Tag Archive: newslettersent

Spending cuts for asylum seekers proposed

The government wants to cut its financial contributions to asylum seekers as part of efforts to tighten the asylum procedure in Switzerland. The payments for individuals, currently around CHF6,000 ($6,312), could be reduced by a third, according to the Swiss News Agency.

Read More »

Read More »

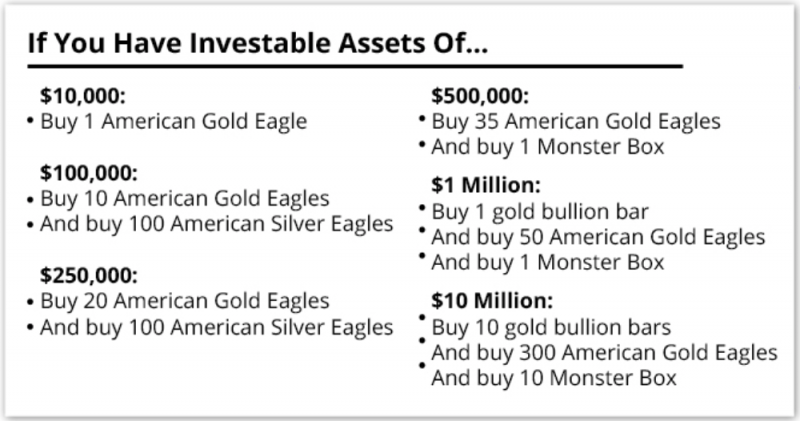

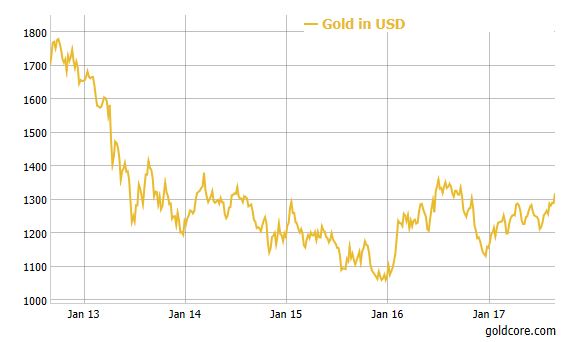

Gold Reset To $10,000/oz Coming “By January 1, 2018” – Rickards

Trump could be planning a radical “reboot” of the U.S. dollar. Currency reboot will see leading nations devalue their currencies against gold. New gold price would be nearly 8 times higher at $10,000/o. Price based on mass exit of foreign governments and investors from the US Dollar. US total debt now over $80 Trillion – $20T national debt and $60T consumer debt. Monetary reboot or currency devaluation seen frequently – even modern history. Buy...

Read More »

Read More »

Cool Video: Bloomberg Discussion of Opioid Epidemic and US Labor

I had the distinct of honor of being on Bloomberg television today with David Gura and Francine Lacqua. Dino Kos, formerly of the NY Fed and now at CLS, joined this segment as well. The broad topic was the Jackson Hole Symposium, and the challenge is fostering more dynamic growth.

Read More »

Read More »

Emerging Markets: What has Changed

India Prime Minister Modi has started a cabinet shuffle. Freeport McMorAn ceded control of the world’s second largest copper mine to the Indonesian government. Central Bank of Russia took over Bank Otkritie, once Russia’s largest private bank. Kenya’s top court nullified last month’s presidential election. Fitch cut Qatar’s rating by one notch to AA- with negative outlook.

Read More »

Read More »

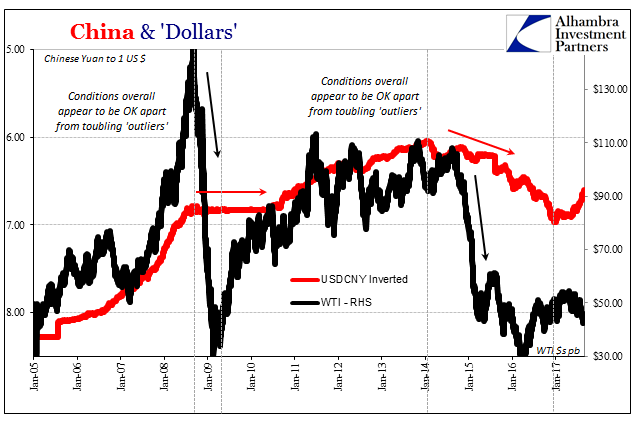

Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is coincidence. Three times is an enemy...

