Tag Archive: newslettersent

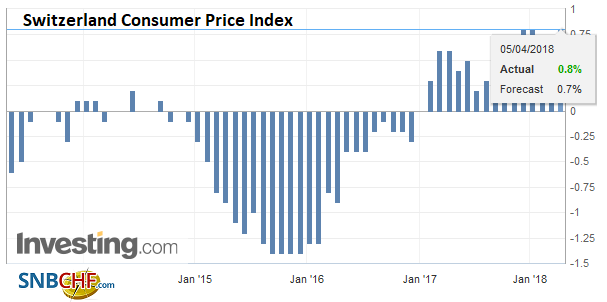

Swiss Consumer Price Index in March 2018: +0.8 percent YoY, +0.4 percent MoM

The consumer price index (CPI) rose by 0.4% in March 2018 compared with the previous month, reaching 101.5 points (December 2015=100). In comparison with the same month of the previous year, inflation stood at 0.8%. These figures were compiled by the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, April 05: Investors Find Comfort in Brinkmanship Blinks

Global equity markets are higher, following the stunning recovery in the US yesterday, where the S&P 500 rallied 76 points or 3% from its lows to it highs, near where it finished. The outside up day is seeing following through today. Without China and Hong Kong, which are on holiday, the MSCI Asia Pacific Index snapped a three-day down draft and closed 0.55% higher.

Read More »

Read More »

The Swiss National Bank owns more A-class Facebook shares than Zuckerberg

At the end of March 2018, the Swiss National Bank (SNB), held 8.93 million A class shares compared to Mark Zuckerberg’s holding of 8.91 million, according to the newspaper Handelszeitung. However, most of Zuckerberg’s shares are B class shares, a class of shares which is not quoted and give the founder control of the business. Zuckerberg holds 393.9 million of these.

Read More »

Read More »

Gold Is Money While Currencies Today Are “IOU Nothings”

Now that the international monetary system we have long known has broken down, and the world is groping through monetary reform for a new one, it is time to consider some fundamentals. What is money anyway? First, it is a means of payment or medium of exchange. I prefer that first phrase. It is simpler. We all use money to pay our bills, to buy goods and services. We also accept money when we sell.

Read More »

Read More »

Bi-Weekly Economic Review

Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for April 01, 2018.

Read More »

Read More »

UBS publishes agenda for the Annual General Meeting of UBS Group AG on 3 May 2018

The Board of Directors of UBS Group AG is proposing Jeremy Anderson and Fred Hu for election as new members of the Board of Directors for a one-year term. Jeremy Anderson (born 1958) was Chairman of Global Financial Services at KPMG International from 2010 until November 2017. He previously held various senior positions at KPMG and was appointed to lead KPMG’s UK Financial Services Practice in 2004.

Read More »

Read More »

