Tag Archive: newslettersent

Ticket cheats in Switzerland soon to be listed in a national register

Tickets cannot be bought on public transport in Switzerland. Passengers are required to have a ticket before boarding. Those caught on public transport without one will soon have their names put into a national register. This will ensure progressively higher fines are issued to repeat offenders.

Read More »

Read More »

Judicial complaint filed over PostBus scandal

The Federal Office of Transport has filed a legal complaint to the Attorney General’s office and judicial authorities of Bern canton in connection with the scandal hitting the Swiss PostBus company. The complaint for possible breaches of administrative law, fraud and mismanagement is filed against unnamed persons.

Read More »

Read More »

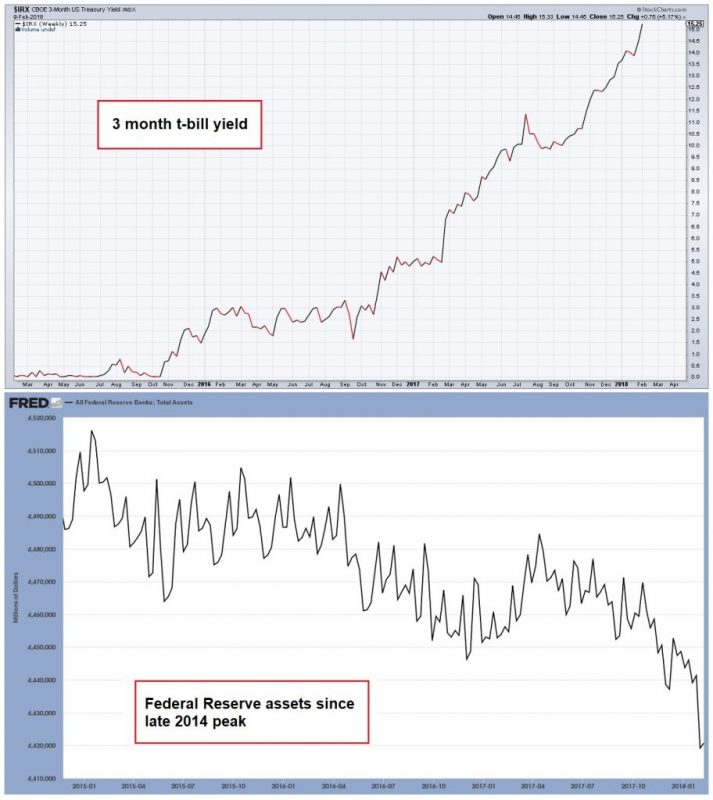

Global Debt Crisis II Cometh

Global Debt Crisis II Cometh

– Global debt ‘area of weakness’ and could ‘induce financial panic’ – King warns

– Global debt to GDP now 40 per cent higher than it was a decade ago – BIS warn

– Global non-financial corporate debt grew by 15% to 96% of GDP in the past six years

– US mortgage rates hit highest level since May 2014

– US student loans near $1.4 trillion, 40% expected to default in next 5 years

– UK consumer debt hit £200b, highest...

Read More »

Read More »

The Future of Copper – Incrementum Advisory Board Meeting Q1 2018

The Q1 2018 meeting of the Incrementum Fund’s Advisory Board took place on January 24, about one week before the recent market turmoil began. In a way it is funny that this group of contrarians who are well known for their skeptical stance on the risk asset bubble, didn’t really discuss the stock market much on this occasion. Of course there was little to add to what was already talked about extensively at previous meetings. Moreover, the main...

Read More »

Read More »