Read More »

Read More »

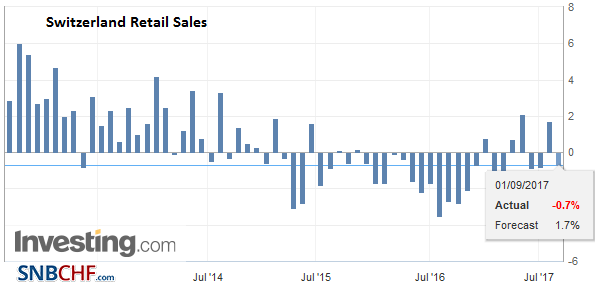

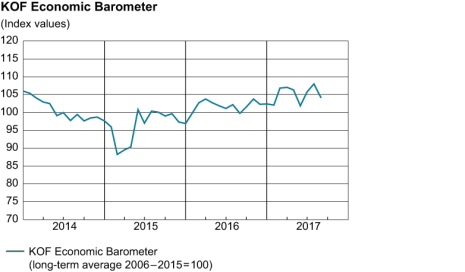

Swiss Retail Sales, July 2017: -0.8 percent Nominal and -1.1 percent Real

Turnover in the retail sector fell by 0.8% in nominal terms in July 2017 compared with the previous year. Seasonally adjusted, nominal turnover fell by 1.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, September 01: Manufacturing PMIs, US Jobs, and Implications of Harvey

As the markets head into the weekend, global equities are firmer, benchmark 10-year yields are mostly lower, and the dollar is consolidating after North American pared the greenback's gains yesterday. Manufacturing PMIs from China, EMU, and the UK have been reported, while in the US, the August jobs data stand in the way of the long holiday weekend for Americans.

Read More »

Read More »

Gold Surges 2.6 percent After Jackson Hole and N. Korean Missile

Gold surges as N. Korea fires ballistic missile over Japan. Safe haven buying sees gold break out to 10-month high after Jackson Hole and rising North Korea risk of attack on Guam. South Korea’s air force dropped eight MK 84 bombs near Seoul; simulating the destruction of North Korea’s leadership.

Read More »

Read More »

Cabinet Called on to Join EU’s no-roaming Charges Deal

The cantonal government of Graubünden has demanded that the cabinet sign Switzerland up to European Union rules abolishing roaming charges. Without such an agreement, the Swiss tourist industry is at a disadvantage, the Graubünden government said in a letter sent last week to Swiss president, Doris Leuthard, according to the Swiss News Agency.

Read More »

Read More »

Bank lobby group sees hope for shrinking Swiss sector

The Swiss banking sector shrank once again last year in terms of banks, profits, share of offshore wealth under management and number of employees. The Swiss Bankers Association (SBA) nevertheless believes there are positives to be found amidst the bleak figures.

Read More »

Read More »

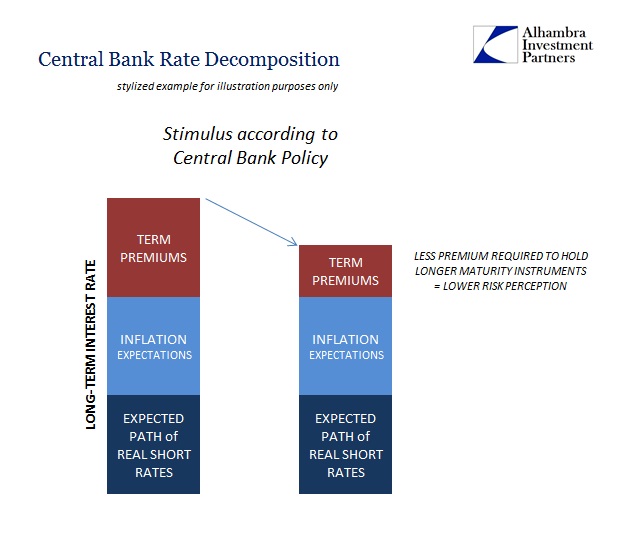

Deja Vu

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that much longer (more return to...

