Tag Archive: newslettersent

Chinese bitcoin mining giant sets up Swiss hub

One of the world’s largest bitcoin miners is setting up a hub for European operations in Switzerland, a person familiar with company has confirmed to swissinfo.ch. The Chinese firm Bitmain Technologies is setting up in Zug just as the Chinese authorities move to shut down cryptocurrency miners.

Read More »

Read More »

The number of people on welfare continues to rise in Switzerland

In 2016, around 273,000 people, 3.3% of the population, received welfare in Switzerland. The number (not the rate) was 2.9% higher than the year before and 15.7% higher than 5 years earlier when the rate was 3.0%. Rates of those receiving government aid varied significantly by canton, ranging from 0.8% in Appenzell Innerrhoden to 7.4% in Neuchâtel.

Read More »

Read More »

Swiss want only five bilateral treaties under EU framework agreement

According to an unpublished list that was revealed in some Swiss papers, Switzerland wants only five of around 120 bilateral treaties with the European Union to figure in a future institutional framework agreement. A reportexternal link on foreign economic policy published on Wednesday stated that an institutional framework agreement would apply to those bilateral agreements that allow access to certain areas of the European Union's (EU) internal...

Read More »

Read More »

Inflation Correlations and China’s Brief, Disappointing Porcine Nightmare

Two years ago, China was gripped by what was described as an epic pig problem. For most Chinese people, pork is a main staple so rapidly rising pig prices could have presented a serious challenge to an economy already at that time besieged by massive negative forces. It was another headache officials in that country really didn’t need.

Read More »

Read More »

Emerging Markets: What Changed

China State Administration of Foreign Exchange (SAFE) disputed press reports that it was slowing or halting purchases of US Treasury bonds. Korean officials warned that it will take stern steps to prevent one-sided currency moves. Bulgaria is talking “intensively” with the ECB and other EU representatives about entering the Exchange Rate Mechanism by mid-year.

Read More »

Read More »

Swiss companies leaking executives abroad

Multinational companies based in Switzerland are increasingly moving experienced executives abroad to run production sites in lower-cost countries, according to a jobs placement company. The trend has been blamed on regulatory uncertainty in the Swiss marketplace.

Read More »

Read More »

Great Graphic: Euro Monthly

The euro peaked in July 2008 near $1.6040. It was a record. The euro has trended choppily lower through the end of 2016 as this Great Graphic, created on Bloomberg, illustrates. We drew in the downtrend line on the month bar chart. The trend line comes in a little below $1.27 now and is falling at about a quarter cent a week, and comes in near $1.26 at the end of February.

Read More »

Read More »

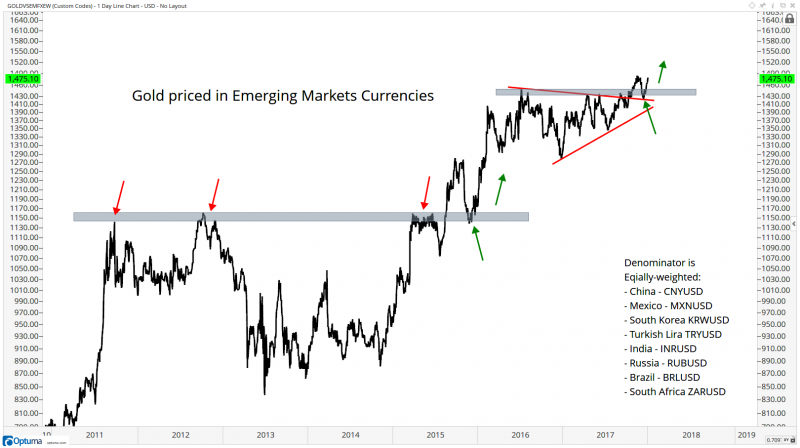

Gold Hits All-Time Highs Priced In Emerging Market Currencies

Gold Hits All-Time Highs Priced In Emerging Market Currencies. Gold at all time in eight major emerging market currencies. A stronger performance than seen when priced in USD, EUR or GBP. As world steps away from US dollar hegemony expect new gold highs in $, € and £. Gold is a hedge against currency debasement and depreciation of fiat currencies.

Read More »

Read More »

2018: The Weakest Year in the Presidential Election Cycle Has Begun

Our readers are probably aware of the influence the US election cycle has on the stock market. After Donald Trump was elected president, a particularly strong rally in stock prices ensued. Contrary to what many market participants seem to believe, trends in the stock market depend only to a negligible extent on whether a Republican or a Democrat wins the presidency.

Read More »

Read More »

FX Daily, January 12: Euro Jumps Higher

There is one main story today and it is the euro's surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month's ECB meeting surprised the market with its seeming willingness to change the forward guidance early this year in a more hawkish direction. This spurred a 0.7% gain in the euro back above $1.20. The euro stayed bid in Asia, but took another leg up (~0.75%) in response to reports that a...

Read More »

Read More »

Is the BOJ Tapering?

The G3 central banks are in flux. The Federal Reserve is gradually raising rates and allowing the balance sheet to shrink by not fully reinvesting the maturing proceeds. The ECB will purchase half as many bonds in the first nine months of 2018 as it did in the last nine months of 2017.

Read More »

Read More »

Trump to attend WEF gathering in Davos

United States President Donald Trump plans to attend the World Economic Forum (WEF) in Davos, Switzerland later this month, his spokeswoman said on Tuesday. In a statement, Sarah Huckabee Sanders, the White House press secretary, said Trump was looking forward to attending the annual gatheringexternal link of world leaders and business executives in the mountain resort in southeast Switzerland.

