Tag Archive: newslettersent

46 percent of Swiss industrial companies considering relocating operations abroad

After a very difficult year in 2015, the Swiss mechanical and electrical engineering industries (MEM) started to recover in 2016, with new orders rising by 9.5%. At the same time 23% of the industry made a loss on the back of high costs and a 1.8% drop in sales, says the industry association Swiss MEM.

Read More »

Read More »

Swiss rents 40 percent too high, according to bank’s calculation

According to the bank Raiffeisen, if rents had followed the path prescribed in the Swiss Code of Obligations, they would be much lower. Their figures show that changes in interest rates have not flowed through to renters. If rents had fallen in step with mortgage interest rates they would be 40% lower than they are currently.

Read More »

Read More »

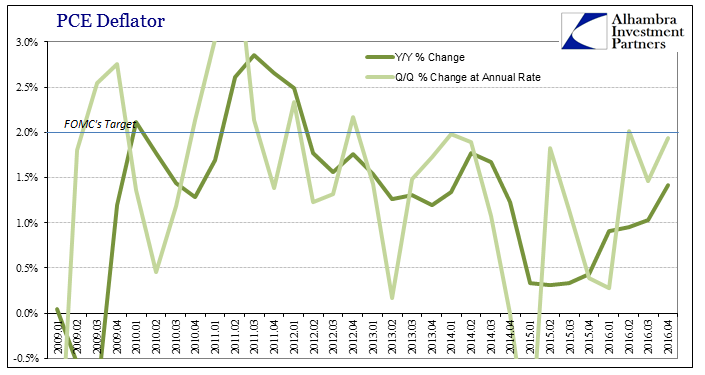

Real Disposable Income: Headwinds of the Negative

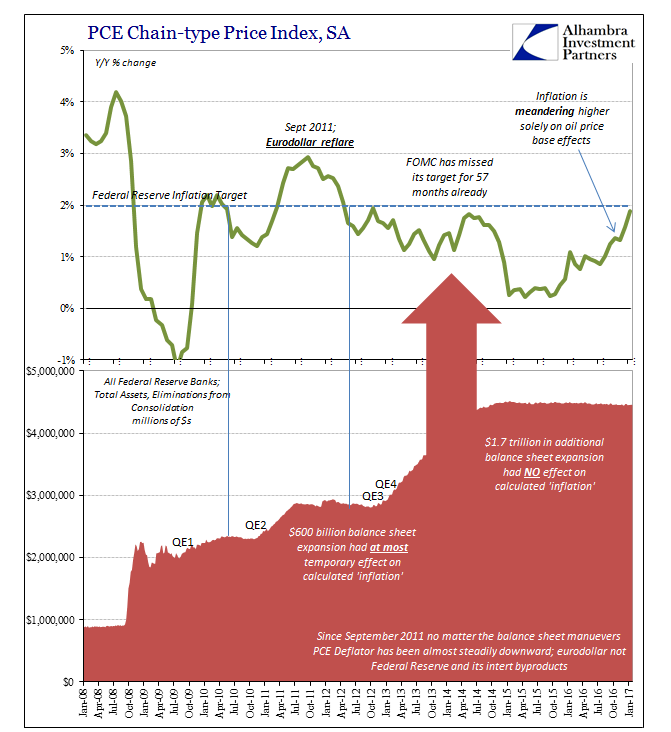

The PCE Deflator for January 2017 rose just 1.89% year-over-year. It was the 57th consecutive month less than the 2% mandate (given by the Fed itself when in early 2012 it made the 2% target for this metric its official definition of price stability).

Read More »

Read More »

European Commission Offers 5 Scenarios

EC is committed to the future of Europe. Juncker presented five scenarios. Even if the populist-nationalist do not win the electoral contests, the national identity issues will continue to exert influence.

Read More »

Read More »

Why Is the Cost of Living so Unaffordable?

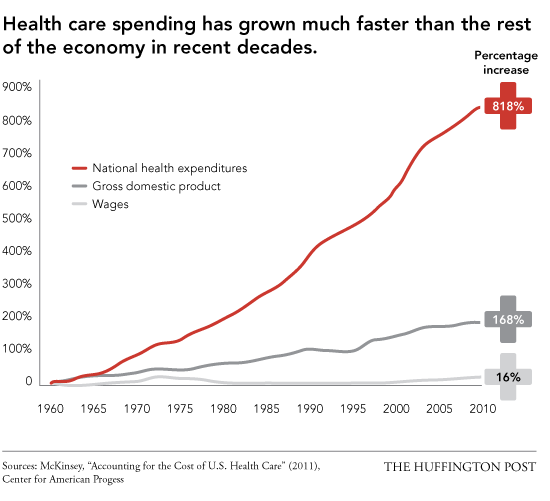

Strip away the centralized power that protects and funds cartels, and prices would plummet. The mainstream narrative is "the problem is low wages." Actually, the problem is the soaring cost of living. If essentials such as healthcare, housing, higher education and government services were as cheap as they once were, a wage of $10 or $12 an hour would be more than enough to maintain a decent everyday life.

