Tag Archive: newslettersent

FX Daily, August 07: Turn Around Tuesday for the Greenback

The US dollar is pulling back today after yesterday's advance. All the major currencies are higher and even the Turkish lira, which plunged nearly 5% yesterday to cap a six-day slide, is trading firmer today ([email protected]). The dollar's losses are modest and appear corrective in nature.

Read More »

Read More »

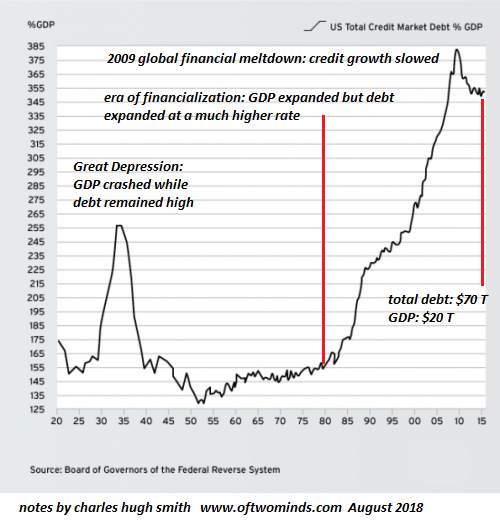

We’ll Pay All Those Future Obligations by Impoverishing Everyone (How to Destroy Our Currency In One Easy Lesson)

The only way to pay all these future obligations is by creating new money. I've been focusing on inflation, which is more properly understood as the loss of purchasing power of a currency, which when taken to extremes destroys the currency and the wealth/income of everyone forced to use that currency.

Read More »

Read More »

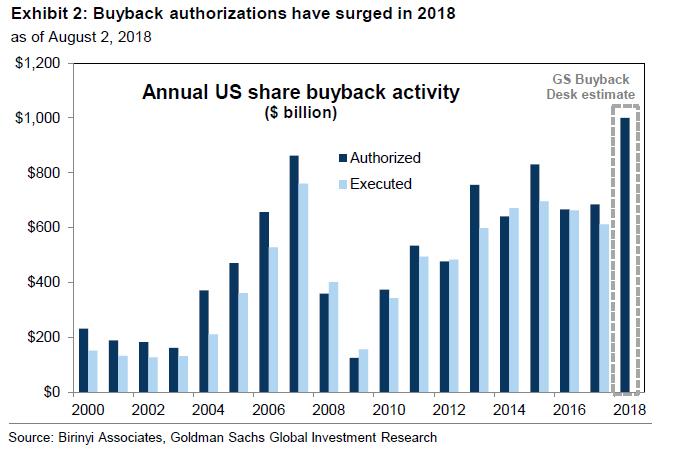

Goldman: You Are Asking The Wrong $1 Trillion Question

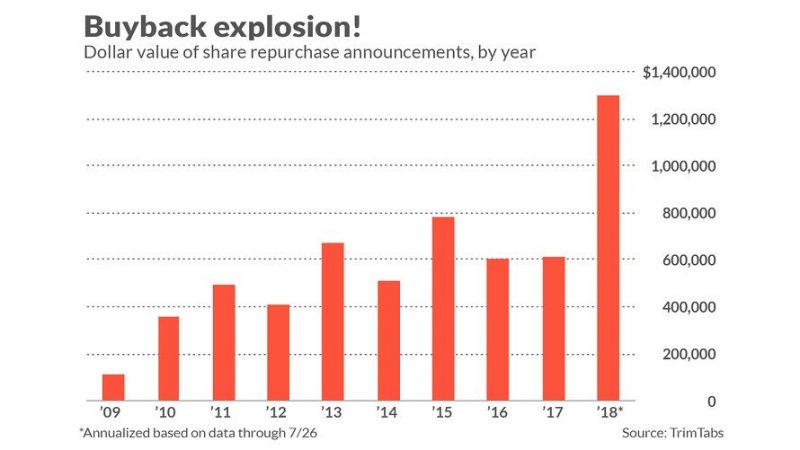

After several months of heated market speculation, to Amazon's chagrin the question of which stock would be the first to reach $1 trillion in market capitalization was answered when Apple reported strong Q2 results (which included $21 billion in stock buybacks) and its stock soared 9% this week, rising above the very round number and elevating its YTD gain to 23% (Amazon, with a market cap of just under $900 billion, will most likely be second).