Read More »

Read More »

Switzerland has more job vacancies than jobseekers

Speaking to Tages-Anzeiger, Cornel Müller, director of marketing at x28, Switzerland’s largest job search aggregator, said there was a large jump in the number of jobs available in Switzerland compared to one year ago.

Read More »

Read More »

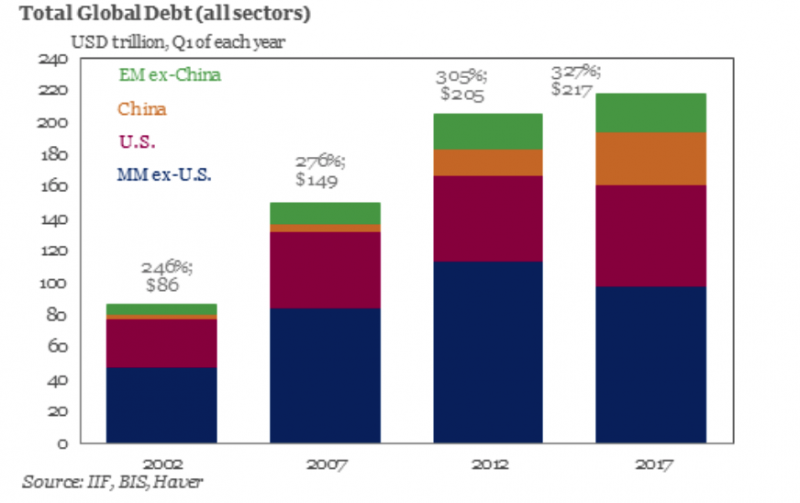

World is $233 Trillion In Debt: UK Personal Debt At New Record

The World is $233 Trillion In Debt: It’s Time to Rebalance To Gold. Record level global debt level hit $233 trillion in Q3 2017. World’s per capita debt now more than $30,000. UK personal debts climbed to the highest level since credit crunch, reaching more than £200bn. US consumer credit highest jump in 2 years by 8.8% in November to $3.83 trillion. BofE warn UK banks could incur £30bn of losses if interest rates and unemployment rise sharply.

Read More »

Read More »

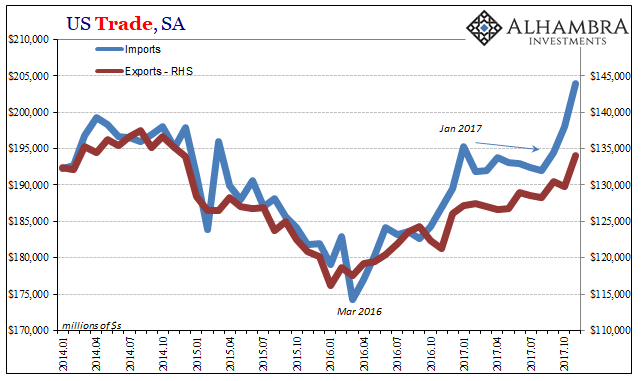

The Conspicuous Rush To Import

According to the Census Bureau, US companies have been importing foreign goods at a relentless pace. In estimates released last week, seasonally-adjusted US imports jumped to $204 billion in November 2017. That’s a record high finally surpassing the $200 billion mark for the first time, as well as the peaks for both 2014 and 2007.

Read More »

Read More »

Dividendes de la BNS: le compte n’y est pas

La Banque nationale suisse s’attend à un bénéfice de 54 milliards de francs pour l’exercice 2017. Celui-ci résulte de: Un gain de 49 milliards de francs sur ses positions en monnaies étrangères. D’une plus-value de 3 milliards de francs sur l’or. D’un bénéfice de 2 milliards de francs sur ses positions en franc.

Read More »

Read More »

FX Daily, January 11: Capital Markets Calmer, Greenback Consolidates

As market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury holdings. Then late yesterday, a news wire reported that Canada suspected the US was going to withdraw from NAFTA.

Read More »

Read More »

Cool Video: Bloomberg TV Clip on Central Banks

I joined Alix Steel and David Westin on the Bloomberg set earlier today. Click here for the link. In the roughly 2.5 minute clip, we talk about the US and and the monetary cycle in Europe. In the US, Q4 was another quarter of above trend growth. The Atlanta Fed says the economy is tracking 2.7%, while the NY Fed puts it at 4.0%.

Read More »

Read More »

Number of unemployed in Switzerland drops by 4 percents

The Swiss unemployment rate fell from 3.3% in 2016 to 3.2% in 2017, according to figures released by the State Secretariat for Economic Affairs (SECO) on Tuesday. In terms of actual numbers, 143,142 people were registered as unemployed, a decrease of 6,175 compared with the year before.

Read More »

Read More »

Gold Prices Rise To $1,326/oz as China U.S. Treasury Buying Report Creates Volatility

Gold prices rise to $1,326/oz on concerns China may slow U.S. Treasury buying. Equities fell sharply on the report as did Treasurys and the U.S. dollar. Chinese officials think U.S. debt is becoming less attractive compared to other assets. Trade tensions could provide a reason to slow down or halt U.S. debt purchases. U.S. dollar vulnerable as China remains biggest buyer of U.S. sovereign debt. Currency wars to return as China rejects U.S....

Read More »

Read More »