Tag Archive: newslettersent

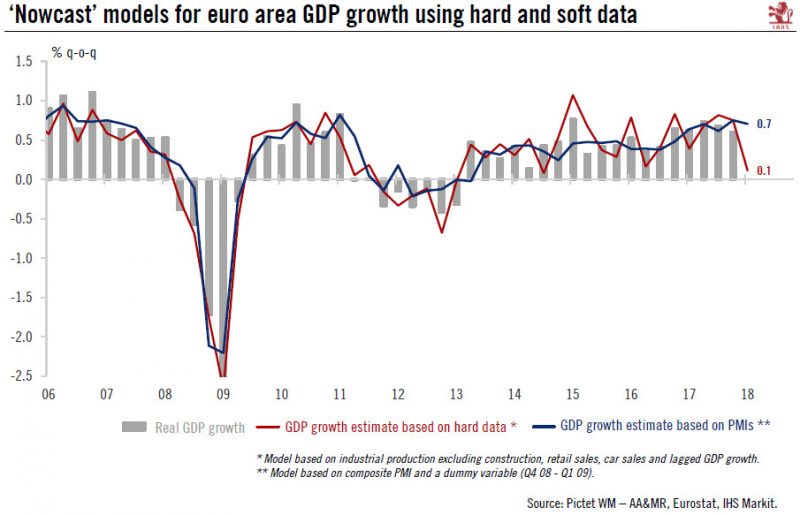

Hard data proves soft in the euro area

Signs of a certain loss of momentum may well fuel additional ECB dovishness in the near term, but is unlikely to compromise upcoming policy normalisation.Euro area industrial production (excluding construction) was weak in February (-0.8% m-o-m) and follows the recent release of other disappointing pieces of hard data such as retail sales, German factory orders and trade. Based on available ‘hard’ data, real GDP growth rate in the euro area is...

Read More »

Read More »

SR Technics to cut jobs at Zurich airport

Aviation support company SR Technics has announced plans to cut a net 200 jobs at Switzerland’s main airport as part of a business review. The company, which is part of China’s HNA group, announced that it could reduce its workforce in aircraft services by as many as 300 positions while adding more than 100 jobs in engine services.

Read More »

Read More »

Emerging Markets: What Changed

Hong Kong Monetary Authority intervened to defend the HKD peg. Moody’s upgraded Indonesia by a notch to Baa2 with a stable outlook. MAS tightened policy by adjusting the slope of its S$NEER trading band up “slightly.” Hungary Prime Minister Orban won a fourth term for his Fidesz party. Poland central bank Governor said it’s possible that the next move will be a rate cut. Russia outlined a range of potential retaliatory measures in response to US...

Read More »

Read More »

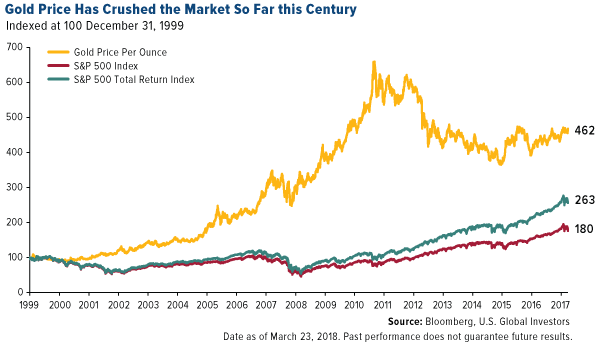

Gold Out Performs Stocks In 2018 and This Century By Ratio Of Two To One

– Gold outperforming stocks in 2018 and this century (see chart)

– Gold up close to 2% in 2018 while S&P 500 is down 2%

– Trump trade wars and Kudlow as Trump chief economic advisor is gold bullish

– Given gold’s performance, Kudlow’s dismissal of gold as “end of the world insurance” is “irrational”

– Market volatility could drive gold to $1,500/oz in 2018 – Holmes

Read More »

Read More »

Elektronisches Zentralbankengeld hat Vorteile

Die Schweizerische Nationalbank hat dem E-Franken eine Absage erteilt – zu Unrecht, sagt Dirk Niepelt im Interview mit finews.ch. Der Direktor des SNB-nahen Studienzentrums Gerzensee erklärt, warum digitales Geld Vorteile bringt. Vergangene Woche hat sich Andréa Mächler, Mitglied des dreiköpfigen Direktoriums der Schweizerischen Nationalbank (SNB), kritisch zur Einführung eines elektronischen Frankens durch die SNB geäussert, wie auch finews.ch...