Read More »

Read More »

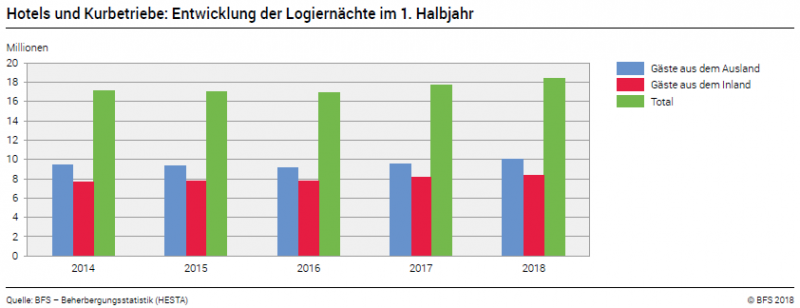

Overnight Stays Increased by 3.8 percent in the First Half of 2018

The hotel sector registered 18.4 million overnight stays in Switzerland in the first half of 2018, representing an increase of 3.8% (+670,000 overnight stays) compared with the same period a year earlier. With a total of 10.0 million overnight stays, foreign demand rose by 4.6% (+444,000). Domestic visitors registered 8.3 million overnight stays, i.e. an increase of 2.8% (+226,000).

Read More »

Read More »

FX Daily, August 06: Sterling’s Drop Paces Dollar Gains

The US dollar edged higher against most of the major currencies, and emerging market currencies are heavier. Sterling's quarter percent drop makes it the weakest of the majors in slow turnover and it was sufficient to record a new 11-month low.

Read More »

Read More »

Stock Market Manias of the Past vs the Echo Bubble

The Big Picture. The diverging performance of major US stock market indexes which has been in place since the late January peak in DJIA and SPX has become even more extreme in recent months. In terms of duration and extent it is one of the most pronounced such divergences in history.

Read More »

Read More »

FX Weekly Preview: Dog Days of August Begin

With most of the major central bank meetings and important economic data out of the way, the dog days of August are upon us. In terms of drivers, it means that players will have to look elsewhere for inspiration and it means that market liquidy is likely not at its best.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW.

Read More »

Read More »

CEO of Baselworld steps down

The head of the world’s largest watch and jewellery trade show, the Swiss-based Baselworld, has handed in his resignation amid a row over the departure of several exhibitors. The MCH Group announced that CEO Peter Kamm would resign from his position “in view of the fundamental transformation phase in business operations”.

Read More »

Read More »

Gold to Enter New Bull Market – Charles Nenner

Gold to Enter New Bull Market – Charles Nenner. “Gold is going to enter a new bull market”. “The first cycle will bottom after the summer”. “$1,212 per ounce is our downside target”. “It’s going to top $2,500 per ounce . . . in about two years or so”. “Gold is in a bull market even though it came down from $1,900 per ounce”

Read More »

Read More »

Swiss court blocks French request for UBS banking data

Switzerland’s Federal Administrative Court has ordered the Federal Tax Administration (FTA) not to provide France with details about 40,000 UBS bank clients with French addresses. In May 2016, the French tax authorities requested administrative assistance from the FTA. They wanted details about UBS clients who lived or had lived in France.

Read More »

Read More »

Great Graphic: Is Something Important Happening to Oil Prices?

Oil prices are weaker for the third straight day and are off in four of the past five sessions, the poorest run in two months. Supply considerations may threaten a year-old trend line. OPEC and non-OPEC, essentially Saudi Arabia and Russia are making good on their commitment to boost output, and US oil inventories unexpectedly rose.

Read More »

Read More »

FX Daily, August 03: Greenback Remains Firm Ahead of Jobs, JGBs Stabilize, Italian Debt Moves into Spotlight

The US dollar is trading at the upper end of its recent ranges against the euro and sterling. The euro finished below $1.16 yesterday for the first time since the end of June and has not been able to resurface that level so far today.