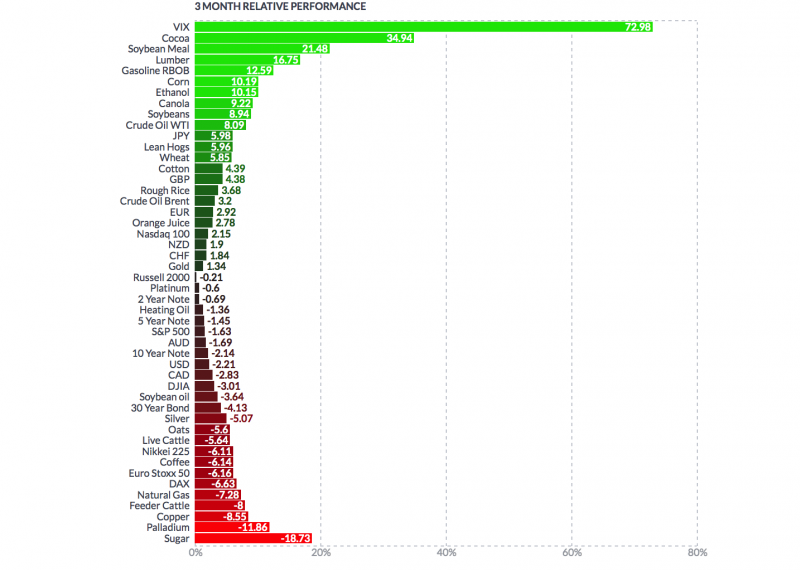

FX Daily, April 04: Trade Specificities Rattle Markets

Late yesterday, the US announced that specific tariffs and goods that would be targeted for intellectual property violations. China had warned of a commensurate response and earlier today made its announcement. This sent reverberations through the capital markets, driving down equities, corn and soybean prices (subject to Chinese tariffs). The US dollar was sold, especially against the yen, euro, and sterling.

Read More »

Read More »

Weekly Technical Analysis: 02/04/2018 – Gold, WTI Oil Futures, GER30 Index, USD/JPY

The USDCHF pair attempted to breach 0.9581 level yesterday but it returns to move below it now, which keeps the bearish trend scenario valid until now, supported by stochastic move within the overbought areas, waiting to head towards 0.9488 as a first target.

Read More »

Read More »

French strike affects Swiss rail connections

Nationwide strikes in France against railway reforms have resulted in all rail connections to Switzerland being cancelled on Tuesday. The so-called Black Tuesday marked the first day of a series of strikes expected to last until the end of June. Rail employees have been called upon to stop work on two out of five days every week until June 30.

Read More »

Read More »

Has Switzerland blown its crypto-opportunity?

Legendary United States crypto investor Tim Draper believes Switzerland has missed the boat in establishing itself as an attractive global hub for blockchain start-ups. Draper has invested in Tezos, which ran into a damaging governance row in Switzerland shortly after its initial coin offering (ICO) fundraiser.

Read More »

Read More »

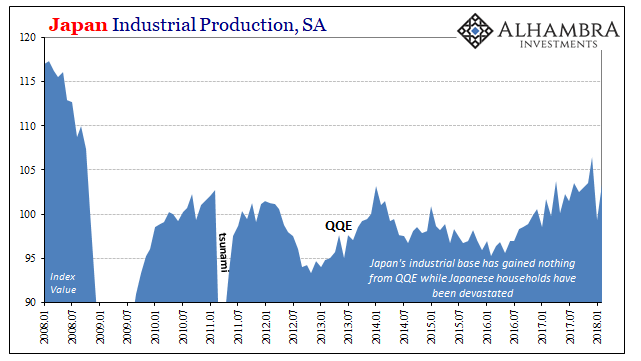

The Best ‘Reflation’ Indicator May Be Japanese

Japanese industrial production dropped sharply in January 2018, Japan’s Ministry of Economy, Trade, and Industry reported last month. Seasonally-adjusted, the IP index fell 6.8% month-over-month from December 2017. Since the country has very little mining sector to speak of, and Japan’s IP doesn’t include utility output, this was entirely manufacturing in nature (99.79% of the IP index is derived from the manufacturing sector).

Read More »

Read More »

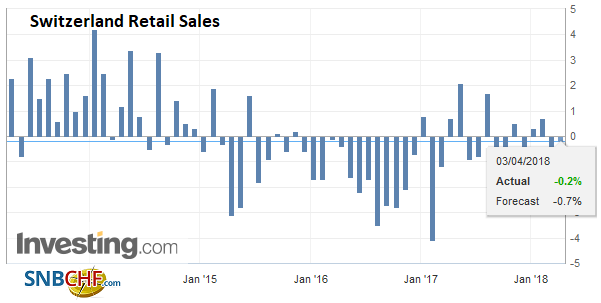

Swiss Retail Sales, February: Stable Nominal and +0.6 Percent Real

Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.2% in February 2018 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered an increase of 0.3%.

Read More »

Read More »

FX Daily, April 03: Markets in Search of Footing

The sell-off in US tech shares dragged the market lower. The S&P 500 fell for the sixth session of the past eight and closed below the 200-day moving average for the first time in a couple of years. The sell-off in Asia and Europe is more muted. The MSCI Asia Pacific Index slipped less than 0.1%. The Hang Seng, an index of H-shares, and Korea's KOSDAQ managed post gains.

