Tag Archive: newslettersent

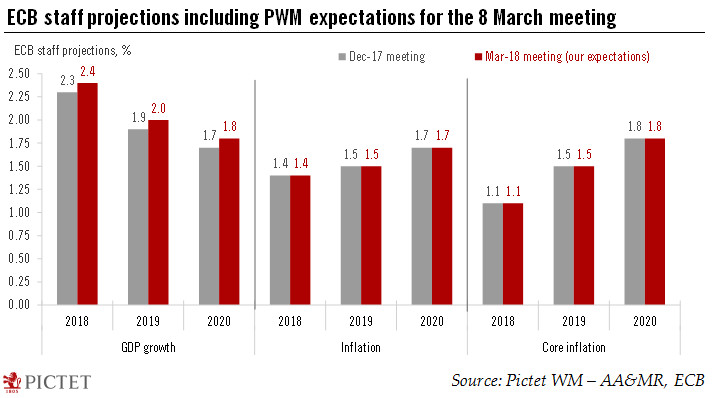

Europe – ECB preview

Market participants have enjoyed a protracted period of very low volatility, but it may well have come to an end in 2018. Central banks are often said to be responsible for the disappearance of volatility, for example through their large-scale asset purchases, which have compressed the term premium. But, now that the same central banks are heading for the exit from unconventional policies, they, too, need to relearn how to live with volatility.

Read More »

Read More »

Jobless in Switzerland after 55 – most end up longterm unemployed

Age discrimination in the Swiss job market appears to be getting worse. Between 2010 and 2016, the number of over 55s on welfare increased by 50.5%, something that cannot be fully explained by an aging population. The population aged between 56 and 64 only increased by 11.6% over the same period.

Read More »

Read More »

Average expat in Zurich earns more than $200,000

Zurich and Geneva are among the top cities in the world for expat salaries, according to this year’s HSBC expat salary survey. The average expat can look forward to a pay packet of $206,875 (CHF191,960) in third-place Zurich and $184,942 in fifth-place Geneva.

Read More »

Read More »

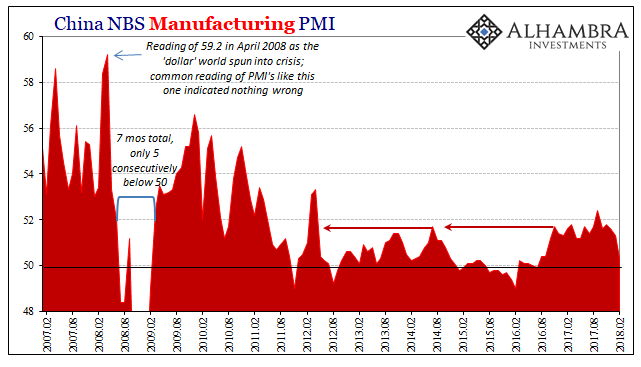

Data Distortions One Way Or Another

Back in October, we noted the likely coming of two important distortions in global economic data. The first was here at home in the form of Mother Nature. The other was over in China where Communist officials were gathering as they always do in their five-year intervals. That meant, potentially. In the US our economic data for a few months at least will be on shaky ground due to the lingering economic impacts of severe hurricanes.

Read More »

Read More »

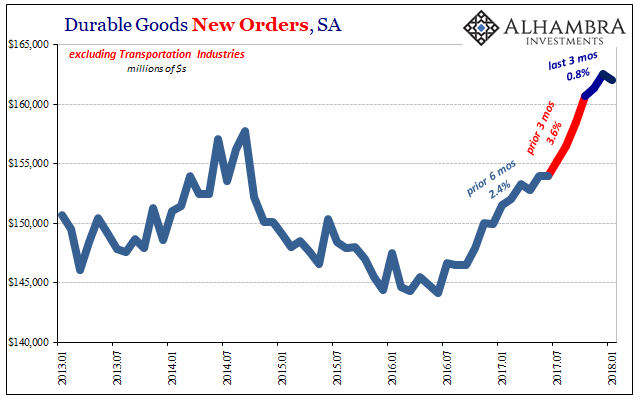

Durable and Capital Goods, Distortions Big And Small

New orders for durable goods, excluding transportation industries, rose 9.1% year-over-year (NSA) in January 2018. Shipments of the same were up 8.8%. These rates are in line with the acceleration that began in October 2017 coincident to the aftermath of hurricanes Harvey and Irma. In that way, they are somewhat misleading.

