Tag Archive: newslettersent

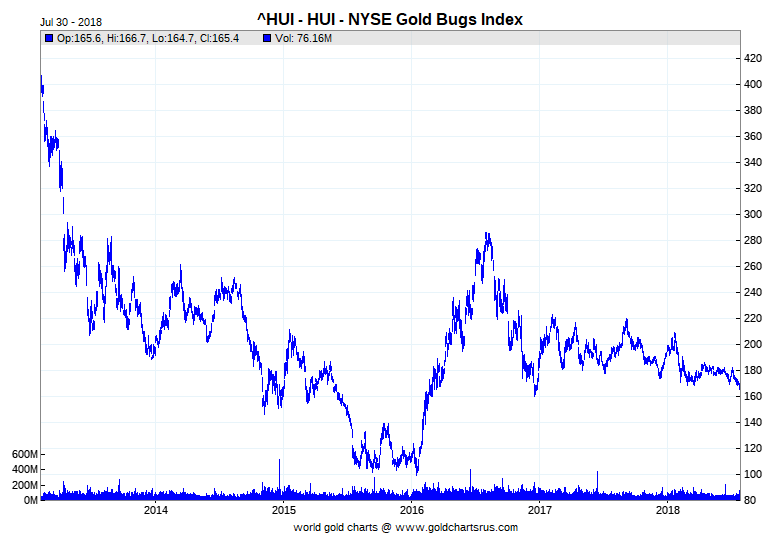

Spotlight on the HUI and XAU Gold Stock Indexes

Probably the two best known gold mining stock indexes in the world’s financial markets are the HUI and the XAU. HUI is the ticker symbol for the NYSE Arca Gold BUGS Index. XAU is the ticker symbol for the Philadelphia Gold and Silver Index. Both of these monikers make an appearance on many gold related websites and many general financial market websites as well, so its worth knowing briefly what these indexes are and what they represent.

Read More »

Read More »

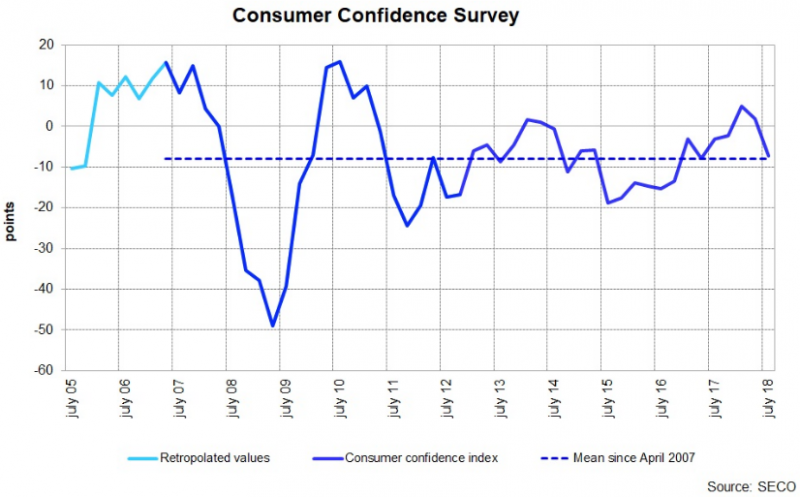

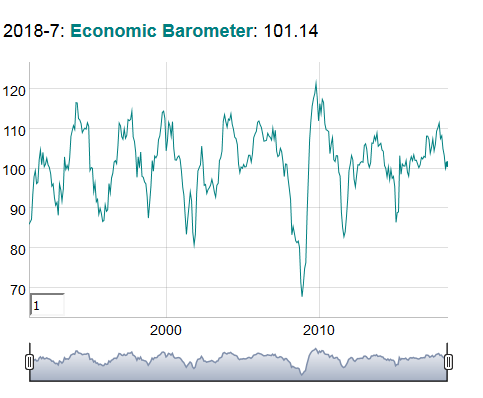

Swiss Consumer Sentiment Falls Almost back to its Average

Consumer sentiment in Switzerland has almost dropped back to its long-term average. While consumers still expect a positive economic development, they are less optimis-tic than in recent quarters. Consumers' expectations regarding their own budget also remain subdued, while they adjusted their assessment of inflation upwards. Corre-spondingly, the likelihood of consumers making major purchases remains low.

