Tag Archive: newslettersent

Peak Gold – Biggest Gold Story Not Being Reported

Peak gold – Biggest gold story not being reported. Gold ‘Mining Zombie Apocalypse’ caused miners to slash exploration budgets. Decline in gold production at world’s top 10 gold mining companies - Byron King. “No new big mines being built in the world today” – Glencore CEO Glasenberg. Primary global gold output declined in 2016 – Thomson Reuters via Mining.com.

Read More »

Read More »

Pressure, Sure, But From Where?

It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule.

Read More »

Read More »

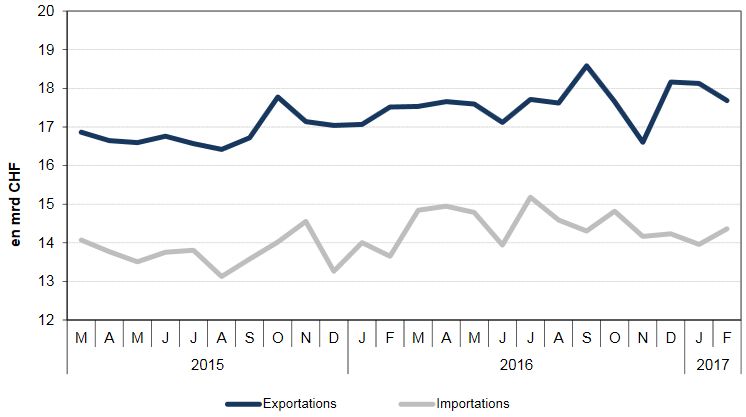

Swiss Trade Balance February 2017: Swiss imports finally rising more than exports

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

Read More »

Read More »

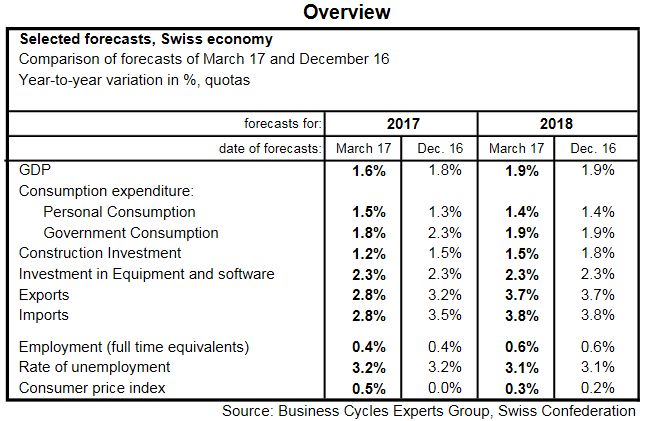

Switzerland’s economic prospects remain positive

Economic forecasts by the Federal Government’s Expert Group – spring 2017*. Swiss economic growth turned out disappointingly weak in the second half of 2016. However, the leading indicators are pointing to a clear upward trend in early 2017 and the global economy is sending out positive signals. The Federal Government’s Expert Group is therefore expecting growth in gross domestic product (GDP) to accelerate to +1.6% in 2017 (previously +1.8%) and...

Read More »

Read More »

FX Daily, March 21: Euro Recovery Continues, Posts New Six Week High Other Currencies Mixed

Growing confidence that Le Pen will not be the next president of France following the televised debate for which two polls showed Macron doing best has lifted the euro and reduced the French interest rate premium over Germany. The euro pushed through $1.0800 after initially dipping below yesterday's lows.

Read More »

Read More »

“People Need to Understand that their Biggest Asset is Individual Liberty” – an Interview with Claudio Grass

As election season is upon us in Europe and political and economic tensions are heating up, Claudio Grass notes that “the euro is the most artificial currency in history”, highlighting one of the most fundamental problems at the heart of the EU’s troubles. It is undeniable that public awareness is growing, and so is active opposition to ever greater centralization of political power.

Read More »

Read More »

The Best Ways to Invest in Gold Today

The cost of buying and selling gold. How to buy gold on the cheap. How to avoid paying capital gains tax (CGT) on your gold. Open an account with one of the online bullion dealers – the likes of GoldMoney, GoldCore or Bullion Vault. Gold Sovereigns and Gold Britannias make for a considerable saving on cost because of the CGT exemption.

