Tag Archive: newslettersent

Yellow Lights are Flashing

Bonds are not rallying despite poor US data. Greater chance that Trump gets elected than the Fed hikes next week. Berlin may be more important than Bratislava.

Read More »

Read More »

How About Presenting the Facts and Letting Voters Decide Who’s “Fit to Serve”?

This simple two-step process would greatly diminish the Ministry of Propaganda's influence. Here's a radical idea: how about presenting the facts and letting voters decide who is "fit to serve"? Consider the context of this presidential election and the judgment call as to who is "fit to serve":

Read More »

Read More »

Crimea: Digging For The Truth

This summer witnessed a renewed escalation between Russia and Ukraine after Russian President Vladimir Putin accused Ukraine of sending saboteurs to attack Russian troops, targeting “critical infrastructure”. Kiev denied the allegations and claimed Russia’s “fantasy” was nothing but a false pretense to launch a “new invasion”.

Read More »

Read More »

Swiss stocks drop on volatility spike

The Swiss Market Index is set to finish the week notably weaker along with global equity markets as fears around global monetary policy hit sentiment ahead of key meetings by the Bank of Japan and US Federal Reserve next week. The SMI did manage to outperform its European peers thanks to its heavy weighting towards more defensive pharmaceuticals and consumer staples sectors.

Read More »

Read More »

SNB Monetary policy assessment September 2016 and Comments

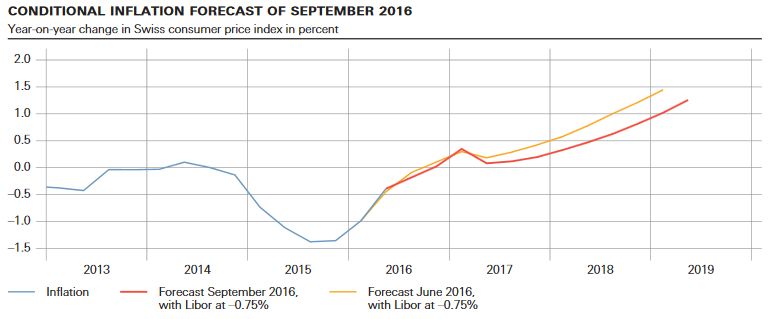

The SNB inflation forecast showed a strange diversion of conditional inflation forecasts: Draghi expected inflation to rebound to 1.2% next year and 1.6% in 2018.

The SNB, however, predicts 2017 inflation at 0.2% and 2018 at 0.6%. For us, one of the two is wrong.

Read More »

Read More »

FX Daily, September 15: Early Update: Full Calendar but Little News

Looking at the diary, today is the most important day of the week. The Bank of England and the Swiss National Bank meet. The UK reports retail sales. EMU reports CPI figures. The US reports retail sales, industrial output, and two September Fed surveys. Yet the economic updates are unlikely change sentiment ahead of next week FOMC and BOJ meetings.

Read More »

Read More »

Follow the Money

PARIS – It’s back to Europe. Back to school. Back to work. Let’s begin by bringing new readers into the discussion… and by reminding old readers (and ourselves) where we stand. US economic growth: average annual GDP growth over time spans ranging from 120 to 10 years (left hand side) and the 20 year moving average of annual GDP growth since 1967

Read More »

Read More »

The Mainstream Media Bet the Farm on Hillary–and Lost

The MSM has forsaken its duty in a democracy and is a disgrace to investigative, unbiased journalism. The mainstream media bet the farm on Hillary Clinton, confident that their dismissal of every skeptical inquiry as a "conspiracy" would guarantee her victory. It now appears they have lost their bet.

Read More »

Read More »

Cash Bans and the Next Crisis

Money sometimes goes “full politics”. Take poor Kenneth Rogoff at Harvard. He wants a dollar with a voter registration card, a U.S. flag on its windshield, and a handgun in its belt – the kind of money that supports the Establishment and votes for Hillary.

Read More »

Read More »

FX Daily, September 14: Precarious Stabilization

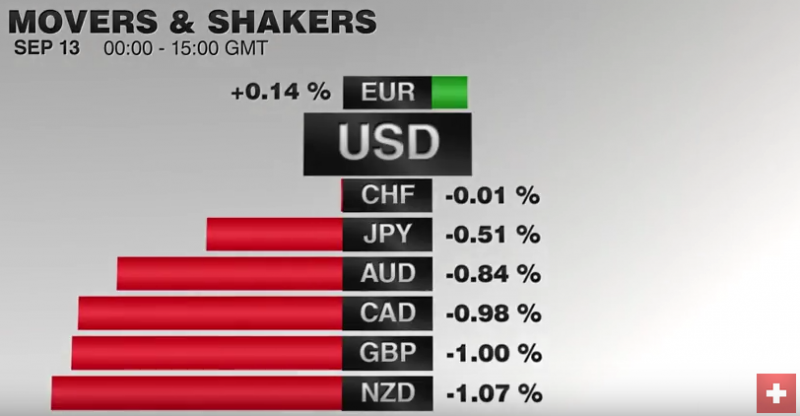

Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that more negative rates are under consideration may have contributed to the weakness of the yen.

