Tag Archive: newslettersent

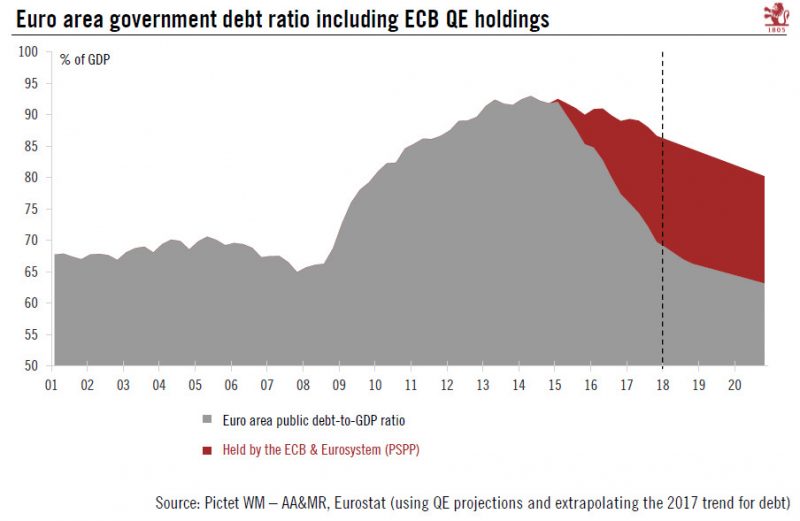

Europe chart of the week – public debt

This week’s Eurostat releases revealed that public finances continue to improve in most euro area member states. As a result of falling deficits, low interest rates and stronger nominal growth, the ratio of euro area government debt to GDP fell to a six-year low of 86.7% in Q4 2017.

Read More »

Read More »

Unions seek to blacklist Swiss firms that underpay women

The workers’ union umbrella group Travail Suisse is calling for the introduction of a blacklist to shame Swiss companies that fail to pay women and men equally. This is one of 28 recommendations which feature in a position paper published by Travail Suisse external linkon Monday, on the eve of International Workers’ Day.

Read More »

Read More »

FX Daily, May 03: Respite to Dollar Short Squeeze

The Australian dollar is higher for a second session. It has been helped today by stronger than expected data in the form of a larger than expected March trade surplus (A$1.57 bln vs. expectations for A$865 mln) and building permits up more than twice as expected (2.6% vs. 1.0%). Today is the first session since April 19 that the Australian dollar has risen above the previous day's high. Initial resistance is seen near $0.7550 and then $0.7580.

Read More »

Read More »

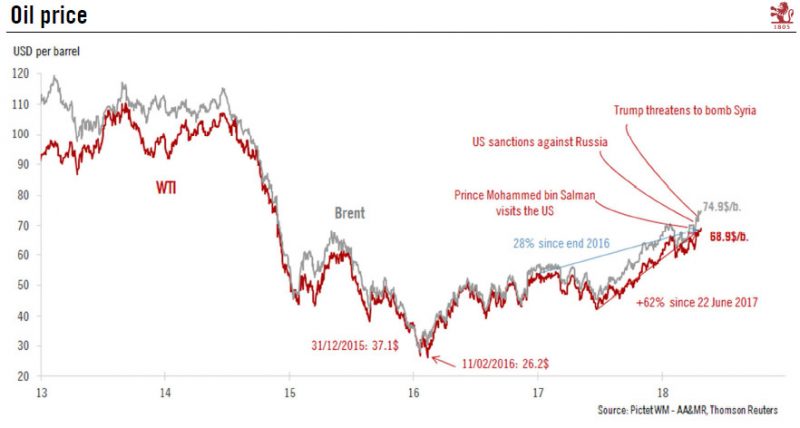

Where next for oil prices?

On 19 April, the price of a barrel of oil reached USD69.56 for West Texas Intermediate (WTI) and reached USD75.27 for Brent, today, the highest price since 2014. Since 9 April, oil prices have been significantly above their longterm fundamental equilibrium value. Three factors explain what has happened.

