Tag Archive: newslettersent

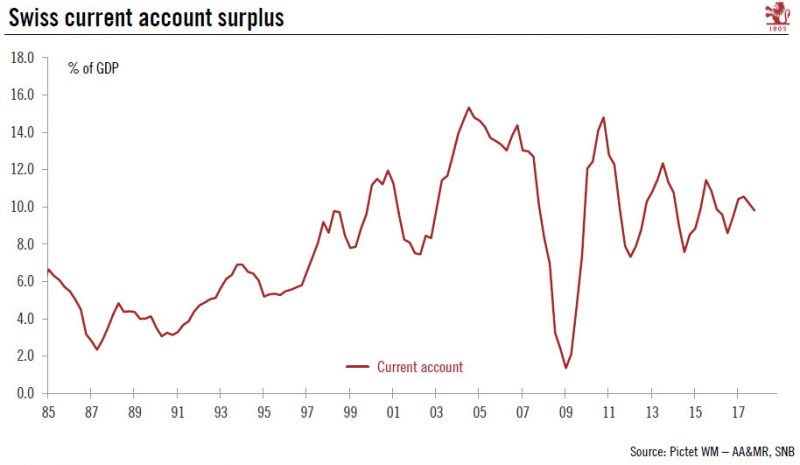

Switzerland, still on the monitoring list

The U.S. Department of Treasury has just published its semi-annual report on International Economic and Exchange Rate Policies. It comes at a time when the US Administration remains deeply concerned by the significant trade imbalances in the global economy. The report only focuses on the US’s 12 largest trading partners, which collectively account for more than 70% of the US’s trade in goods.

Read More »

Read More »

Insurance boss suggests Swiss health insurance deductibles of 10,000 francs

Philomena Colatrella, the CEO of Swiss insurer CSS Insurance, has stirred the lively debate around Switzerland’s rising cost of health insurance by proposing deductibles of CHF 5,000 and CHF 10,000 – deductibles set the amount people pay out of their own pockets before their insurance kicks in.

Read More »

Read More »

FX Daily, April 18: Greenback is Firm, While Soft Inflation Drags Sterling from Perch

The US dollar is enjoying a firmer tone against major and most emerging market currencies. Sterling, which has become a market darling, hit an air pocket after softer than expected CPI. UK headline CPI rose 0.1% in March, while the market expected a 0.3% increase. The recently introduced preferred measure, CPIH slipped to 2.3% from 2.5%, the weakest in a year.

Read More »

Read More »

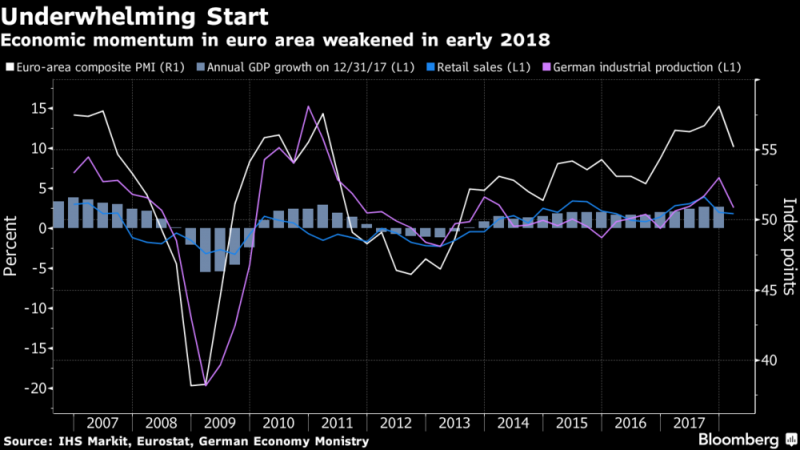

EU and Euro Exposed To Risks Including Trade Wars and War With Russia In Middle East

– EU and euro face growing risks including trade wars, energy independence and war with Russia in Middle East. – Middle East war involving Russia may badly impact energy dependent & fragile EU. – Trade and actual wars on European doorstep show the strategic weakness of the EU. – Toxic combination due to growing anti-EU and anti-Euro sentiment in many EU nations.

