Tag Archive: newslettersent

Central Bank Chiefs and Currencies

Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election.

Read More »

Read More »

Brexit UK Vulnerable As Gold Bar Exports Distort UK Trade Figures

Brexit UK vulnerable as gold bar exports distort UK trade figures. Britain’s gold exports worth more than any other physical export. Gold accounted for more than one in ten pounds of UK exports in July 2017. UK’s stock of wealth has collapsed from a surplus of £469bn to a net deficit of £22bn – ONS error. Brexiteers argue majority of trade is outside EU, this is due to large London gold exports. Single gold bar (London Good Delivery) is, at today’s...

Read More »

Read More »

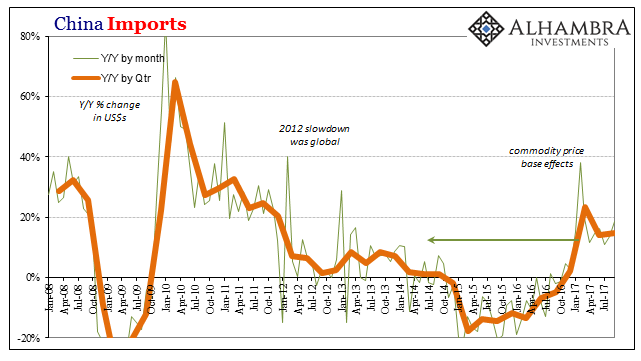

China Exports/Imports: Enforcing A Global Speed Limit

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month.

Read More »

Read More »

The Fading Scent of the American Dream

The theme this week is The Rot Within. It's been 10 years since I devoted a week to the theme of The Rot Within (September 17, 2007). Back in 2007, I listed 16 systemic sources of rot in our society, politics and economy; none have been fixed. Instead, the gaping holes have been filled with Play-Do and hastily painted to create the illusion of shiny solidity.

Read More »

Read More »

NAFTA Worries Take Toll, Yellen’s Best Guess Supports Greenback

Risk that NAFTA collapses weighs on CAD and MXN. Yen is slightly firmer despite US yields edging higher and weekend polls suggesting LDP could nearly secure a 2/3 majority of its own. The sterling is consolidating after sharp moves at the end of last week.

Read More »

Read More »

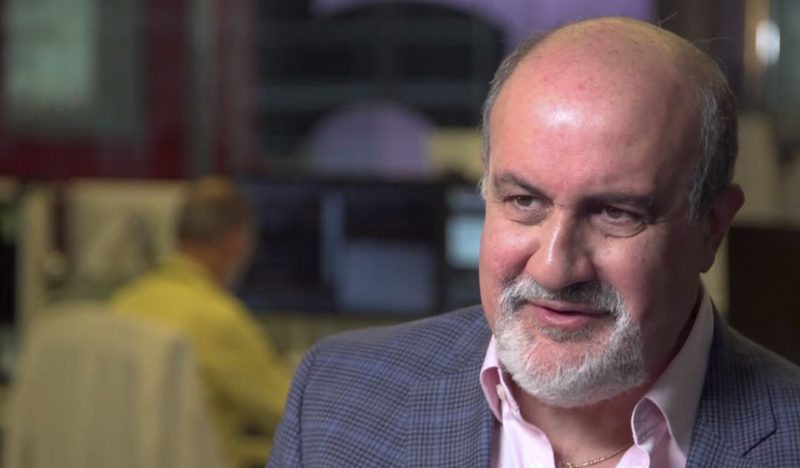

Taleb Explains How He Made Millions On Black Monday As Others Crashed

Former trader and author of best-selling book “The Black Swan” sat down for an interview with Bloomberg News to mark the upcoming thirtieth anniversary of the stock-market crash that occurred on Oct. 19, 1987 – otherwise known as Black Monday.

Read More »

Read More »

Credit Suisse targeted for break-up by activist hedge fund

A Swiss hedge fund is poised to launch an activist campaign to break up Credit Suisse, tapping into investor impatience with the progress of the bank’s turnround under chief executive Tidjane Thiam. RBR Capital Advisors, supported by Gaël de Boissard, a former Credit Suisse investment bank co-head, is set to unveil the plan later this week at the JPMorgan Robin Hood investor conference in New York, according to people briefed on it.

