SMIThe Swiss Market Index is set to finish the week notably weaker along with global equity markets as fears around global monetary policy hit sentiment ahead of key meetings by the Bank of Japan and US Federal Reserve next week. The SMI did manage to outperform its European peers thanks to its heavy weighting towards more defensive pharmaceuticals and consumer staples sectors. |

|

Economic DataGlobal equity markets had a tough start to the new week after several Federal Reserve officials appeared to support rate hikes as early as this month, warning that waiting too long to raise interest rates threatened to overheat the US economy and could risk financial stability. Markets experienced increased volatility as investors monitored economic data from around the world for indications of the strength of the global economy and whether a rate hike could be justified at the Fed’s September meeting. |

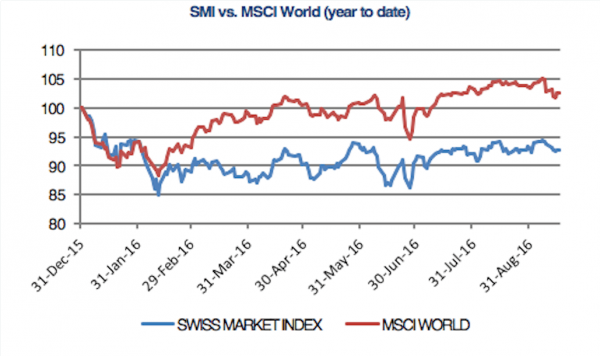

SMI vs. MSCI World Week September 16(see more posts on MSCI World Index, SMI Swiss Market Index, ) |

| A drop in the oil price below $45 per barrel also increased the pace of the sell-off after the International Energy Agency (EIA) said it expects that the oil glut will last longer than previously thought as demand continues to slump and output remains resilient. |

SMI vs. MSCI World(see more posts on MSCI World Index, SMI Swiss Market Index, ) |

Swiss Economic DataIn Switzerland, the Swiss National Bank maintained, as expected, its ultra-loose negative interest rate policy at -0.75% and pledged to intervene in currency markets if needed. The central bank said that the Brexit vote in June had clouded its view of the global economy. Credit Suisse in released its ZEW indicator this week. The report, which gauges analysts’ expectations for Switzerland’s economy for the coming six months, rose by 5.5 points in September to a reading of just +2.7 points. This marks the third consecutive month that the indicator has hovered around the zero mark, providing little clue as to the direction of the domestic economy. |

|

Swiss CompaniesIn company news, pharmaceutical giants Roche and Novartis are amongst this week’s top performing stocks as investors sold off more cyclical companies. Richemont, maker of Cartier jewelry, was among the SMI’s losers this week after reporting that its first-half operating profit will probably decline about 45% as the luxury goods sector continues to suffer. |

|

Tags: Credit Suisse,MSCI World Index,newslettersent,SMI Swiss Market Index