Read More »

Read More »

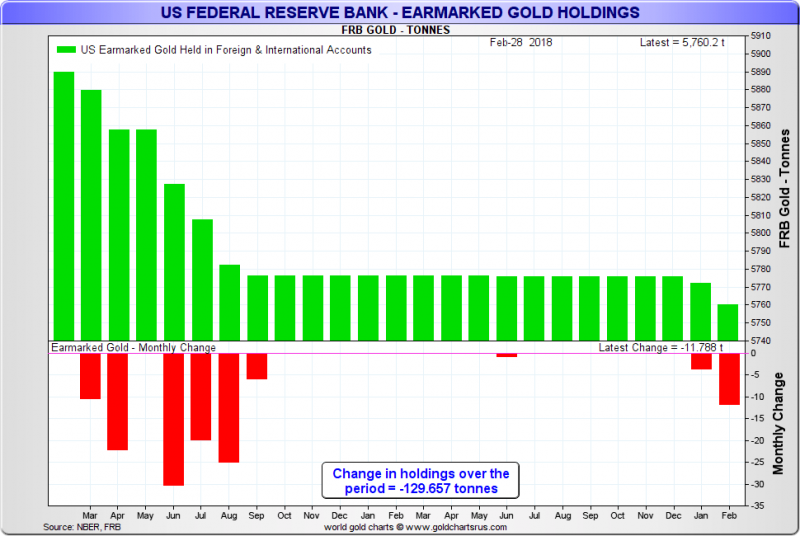

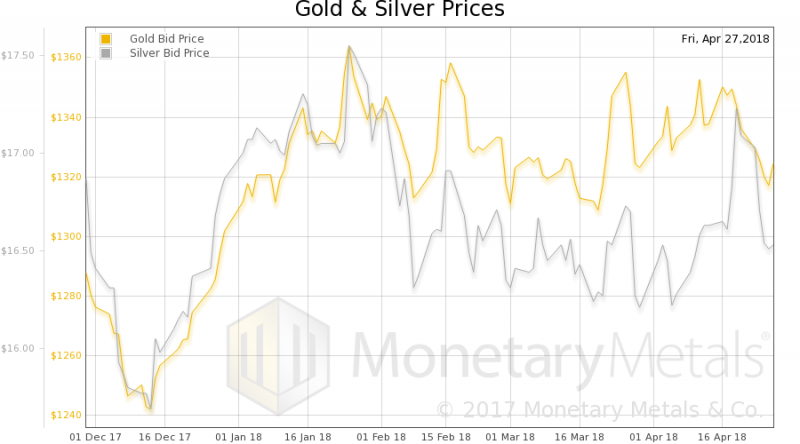

Turkey and Russia Highlight Gold’s Role as a Strategically Important Asset

On 17 April, Turkish news publication Ahval published a report stating that during 2017, Turkey withdrew 26.8 tonnes of gold that it had stored in the vaults of the New York Federal Reserve, and moved this gold under the custodianship of the Bank of England and the Bank for International Settlements (BIS). The source of the Ahval report was a Turkish language article from the popular Hürriyet newspaper in Turkey.

Read More »

Read More »

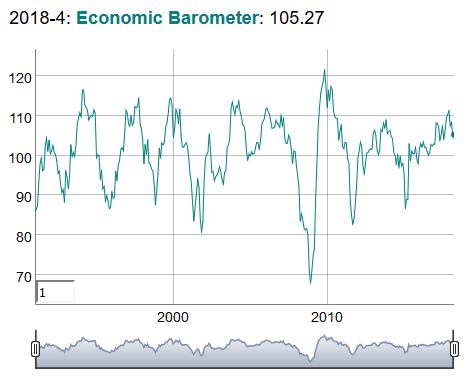

Konjunktur, Geldpolitik und eine riesige Bilanzsumme

Die Schweizer Konjunktur brummt wie schon lange nicht mehr. Vor allem zeigt der kürzlich publizierte Bericht der Seco-Expertengruppe, dass die Erholung auf breiter industrieller Basis stattfindet. Der Frankenschock von 2015 ist definitiv überwunden.

