Tag Archive: S&P 500 Index

The Psychological Impact Of Loss

For the third time in four weeks, the market was closed on Monday due to a holiday. Not only is this week shortened by a holiday, it is also coinciding with the annual Billionaire’s convention in Davos, Switzerland and the Presidential inauguration on Friday. Increased volatility over the next couple of days will certainly not be surprising.

Read More »

Read More »

FX Weekly Review, January 09 – 14: Dollar Correction may be Over or Nearly So

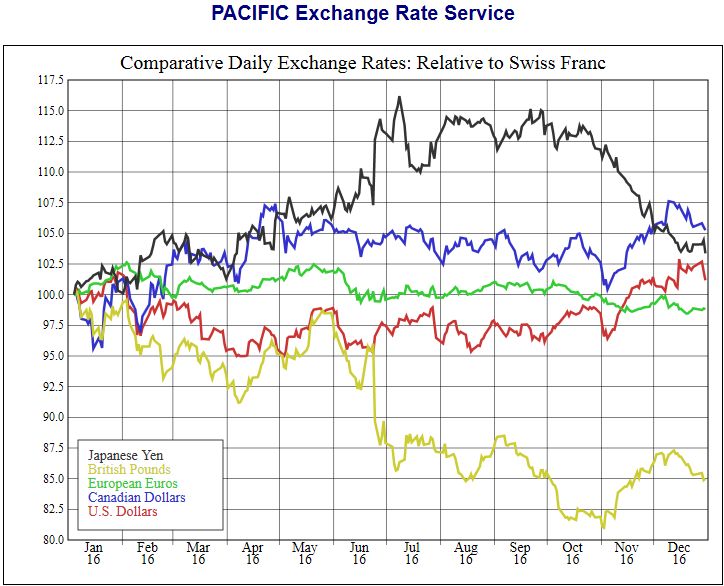

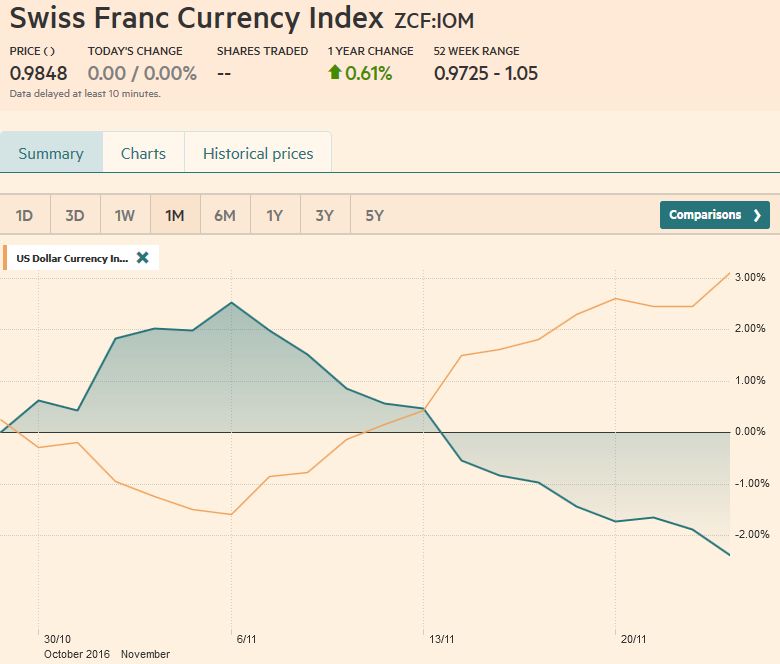

For the first week since the election of Trump, the Swiss Franc index had a clearly better performance than the dollar index. It improved by 1.5% in the last ten days.

Read More »

Read More »

SNB announces 24 bn CHF profit for 2016 thanks to rising stock markets.

The Swiss National Bank has announced 24 bn profits from 2016. Profits came from the dollar, yen and Canadian dollar, while the pound retreated by 15%. The EUR/CHF is only slightly weaker, mostly because the SNB actively supported the euro.

Read More »

Read More »

FX Weekly Review, January 02 – 07: Is the corrective phase of the dollar over?

The lack of full participation and the resulting choppy conditions may have obscured the signal from the capital markets. That signal we think was one of correction since shortly after the Fed's rate hike in id-December. The question now, after the US employment data showed continued labor market strength and that earnings improvement remains intact, is whether the corrective phase is over.