Read More »

Read More »

Switzerland GDP Q4 2016: +0.1 percent QoQ, +0.6 percent YoY

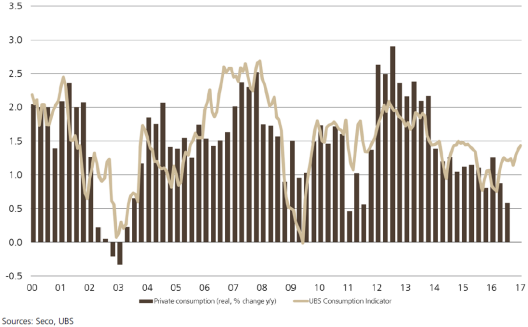

The Swiss economy relies very much (and probably too much) on exports. In the fourth quarter export of goods fell by 3.8%, while imports remained the same. Investments dipped, too. On the other side, consumption rose by a strong 0.9%. In total, the economy grew by only 0.1% QoQ (+0.6% YoY).

Read More »

Read More »

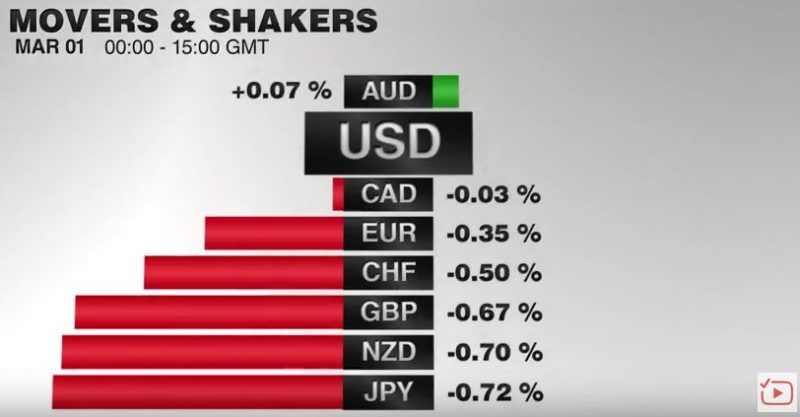

FX Daily, March 02: Dollar Remains Bid

The US dollar is bid against the major currencies as the combination the increased expectation of a Fed rate hike and the President's commitment to fiscal stimulus buoys sentiment. The dollar-bloc, where speculators in the futures market, have grown a net long position, are leading the move.

Read More »

Read More »

Swiss Retail Sales, January: Minus 2 percent Nominal and Minus 1.4 percent Real

Turnover in the retail sector fell by 2.0% in nominal terms in January 2017 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Switzerland UBS Consumption Indicator January: Light and shade

The UBS consumption indicator rose from 1.38 to 1.43 points in January and continues to signal solid growth in private consumption. Swiss consumers view the economic and financial situation with considerably more optimism than in the last quarter. New car registrations and domestic tourism have, however, fallen compared with the previous January. Zurich, 1 March 2017 – Following a comprehensive data revision, the UBS consumption indicator climbed...

Read More »

Read More »

Proposal to remove Swiss home-owner tax rejected

In Switzerland, those who own the home they live in must add imputed rent to their income when calculating their income tax. This means owner-occupiers are taxed for living in their own homes, an odd concept for some who are new to Switzerland.

Read More »

Read More »

Great Graphic: Fed’s Real Broad Trade Weighted Dollar

To begin assessing the dollar's impact on the US economy, nominal bilateral exchange rates may be misleading. From a policymakers' point of view, the real broad trade weighted measure is more important. The Federal Reserve tracks it on a monthly basis.

Read More »

Read More »

FX Daily, March 01: Greenback Bounces, More Fed than Trump

The much-anticipated speech by US President Trump was light on the details that investors interested in, like the tax reform, infrastructure initiative, and deregulation. There appears to be an agreement to repeal the national healthcare, but there is no consensus on its replacement.

