Tag Archive: newslettersent

Brief Thoughts on the Euro

Euro peaked a month ago. The reversal before the weekend marks the end of the leg lower. ECB meeting is next big focus. ECB may focus on gross rather than net purchases.

Read More »

Read More »

Emerging Markets: What has Changed

Thailand announced general elections will be held in November 2018. Czech police filed criminal charges against ANO leader Andrej Babis. South Africa President Zuma may face corruption charges that were previously dropped. The US suspended visa services for travelers from Turkey. Kenyan opposition candidate Odinga withdrew from a redo of the annulled presidential election. Saudi Arabia will take a more gradual approach to removing fuel subsidies....

Read More »

Read More »

Swiss Flush $3 Million In Gold And Silver Down The Drain Every Year

When it comes to flushing valuables down the toilet, the Swiss are hardly "Austrians", and appear to be equity-opportunity dumpers, whether it is fiat or hard money. Last month we reported that Switzerland was gripped in a mystery, after it was discovered that someone tried to flush $120,000 in €500 bills down the toilet in a bathroom close to a UBS bank vault as well as three nearby restaurants, which in turn clogged the local toilets requiring...

Read More »

Read More »

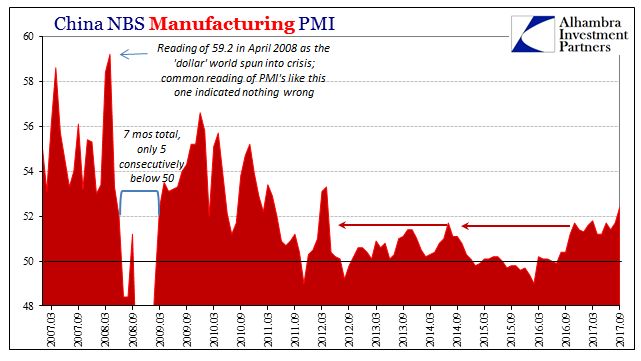

Noisy PMI’s In China

In the US our economic data for a few months at least will be on shaky ground due to the lingering economic impacts of severe hurricanes. In China, the potential for irregularity is perhaps as great, though it has nothing to do with the weather. In a little over a week, Communist Party officials will gather for their 19th Party Congress.

Read More »

Read More »

Le déclin de la valeur travail

Le travail: toujours une valeur? Et a-t-il encore de la valeur? Le commerce et, d’une manière générale, les échanges transfrontaliers entre nations, ont considérablement amélioré nos conditions de vie. Mais, en fait, que ferait-on sans commerce ? En d’autres termes, s’il fallait tout réaliser soi-même sans faire appel à d’autres corps de métier, à d’autres entreprises et à d’autres nations dont la spécialité n’est guère disponible dans notre pays...

Read More »

Read More »

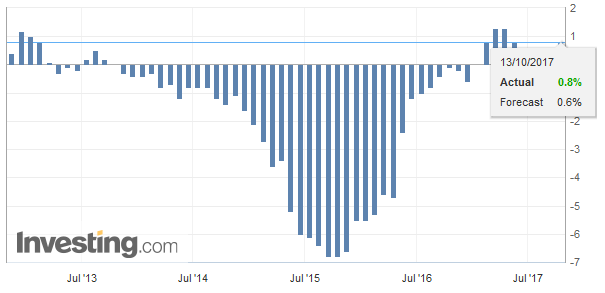

Swiss Producer and Import Price Index in September 2017: +0.8 YoY, +0.5 MoM

The Producer and Import Price Index rose in September 2017 by 0.5% compared with the previous month, reaching 100.5 points (base December 2015 = 100). The rise is due in particular to higher prices for petroleum products, basic metals, semi-finished products of metal, and scrap. Compared with September 2016, the price level of the whole range of domestic and imported products rose by 0.8%.

Read More »

Read More »

FX Daily, October 13: Sterling Extends Yesterday’s Recovery; US Data Awaited

The EU's leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The willingness to discuss a two-year transition period spurred sterling's recovery. After trading on both sides of Wednesdays, it closed on its highs was a bullish technical signal and there has been follow-through buying...

Read More »

Read More »

Dollar Dropped like Hot Potato After Core CPI Disappointed

The dollar was bid before the US economic data. The market responded quickly upon seeing the disappointing 0.1% rise in core CPI. Given the base effect, the 0.1% increase kept the year-over-year rate at 1.7% for the fourth consecutive month. The dollar reversed lower.

