Tag Archive: newslettersent

Abe’s Fiscal Policy: More of the Same

Japan's fiscal stimulus if smaller than it appear and is unlikely to boost the economy as much as officials may think. The problem in Japan is not that interest rates are too high or that pubic investment is too weak. The risk is that the yen strengthens further, and we suggest the dollar may fall toward JPY94.60.

Read More »

Read More »

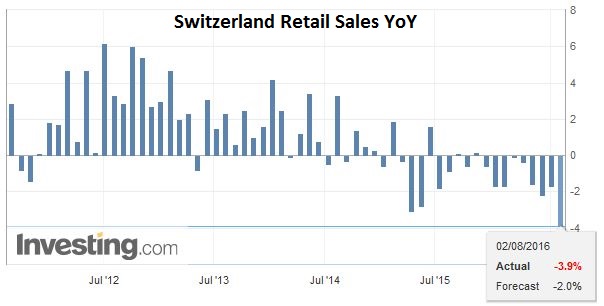

Swiss Retail Sales -4.6 percent nominal (YoY) and -3.9 percent real (YoY)

Turnover in the retail sector fell by 4.6% in nominal terms in June 2016 compared with the previous year. The decline has been ongoing since January 2015. This is the largest decline since January 2003. Seasonally adjusted, nominal turnover fell by 0.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

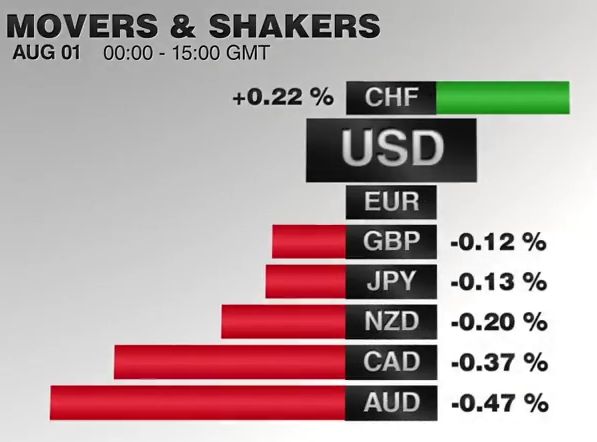

FX Daily, August 01: Dog Days of August Begin

The US dollar is trading with a small upside bias in narrow trading ranges. The main news has consisted of PMI reports, while investors continue to digest last week's developments. In particular the BOJ's underwhelming response to poor economic data and a missed opportunity to reinforce the fiscal stimulus, and the dismal US GDP.

Read More »

Read More »

Great Graphic: Real Broad Trade-Weighted Dollar

The real broad trade-weighted dollar index rose in July for the third month. It peaked in January above trendline drawn through the Reagan and Clinton dollar rallies. Expect the trendline to be violated again before the end of the year.

Read More »

Read More »

No Big Thoughts, but Several Smaller Observations

Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe.

Read More »

Read More »

The Helicopter Mortgage

Medical vs. Financial Engineering. I broke my elbow a month ago, pretty badly as I was told. The surgeon screwed the pieces back together, using a steel alloy bracket and six screws. Two hours later, I left the hospital with no cast, a bandage (just to cover a very ugly scar), a prescription for painkillers and therapy started a week later.

Read More »

Read More »

Switzerland has world’s priciest Big Macs. So eat Swiss chocolate instead.

The Economist invented the Big Mac index in 1986 as a tongue-in-cheek guide to currency valuations. Because the well-known burger is the same throughout much of the world, the magazine thought it could be used as a measure of how over or undervalued a currency was. An overpriced burger suggests an overvalued currency and a cheap one an undervalued currency.

Read More »

Read More »

Visions of Tomorrow from the Permanently High Plateau

Mad as a Hatter. Somewhere, someone first said “bull markets don’t die of old age.” We suppose this throwaway phrase was first uttered in a time and place much like today. That is, in the midst of a protracted bull market where stock prices had detached from the assets and earnings of companies their shares represent claim to.

Read More »

Read More »

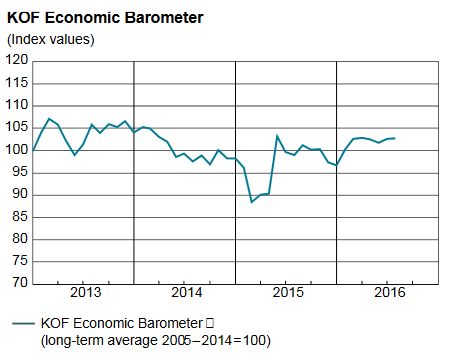

Greenspan explains negative Swiss Yields

For Alan Greenspan, negative Yield Reflect Spread between Italian and Swiss Bonds. For him, bond prices in general have risen too much.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a firm note, helped by the weaker than expected US Q2 GDP report as well as the small bounce in oil. With the RBA and BOE expected to ease this week, the global liquidity backdrop remains favorable for EM and “risk.” US jobs report Friday will be very important for EM going forward. We get our first glimpse of the Chinese economy for July with the PMI readings this week.