Read More »

Read More »

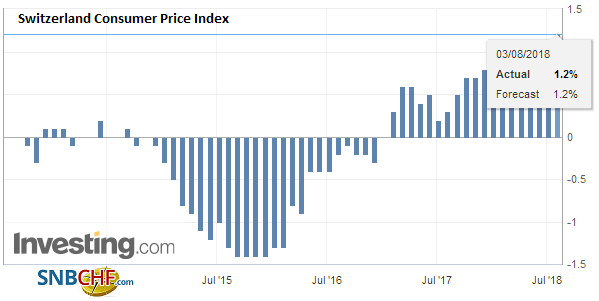

Swiss Consumer Price Index in July 2018: +1.2 percent YoY, -0.2 percent MoM

The consumer price index (CPI) fell by 0.2% in July 2018 compared with the previous month, reaching 101.8 points (December 2015=100). Inflation was 1.2% compared with the same month of the previous year. These are the results from the Federal Statistical Office (FSO).

Read More »

Read More »

Fed Looks to September

There was little doubt in the market's collective mind that the Federal Reserve, which hiked rates in July, would stand pat today. It did not disappoint. The statement itself was almost identical. Growth was said to be "strong" instead of "solid," for example, a nuance to be lost on most observers. It recognized that the unemployment rate stabilized after falling.

Read More »

Read More »

TARGET-2 Revisited

Capital Flight vs. The Effect of QE. Mish recently discussed the ever increasing imbalances of the euro zone’s TARGET-2 payment system again in response to a few articles which played down their significance. He followed this up with a nice plug for us by posting a comment we made on the subject. Here is a chart of the most recent data on TARGET-2 available from the ECB; we included the four largest balances, namely those of Germany, Italy, Spain...

Read More »

Read More »

IT made compulsory for upper secondary pupils

Computer science has become obligatory at Swiss upper secondary schools, as the country seeks to plug its information technology (IT) skills gap. These schools (Gymnasium/lyceé/liceo), whose pupils typically go on to university, have until the school year 2022/3 to introduce the compulsory lessons, under a regulation change that came into force on August 1. Previously, IT had the status of a non-obligatory supplementary subject.

Read More »

Read More »

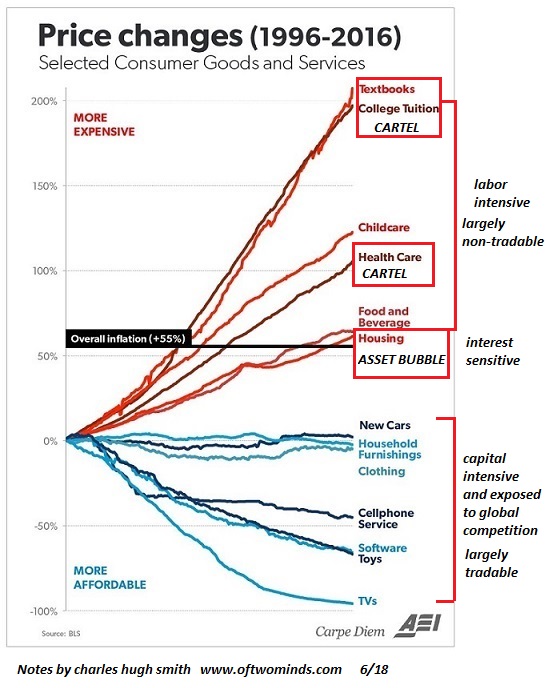

The 21st Century Misery Index: Labor’s Share of the Economy and Real-World Inflation

In the late 1970s and early 1980s, an era of stagflation, the Misery Index was the unemployment rate plus inflation, both of which were running hot. Now those numbers are at 50-year lows: both the unemployment rate and inflation are about as low as they can go, reaching levels not seen since the mid-1960s.

Read More »

Read More »

FX Daily, August 02: BOJ Surprises, BOE on Tap, Trade Worries Weigh on Stocks

The Bank of England meeting concludes a run of major central bank meetings over the past fortnight. The BOE is widely expected to join the Bank of Canada in raising rates. The Federal Reserve and the ECB were content to do and say nothing new.

Read More »

Read More »