Read More »

Read More »

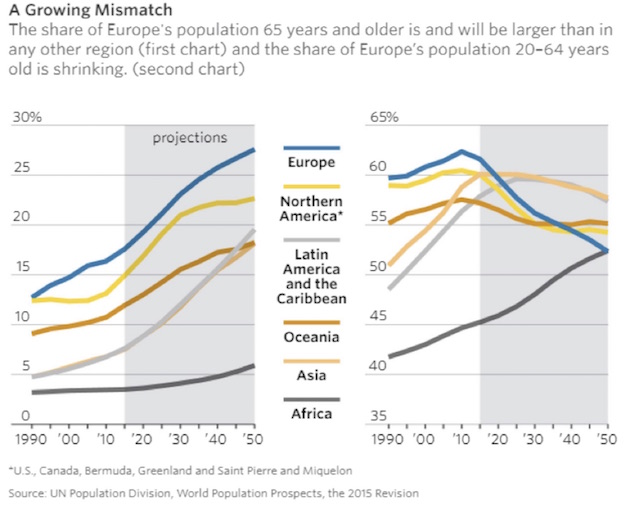

“This May Be The End Of Europe As We Know It”: The Pension Storm Is Coming

I’ve written a lot about US public pension funds lately. Many of them are underfunded and will never be able to pay workers the promised benefits - at least without dumping a huge and unwelcome bill on taxpayers. And since taxpayers are generally voters, it’s not at all clear they will pay that bill. Readers outside the US might have felt safe reading those stories. There go those Americans again… However, if you live outside the US, your country...

Read More »

Read More »

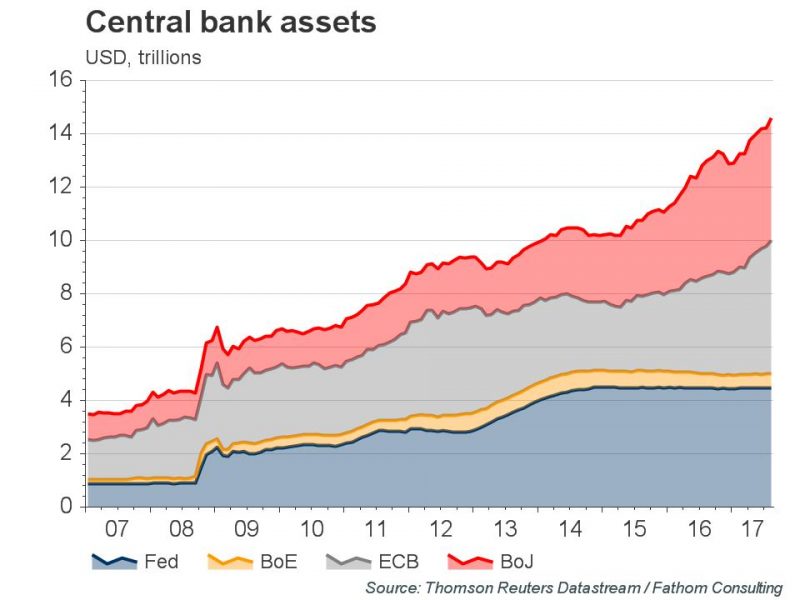

Global Outlook – Mad, Mad, Mad, MAD World: News in Charts

Global Outlook – Mad, Mad, Mad, MAD World: News in Charts by Fathom Consulting via Thomson Reuters. Alarm bells are ringing for economic fundamentalists such as Fathom Consulting. Asset prices look increasingly out of step with fundamentals, and in some cases they look downright bubbly. And other geopolitical developments are similarly alarming. One might even describe them as…

Read More »

Read More »

The Payroll Report To Focus On Is August’s, Not September’s

The hurricanes didn’t disappoint, causing major damage at least to the BLS. Precisely how much the statistics were affected by the disruptions in Texas and Florida really can’t be calculated, not that everyone won’t try. It makes this month’s payroll report a Rorschach test of sorts. You can pretty much make it out to be whatever you want.

Read More »

Read More »

FX Daily, October 12: Discipline Argues Against Consensus Narrative

Following the release of the FOMC minutes from last month's meeting, the consensus narrative that has emerged says that it was dovish because there is a growing worry the reason inflation fell is not simply due to transitory factors. This explains, according to the narrative the dollar's losses and the stock market rally.

Read More »

Read More »

The new 10 Swiss franc note hand mystery

The third in a series of gorgeous new Swiss franc bank notes will be released by the Swiss National Bank (SNB) on October 18th. The 10-franc note keeps its yellow colour, but most everything else in the design and construction is different. What’s most remarkable about the new bank note? Not the 40 centimes or so it takes to make each note, nor that each note is projected to last only about a year. Not the sophisticated security measures, including...

Read More »

Read More »

Young Guns of Gold Podcast – ‘The Everything Bubble’

Young Guns of Gold Podcast – ‘The Everything Bubble’. Precious Metal Roundtable discuss gold in 2017 and outlook. Gold +9.1% year to date; Performing well given Fed raising rates, lack of volatility and surge in stock markets. “People are expecting too much from gold”. Economy: Inflation indicators, recession on the horizon, global debt issues. Global demand: ETF inflows, Russia central bank purchases, Germany investment figures and international...