Read More »

Read More »

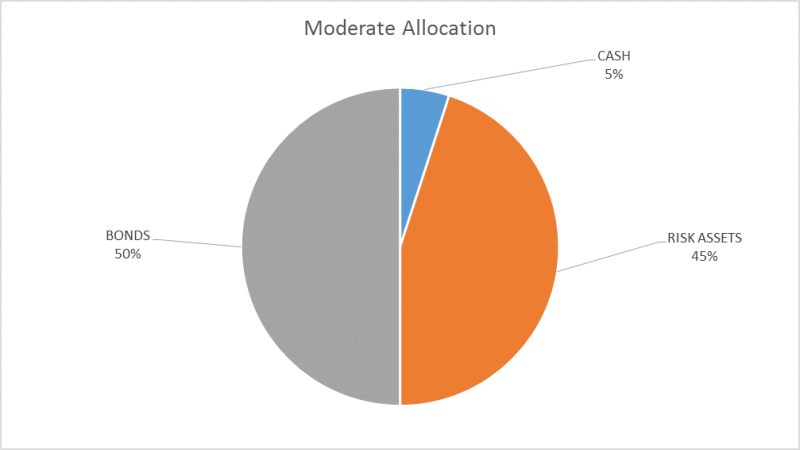

Global Asset Allocation Update: The Certainty of Uncertainty

There is no change to the risk budget this month. For the moderate risk investor, the allocation to bonds is 50%, risk assets 45% and cash 5%. Stocks continued their erratic ways since the last update with another test of the February lows that are holding – for now. While we believe growth expectations are moderating somewhat (see the Bi-Weekly Economic Review) the change isn’t sufficient to warrant an asset allocation change.

Read More »

Read More »

Geneva hotels are the most expensive in Europe

Staying in a hotel in Geneva costs more than anywhere else in Europe, according to an international survey. The €242.90 (CHF288 or $300) average charge per night puts Geneva ahead of Paris (€232.30), while Zurich is listed as the third most expensive destination at €203.90. The Hotel President Wilson in Geneva reportedly boasts the most expensive overnight tariff in the world, charging around CHF80,000 ($83,300) to stay in its royal penthouse...

Read More »

Read More »

FX Daily, April 17: Dollar Recovers from Further Selling as Turnaround Tuesday Unfolds

After the retreating in the North American session yesterday, despite a rebound in retail sales after three-months of declines, the greenback has been sold further in Europe and Asia. The euro edged through last week's high near $1.24, and sterling rose through the January high to reach its best level since the mid-2016 referendum. Sterling rose through $1.4375 before the easing after the employment report.

Read More »

Read More »

Silent Circle founder joins metals-backed crypto coin project

Renowned cryptographer Philip Zimmermann, who moved his smartphone encryption firm Silent Circle to Switzerland four years ago, has signed up to the metals-backed crypto Tiberius Coin venture as chief science and security officer. Zimmermann, who was inducted into the Internet Hall of Fame by the Internet Society in 2012, came to Switzerland to further develop his anti-snooping Blackphone away from invasive surveillance techniques in his native...

Read More »

Read More »

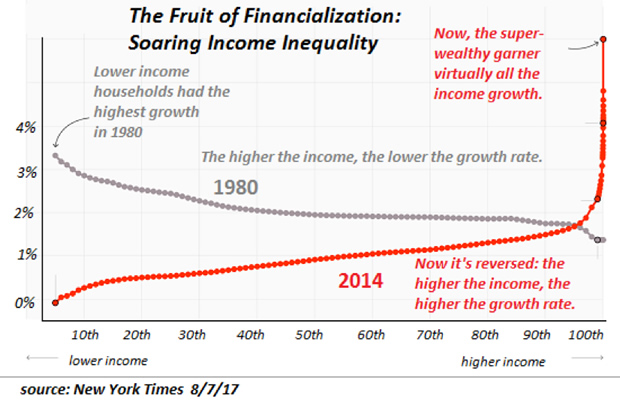

Why Trade Wars Ignite and Why They’re Spreading

What ignites trade wars? The oft-cited sources include unfair trade practices and big trade deficits. But since these have been in place for decades, they don't explain why trade wars are igniting now. To truly understand why trade wars are igniting and spreading, we need to start with financial repression, a catch-all for all the monetary stimulus programs launched after the Global Financial Meltdown/Crisis of 2008/09.

Read More »

Read More »

Negative Rates: Rise of the Japanese Androids

One of the unspoken delights in life is the rich satisfaction that comes with bearing witness to the spectacular failure of an offensive and unjust system. This week served up a lavish plate of delicious appetizers with both a style and refinement that’s ordinarily reserved for a competitive speed eating contest. What a remarkable time to be alive.