Read More »

Read More »

FX Weekly Review, December 26 – 30: Dollar Correction Poised to Continue

The technical condition of the US dollar, which has been advancing through most of the Q4 16, has been deteriorating This led us to anticipate a consolidative or corrective phase.

Read More »

Read More »

FX Weekly Review, December 19 – December 23: Assessment of the Dollar’s Technical Condition

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »

FX Weekly Review, December 12 – December 16: Fed Lifts Dollar, but Consolidation may be on Tap

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »

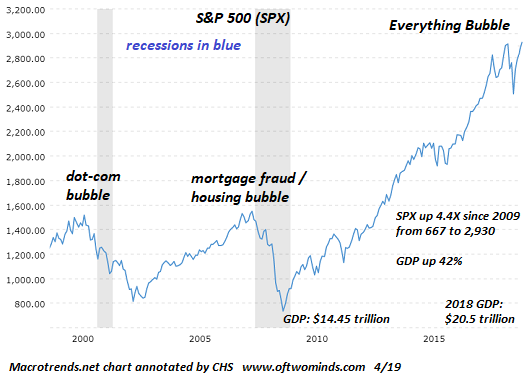

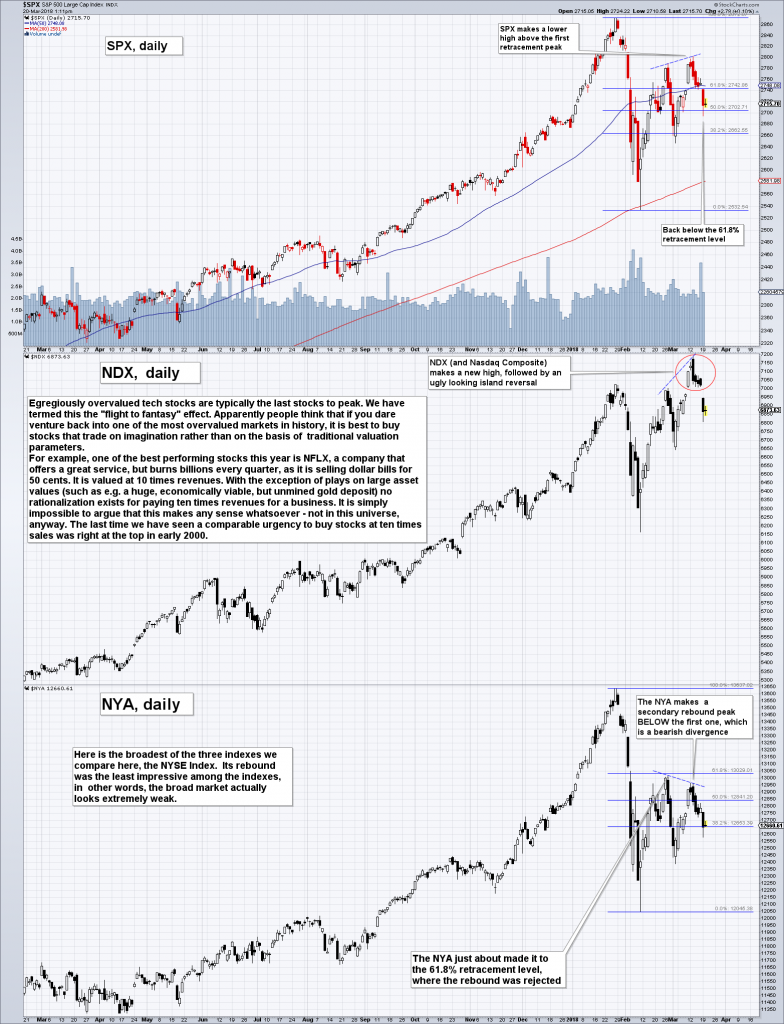

The Exiling of Risk

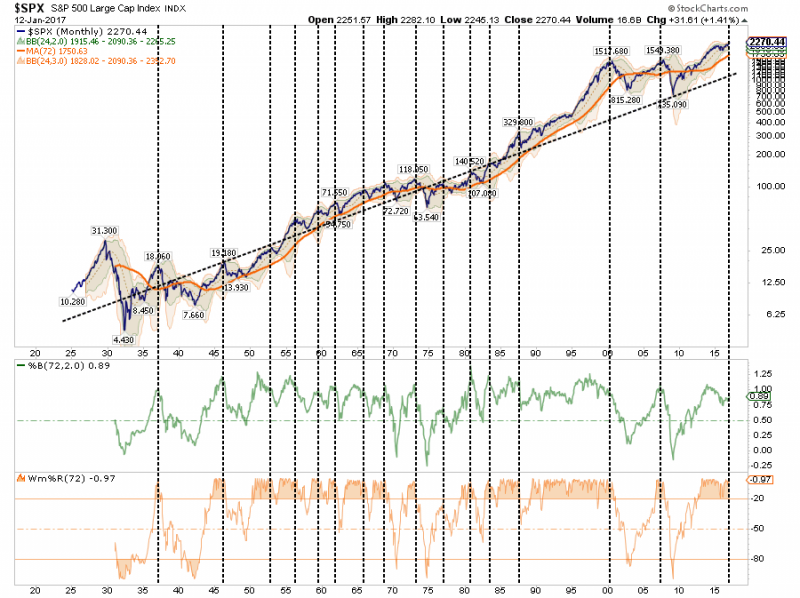

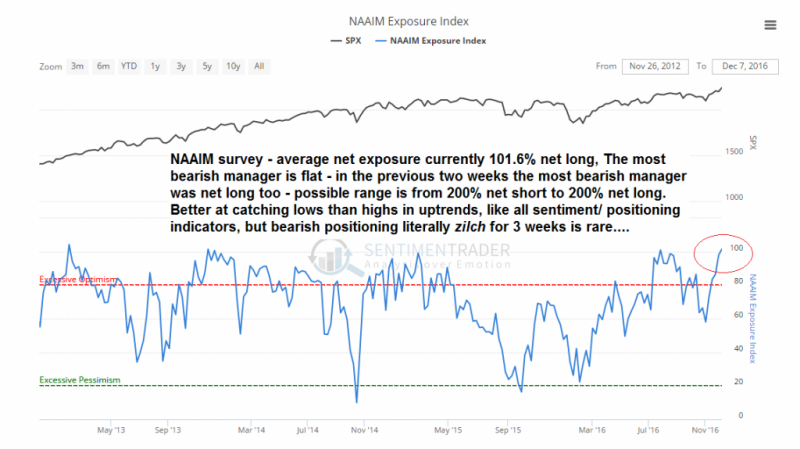

A Quick Chart Overview Below is an overview of charts we picked to illustrate the current market situation. The selection is a bit random, but not entirely so. The first set of charts concerns positioning and sentiment. As one would expect, these look fairly stretched at the moment, but there are always ways in which they could become even more stretched. First a look at the NAAIM exposure index.

Read More »

Read More »

FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

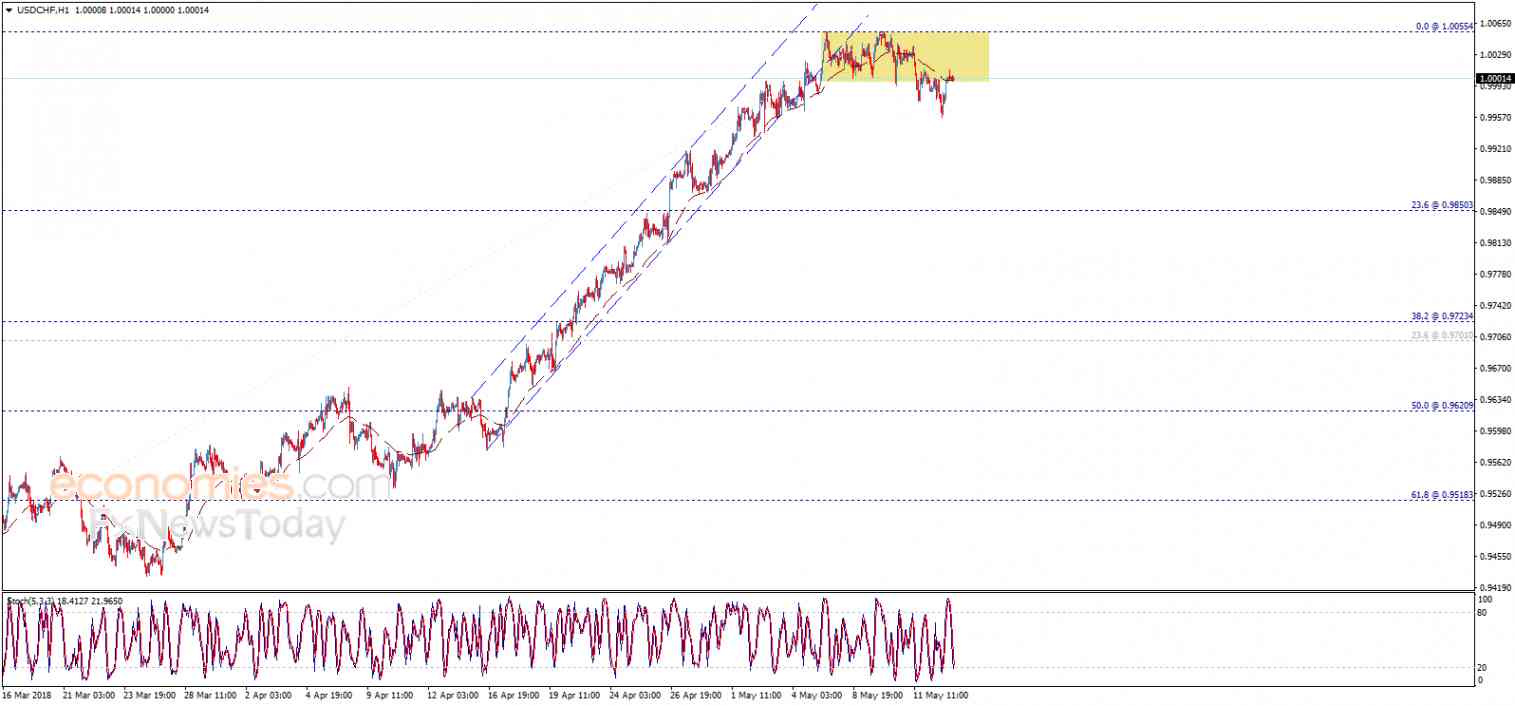

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. USD/CHF The US dollar is finishing the year on a firm note. It rose … Continue reading »

Read More »

Read More »

FX Weekly Review, November 28 – December 02: CHF Index still at its 4% loss since U.S. Elections

The Swiss Franc index continued around its 4% loss since the U.S. elections, while the US Dollar index had a 4% increase. The focus shifts to the ECB meeting, where participants are wary of a "hawkish ease".

Read More »

Read More »

FX Weekly Review, November 21 – November 25: Dollar Strength Losing Steam

After a three-week rally, the dollar bulls finally showed signs of tiring ahead of the weekend. At least against the Swiss Franc index, the dollar index could further advance. We had observed SNB interventions in the previous week that kept the euro mostly above 1.07.

Read More »

Read More »

FX Weekly Review, November 14 – November 18: Best Dollar Weeks since Reagan

The US dollar has recorded its best two-week performance since Reagan was President. The weeks after Trump's election continue to see a weakening of the Swiss Franc, while the dollar index is on a steady rise. Still both the euro and the yen have seen worse performance than the Swiss Franc. The euro is currently under 1.07.

Read More »

Read More »

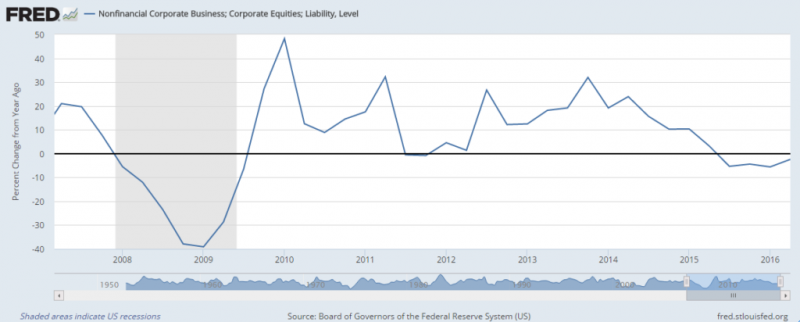

Did President-Elect Trump Just Inadvertently Kill The Golden Goose?

President-Elect Trump may have just unwittingly sowed the seed of an equity market draw-down which will send even more protesters into the streets of America. Donald Trump’s stated economic policies are clearly pro-growth and if he manages to implement his pro-business, anti-regulation agenda, in the longer term they have the potential to surpass the bold and successful initiatives of Ronald Reagan.

Read More »

Read More »

FX Weekly Review, November 07 – November 11: The Trump Reflation Trade

The Swiss Franc Index rose sharply, shortly after the U.S. elections. But then the Trump reflation trade came. Trump may fulfills the wet dreams of many economists. With tax cuts he might extend the U.S. fiscal deficit up to 10% per year. This resulted in:

Gains on U.S. stocks, inflows in U.S. Bonds, inflation hedges gold and Swiss Francs.