Read More »

Read More »

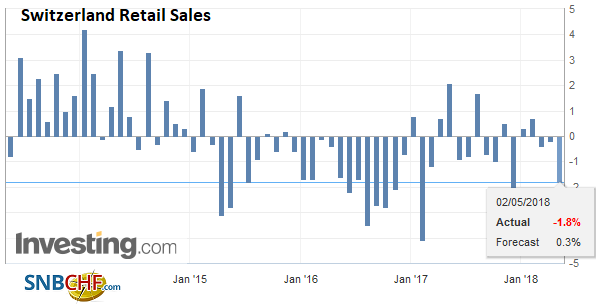

Swiss Retail Sales, March: -1.2 Percent Nominal and +0.1 Percent Real

Neuchâtel, 2 May 2018 (FSO) – Turnover in the retail sector fell by 1.2% in nominal terms in March 2018 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

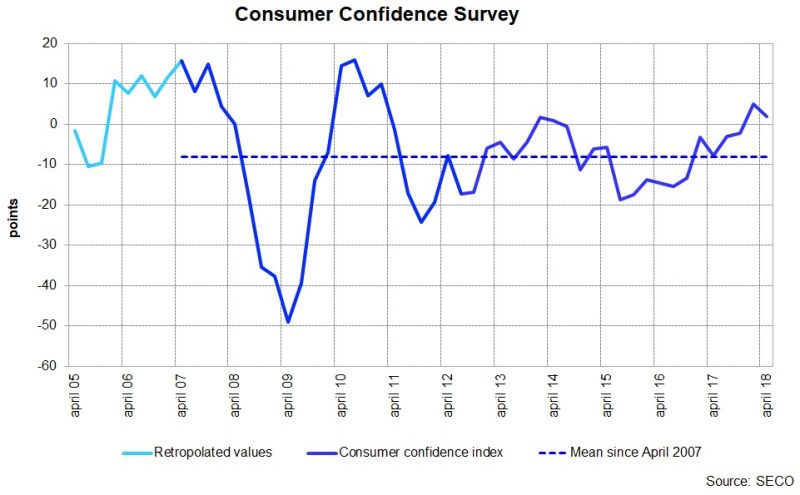

Swiss Consumers remain optimistic

The consumer sentiment index* stands at 2 points in April 2018, once again putting it significantly above its long-term average (-9 points). The index has fallen slightly since last January (5 points). But essentially, it has remained on the highest level since 2014.

Read More »

Read More »

Some Swiss train fares to fall in June

This week, ch-direct, an association of public transport providers that sets ticket prices, announced there would be no ticket price rises in 2019. Instead the prices of some tickets will fall slightly on 1 June 2018. The price small cuts on standard fares in June relate to the shift from 8.0% to 7.7% VAT at the beginning of the year.

Read More »

Read More »

FX Daily, May 02: Confident Fed Key to New Found Respect for the Dollar

There is a brief respite in the powerful short squeeze that has fueled the dollar's dramatic recovery. The greenback which was nearly friendless a month ago now has many suitors. It is higher on the year against all the major currencies but the yen (~2.6%), the Norwegian krone (~1.6%) and sterling ~0.9%). It is virtually flat against the euro.