Read More »

Read More »

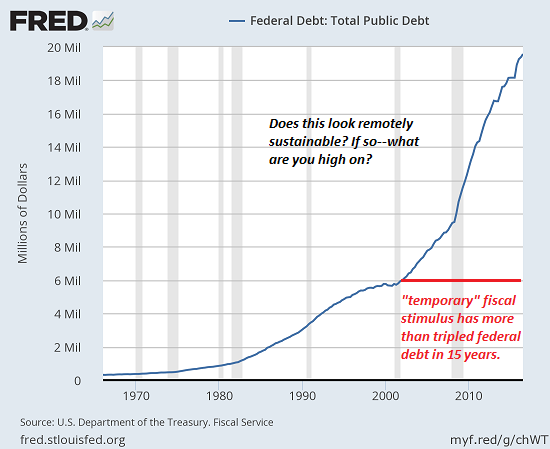

The Consent of the Conned

Every single line item in our entire Bernie Madoff scam of a system is cooked. My theme this week is The Great Unraveling, by which I mean the unraveling of our social-political-economic system of hierarchical, centralized power. Let's start by looking at how the basis of governance has transmogrified from consent of the governed to consent of the conned.

Read More »

Read More »

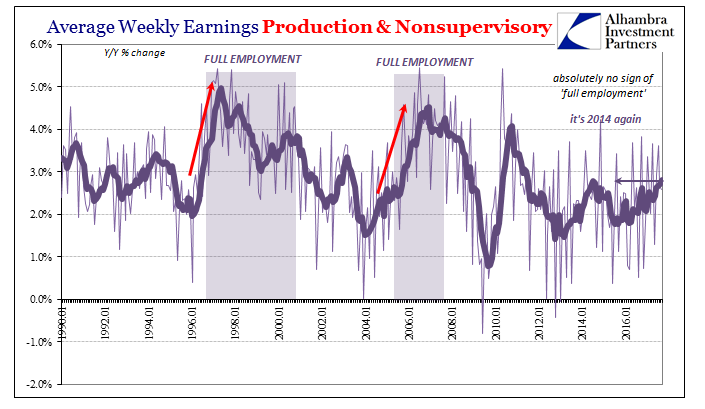

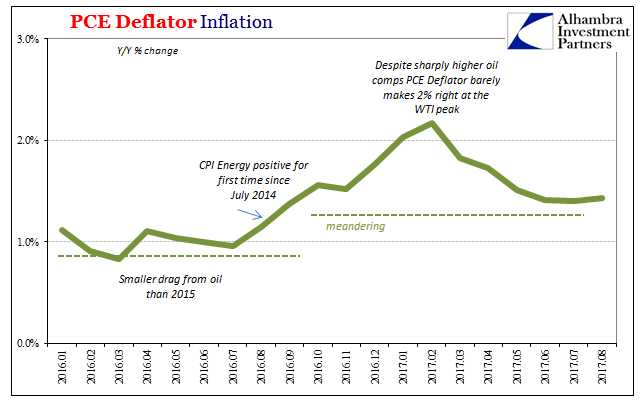

Non-Transitory Meandering

Monetary officials continue to maintain that inflation will eventually meet their 2% target on a sustained basis. They have no other choice, really, because in a monetary regime of rational expectations for it not to happen would require a radical overhaul of several core theories. Outside of just the two months earlier this year, the PCE Deflator has missed in 62 of the past 64 months. The FOMC is simply running out of time and excuses.

Read More »

Read More »

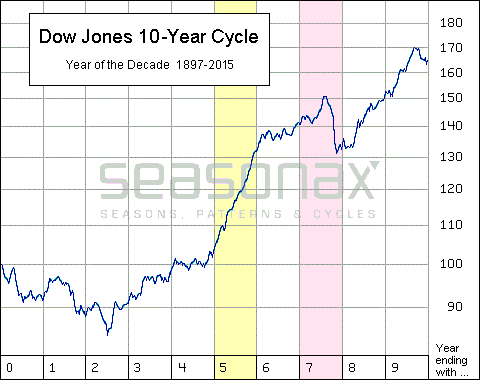

1987, 1997, 2007… Just How Crash-Prone are Years Ending in 7?

Bad Reputation. Years ending in 7, such as the current year 2017, have a bad reputation among stock market participants. Large price declines tend to occur quite frequently in these years. Just think of 1987, the year in which the largest one-day decline in the US stock market in history took place: the Dow Jones Industrial Average plunged by 22.61 percent in a single trading day. Or recall the year 2007, which marked the beginning of the GFC...

Read More »

Read More »

Swiss National Bank Releases New 10-franc note

The Swiss National Bank (SNB) will begin issuing the new 10-franc note on 18 October 2017. Following the 50-franc and 20-franc notes, it is the third of six denominations in the new banknote series to be released. The current eighth-series banknotes will remain legal tender until further notice.

Read More »

Read More »

FX Daily, October 11: Markets Looking for a New Focus

The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday's ranges against the major currencies, the euro has made a marginal new high, briefly trading through the $1.1830 area noted yesterday.

Read More »

Read More »

3 million francs of gold and silver found in Swiss sewers

Call it “dirty money” if you wish, because there’s about CHF 3 million in gold and silver found each year in Swiss sewage. But no one is going to get rich, according to a just-published report by the Swiss Federal Institute of Aquatic Science and Technology (Eawag). Recovering the estimated CHF 1.5 million in gold, and the same in silver, that passes through Swiss wastewater each year, wouldn’t be cost-effective, says the report. On the bright...

Read More »

Read More »