Read More »

Read More »

Richemont, Hermes slump as gloom deepens for luxury-goods makers

The crisis in the global luxury-goods industry deepened after Hermes International SCA abandoned a long-standing forecast and Richemont predicted a profit plunge that Chairman Johann Rupert deemed unacceptable.

Read More »

Read More »

Great Graphic: Net Mexican Migration to the US–Not What You Might Think

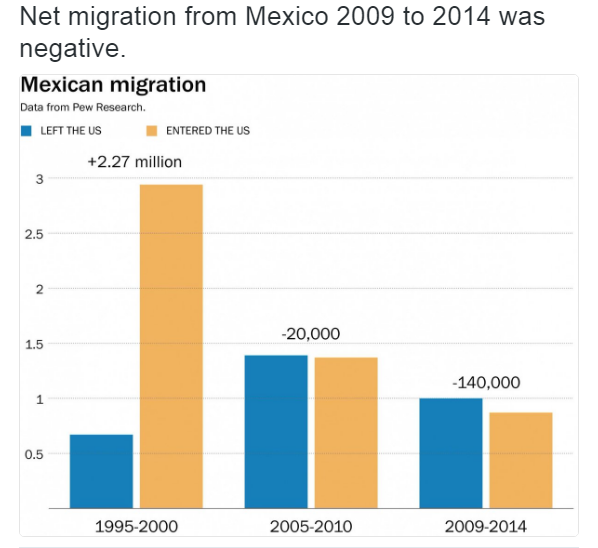

Net migration of Mexicans into the US has fallen for a decade. The surge in Mexican migration into the US followed on the heels of NAFTA. Although Trump has bounced in the polls, and some see this as negative for the peso, rising US interest rates and the slide in oil price are more important drivers.

Read More »

Read More »

Rogoff Warns “Cash Is Not Forever, It’s A Curse”

Kenneth Rogoff, Professor of Public Policy at Harvard University, postulates to get rid of cash. In his opinion, killing big bills would hamper organized crime and make negative interest more effective. Kenneth Rogoff makes a provocative proposal. One of the most influential economists on the planet, he wants to phase out cash.

Read More »

Read More »

Seven years of inaction on SNB rates day won’t end this week

Anyone feeling let down that the European Central Bank didn’t do much last week might just want to skip the Swiss rate decision on Thursday to avoid more disappointment. While the Swiss National Bank may be infamous for some seismic policy changes in the last few years, those bombshells weren’t dropped at scheduled meetings. In fact, the last time the institution altered interest rates at a decision in its public calendar was more than seven years...

Read More »

Read More »

Thoughts on the Price Action

Global interest rates are rising. Something important is happening. It appears to be dollar positive.

Read More »

Read More »

Strong Swiss growth lessens chance SNB will act

Swiss real GDP growth data surprised on the upside in Q2, expanding by 0.6% q-o-q (and 2.5% q-o-q annualised). In addition, growth in the three previous quarters was revised significantly higher. As a result, our GDP growth forecast for growth in Switzerland rises mechanically from 0.9% to 1.5% for 2016.

Read More »

Read More »

FX Daily, September 13: Much Noise, Weak Signal

The last ECB meeting and Dragh's hawkish comments is for us the main reason of the euro strength, this despite stronger Swiss GDP growth.

Read More »

Read More »

It’s Time to Bring Back Bernie

This tells you everything you need to know about how Hillary will operate as President: there will be no honesty, transparency or truth, ever. Hillary's bid for the presidency is no longer defensible; it's time to bring back Bernie Sanders as the Democratic nominee.

Read More »

Read More »

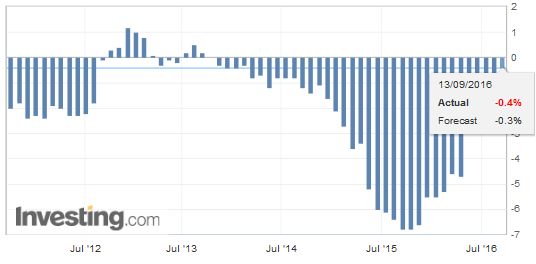

Swiss Producer and Import Price Index, August 2016: -0.3 percent MoM, -0.4 percent YoY

The Producer and Import Price Index fell in August 2016 by 0.3% compared with the previous month, reaching 99.5 points (base December 2015 = 100). This decline is due in particular to lower prices for petroleum products and pharmaceutical products. Compared with August 2015, the price level of the whole range of domestic and imported products fell by 0.4%.

Read More »

Read More »