Read More »

Read More »

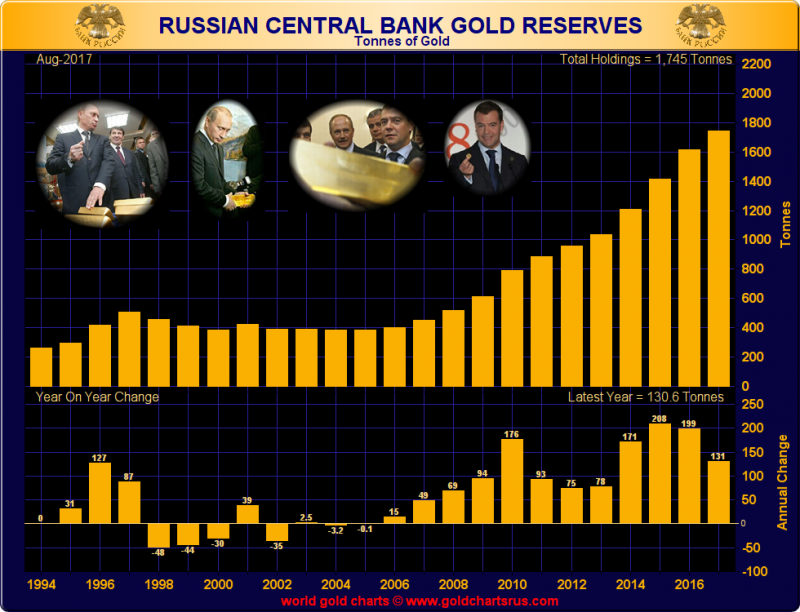

Neck and Neck: Russian and Chinese Official Gold Reserves

Official gold reserve updates from the Russian and Chinese central banks are probably one of the more closely watched metrics in the gold world. After the US, Germany, Italy and France, the sovereign gold holdings of China and Russia are the world’s 5th and 6th largest. And with the gold reserves ‘official figures’ of the US, Germany, Italy and France being essentially static, the only numbers worth watching are those of China and Russia.

Read More »

Read More »

About Those “Hedonic Adjustments” to Inflation: Ignoring the Systemic Decline in Quality, Utility, Durability and Service

The quality, durability, utility and enjoyment-of-use of our products and services has been plummeting for years. One of the more mysterious aspects of the official inflation rate is the hedonic quality adjustments that the Bureau of Labor Statistics makes to the components of the Consumer Price Index (CPI). The basic idea is that when innovations improve the utility (and pleasure derived from) a product, the price is adjusted to reflect this...

Read More »

Read More »

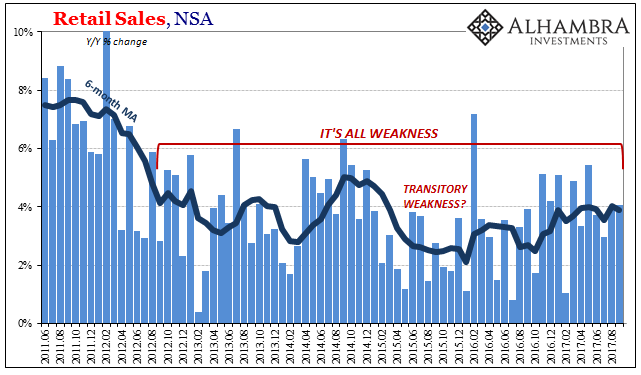

US Retail Sales: Retail Storms

Retail sales were added in September 2017 due to the hurricanes in Texas and Florida (and the other states less directly impacted). On a monthly, seasonally-adjusted basis, retail sales were up a sharp 1.7% from August. The vast majority of the gain, however, was in the shock jump in gasoline prices. Retail sales at gasoline stations rose nearly 6% month-over-month, so excluding those sales retail sales elsewhere gained a far more modest 0.6%.

Read More »

Read More »

FX Weekly Preview: The Markets and the Long Shadow of Politics

Rise in paper asset prices, including so-called cyber currencies, reflects the abundance of capital. Have we forgotten what Minski taught again? Political considerations may dominate ahead of the ECB meeting later this month.

Read More »

Read More »

Bern’s SkyWork could be grounded at end of month

SkyWork Airlines, which flies to various European destinations from Bern Airport, may be forced to cease operations by the end of October due to its unstable financial situation. The Federal Office of Civil Aviation (FOCA) has limited SkyWork’s operating permit to the end of this month because the company is unable to meet its financial commitments for its 2017 and 2018 winter schedule.

Read More »

Read More »