Read More »

Read More »

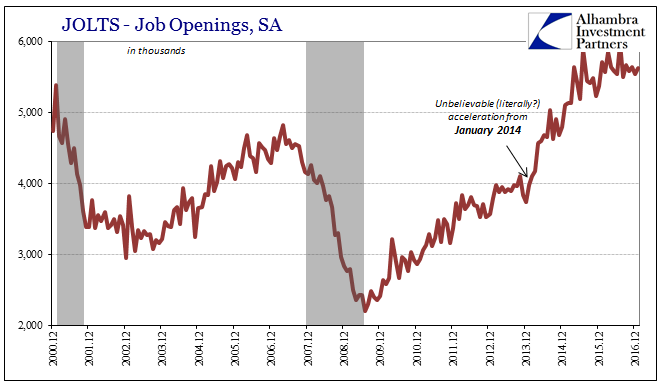

Was There Ever A ‘Skills Mismatch’? Notable Differences In Job Openings Suggest No

Perhaps the most encouraging data produced by the BLS has been within its JOLTS figures, those of Job Openings. It is one data series that policymakers watch closely and one which they purportedly value more than most. While the unemployment and participation rates can be caught up in structural labor issues (heroin and retirees), Job Openings are related to the demand for labor rather than the complications on the labor supply side.

Read More »

Read More »

Solutions Abound–on the Local Level

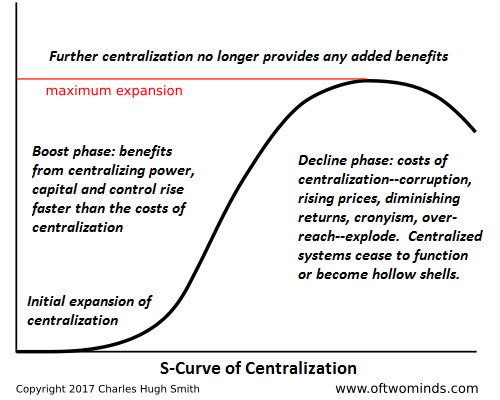

Rather than bemoan the inevitable failure of centralized "fixes," let's turn our attention and efforts to the real solutions: decentralized, networked, localized.Those looking for centralized solutions to healthcare, jobs and other "macro-problems" will suffer inevitable disappointment. The era in which further centralization provided the "solution" has passed: additional centralization (Medicare for All, No Child Left Behind, federal job training,...

Read More »

Read More »

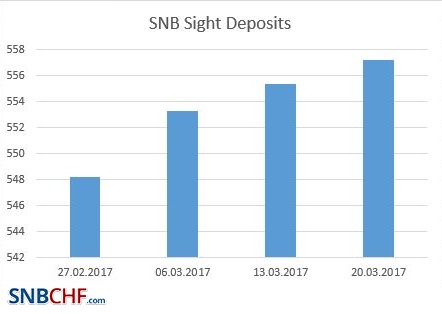

Weekly Sight Deposits and Speculative Positions: EUR/CHF suddenly higher after ECB

The EUR/CHF suddenly appreciated with the ECB meeting, when Draghi seemed less dovish than before. The rate rose from the previous 1.0650 to over 1.0750. With the SNB meeting, the EUR/CHF receded again. SNB interventions, are currently at 2 bn. per week compared to 5 bn. before Draghi.

Read More »

Read More »

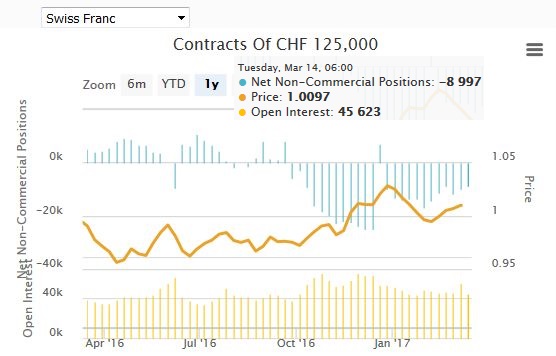

Weekly Speculative Position: After ECB, Reduction of Euro Shorts

Speculators reduced their net Euro shorts after the less dovish ECB. But the net short of CHF nearly remains stable. This resulted in an appreciation of EUR/CHF.

