Tag Archive: newslettersent

FX Daily, February 01: Fed’s Hawkish Hold Keeps Dollar Consolidation Intact

The Yellen Fed ended on a high note. She took over the reins the of Federal Reserve an implemented a strategic normalization process monetary policy, and helped engineer not only the first post-crisis rate hikes but also the beginning of unwinding its balance sheet. Most reckon she has done an admirable job at the Federal Reserve, not only in terms of the economic performance on her watch but also the nimble execution policy.

Read More »

Read More »

Push to extend shop opening hours to 8pm in Geneva

The Swiss People’s Party (UDC/SVP) in Geneva wants shopping hours in Geneva to be standardized and extended. In general, French-speaking Switzerland has stricter laws on opening hours that the rest of Switzerland. For example a Migros store in Zurich is open until 9pm every night except Sunday. A similar store in Geneva is only open until 9pm one day a week. The rest of the week it shuts between 6pm and 7:30pm.

Read More »

Read More »

Swiss watch industry posts growth

After two years of decline, the Swiss watch industry grew by 2.7% in 2017, according to the figures released by the Federation of the Swiss Watch Industry (FH) on Tuesday. Exports grew by 2.7 % to CHF19.9 billion ($21.3 billion) on 2016. “Growth returned sooner than expected,” said the FH in a press release.

Read More »

Read More »

The Donald Saves the Dollar

The world is full of bad ideas. Just look around. One can hardly blink without a multitude of bad ideas coming into view. What’s more, the worse an idea is, the more popular it becomes. Take Mickey’s Fine Malt Liquor. It’s nearly as destructive as prescription pain killers. Yet people chug it down with reckless abandon.

Read More »

Read More »

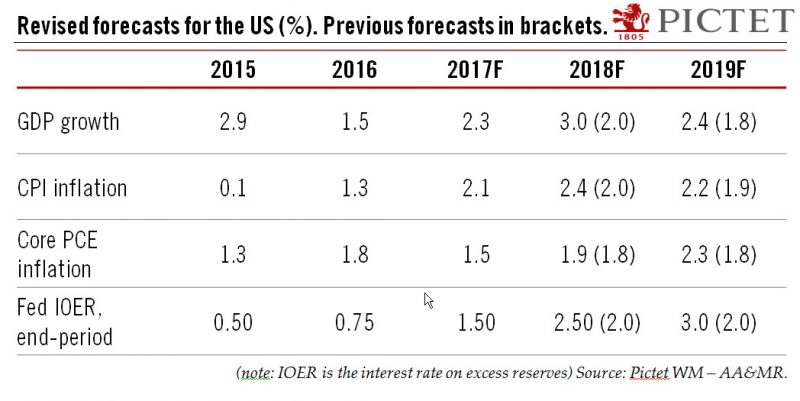

Tax cuts and ‘animal spirits’ mean higher US growth in 2018

December’s US tax cuts – which saw corporate taxation reduced particularly sharply – are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We therefore upgrade our 2018 US growth forecast from 2.0% to 3.0%. We forecast that real non-residential investment growth will accelerate to 7.0% in 2018, up from an estimated 4.6% in 2017. We...

Read More »

Read More »

A quarter of Swiss workers stressed and exhausted, according to new research

Around a quarter of Swiss workers are stressed and exhausted, according to new research. A three-year study by the University of Bern and Zurich University of Applied Sciences, which covers the period from 2014 to 2016, estimates that this stress and exhaustion cost Swiss companies between CHF 5 and CHF 5.8 billion a year.

Read More »

Read More »

Swiss court condemns €8 per hour wages of Polish workers

A labour court in Geneva has ruled against a Polish subcontractor that underpaid its seconded employees working on a Geneva building site. The workers were earning €8 an hour, about a third of what the work warranted, the court said. The case has been ongoing for almost five years and was led by the UNIA trade union on behalf of the workers.