Read More »

Read More »

FX Daily, August 31: US Core PCE Deflator may Challenge the Greenback’s Firmer Tone

The US dollar recovery was marginally extendedin Asia, and while it remains firm, it is lost some of its momentum. The Fed's target inflation measure, the core PCE deflator, may decline from 1.5% to 1.4%, according to the median forecast in the Bloomberg survey. That would be the lowest read since the end of 2015 and likely spur more speculation against another Fed hike before the end of the year.

Read More »

Read More »

Swiss Agency Reports Major Breach of Online Credentials

Around 21,000 passwords and personal details used to access online services have been stolen and could be used illegally, Switzerland’s cybercrime monitoring centre has reported. The Reporting and Analysis Centre for Information Assurance (MELANI) said on Tuesday that a confidential source had sent copies of the stolen data to the cybercrime centre.

Read More »

Read More »

Petition calls for faster, stricter diesel standards in Switzerland

Swiss citizens are calling on their government to more quickly require stricter anti-pollution tests for diesel cars. Some 7,200 people submitted a petition to the Federal Chancellery on Tuesday.

The petition, also supported by various environmental and consumer lobby groups, asks Swiss Transport Minister Doris Leuthard to ensure that new diesel cars only be allowed on the road if they “strictly conform” to the Euro-6d-TEMP emissions standard. In...

Read More »

Read More »

Diversify Into Gold On U.S. “Political Instability” Advise Blackrock

Gold set to shine as Washington stumbles. “Bet on gold’s diversifying properties rather than political stability”. World’s largest asset manager believes Trump and political drama in the U.S. means gold likely to rise. Real rates flattening out and rising political instability – Blackrock’s Koesterich. “For now my bias would be to stick with gold” – Blackrock. U.S. debt ceiling issue to be fractious as bankrupt U.S. hits $20 trillion debt....

Read More »

Read More »

Currency Risk That Isn’t About Exchange Values (Eurodollar University)

This week the Bureau of Economic Analysis will release updated estimates for Q2 GDP as well as Personal Consumption Expenditures (PCE) and Personal Incomes for July. Accompanying those latter two accounts is the currently preferred inflation standard for the US economy. The PCE Deflator finally hit 2% and in two consecutive months, after revisions, earlier this year.

Read More »

Read More »

Les réserves de la BNS au service des investisseurs étrangers

M Cedric Tille, professeur d’Economie (Cédric tille bns) vient de publier une étude fort intéressante qui gagne à être découverte. Elle cartographie la position économique de la Suisse par rapport au reste du monde.Il démontre à quel point la structure qui compose le moteur économique, financier et monétaire de la Suisse dans ses relations avec l’étranger avait changé en dix ans.

Read More »

Read More »

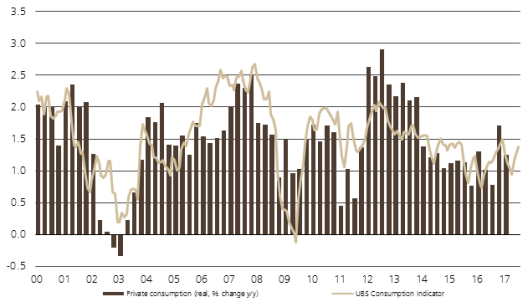

Switzerland UBS Consumption Indicator July: Weaker Swiss Franc Offers a Ray of Hope

UBS consumption indicator printed 1.38 in June, pointing to subdued growth in Swiss private consumption in recent months. Relatively weak growth in employment was much to blame for the lackluster number, however this was offset somewhat by robust new car registrations data and overnight hotel stays by Swiss nationals.

Read More »

Read More »