Read More »

Read More »

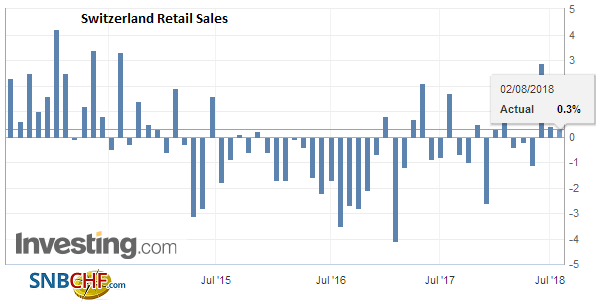

Swiss Retail Sales, June: +1.1 percent Nominal and +0.3 percent Real

Turnover in the retail sector rose by 1.1% in nominal terms in June 2018 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

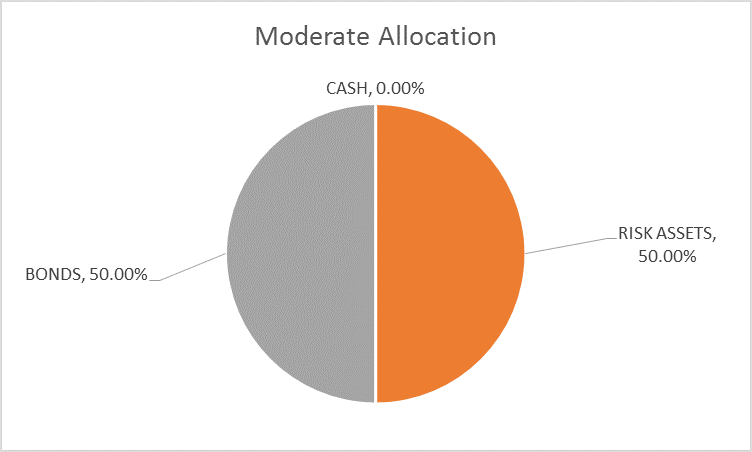

Global Asset Allocation Update

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY.

Read More »

Read More »

Switzerland’s young socialists restart the debate on first class train seats

Recently, members of the young socialists raised the debate of the social inequalities associated with two ticket classes again while on trains travelling between Fribourg and Bern. They complain that at periods of peak demand second class carriages are overflowing, while first class ones often have space and spare seats.

Read More »

Read More »

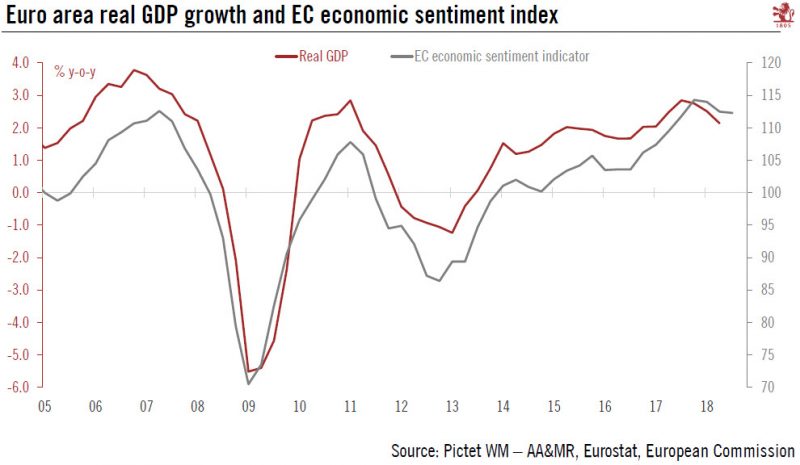

Revising our euro area 2018 GDP growth forecast down

The cut to our growth forecast reflects slippage in euro area data.According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018, below consensus expectations. This was the weakest growth in two years and is down slightly from GDP growth of 0.4% q-o-q in Q1.Following today’s GDP growth data and recent economic indicators, we have revised down our GDP growth forecast for 2018.

Read More »

Read More »

FX Daily, August 01: Trade and Japan Drive Markets Ahead of Stand Pat Fed

Investors recognize the risks to growth posed by the tariffs and counter-tariffs being imposed, but the way the US is going about it is also disconcerting. Within a few hours of signals that the US and China were looking to re-engage in high-level talks, which have not taken place for two months according to reports, the US signaled that the 10% tariff on $200 bln of Chinese goods could now face a 25% tariff instead.