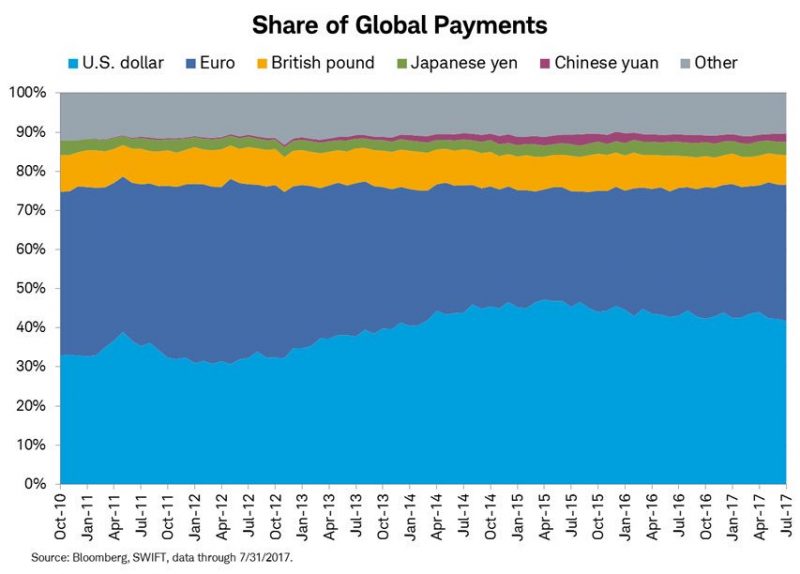

The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece was released ‘the story’ was...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed the week on a firm note, as softer than expected US CPI data weighed on the dollar. We continue to believe that investors are underestimating the Fed’s tightening potential. Meanwhile, idiosyncratic political risk remains high for MXN, TRY, and ZAR.

Read More »

Read More »

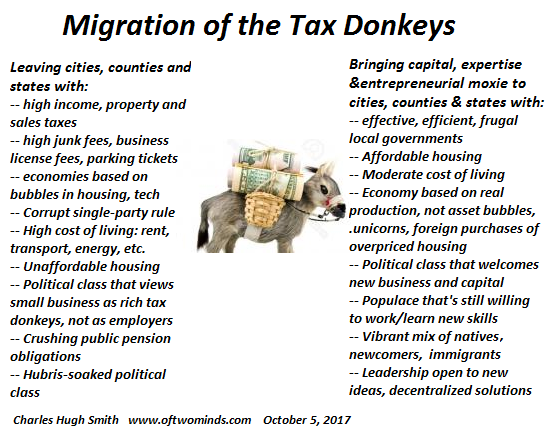

Migration of the Tax Donkeys

Dear local leadership: here's the formula for long-term success. A Great Migration of the Tax Donkeys is underway, still very much under the radar of the mainstream media and conventional economists. If you are confident no such migration of those who pay the bulk of the taxes could ever occur, please consider the long-term ramifications of these two articles.

Read More »

Read More »

Political Focus Shifting in Europe

There was a huge sigh of relief among investors when it became clear that the populist-nationalist wave that ostensibly led to Brexit and Trump's election was not going to sweep through Europe. The euro gapped higher on April 24, and it has not looked back. We have suggested that with the outcome of the German election, European politics shift from tailwind to headwind.

Read More »

Read More »

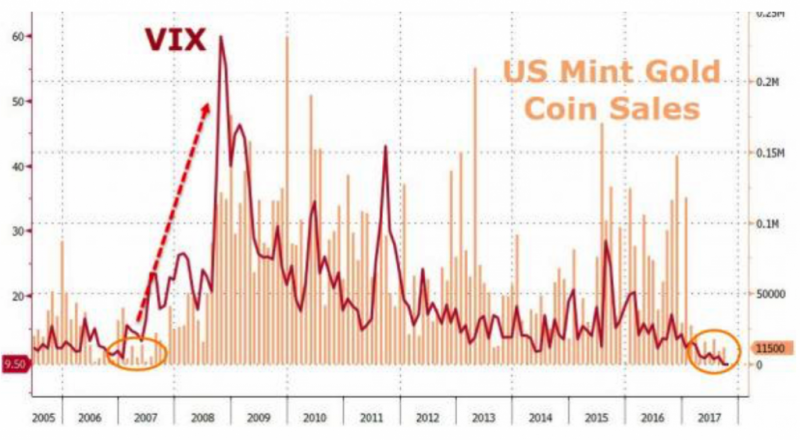

U.S. Mint Gold Coin Sales and VIX Point To Increased Market Volatility and Higher Gold

US Mint gold coin sales and VIX at weakest in a decade. Very low gold coin sales and VIX signal volatility coming. Gold rises 1.7% this week after China’s Golden Week; pattern of higher prices after Golden Week. U.S. Mint sales do not provide the full picture of robust global gold demand. Perth Mint gold sales double in September reflecting increased gold demand in both Asia and Europe. Middle East demand likely high given geopolitical risks. Iran...

