Tag Archive: newslettersent

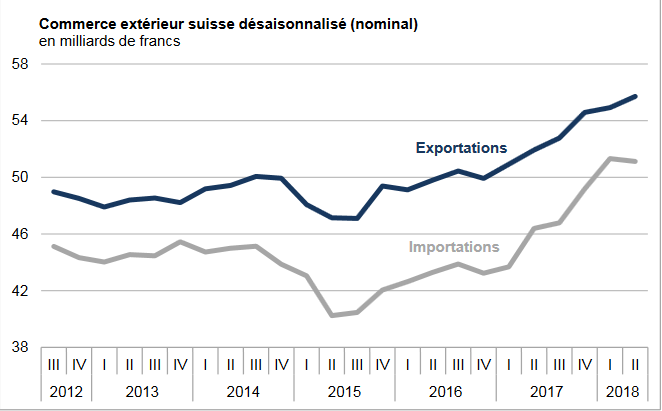

Swiss Trade Balance June 2018: Fifth consecutive record of exports

The dynamism shown by exports since the beginning of 2017 continued in the second quarter of 2018. They are thus flying from record to record for the fifth quarter in a row. Imports, on the other hand, came to a standstill, at a high level, however, after posting strong growth in previous quarters. The trade balance closes on a surplus of 4.6 billion francs.

Read More »

Read More »

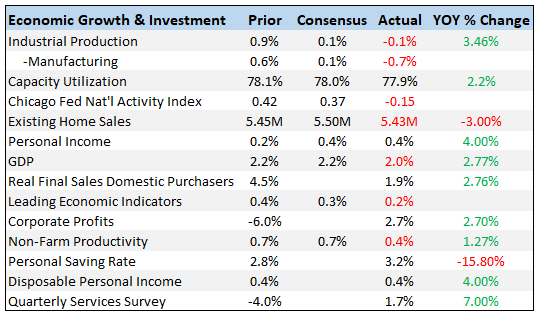

Bi-Weekly Economic Review

This will be a fairly quick update as I just posted a Mid-Year Review yesterday that covers a lot of the same ground. There were, as you’ll see below, some fairly positive reports since the last update but the markets are not responding to the better data. Markets seem to be more focused on the trade wars and the potential fallout. I would also note that at least some of the recent strength in the data is related to the tariffs.

Read More »

Read More »

Chinese Gold Market: Still in the Driving Seat

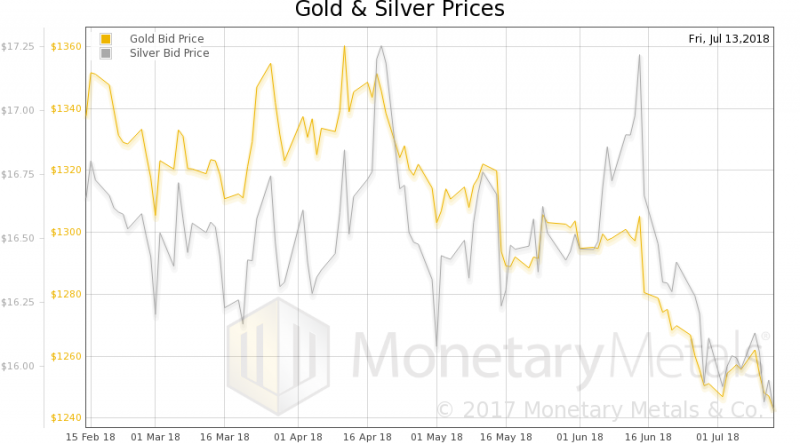

With the first half of 2018 now behind us, it’s an opportune time to look at whats been happening in the Chinese Gold Market. As a reminder, China is the largest gold producer in the world, the largest gold importer in the world, and China’s Shanghai Gold Exchange is the largest physical gold exchange in the world.

Read More »

Read More »

Swiss bank settles US tax evasion probe

The Zurich-based Neue Privat Bank (NPB) has paid $5 million (CHF5 million) fine to settle a criminal tax evasion investigation in the United States. NPB is one of a handful of so-called ‘category 1’ Swiss or Swiss-based bank branches that were still facing sanctions at the start of this year.

Read More »

Read More »

FX Daily, July 19: Greenback Extends Gains

The US dollar is extending its recent gains against most of the world's currencies. We continue to see the most compelling case for the macro driver being the diverging policy mixes. There are also more immediate factors too. The surprisingly poor UK retail sales report, for example, managed to do what the Brexit chaos and softer than expected CPI fail to do.

Read More »

Read More »

Mid-Year Global Markets Update

Volatility returned to markets with a vengeance in the first half of this year. 2018 started off as an extension of last year when volatility was almost wholly absent. Stocks roared out of the starting gate, up almost every day until January 26th. And then – whoosh. What took nearly a month to gain took just 6 trading days to give back and then some.

Read More »

Read More »

Bitcoin — when mainstream?

Since the beginning of the year, Bitcoin has seen its price cut in half and beyond. Other crypto assets have fallen even more. Although the king of the crypto world has rebelled from time to time over recent months, Bitcoin’s occasional price increases have always been met with follow-up downturns.

Read More »

Read More »

Swiss claim success in international cybercrime case

Two people suspected of illegally obtaining and using the e-banking data of Swiss bank customers have been arrested in the Netherlands. The Swiss Office of the Attorney General says the suspects were arrested near the city of Rotterdam and premises were searched in the coordinated operation between Dutch and Swiss police and justice authorities.

Read More »

Read More »

FX Daily, July 18: Greenback Extends Gains-For Now

After softening in Europe yesterday, the dollar recovered in the North American session with the help of assurances by Fed Chair Powell who reaffirmed the path gradual path despite clear recognition that tariffs threaten wages and growth. The greenback has extended those gains today and is higher against all the emerging market currencies, expected the Turkish lira, which is slightly firmer.