Read More »

Read More »

Cool Video: Bloomberg Double Feature

Many are still celebrating the Easter holiday today, but not Tom Keene and Lisa Abramowicz and the Bloomberg team. They hosted me on Bloomberg TV today. As is often the case, the discussion was broad, covering the pressing economic and financial issues.

Read More »

Read More »

Food consumes far less of Swiss budgets than it did 25 years ago

Comparing the most recent statistics on Swiss consumer inflation to those in 1993 reveals a steep drop in the percentage of spending allocated to food. When statisticians calculate consumer price rises they look at the prices of a standard basket of goods. In 1993, food and non-alcoholic beverages made up 14.3% of the value of this standard basket. By 2018, the percentage had fallen to 10.4%, a 27% drop.

Read More »

Read More »

Gold Outperforms Stocks In Q1, 2018

Gold Outperforms Stocks In Q1, 2018. Gold signs off Q1 2018 with best run since 2011. Gold price supported by safe haven demand, interest-rate concerns and inflation. Trade wars and concerns over equity market have sent investors towards gold. ETF holdings highest in nearly a decade. Goldman Sachs: ‘The dislocation between the gold prices and U.S. rates is here to stay’.

Read More »

Read More »

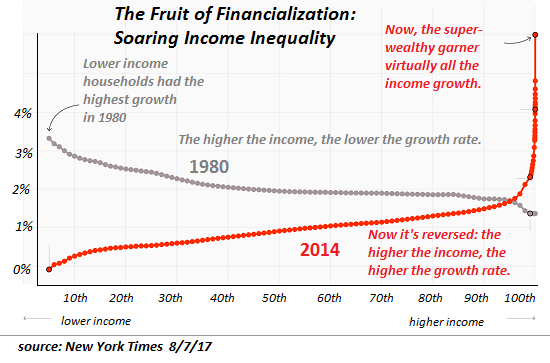

The Problem with a State-Cartel Economy: Prices Rise, Wages Don’t

The vise will tighten until something breaks. It could be the currency, it could be the political status quo, it could be the credit/debt system--or all three. The problem with an economy dominated by state-enforced cartels and quasi-monopolies is that prices rise (since cartels can push higher costs onto the consumer) but wages don't (since cartels can either dominate local labor markets or engage in global wage arbitrage: offshore jobs, move to...

Read More »

Read More »

Trilogie des Fiatgeldes (II): Das fraktionelle Reservesystem, die Mutter aller Finanzkrisen und die Quelle der Ohnmacht der Notenbanken

Genial aus der Sicht der Banken war, dass sie das fraktionelle Reservesystem in das Zeitalter des FED hinüberretten konnten – sie waren selber erstaunt, dass ihnen dies gelang und der Geniestreich nur von einigen wenigen Senatoren und Beobachtern durchschaut wurde. So konnten sie ihr eigenes Buchgeld weiterhin emittieren und dies einzig und allein mit dem Versprechen, es jederzeit in Bargeld umzutauschen.

Read More »

Read More »

FX Daily, April 02: Monday Blues

The US dollar drifted a little lower in Asia to start the week while equities had a slightly heavier bias. The MSCI Asia Pacific Index slipped 0.1%. European bourses are mostly closed for the extended Easter holiday, while the S&P is set to start the new quarter about 0.3% lower. Although the subdued price action may not reflect it, there have been several new economic reports and developments.

Read More »

Read More »

FX Weekly Preview: The Start of Q2

The chief uncertainty has shifted from monetary policy and macroeconomics to the increase of volatility in the stock markets and the prospects of a trade war. Some of the major benchmarks, including the S&P 500, the MSCI Asia Pacific Index, the MSCI Emerging Markets Index, and Shanghai Composite held above the February lows in the retreat during the second half of March.

Read More »

Read More »