Read More »

Read More »

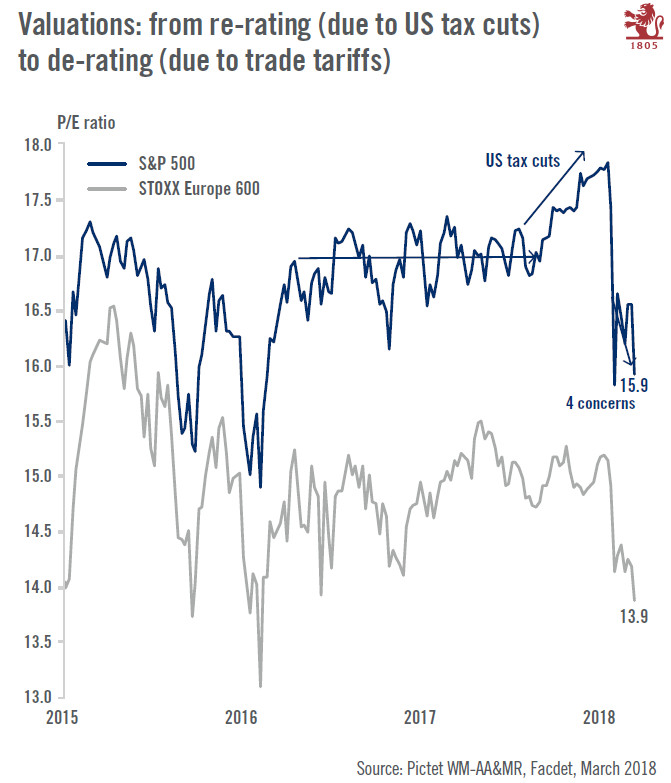

House View, April 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes. While macroeconomic and corporate fundamentals still favour risk assets, challenges have been steadily increasing and a lot of good news is already priced into valuations. We sold part of our equity overweight during the early March rally.

Read More »

Read More »

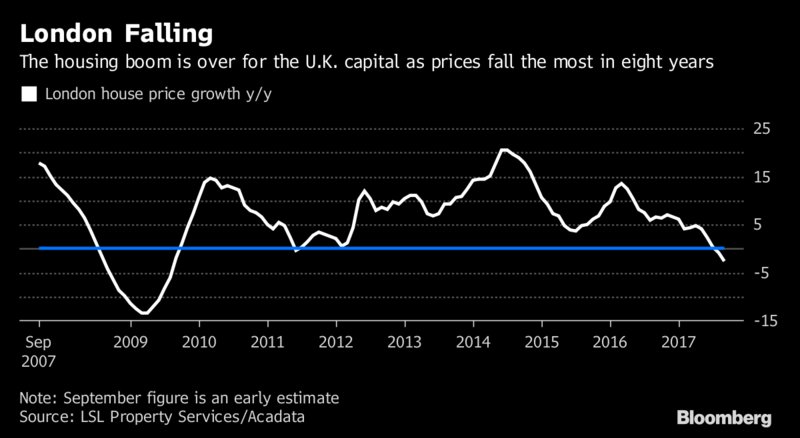

London House Prices See Fastest Quarterly Fall Since 2009 Crisis

London house prices fell by 3.2% in the first quarter – Halifax. Brexit, financial and geo-political uncertainty lead to falls. Excluding sale of seven £10m-plus houses in London, prices were down 3.4% in the year. UK house prices climb by just 0.4% in April, the slowest increase since 2008 for same period. Sales transactions fall by 19% and asking versus selling prices show turning into buyers’ market. Homeowner or not, buy physical gold to hedge...

Read More »

Read More »