Read More »

Read More »

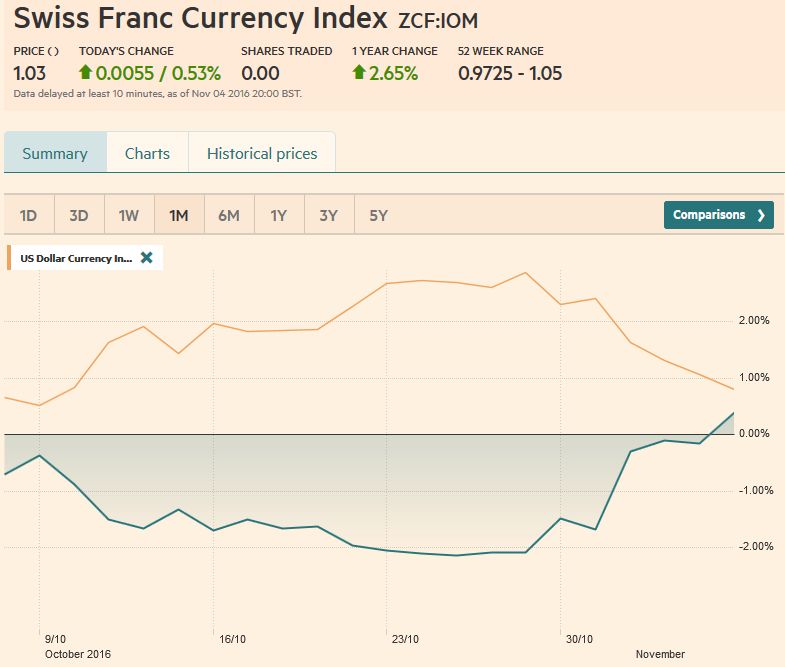

FX Weekly Review, October 31 – November 04: Dollar at Crossroads

Swiss Franc Currency Index As visible in the graph, the Swiss Franc index recovered most of its losses against the US Dollar Index for the last 30 days. In the last 30 days, both the USD currency index and the CHF currency index have had a positive performance.

Read More »

Read More »

FX Weekly Review, October 24-28: October Surprise Pushes Open Door

The Swiss Franc Index could recover some of the losses as compared to the US dollar index. Still the USD/CHF remains above 0.99. The US dollar rose against most of the major currencies last week, but the upside momentum appeared to be dissipating, even before the FBI's announcement about new Clinton emails. There are a few exceptions like the greenback's performance against the Japanese yen, Canadian dollar, and Swedish krona. The dollar made new...

Read More »

Read More »

FX Weekly Review, October 17-21: Golden Cross in Dollar Index and Deadman’s Cross in the Euro

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

FX Weekly Review, October 10-14: Rates Still Key to Dollar’s Outlook

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

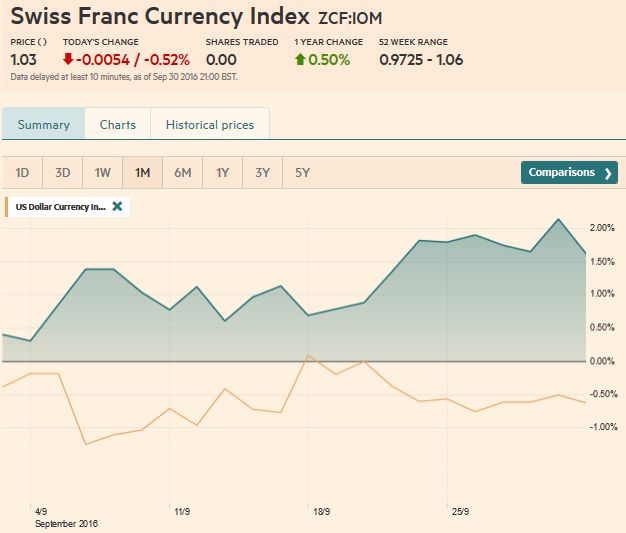

FX Weekly Review, October 03-07: Dollar Profits on Strong ISM Index

The Franc index lost considerably in the last week, in particularly in comparison to the dollar index. Reason was the exceptionally strong U.S. ISM Non-Manufacturing Index.

Read More »

Read More »

The Yen in Three Charts

The dollar is taking out a several month downtrend against the yen. The correlation between the yen and the S&P 500 has broken down. The US 2-year premium over Japan has steadily risen.

Read More »

Read More »