Read More »

Read More »

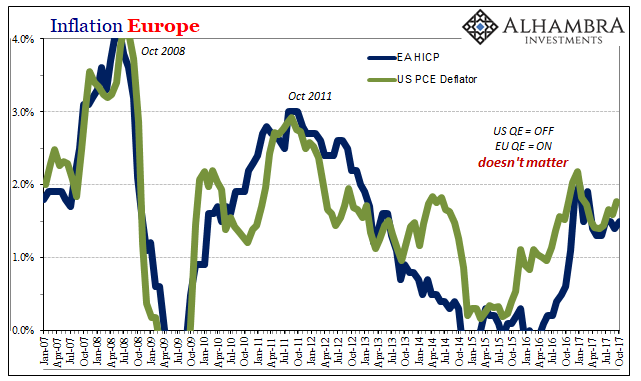

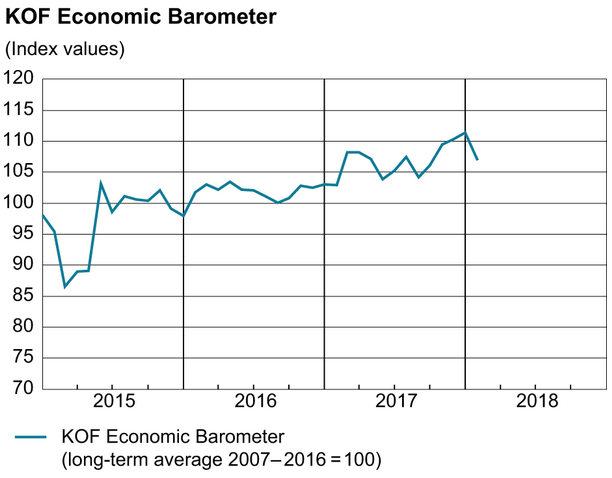

Globally Synchronized What?

In one of those rare turns, the term “globally synchronized growth” actually means what the words do. It is economic growth that for the first time in ten years has all the major economies of the world participating in it. It’s the kind of big idea that seems like a big thing we all should pay attention to. In The New York Times this weekend, we learn.

Read More »

Read More »

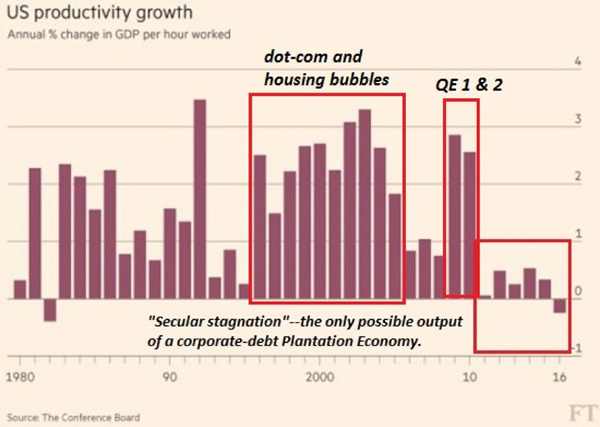

The Pie Is Shrinking for the 99 percent

The ensuing social disunity and disruption will be of the sort many alive today have never seen. Social movements arise to solve problems of inequality, injustice, exploitation and oppression. In other words, they are solutions to society-wide problems plaguing the many but not the few (i.e. the elites at the top of the wealth-power pyramid).

Read More »

Read More »

The FOMC Meeting Strategy: Why It May Be Particularly Promising Right Now

As readers know, investment and trading decisions can be optimized with the help of statistics. One way of doing so is offered by the FOMC meeting strategy. A study published by the Federal Reserve Bank of New York in 2011 examined the effect of FOMC meetings on stock prices. The study concluded that these meetings have a substantial impact on stock prices – and contrary to what most investors would probably tend to expect, before rather than after...

Read More »

Read More »

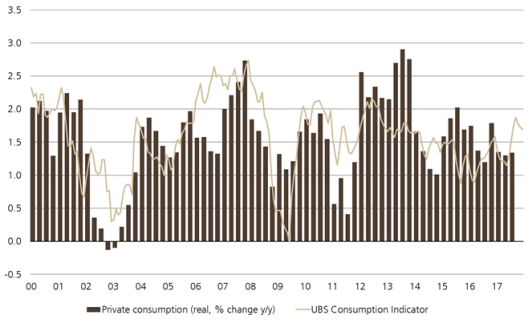

Switzerland UBS consumption indicator December: pleasing end to the year

At 1.69 points, the consumption indicator lay well above the long-term average in December 2017, conveying an optimistic snapshot of Swiss private consumption. Weaker figures for new car registrations prevented an even higher value. The consumption indicator fell slightly in December 2017 to 1.69 points from 1.73. However, values had been revised upward in the past few months.