Read More »

Read More »

Russia Sells 80 percent Of Its US Treasuries

Russia Sells 80% Of Its US Treasuries. Description: In just over 2 months Russia has sold-off over 85% of its holdings of U.S. Treasuries, should the U.S. be concerned? – Russia has liquidated 85% of its US Treasury holdings in just two months. – Russia dumps over $90 billion of Treasuries in April and May as holdings collapse from near $100 billion to just $9 billion.

Read More »

Read More »

Tensions Beyond Trade

Chinese officials do not seem to appreciate the extent of its isolation. The disruption from the US as Trump positions the US as a revisionist power-one that wants to alter the world order, which it was instrumental in constructing, may have obscured the fact that China's practices are a source of frustration and animosity broadly and widely.

Read More »

Read More »

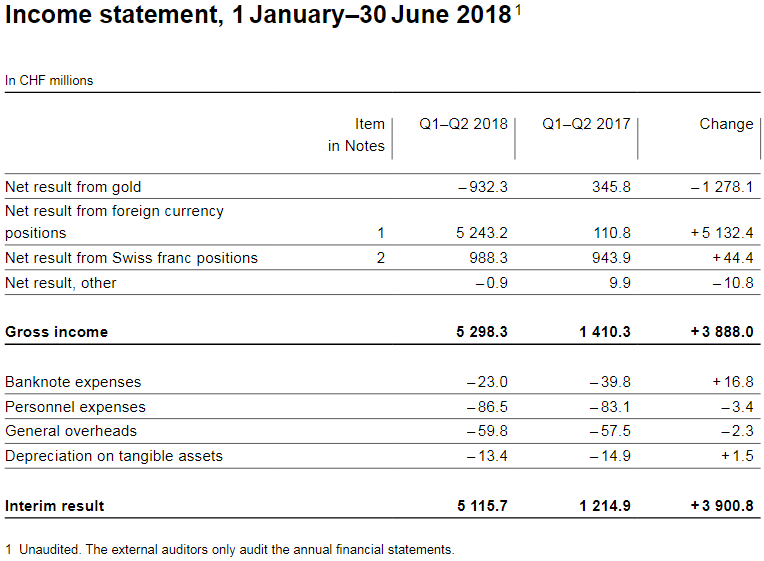

Central bank back in the black after shaky 2018 start

The Swiss National Bank (SNB) has reported strong profits for the first half of the year, largely thanks to a weakening franc and gains in the foreign currency market. The results, published in an SNB press releaseon Tuesday, show overall profits of CHF5.11 billion ($5.17 billion) for the first six months of 2018, compared with CHF1.22 billion the previous year.

Read More »

Read More »

SNB reports a profit of CHF 5.1 billion for the first half of 2018

The Swiss National Bank (SNB) reports a profit of CHF 5.1 billion for the first half of 2018. A valuation loss of CHF 0.9 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.2 billion. The profit on Swiss franc positions was CHF 1.0 billion.

Read More »

Read More »

FX Daily, July 31: BOJ Prepares for QE Infinity

The Japanese yen has been sold following the adjustments to policy and outlook by the BOJ that will allow the unconventional policies continue for an "extended period of time." Cross rate pressure and month-end demand have lifted the euro and sterling through yesterday's highs.

Read More »

Read More »

Swatch Group withdraws from Baselworld

With the departure of its largest exhibitor from 2019, it’s yet another setback for the world’s largest watch and jewellery trade show, which has seen participation dwindle in recent years.

Read More »

Read More »

Great Graphic: USD Pushes Below CAD1.30

For the first time since mid-June, the US dollar has traded below CAD1.30. The greenback is weaker against all the major currencies. However, for the most part, it is still in well-worn ranges, which makes the breakdown against the Canadian dollar even more notable. It is not clear that today's break will be sustained. Indeed, we lean against it.

