Tag Archive: newslettersent

Weekly Swiss Markets: Stocks fluctuated on central bank statements

The Swiss Market Index is set to finish the week mainly unchanged, outperforming global stocks modestly while markets fluctuated on speculation that the US Fed will increase interest-rate later this year.

Read More »

Read More »

Switzerland’s central bank offers a glimpse behind the curtain

The Swiss National Bank is offering a rare look into how it sets monetary policy. A video of SNB President Thomas Jordan and fellow members of the governing board shows them beginning their quarterly policy assessment discussing the state of the economy with about 30 people.

Read More »

Read More »

US and Canada Jobs: Sill Strong Enough for a Rate Hike

The US grew 156k jobs in August, missing the median estimate by about 16k. The July series was revised up by 16k. The unemployment and participate rate ticked up 0.1% to 5.0% and 62.9% respectively. Hourly earnings rose 0.2% to lift the year-over-year rate to 2.6% from 2.4%. The average work week increased to 34.4 hours from 34.3.

Read More »

Read More »

Algos, Barriers, Rumors: Some Theories On What Caused The Pound Flash Crash

As reported moments ago, just around 7:07pm ET, cable snapped and plunged by what some say may have been as much as 1200 pips, dropping from 1.26 to as low as 1.14 according to some brokers, before snapping back up.

Read More »

Read More »

Is Someone Trying To Buy The Swiss National Bank?

By now it is well-known that as we profiled previously, one of the most ravenous buyers of US stocks in recent years, has been a central bank: the Swiss National Bank... However, it is far less known that not only is the Swiss National Bank also a publicly traded stock, but is also one of the best performing stocks in the world this year.

Read More »

Read More »

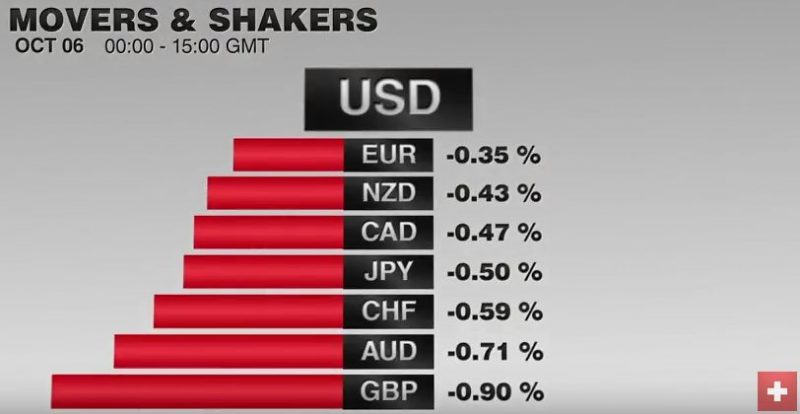

FX Daily, October 06: The Dollar is Firm in Quiet Market

The US dollar is advancing against the major and most emerging market currencies. Activity is subdued and ranges are narrow. We share four observations about the price action. First, the euro has been unable to sustain upticks even after Germany reported a jump in industrial orders three-times more than the median estimate (1.0% vs. 0.3%).

Read More »

Read More »

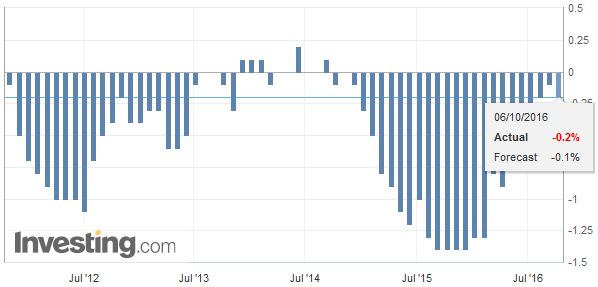

Swiss Consumer Price Index 0.1 percent MoM, -0.2 percent YoY

We often look at parts of the CPI. For example food inflation is relevant in emerging markets or poorer people in developed nations. Food inflation in Switzerland has risen by 1.3% YoY in August compared to 0.2% in the U.S., and 1.4% in the eurozone and 1.1% in neighbour Germany. Furtunately it has fallen again.

Read More »

Read More »

Canadian Dollar: A Little Less About Oil, a Little More about Rates

The Canadian dollar's link to oil has loosened. Its sensitivity to interest rates has increased. Lumber issue is coming to a head shortly.

Read More »

Read More »

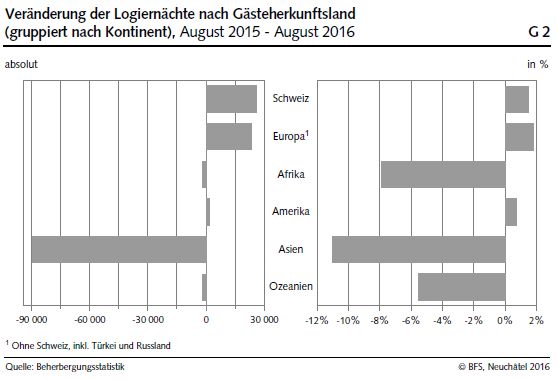

Statistics on tourist accommodation in August 2016: Overnight stays decline in August 2016

The Swiss hotel industry registered 4.1 million overnight stays in August 2016, which corresponds to a decrease of 1.0% (-43,000 overnight stays) compared with August 2015. Foreign visitors generated 2.4 million overnight stays, representing a decline of 2.8% (-69,000). Domestic visitors registered 1.7 million overnight stays, i.e. an increase of 1.5% (+26,000). These are provisional results from the Federal Statistical Office (FSO).