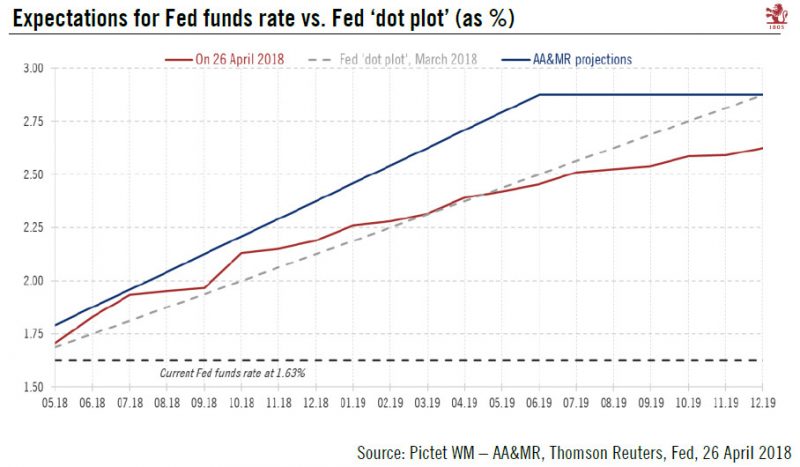

Euro weakness should prove temporary

Over the past 10 days, the euro has declined significantly against the US dollar. On 26 April, the EUR/USD rate moved below the low of its 1.21501.2550 trading range, which had been in place since 18 January. Reasons for this decline can be found in the growth differential and monetary policy divergence.

Read More »

Read More »

French strike limits rail links with Switzerland

Rail services between Switzerland and France are limited on Saturday, owing to a strike by French workers against railway reforms. Most high-speed train (TGV) services have been cancelled, with the exception of six return journeys between Paris and Zurich (2), Paris and Geneva (2) and Paris and Lausanne. A similar service is planned for Sunday.

Read More »

Read More »

FX Daily, May 01: Little Help on May Day

Most of the world's financial centers are closed for the May Day holiday, but the lack of participation has not prevented the extension of the US dollar's recovery. The Dollar Index has traded above its 200-day moving average for the first time in a year.

Read More »

Read More »

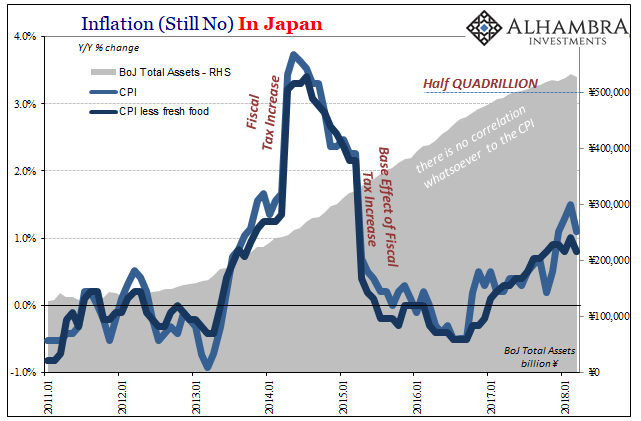

Transitory’s Japanese Cousin

Thomas Hoenig was President of the Federal Reserve’s Kansas City branch for two decades. He left that post in 2011 to become Vice Chairman of the FDIC. Before that, Mr. Hoenig as a voting member of the FOMC in 2010 cast the lone dissenting vote in each of the eight policy meetings that year (meaning he was against QE2, too). This makes him, apparently, the hawk of all hawks.

Read More »

Read More »

“Was Vollgeld bringt – und was nicht (Sovereign Money—Pluses and Minuses),” SRF, 2018

Wer soll Franken herstellen dürfen? Nur die Schweizerische Nationalbank, oder auch die Geschäftsbanken wie UBS, CS oder die Kantonalbanken? Ginge es nach der Vollgeld-Initiative, über die wir am 10. Juni abstimmen, wäre künftig klar: Geld als gesetzliches Zahlungsmittel gäbe es nur von der SNB.

Read More »

Read More »

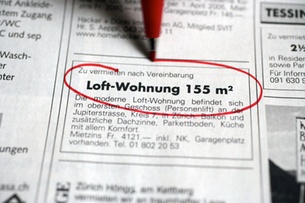

One in four Swiss tenants wants to move, but can’t

More than a quarter of tenants in Switzerland are unhappy with their accommodation, but are unable to move – especially for financial reasons. A survey published by online price comparison portal comparis.chexternal link on Thursday has found that 26% of Swiss tenants consider their housing situation to be unsatisfactory. Of the 4,000 tenants surveyed, 67% said that they could not afford to move to a better place.

Read More »

Read More »