Read More »

Read More »

Nine out of ten Swiss want to buy less, survey finds

A World Wildlife Fund (WWF) survey published on Monday has found that the majority of people in Switzerland are considering shopping less, and young people are particularly likely to take a critical look at their buying behaviour. The Swiss consume “as if there is no tomorrow”: they fly twice as frequently as their neighbours, buy the heaviest cars in Europe, and produce more waste per capita than in any other nation on earth, the WWF said in a...

Read More »

Read More »

FX Daily, April 13: Markets Struggle to Find Footing while News Stream Improves

It had looked to many investors that world was headed for a trade war and an escalating risk war in Syria. But now it seems less clear. US President Trump's rhetoric on trade took a more constructive tone, and a divided Administration leaves Syria in a bit of a limbo. US equities rallied yesterday, and Asia and European bourses are advancing today, but the conviction may not be particularly strong.

Read More »

Read More »

Great Graphic: Aussie-Kiwi Approaches Trendline

Today is the fifth consecutive session that the Australian dollar has weakened against the New Zealand dollar. It has now fallen to test a three-year old trendline that we show on the Great Graphic, composed on Bloomberg. The last leg down in the Aussie actually began last October, and through today's low, it is off by a little more than 7%.

Read More »

Read More »

US Gold & Silver Futures Markets: “Easy” Targets

Following news coverage of the charging of five precious metals traders and three banks in January, Commodities Futures Trading Commission and Department of Justice documents reveal a global criminal cabal of 16 traders operating in at least four major financial institutions between 2008 and 2015 to defraud COMEX gold and silver futures markets.

Read More »

Read More »

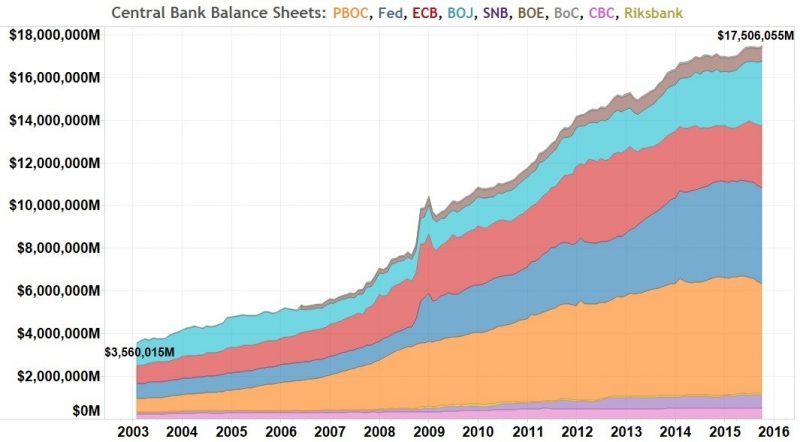

Création monétaire: Entente illégale entre banques centrales et commerciales sur fond de silence politique

Création monétaire: Entente illégale entre banques centrales et commerciales sur fond de silence politique. Les crises permanentes du marché financier ont permis, aux banques centrales qui comptent, de justifier des programmes communs de quantitative easing. Cela consiste en une transformation de la monnaie bancaire scripturale en centrale, passée en mains des banques centrales. Ainsi, celles-ci offrent au marché de la haute finance un socle...

Read More »

Read More »

Cross-border workers in Geneva face ‘toxic’ environment

Cross-border workers are tired of being the target of political attacks in Geneva, says the president of a French-Swiss cross-border lobby group, who calls for a change in current rhetoric to prevent future damage to the Swiss economy. For Michel Charrat, president of the Groupement transfrontalier européenexternal link, disenchantment between Geneva and its cross-border workers may be at its lowest point.

Read More »

Read More »

FX Daily, April 12: Geopolitics Overshadow the Fed, Greenback Steadies

The US dollar steadied at lower levels, while equities eased as investors remain focused on the preparations to strike Syria and still tense rhetoric on trade. Reports indicate that the US and France have moved warships into the area and the UK has moved submarines within striking distance as well.