Read More »

Read More »

Great Graphic: Fed Raising Rates, but Yields Still Negative

The yield on the 3-month US Treasury bill is pushing above 2% today for the first time since 2008. The yield had briefly dipped below zero as recently as late 2015. Although today's yield seems high, this Great Graphic shows the nominal generic three-month yield going back to 1990. Then the three-month bill yielded 8%. The peak in the last cycle (2006-2007) was a little above 5%.

Read More »

Read More »

US Money Supply and Fed Credit – the Liquidity Drain Becomes Serious

Our good friend Michael Pollaro, who keeps a close eye on global “Austrian” money supply measures and their components, has recently provided us with a very interesting update concerning two particular drivers of money supply growth. But first, here is a chart of our latest update of the y/y growth rate of the US broad true money supply aggregate TMS-2 until the end of June 2018 with a 12-month moving average.

Read More »

Read More »

What will the rest of the year bring?

Risk assets have disappointed this year and global equities were trendless, but as long as fundamentals can re-assert themselves, there could still be some life in risk markets.Global equities were trendless and the overall performance of risk assets lacklustre in the first half of 2018.

Read More »

Read More »

FX Daily, July 17: Dollar on Back Foot Ahead of Powell

The US dollar eased in Asia session and the European morning. The greenback had appeared technically vulnerable, and the economic news stream is light. Sterling, unlike most of the other major currencies, remains within yesterday's range. Yesterday's high, a little above $1.3290, maybe reinforced a little today by the GBP245 mln $1.33 option that is expiring. Brexit concerns may also be acting as a drag.

Read More »

Read More »

Great Graphic: Two-year Rate Differentials

Given that some of the retail sales that were expected in June were actually booked in May is unlikely to lead to a large revision of expectations for Q2 US GDP, the first estimate of which is due in 11 days. Before the data, the Atlanta Fed's GDPNow projects the world's biggest economy expanded at an annualized pace of 3.9% in Q2.

Read More »

Read More »

The Great Gold Upgrade, Report 15 July 2018

In part I the Great Reset, we said that a reset is a terrible thing. The closest example is the fall of Rome in 476AD, in which more than 90% of the population of the city fled or died. No one should wish for this to happen, but we are unfortunate to live under a failing monetary system. Debt is growing exponentially. A way must be found to transition to the use of gold. We covered a few ways that won’t work.

Read More »

Read More »

FX Daily, July 16: Dollar Softens a Little as Market Awaits Developments

The US dollar is slightly softer against most of the major currencies but is in narrow ranges ahead of today's key events, which include US retail sales and the debate in the UK parliament over Brexit. The yen is the main exception. The local markets are closed for a public holiday, and the yen did initially strengthen (the dollar eased to ~JPY112.10) but surrendered those gains and consolidating its biggest loss last week in 10 months.

Read More »

Read More »

FX Weekly Preview: For the Millionth Time: Investors Exaggerate Trade Tensions at Their Own Peril

You would never have guessed it reading many of the op-eds and pundits pronouncing the end to globalization or the West, or liberalism. Global equities have rallied. Of course, stock prices are not the end all and be all, but it stands in stark contrast to the cries that the sky is falling.

Read More »

Read More »

Uber plans softer Swiss expansion drive

The ride sharing service Uber plans to expand further in Switzerland, but not as aggressively as in the past, Swiss head Steve Salom says in a newspaper interview. Uber is present in Zurich, Basel, Geneva and Lausanne with 300,000 regular customers and some 2,600 drivers in Switzerland, Salom told SonntagsBlick.

Read More »

Read More »

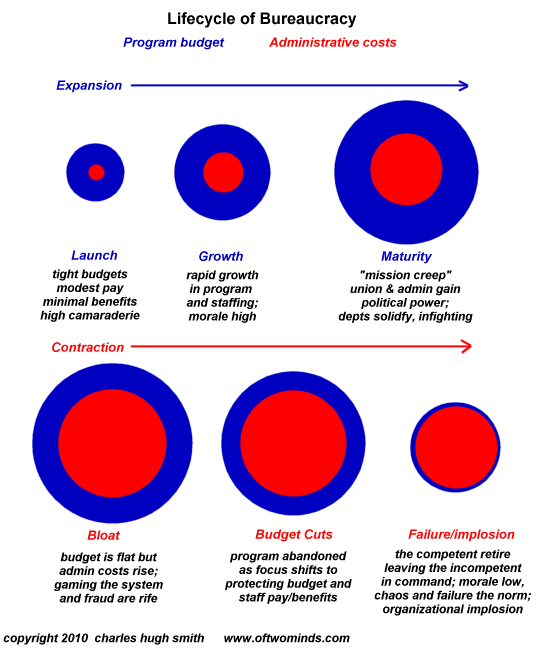

Our Institutions Are Failing

Our institutional failure reminds me of the phantom legions of Rome's final days. The mainstream media and its well-paid army of "authorities" / pundits would have us believe the decline in our collective trust in our institutions is the result of fake news, i.e. false narratives and data presented as factual.

Read More »

Read More »

The large tax differences between Swiss cantons

In Switzerland, tax is largely determined by the canton of residence. The range of tax rates is wide. In 2017, a single person earning CHF 100,000 paid only CHF 7,592 in the canton of Zug but CHF 19,233 in the canton of Neuchâtel, more than 2.5 times as much. Someone married with children earning the same amount paid CHF 920 in Zug and CHF 9,249 in Neuchâtel, more than 10 times as much.

Read More »

Read More »