Read More »

Read More »

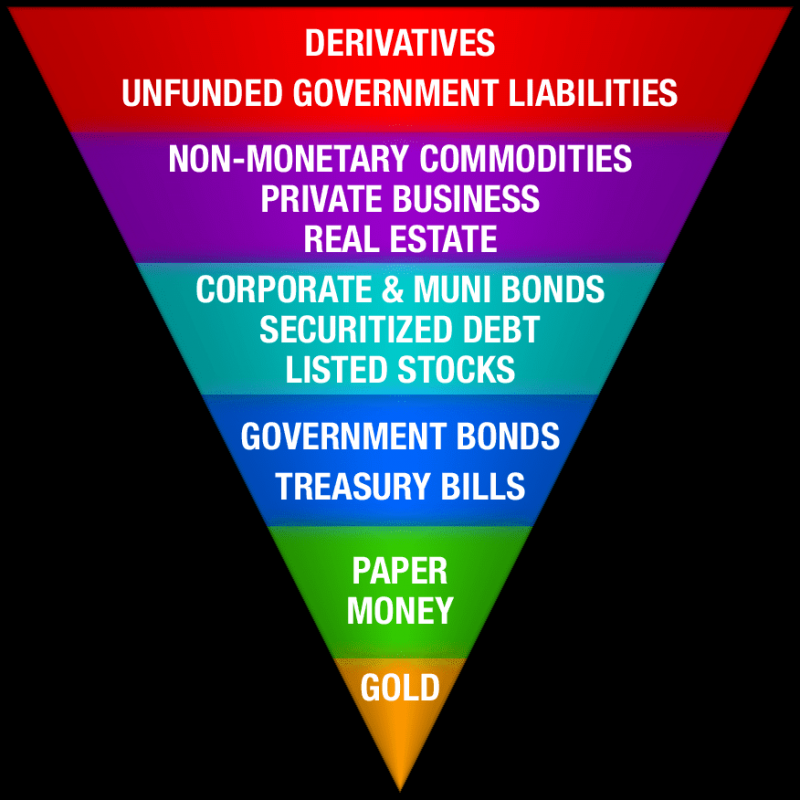

A Dire Warning, Report 29 July 2018

Let’s return to our ongoing series on the destruction of capital, and how to identify the signs. Steve Saville posted a thoughtful article this week entitled The “Productivity of Debt” Myth. His article provides a good opportunity to add some additional thoughts. We have written quite a lot on this topic. Indeed, we have a landing page for marginal productivity of debt (MPoD) with four articles so far.

Read More »

Read More »

Here’s What We’ve Lost in the Past Decade

The confidence and hubris of those directing the rest of us to race off the cliff while they watch from a safe distance is off the charts. The past decade of "recovery" and "growth" has actually been a decade of catastrophic losses for our society and nation. Here's a short list of what we've lost: 1. Functioning markets. Free markets discover price and assess risk.

Read More »

Read More »

FX Daily, July 30: Equities, Bonds, and the Dollar Start Week Softer

The week's big events lie ahead. It is seen as the last important week before the dog days of summer when many participants will take holidays. The BOJ's two-day meeting concludes tomorrow. Speculation that the BOJ is looking for ways to tweak its program continues to spur a small taper-lite tantrum in Tokyo.

Read More »

Read More »

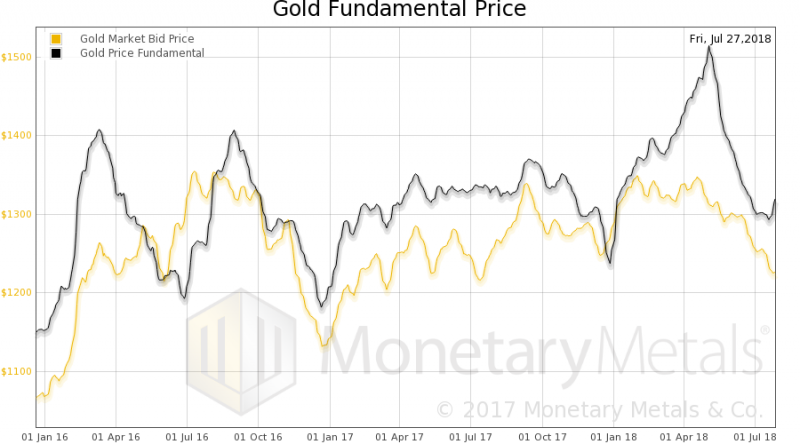

Valuing Gold In A World Awash With Dollars

In this article I point to the pressures on the Fed to moderate monetary policy, but that will only affect the timing of the next cyclical credit crisis. That is going to happen anyway, triggered by the Fed or even a foreign central bank. In the very short term, a tendency to moderate monetary policy might allow the gold price to recover from its recent battering.

Read More »

Read More »