Read More »

Read More »

FX Weekly Preview: After this Week, Does August Matter?

RBA meeting is a close call. BOE meeting consensus on rate cut, maybe new QE and lending-for-funding. More details of Japan's fiscal policy. U.S. jobs data. After this week, and outside of RBNZ rate cut, August may be uneventful.

Read More »

Read More »

The Fundamentals behind Gold Price Seasonality

Many know that gold is very volatile in the course of year. Gold prices tend to be low in January and rise between July and November. But what are the fundamental reasons behind this seasonality?

Read More »

Read More »

FX Weekly Review, July 25 – July 29: Dollar Hobbled; Technicals Warn of More Losses

The US dollar advance was stopped in its tracks by the

disappointingly weak Q2 GDP figures. The 1.2% annualized growth rate was

roughly half of the pace expected. The FOMC statement earlier in the week did not leave the impression that a September hike was likely, and with the poor growth numbers, the odds were downgraded

further.

Read More »

Read More »

Weekly Speculative Postions: Speculators Sell European Currency Futures

The euro bears added another 10.3k contracts to their gross short position, which brought it to 221.8k contracts., This is this is the largest grossshort position since early January.

Read More »

Read More »

The FOMC Butterfly that Will Ruin the World

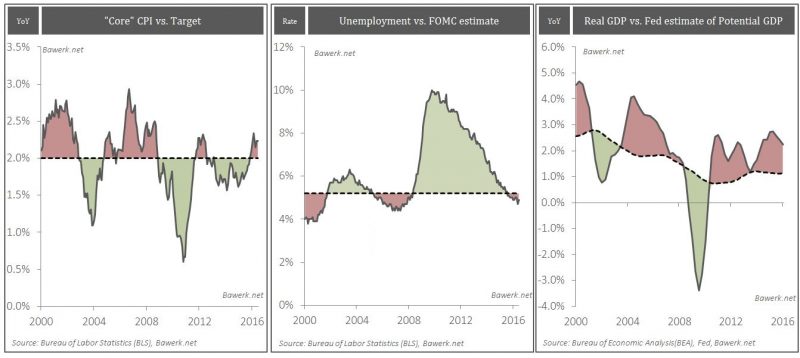

Given the fact that the core CPI is currently over the arbitrarily set 2 per cent target unemployment below what the FOMC regards as full employment and GDP running at a rate far above the Federal Reserve’s own estimates of so-called potential; you would say the Federal Funds rate would be in the vicinity of five per cent.

Read More »

Read More »

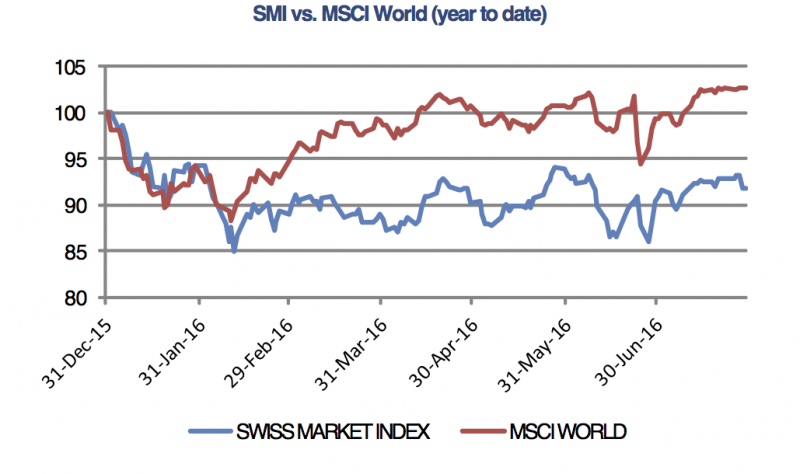

Swiss stock market rally loses momentum

The Swiss Market Index and global stock markets failed to extend last week’s rally after the Federal Reserve and Bank of Japan left rates unchanged and gave mixed messages about the global economic outlook.

Read More »

Read More »

Emerging Markets: What has Changed

Indonesian President Widodo shuffled his cabinet

Egypt has requested a three-year $12 bln loan from the IMF

Johannesburg Stock Exchange data on investment flows into South Africa was wrong

Fitch downgraded South Africa’s local currency rating by one notch to BBB- with a stable outlook

Fitch cut its outlook on Colombia's BBB rating from stable to negative

Read More »

Read More »