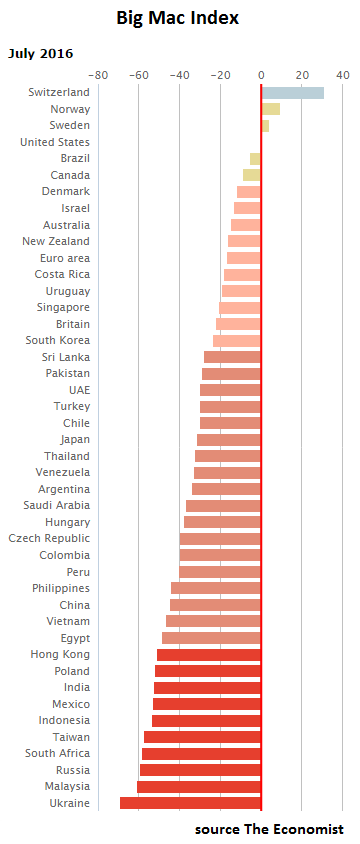

| The Economist invented the Big Mac index in 1986 as a tongue-in-cheek guide to currency valuations. Because the well-known burger is the same throughout much of the world, the magazine thought it could be used as a measure of how over or undervalued a currency was. An overpriced burger suggests an overvalued currency and a cheap one an undervalued currency.

As it did last year, Switzerland topped the chart this year with the world’s most expensive Big Macs. At US$ 6.59 (CHF 6.50) the Swiss price for the double layered burger far outstripped second placed Norway (US$ 5.51). In the US the triple-bunned meal cost US$ 5.04, and in the Ukraine, the cheapest place, it cost only US$1.57. What does this mean? It suggests the Swiss franc is 30.8% overvalued.

A key criticism of the index is that it ignores the higher cost of labour in richer countries. To correct for this the Economist has created an adjusted index, which calculates Big Mac prices relative to average national incomes (GDP per person). Rich countries pay workers more, so Big Macs should cost more there. After making this adjustment, Switzerland loses its top spot to Brazil where the US$ 4.78 burger overvalues the Brazilian Real by 54.2%. On this measure the Swiss franc is only 8.7% overvalued. |

Let them eat chocolate

If this logic works for Big Macs then it ought to work for other products. Instead of Big Macs we looked at a Swiss branded product: Lindt chocolate.

A 100g bar of Lindt Excellence chocolate with 70% cocoa costs US$ 2.92 at Walmart in New York – US$ 2.68 + sales tax. At Coop in Switzerland the same bar costs US$ 2.89 (CHF 2.85). On a raw measure, chocolate prices suggest Switzerland’s currency is 1.1% undervalued, a far cry from the 30.8% over valuation suggested by the unadjusted Big Mac index.

If we look at the price of the same Swiss chocolate in another country, Hong Kong, the shift is even more dramatic. The unadjusted Big Mac index suggests Hong Kong’s currency is 50.9% undervalued. When using chocolate, its currency shifts from appearing 50.9% undervalued to 58.6% overvalued. The same bar in Hong Kong costs US$ 4.64 (HK$ 35.90) at the Wellcome and ParknShop supermarkets.

It seems value is hard to measure. High quality chocolate, an everyday product in Switzerland, is a luxury in Hong Kong. And in Hong Kong, Big Macs have to compete with a lot of very tasty local fast food.

The same could probably said of currencies.

More on this:

The Big Mac index (The Economist website – in English)

For more stories like this on Switzerland follow us on Facebook and Twitter.

Full story here Are you the author? Previous post See more for Next postTags: Business & Economy,Editor's Choice,newslettersent