Read More »

Read More »

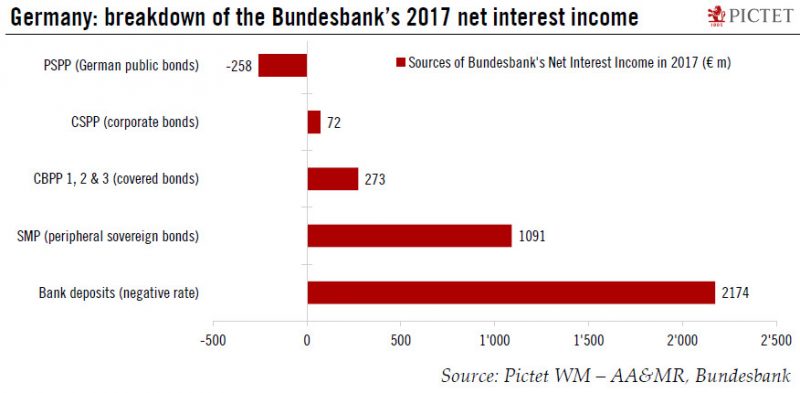

ECB policy is boosting the Bundesbank’s profits

This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end of 2017, and the corresponding flows of income stemming from its asset purchases. Remember that QE is largely...

Read More »

Read More »

E-franc pipe dream fails to arouse Switzerland

Mounting calls for Switzerland to introduce a blockchain-based national cryptocurrency continue to fall on deaf ears at the Swiss National Bank (SNB). Romeo Lacher, chairman of the SIX Groupexternal link that runs the Swiss stock exchange, recently added his voice to the debate by advocating such a virtual currency.

Read More »

Read More »

Gold Corridor From Dubai to China Sought By China

Gold corridor from Dubai to China sought by Chinese Gold & Silver Exchange Society. New Asian gold trading corridor could boost demand for 1 kg gold bars. Should increase turnover for yuan-denominated gold coins and bars – President. Secure supplies of physical gold from Middle East and Asia for China. China positioning itself as leading gold trading and owning nation.

Read More »

Read More »

Emerging Markets: What Changed

China plans to change its constitution to eliminate term limits for President Xi Jinping. Bank Indonesia Deputy Governor Perry Warjiyo was nominated by President Widodo to be the next Governor. Bank of Korea Governor Lee was reappointed by President Moon for a second term. Hungary ruling party candidate lost the mayoral vote in Hodmezovasarhely. S&P upgraded Russia to BBB- with stable outlook.

Read More »

Read More »

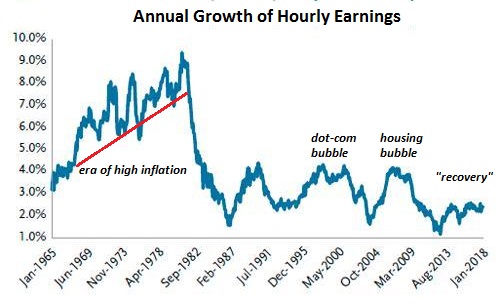

Our Fragmented Labor Markets Defy Outdated Conventions

There are hundreds of extraordinarily diverse labor markets in the U.S. economy, and it takes a much more granulated approach to make any sense of this highly fragmented and dynamic marketplace. onventional economists/media pundits typically view the labor market as monolithic, i.e. as one unified market. The reality is the labor market is highly fragmented. Thus it's little wonder that conventional measures are giving mixed signals on employment,...