Read More »

Read More »

FX Weekly Preview: Divergence Theme Questioned

Recent developments have given rise to doubts over the divergence theme, which we suggested have shaped the investment climate. There are some at the ECB who suggest rates can rise before the asset purchases end. The Bank of England left rates on hold, but it was a hawkish hold, as there was a dissent in favor of an immediate rate hike, and the rest of the Monetary Policy Committee showed that their patience with both rising price prices and the...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX had a stellar week, ending on a strong note in the aftermath of what the market perceived as a dovish Fed hike Wednesday. Every EM currency except ARS was up on the week vs. USD, with the best performers ZAR, TRY, COP, and MXN. There are some risks ahead for EM this week, with many Fed speakers lined up and perhaps willing to push back against the market’s dovish take on the FOMC.

Read More »

Read More »

FX Weekly Review, March 13 – March 18: Fed Disappoints, Dollar Losses

The failure of the Fed to signal an increased pace of normalization and the prospects of other central banks raising rates spurred dollar losses, which deteriorated its technical outlook.

Read More »

Read More »

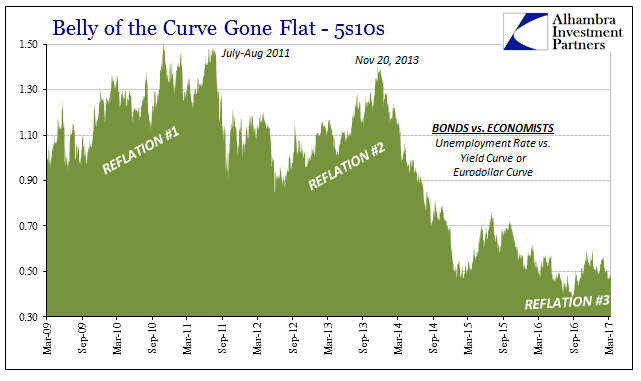

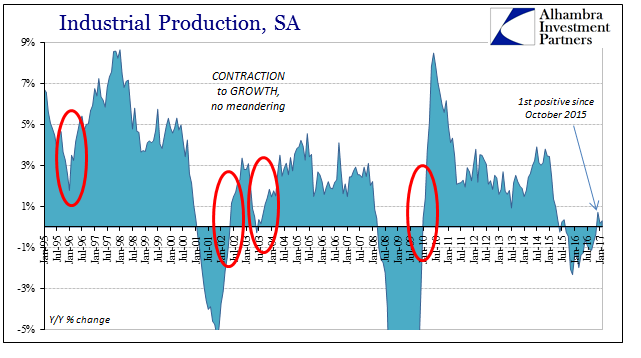

Industrial Symmetry

There has always been something like Newton’s third law observed in the business cycles of the US and other developed economies. In what is, or was, essentially symmetry, there had been until 2008 considerable correlation between the size, scope, and speed of any recovery and its antecedent downturn, or even slowdown. The relationship was so striking that it moved Milton Friedman to finally publish in 1993 his plucking model theory he had first...

Read More »

Read More »

Oil Supply Remains Resilient, Prices Heavy

Nearly half of OPEC's intended cuts are being offset by an increase in US output. The contango rewards the accumulation of inventories. The drop in oil prices probably weighs more on European reflation story than the US.

Read More »

Read More »

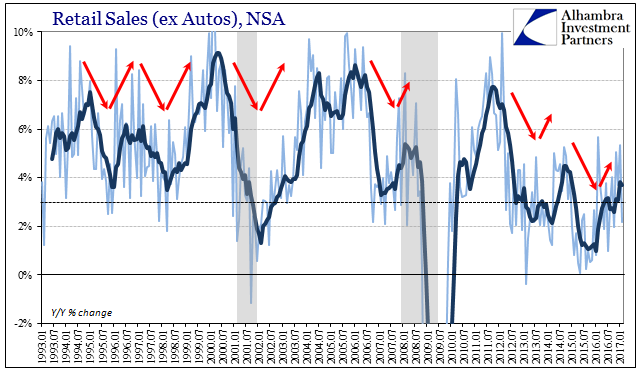

Retail Sales: Extra Day Likely, no Meaningful Difference

Retail sales comparisons were for February 2017 skewed by the extra day in February 2016. With the leap year February 29th a part of the base effect, the estimated growth rates (NSA) for this February are to some degree better than they appear. Seasonally-adjusted retail sales were in the latest estimates essentially flat when compared to the prior month (January). That leaves too much guesswork to draw any hard conclusions.

Read More »

Read More »

Welcome to Totalitarian America, President Trump!

If there had been any doubt that the land of the free and home of the brave is now a totalitarian society, the revelations that its Chief Executive Officer has been spied upon while campaigning for that office and during his brief tenure as president should now be allayed.

Read More »

Read More »