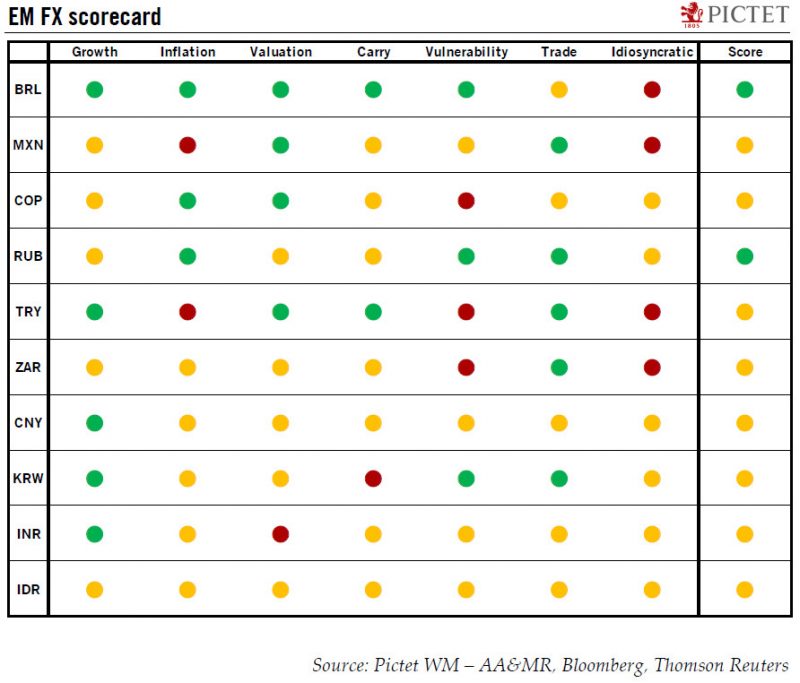

Our emerging market currencies scorecard gives good marks to real and rouble

The scope of this note is to present a score card for Emerging Market (EM)currencies, designed to assess the attractiveness of a given currency over the coming 12 months. The scorecard (see chart), constructed using a rules - based methodology, suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.

Read More »

Read More »

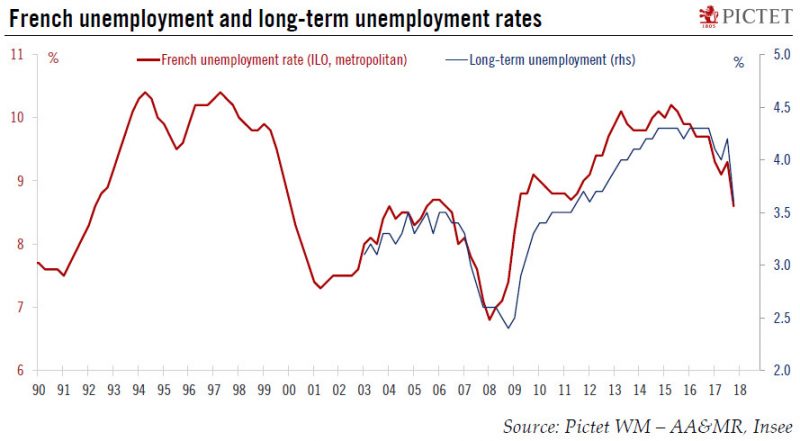

Europe chart of the week – French unemployment

French unemployment fell surprisingly fast in Q4 2017, to a new cyclical low.France registered the largest drop in unemployment in about ten years in Q4 2017. In metropolitan France, the number of unemployed fell by 205,000 to 2.5 million people, pushing the ILO unemployment rate down to 8.6% of the labour force (-0.7pp), its lowest level since Q1 2009.

Read More »

Read More »

Swiss public accounts better than expected in 2017

Swiss government accounts closed with a surplus of CHF2.8 billion ($3 billion) for 2017, compared with a forecast deficit of CHF250 million, Finance Minister Ueli Maurer said at a press conference in Bern on Wednesday. This was due mainly to higher-than-estimated tax revenues.

Read More »

Read More »