Read More »

Read More »

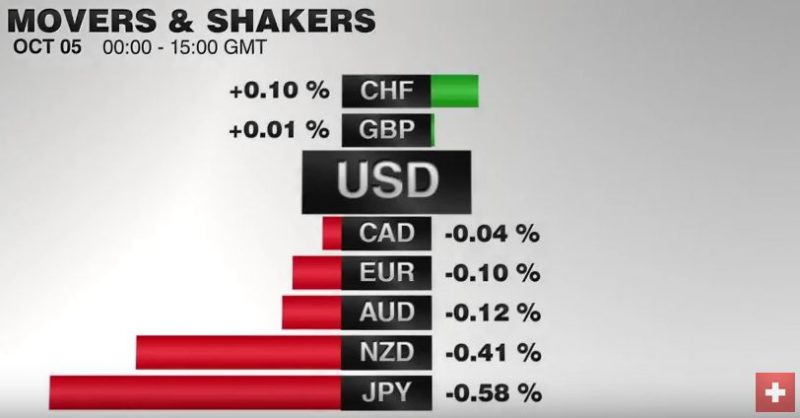

FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

After the sudden rise to 1.0973 the EUR/CHF is falling again. The volatiliy is related to the CHF speculative postion, that suddenly was Short CHF. Traders that moved with the SNB Window Dressing for Q3 are closing their shorts again.

Read More »

Read More »

The Dying Middle Class

As expected, Ms. Yellen smiled last week, announcing no change to the Fed’s extraordinary policies. For the last eight years, she has been aiding and abetting the largest theft in history. Thanks to ZIRP (zero-interest-rate policy) and QE (quantitative easing), every year, about $300 billion is transferred from largely middle-class savers to largely better-off speculators, financial asset owners, and the biggest borrowers during that period –...

Read More »

Read More »

Why Portugal Matters

DBRS reviews its investment grade rating of Portugal on Oct 21. A cut in its rating would have far reaching implications. A cut in the outlook is more likely than a cut the rating.

Read More »

Read More »

It’s Time We Crush the Putrid Roach Motels of Philanthro-Crony-Capitalism, Starting with the Clinton Foundation

Granted, the fantasy of philanthrocapitalism is appealing: take a bunch of fabulously successful entrepreneurial billionaires, grant their foundations tax-free status, and then unleash them on the world as philanthropists who will solve problems by applying the incentives of capitalism.

Read More »

Read More »

Will The ECB Buy Stocks?

Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility. We think the ECB could legally buy ETFs that fit its requirements… but it would be controversial and we question the benefits. An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme.

Read More »

Read More »

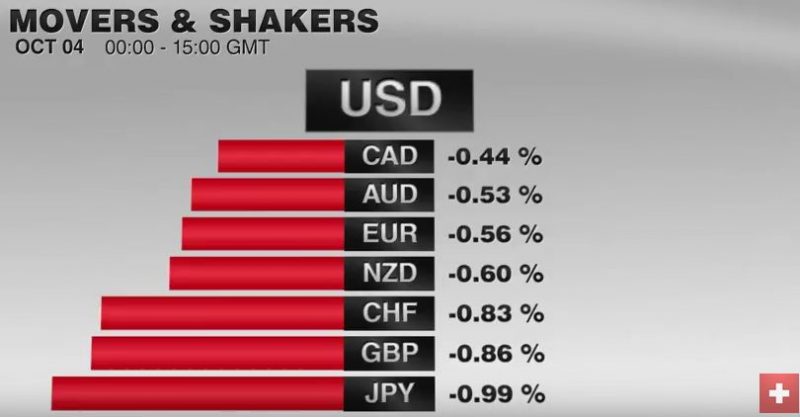

FX Daily, October 04: Sterling’s Slide Continues, EUR/CHF Soars Again

UK Prime Minister May's comments at the Tory Party Conference over the weekend played up the risk of what has been dubbed a hard Brexit and triggered a slide in sterling saw it fall to new 30-year+ low against the dollar just below $1.2760. The EUR/CHF has soared again. Later during the day, it has even achieved 1.0970.

Read More »

Read More »

Cool Video: Bloomberg TV-Dollar Supercycle and Brexit

I reiterated my long-standing view that the euro is going to retest its record lows before the Obama Dollar Rally is over. I warn that the UK's quest to regain sovereignty is an illusion. I announce that my new book will be published in early December or early January.

Read More »

Read More »

The Yen in Three Charts

The dollar is taking out a several month downtrend against the yen. The correlation between the yen and the S&P 500 has broken down. The US 2-year premium over Japan has steadily risen.

Read More »

Read More »

FX Daily, October 03: May’s Confirmation Sends Sterling Lower

Sterling has a bad case of the Monday blues. Even the moon looks distraught. Prime Minister May has confirmed earlier suggestions that she will trigger Article 50 to formally begin its divorce proceedings from the EU at the end of Q1 17. Several officials have already hinted this time frame, though many have been skeptical that Article 50 would be triggered at all, given the complexities of the issues.

Read More »

Read More »