Read More »

Read More »

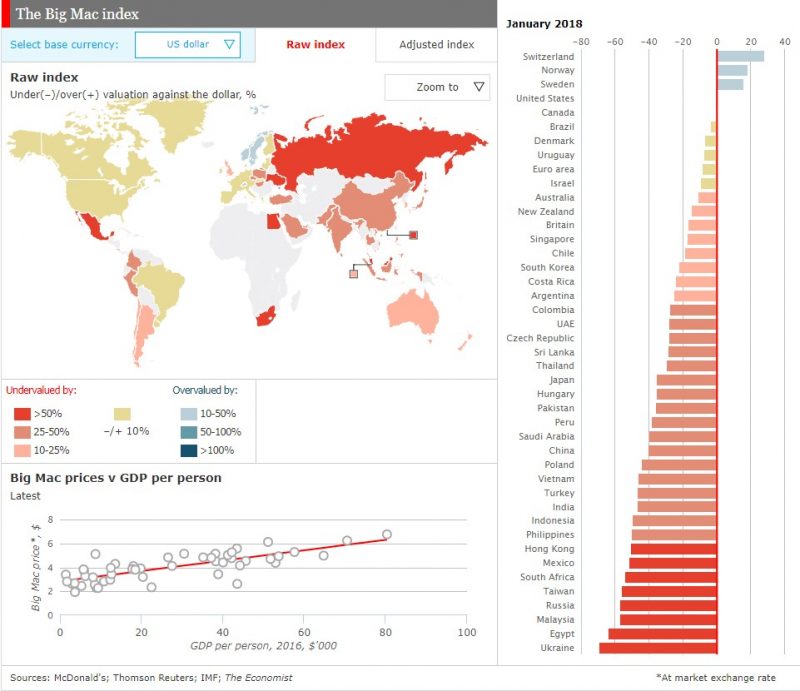

Purchasing Power Parity or Nominal Exchange Rates?

“An alternative exchange rate – the purchasing power parity (PPP) conversion factor – is preferred because it reflects differences in price levels for both tradable and non-tradable goods and services and therefore provides a more meaningful comparison of real output.” – the World Bank

Read More »

Read More »

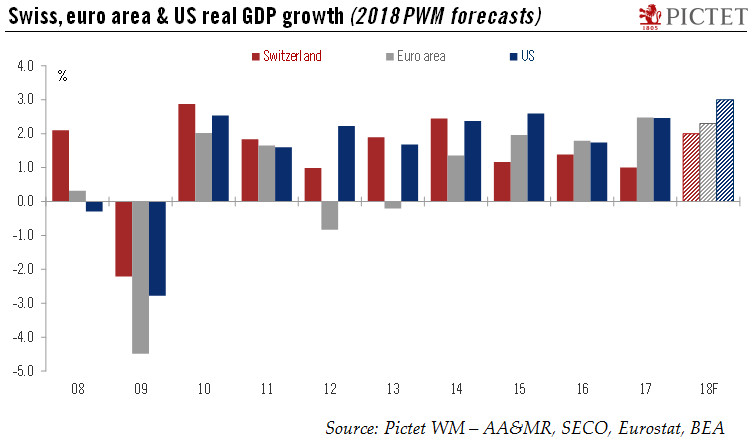

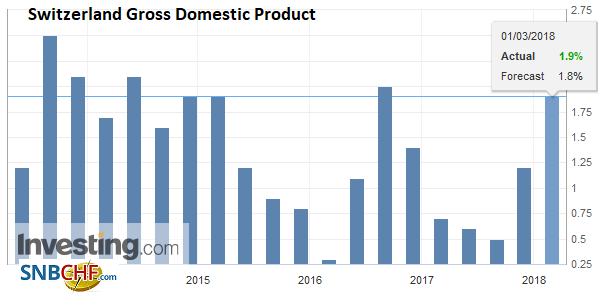

Switzerland: So far so good

According to the State Secretariat for Economic Affairs (SECO)’s quarterly estimates, Swiss real GDP rose by 0.6% q-o-q in Q4 (2.4% q-o-q annualised; 1.9% y-o-y), above consensus expectations (0.5%). The Swiss economy expanded by 1.0% in 2017 overall, in line with our own forecast. This comes after GDP growth of 1.4% in 2016 and 1.2% in 2015.

