: A weak economic assessment in the Beige Book and an ECB that slashed growth forecasts have been followed by news of a nearly 21% slump in China's exports have marked the end of the dramatic equity rally that was seen in the first part of 2019 after the sharp losses late last year.

Read More »

Read More »

FX Daily, March 07: EMU Looks to ECB

The ECB meeting is today's highlight. A dovish signal is expected. The euro remains pinned near its lows ahead it. The global equity market rally in January and February is faltering this week. Asian equities were mixed, but the Nikkei eased for the third consecutive session.

Read More »

Read More »

Gold traders on trial: Only buy physical

2022-07-15

by Stephen Flood

2022-07-15

Read More »