Read More »

Read More »

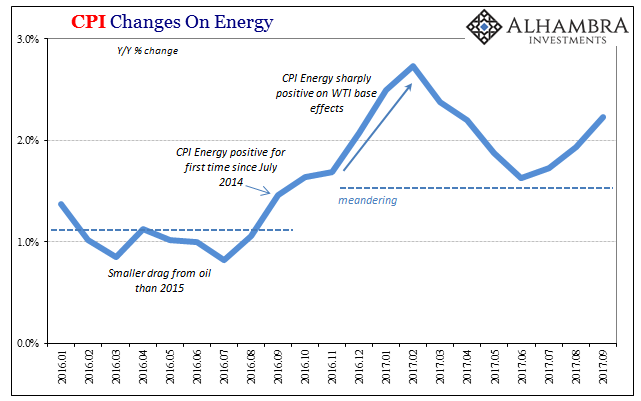

US CPI: Inflation Still Isn’t About Inflation

The US Consumer Price Index (CPI) rose back above 2% in September 2017 for the first time since April. Boosted yet again by energy prices, consumer prices overall still aren’t where the Fed needs them to be (by its own policies, not consumer reality). In fact, despite a 10.2% gain in the energy price index last month, the overall CPI just barely crossed the 2% mark (though for the Fed it really needs to be closer to 3% to match a 2% PCE Deflator).

Read More »

Read More »

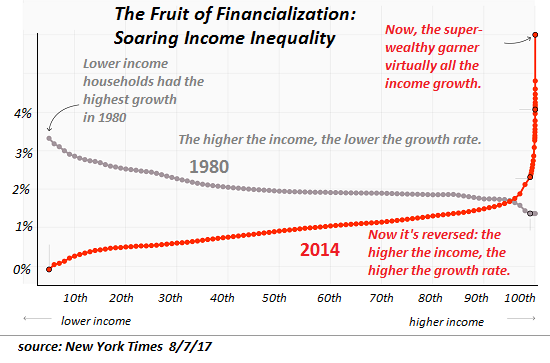

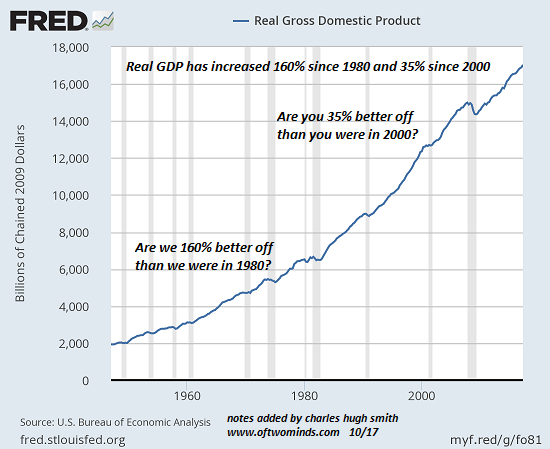

Are You Better Off Than You Were 17 Years Ago?

We tend to measure what's easily measured (and supports the status quo) and ignore what isn't easily measured (and calls the status quo into question). If we use gross domestic product (GDP) as a broad measure of prosperity, we are 160% better off than we were in 1980 and 35% better off than we were in 2000. Other common metrics such as per capita (per person) income and total household wealth reflect similarly hefty gains.

Read More »

Read More »

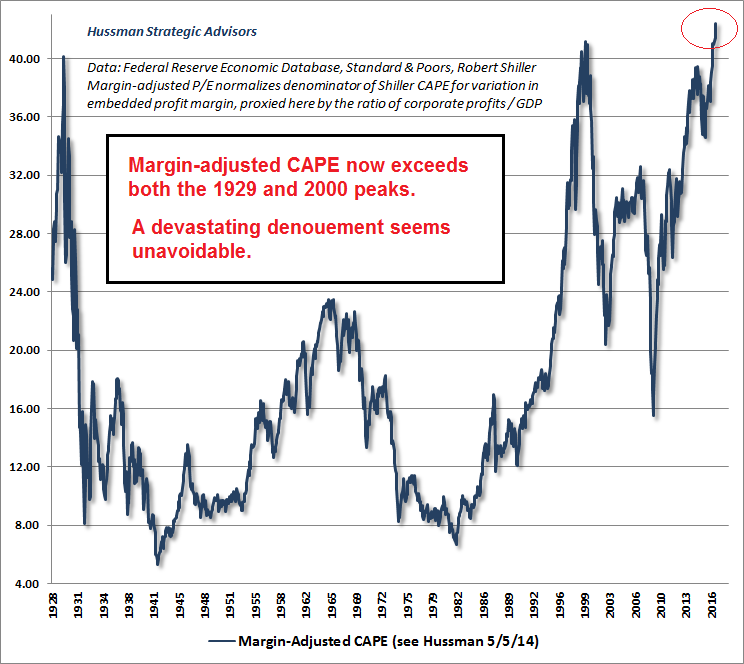

The Donald Can’t Stop It

The Dow’s march onward and upward toward 30,000 continues without a pause. New all-time highs are notched practically every day. Despite Thursday’s 31-point pullback, the Dow is up over 15.5 percent year-to-date. What a remarkable time to be alive. President Donald Trump is pumped! As Commander in Chief, he believes he possesses divine powers. He can will the stock market higher – and he knows it.

Read More »

Read More »