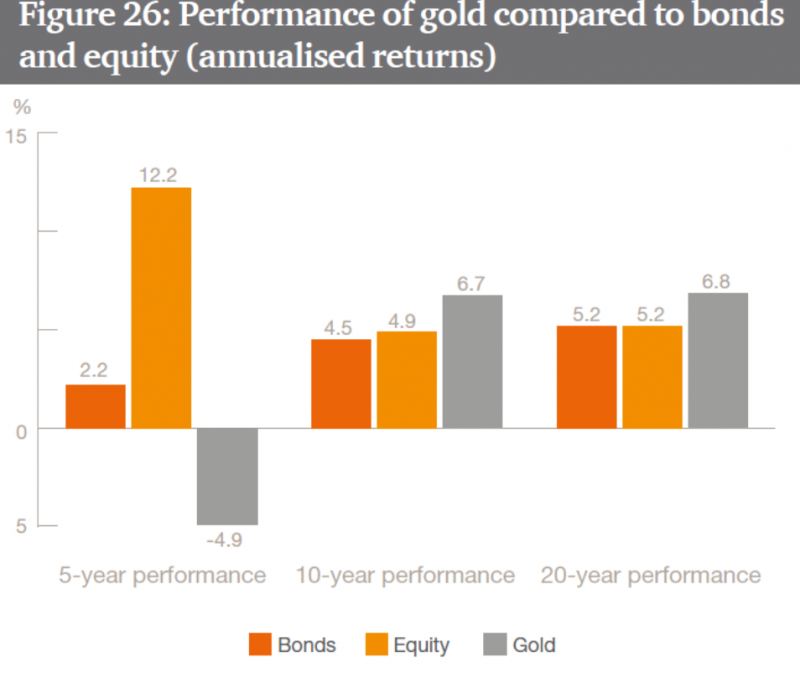

Sovereign Wealth Funds Investing In Gold For “Long Term Returns” – PwC

Sovereign wealth funds investing in gold for long term returns – PwC. Gold has outperformed equities and bonds over the long term – PwC Research. Gold is up 6.7% and 6.8% per annum over 10 and 20 year periods; Stocks and bonds returned less than 5.2% respectively over same period (see PwC table). From 1971 to 2016 (45 years), “gold real returns were approximately 10% while inflation increased 4%”.

Read More »

Read More »

Emerging Markets: What Changed

The National Stock Exchange of India will end all licensing agreements and stop offering live prices overseas. Philippine central bank cut reserve requirements for commercial banks. Egypt cut rates for the first time since 2015. Israeli police recommended that Prime Minister Netanyahu be charged. South Africa President Zuma resigned before a no confidence vote was held.

Read More »

Read More »

What Kind of Stock Market Purge Is This?

Down markets, like up markets, are both dazzling and delightful. The shock and awe of near back-to-back 1,000 point Dow Jones Industrial Average (DJIA) free-falls is indeed spectacular. There are many reasons to revel in it. Today we shall share a few. To begin, losing money in a multi-day stock market dump is no fun at all. We’d rather get our teeth drilled by a dentist. Still, a rapid selloff has many positive qualities.

Read More »

Read More »

Favoritisme de la BNS: l’horlogerie suisse supplantée par Apple

La grande nouvelle du jour est que Apple aurait vendu plus de montrer dans le monde que toute l’horlogerie suisse réunie. Ces chiffres sont tout de même à relativiser fortement, car ils sont le fruit d’analyse de marché, diffusés par le CEO de Apple lui-même….En rouge, l’industrie horlogère suisse dans sa totalité face à Apple en bleu. Ainsi, selon ces chiffres, Apple aurait vendu 8 millions de montres contre 6,8 pour l’ensemble de l’industrie...

Read More »

Read More »

FX Daily, February 16: Worst Week for the Dollar since 2015-2016, While Stocks Continue to Recover

Nearly all the major currencies have risen at least two percent against the US dollar this week. The Canadian dollar is an exception. It has risen one percent this week ahead of today's local session. Sterling is becoming another exception after disappointing retail sales. It is up just shy of two percent. The Dollar Index is off 2.3% on the week, which would be the biggest weekly loss since 2015.

Read More »

Read More »

Great Graphic: Bears Very Short US 10-Year Ahead of CPI

The US reports January CPI figures tomorrow. The market seems especially sensitive to it. The main narrative is that it is an inflation scare spurred by the jump in January average hourly earnings that pushed yields higher and unhinged the stock market. This Great Graphic comes from Bloomberg and is derived from data issued by the Commodity Futures Trading Commission (CFTC).

Read More »

Read More »

Idaho House Votes Overwhelmingly to Remove Income Taxation from Gold & Silver

Boise, Idaho (February 12, 2018) – The Idaho State House today overwhelmingly approved a bill which helps restore constitutional, sound money in the Gem State. State representatives voted 60-9 to pass House Bill 449 sending the measure introduced by House Majority Leader Mike Moyle and Senate Assistant Majority Leader Steve Vick to the Senate for a hearing in the Local Government and Taxation Committee.