Read More »

Read More »

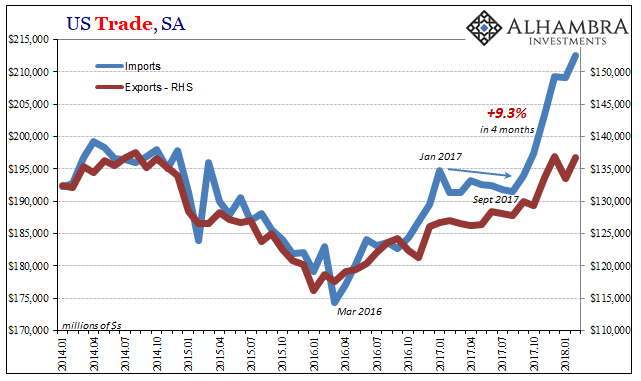

US Imports Don’t Quite Match Chinese Exports

In early 2015, a contract dispute between dockworkers’ unions and 29 ports on the West Coast of the US escalated into what was a slowdown strike. Cargoes piled up especially at some of the largest facilities like those in Oakland, LA, and Long Beach, threatening substantial economic costs far and away from just those directly involved. Each side predictably blamed the other for it.

Read More »

Read More »

Vers une décroissance inéluctable

Nous avertissons depuis quelques années sur les risques de récession. La déflation de la BNS qui s’est installée en 2011 en était un indicateur avancé. Le risque d’un effondrement global de l’économie ne peut être exclu pour les temps à venir.

Read More »

Read More »

FX Daily, April 11: Mr Market Waits for Other Shoe to Drop

Between Syria, trade tensions, and the US special investigator into Russia's attempt to influence the US election, market participants are cautious as they wait for another shoe to drop. The US equity market recovery yesterday has short coattails as markets in Asia and Europe struggle. Bond yields are mostly softer, and the US 10-year note yield is dipping back below 1.80%.

Read More »

Read More »

Understanding the Latest International Reserve Figures

At the end of every quarter, the IMF publishes the most authoritative reserve data with a three-month lag. On Good Friday, the IMF published Q4 17 reserve holdings. A recent article on Bloomberg played up an economist's forecast that euro reserves would increase by $500 bln over the next couple of years. A review of the reserve data may help us evaluate such a claim, which if true, could have important implications for international investors.

Read More »

Read More »

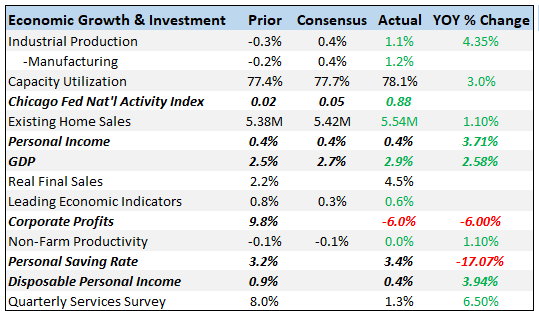

Bi-Weekly Economic Review: Investing Is Not A Game of Perfect

The market volatility this year has been blamed on a lot of factors. The initial selloff was blamed on a hotter than expected wage number in the January employment report that supposedly sparked concerns about inflation – although a similar number this month wasn’t mentioned as a cause of last Friday’s selling. The unwinding of the short volatility trade exacerbated the situation and voila, 12% came off the market in a matter of days.

Read More »

Read More »

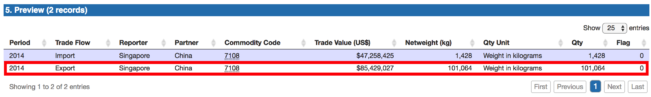

China’s Secret Gold Supplier Is Singapore

Since 2013 China continues to absorb physical gold from the rest of the world at a staggering pace. Worth noting is that gold imported into the Chinese domestic market is not allowed to be returned in the foreseeable future. Because ownership and the disposition of these volumes of gold likely will be of great importance next time around the international monetary system is under stress, it’s well worth tracking China’s progress of imports –...

Read More »

Read More »

The important role of official statistics in a world of fact, fiction and everything in between

Facts provide the foundation for political and social dialogue. But what happens when instead of facts, purposely spread untruths begin to dominate that dialogue? And what can be done about it, or better still, what can be done to stop it? Possible answers can be found at the conference entitled “Truth in numbers - the role of data in a world of fact, fiction and everything in between" that highlights the importance of official statistics for...

Read More »

Read More »