Read More »

Read More »

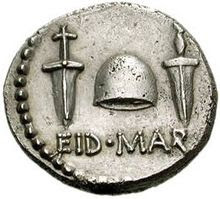

Beware the Ides of March

Numerous events converge in the middle of March. We still lean toward a May hike rate than March. Wilders may garner a plurality of the vote in the Netherlands, but is unlikely to form a government for want of coalition partners. How will the Republican US Congress and President deal with the debt ceiling?

Read More »

Read More »

Some Notes On GDP Past And Present

The second estimate for GDP was so similar to the first as to be in all likelihood statistically insignificant. The preliminary estimate for real GDP was given as $16,804.8 billion. The updated figure is now $16,804.1 billion. In nominal terms there was more variation, where the preliminary estimate of $18,860.8 billion is now replaced by one for $18,855.5 billion.

Read More »

Read More »

Bank drops plan to loosen Swiss mortgage restrictions

The bank Raiffeisen has dropped its attempt to reduce minimum deposit requirements for home loans, according to RTS. Last autumn, it unveiled plans to reduce loan deposit requirements. However, last week, the bank announced that FINMA, Switzerland’s financial regulator, was opposed to the idea.

Read More »

Read More »

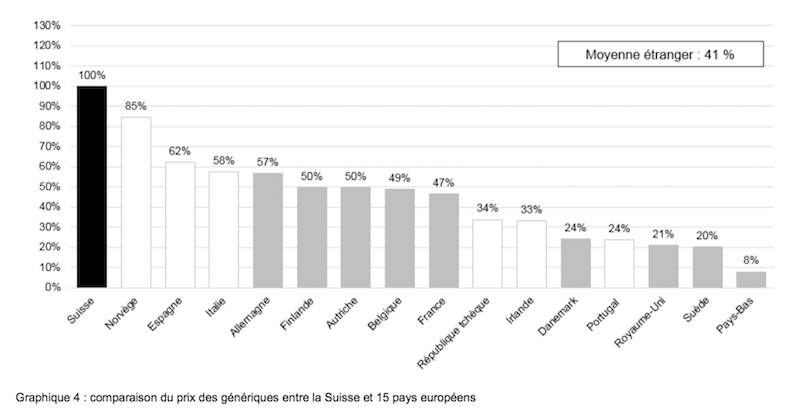

Swiss drug prices more than double european average – “Mr Price” takes aim

Switzerland’s public price watchdog chief, Stefan Meierhans, also know as “Mr Price”, has taken aim at high Swiss drug prices. A report published last week shows prices of generic drugs are nearly 2.4 times more expensive in Switzerland compared to the average price across 15 european countries.

Read More »

Read More »

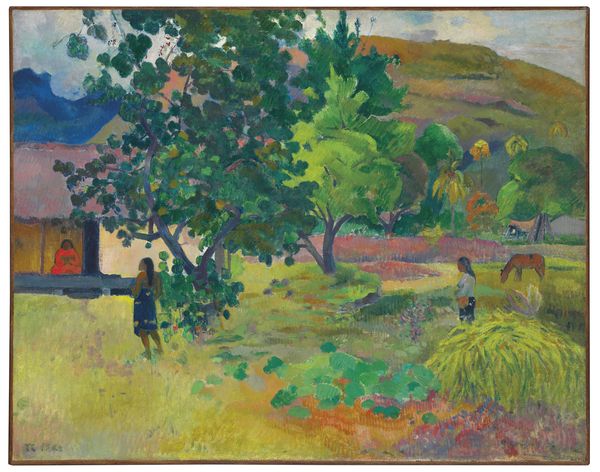

Art Market Bubble Bursting? Gauguin Priced At $85 Million Collapses 74 percent

Art Market Bubble Bursting? Russian Billionaire Takes 74% Loss On “Investment”. $85 Million Gauguin Bought By Dmitry Rybolovlev in 2008. Christie’s auctioned the work at its evening sale in London. Global art sales plummet, but China rises as ‘art superpower’. China soon to dominates global art and gold market. Art price volumes doubled since 2009. As currencies debase super rich seek out stores of value. Gold remains accessible store of value...

Read More »

Read More »

FX Daily, February 28: Markets Little Changed as Breakout is Awaited

The capital markets are becalmed, and the US dollar is in narrow trading ranges. Month-end considerations are at work, but the key event is much-awaited speech US President Trump to a joint session of Congress this evening (early Wednesday in Asia). The hope is that he provides the policy signals that allow the dollar to break out of its recent ranges.

Read More »

Read More »

The Misplaced Animosity toward Imports

Pity imports, they are misunderstood. Imports create jobs directly and indirectly. Restricting US imports would likely also curb exports.

Read More »

Read More »