Read More »

Read More »

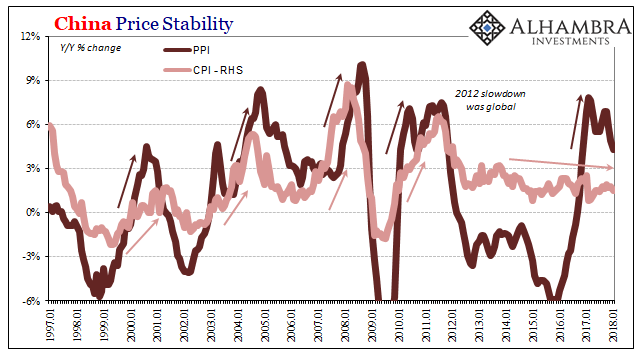

China: Inflation? Not Even Reflation

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference.

Read More »

Read More »

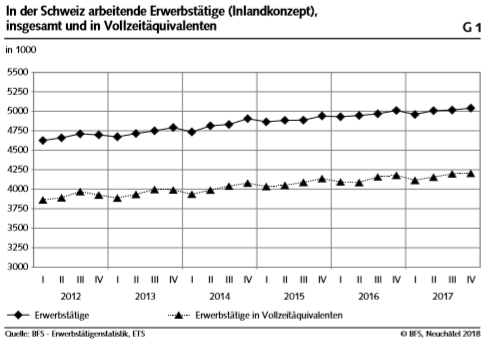

Swiss Labour Force Survey in 4th quarter 2017: 0.6 percent increase in number of employed persons; unemployment rate based on ILO definition at 4.5 percent

The number of employed persons in Switzerland rose by 0.6% between the 4th quarters of 2016 and 2017. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) declined from 4.6% to 4.5%. The EU's unemployment rate decreased from 8.3% to 7.4%. These are some of the results of the Swiss Labour Force Survey (SLFS) conducted by the Federal Statistical Office (FSO).

Read More »

Read More »

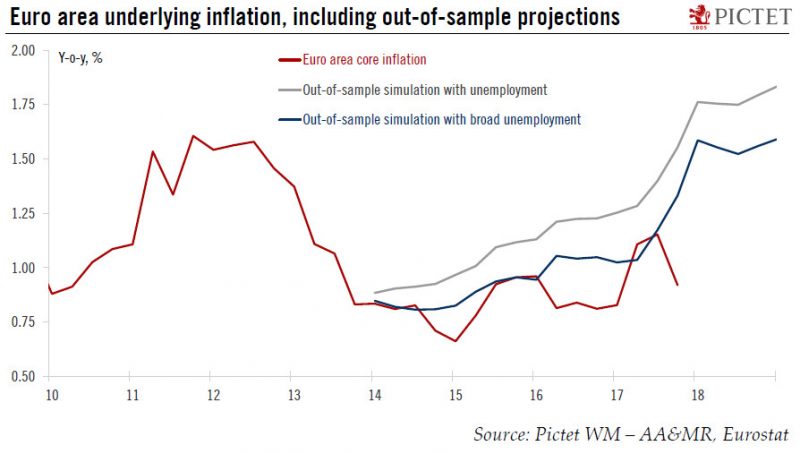

Euro area inflation: the Phillips curve and the ‘broad unemployment’ hypothesis

Monetary policy in 2018 is all about the Phillips curve. The extent to which wage growth and inflation respond to falling unemployment will shape the monetary tightening cycle. If recent price action is any guide, any surprise on that front could result in market overreaction and volatility spikes. The most elegant description of the current state of research was provided by ECB Executive Board member Benoît Coeuré last year, who described the...

Read More »

Read More »

FX Daily, February 15: Stocks Jump, Bonds Dump, and the Dollar Slumps

The significant development this week has been the recovery of equities after last week's neck-breaking drop, while yields have continued to rise. The dollar has taken is cues from the risk-on impulse from the equity market and the sales of US bonds more than the resulting higher yields. Asia followed US equities higher.

Read More »

Read More »

Bitcoin and Crypto Prices Being Manipulated Like Precious Metals?

Bitcoin and Crypto Prices Being Manipulated Like Precious Metals? – FSN Interview GoldCore. Kerry Lutz of the Financial Survival Network (FSN) interviewed GoldCore’s Mark O’Byrne about the outlook for crypto currencies, financial markets and precious metals. Are bitcoin and crypto prices being manipulated like precious metals? Is there a coordinated backlash against bitcoin from JPM and powerful interests?

Read More »

Read More »