Read More »

Read More »

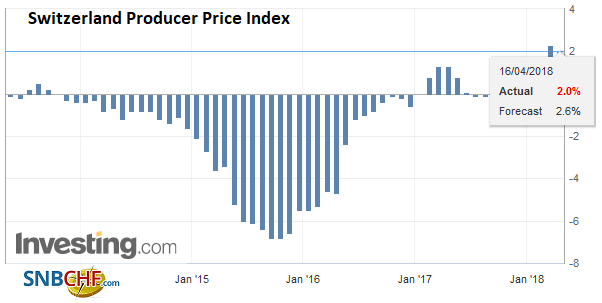

Swiss Producer and Import Price Index in March 2018: +2.0 percent YoY, +0.2 percent MoM

The Producer and Import Price Index fell in March 2018 by 0.2% compared with the previous month, reaching 102.3 points (December 2015 = 100). This decline was due in particular to lower prices for petroleum products and pharmaceutical preparations. Compared with March 2017, the price level of the whole range of domestic and imported products rose by 2.0%. These are some of the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Swiss welfare recipient made to repay 173,000 francs

In some parts of Switzerland welfare payments are effectively loans that must be repaid when the recipient’s financial situation improves. According to the Aargauer Zeitung, a welfare recipient in the commune of Klingnau in the canton of Aargau received a bill of 173,000 francs after he came into some money. A windfall of 173,000 francs is rare, according to Rolf Walker, head of administration at the commune.

Read More »

Read More »

FX Daily,April 16: Market Struggles for Direction

The Syrian strike over the weekend, and the official indication that "mission accomplished" and that was a limited one-off strike has spurred little market reaction. There is one more loose end, as it were, and that is that the US has indicated it will announce additional sanctions on Russia for its involvement in Syria's chemical weapon use. The ruble is volatile but slightly firmer to start the week, and while dollar-bond yields are firmer, the...

Read More »

Read More »

FX Weekly Preview: Still Looking for Terra Firma

The weekend strike by the US, British and French forces against Syria appear to have been conducted in ways that minimize the risks of escalation by Russia. The limited nature of the strike and objectives suggest that the impact on the constellation of forces in Syria will be minimal. There is unlikely to be much of an impact in the global capital markets, though thin markets in early Asia could see a knee-jerk effect.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mixed Friday, capping a mixed week as a whole. COP, CLP, and MXN were the best performers last week, while RUB, BRL, and TRY were the worst. While concerns about trade wars and Syrian missile strikes have ebbed, risks to EM remain elevated. US retail sales Monday and Fed Beige Book Wednesday are the economic highlights this week.

Read More »

Read More »

“Swissleaks” author arrested in Spain at Switzerland’s request

According to Tribune de Genève, Hervé Falciani was arrested in Madrid last week at Switzerland’s request. In 2008, Falciani a French-Italian who grew up in Monaco, took confidential information from the Geneva offices of HSBC, his employer, and fled to Lebanon where some claim he attempted to sell it. Later he shared the information with authorities in France and sought refuge there in 2009.

Read More »

Read More »

Great Graphic: Loonie Takes Big Step toward Technical Objective

For a little more than two weeks, we have been monitoring the formation of a possible head and shoulders top in the US dollar against the Canadian dollar. The neckline broke a week ago. It is not uncommon for the neckline to be retested after the break. That was what happened yesterday. The US dollar recorded an outside down day yesterday.

Read More »

Read More »

The Genie’s Out of the Bottle: Eight Defining Trends Are Reversing

Though the Powers That Be will attempt to placate or suppress the Revolt of the Powerless, the genies of political disunity and social disorder cannot be put back in the bottle. The saying "the worm has turned" refers to the moment when the downtrodden have finally had enough, and turn on their powerful oppressors.

Read More »

Read More »

Trump Tweets Russia “Get Ready” For Missiles In Syria – Gold, Oil Rise and Stocks Fall

Dow set to drop 300 points at open after Trump tweet today. Stocks see sell off and gold pops to test resistance at $1,350/oz. US stock futures suggest over 1% losses at New York open. Oil surged to a two-week high and has surged nearly 7% this week. U.S. bombing Syria may provoke escalation of conflict with Russia and wider conflict in volatile Middle East.

Read More »

Read More »

Monnaie pleine… ou monnaie vide?

Dans cette contribution critique de l’initiative, l’auteure souligne l’insuffisance totale de gages ou richesses tangibles pour couvrir la production massive d’une «monnaie centrale».

Read More »

Read More »