Read More »

Read More »

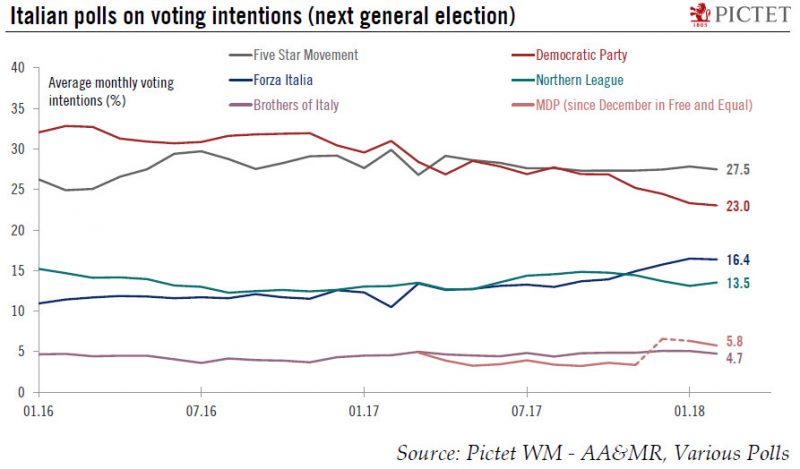

Who will tackle Italy’s root problems?

The Italian general election campaign is in its final stretch before voting on 4 March. The election will take place under the new electoral law (Rosatellum bis), which allocates 37% of parliamentary seats via the principle of "first-past-the-post" and 61% via proportional representation, with the remaining 2% reserved for overseas constituencies (see our previous Flash Note for further details).

Read More »

Read More »

FX Daily, March 02: Markets Unanchored?

The announcement of the US intention to impose tariffs on imported steel and aluminum on national security grounds has sent ripples through the capital markets. Yet there is certainly more going on here than that. The tariffs, justification, and magnitude have indicated and expected. After reversing lower on Tuesday and selling off on Wednesday, equity investors hardly needed a fresh reason to sell on Thursday.

Read More »

Read More »

First of new Bombardier trains makes maiden voyage

After years of delay, the double-decker train named ‘FV-Dosto’ completed its first rail journey on Monday. The fate of the rest of the 62-train fleet still pends on a court decision following a legal challenge by disabled groups.

Read More »

Read More »

Career Advice to 20-Somethings: Create Value as a Mobile Creative

Finding work that fits who you are is rarely easy, especially if you don't fit into the mainstream, and usually it requires a lot of compromises, hard work and dead-ends. But that’s the process. Establishing a satisfying career is difficult in today's economy, doubly so for those who find life within hierarchical institutions (corporate America and government) unrewarding, and triply so for those burdened with student loan debt and college...

Read More »

Read More »

Socialism and Capital Consumption

We have been promising to get back to the topic of capital destruction, which we put on hiatus for the last several weeks to make our case that the interest rate remains in a falling trend. Today, we have a different way of looking at capital destruction.

Read More »

Read More »

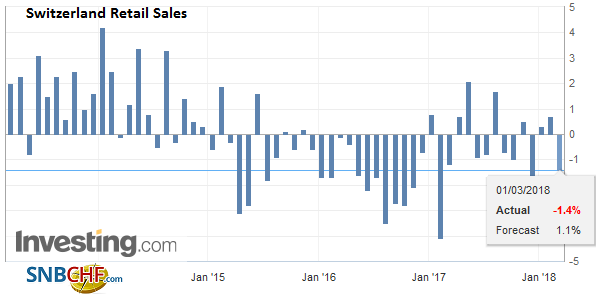

Swiss Retail Sales, January: -0.8 Percent Nominal and -0.6 Percent Real

Turnover in the retail sector fell by 0.8% in nominal terms in January 2018 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Switzerland GDP Q4 2017: +0.6 percent QoQ, +1.9 percent YoY

Switzerland’s real gross domestic product (GDP) grew by an above-average 0.6% in the 4th quarter of 2017.1 Growth was broad-based across the various business sectors, with manufacturing, construction and most service sectors, particularly financial services, providing momentum. On the expenditure side, growth was underpinned by consumption and investment in construction but was hindered by investment in equipment and foreign trade.

Read More »

Read More »

FX Daily, March 01: USD Snaps 3-Month Slide, Firm Ahead of Powell Part II

The US dollar rebounded last September and October before the downtrend resumed in November, and lasted through January. The dollar gained broadly last month, except against the yen, which rose almost 2.4% in February. This pattern is evident today, the first trading day of March. The dollar is extending its gains against most currencies but is only managing to consolidate in a narrow range against the yen.

Read More »

Read More »