Read More »

Read More »

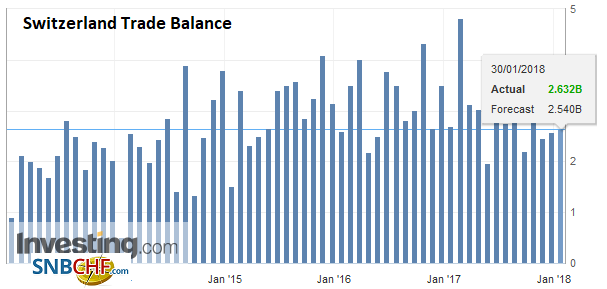

Swiss Trade 2017: Exports at all-time high

Last year, Swiss foreign trade accelerated yet again relative to 2016: exports rose by 4.7% to reach a new record high. Imports grew by 6.9%, posting their strongest growth rate since 2010. Aside from the improved economic situation worldwide, the weakening of the Swiss franc and price trends played a decisive role in both directions of trade. With a surplus of CHF 34.8 billion, the balance of trade closed the year 6% (or CHF 2.1bn) lower than the...

Read More »

Read More »

FX Daily, January 30: Dollar and Bonds Stabilize; Equities not Yet

The US dollar is paring yesterday's gains, and the 10-year Treasury yield has slipped back below the 2.70% level after pushing 2.73% briefly. European bonds have also eased, with yields one-two basis points lower. It is thus far a mild Turn Around Tuesday but suggests that the market psychology that has driven the dollar lower and yields higher persistently since mid-December have not been broken.

Read More »

Read More »

Weekly Technical Analysis: 29/01/2018 – USDJPY, EURUSD, GBPUSD, GBPJPY

The USDCHF pair shows some bullish bias to approach retesting the previously broken support that turns into key resistance now at 0.9418, noticing that stochastic loses its bullish momentum clearly to reach the overbought areas, while the EMA50 forms continuous negative pressure against the price.

Read More »

Read More »

Swiss continue to rent rather than buy houses

Some 59% of Swiss households were rentals in 2015, according to the most recent figures. The average monthly rent across the country came in at just over CHF1,300 ($1,395). The numbers were released on Monday by the Federal Statistical Office and reflect the situation at the end of 2015, when 2.1 million rented accommodations were recorded.

Read More »

Read More »

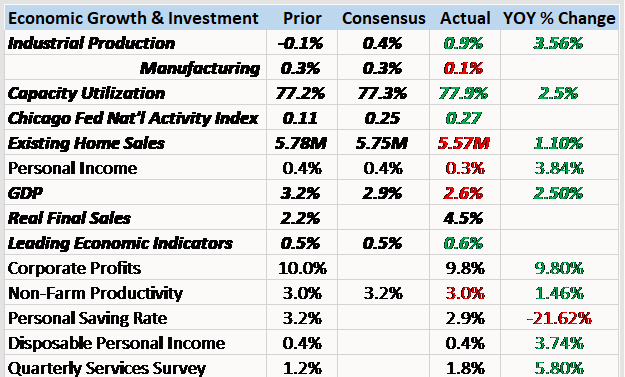

Bi-Weekly Economic Review: Markets At Extremes

Production ended the year on a strong note but early readings from January are not as positive. The December industrial production report headline was strong at a 0.9% gain but a lot of that strength was in the mining (oil drilling) and utility sectors. Mining has actually led the way the last year as rig count has risen with drilling activity. I’d love to see our economy less dependent on the price of oil but that is what we’ve become over the...

Read More »

Read More »

FX Daily, January 29: A Brief Word

The US dollar is modestly firmer, but nothing to suggest a outright correction rather than consolidation. However, have a dramatic drop over the past month, much more than we think is justified by macroeconomic developments and interest rates, we think the dollar may have overshot.

Read More »

Read More »

FX Weekly Preview: Market Confusion and New Inputs

Many investors are confused, and the official communication only fanned the confusion. Before turning to next week’s key events and data, let's first spend some time, working through some of the confusion. There was no change in policy last week. The US did not suddenly become protectionist. It did put tariffs on solar panels and washing machines.

Read More »

Read More »

Swiss fact: nearly half of Swiss rental properties owned by individuals

If you rent a home in Switzerland it is more likely to belong to an individual than a big real estate company or pension fund. In 2017, 49% of residential rental properties in Switzerland were owned by individuals, according to Statistics published by the Swiss Federal Statistical Office. The highest rate of rental home ownership by individuals was in the Italian-speaking canton of Ticino (71%). The lowest rate was in the Lake Geneva region (41%).

Read More »

Read More »