Tag Archive: newslettersent

Global Asset Allocation Update

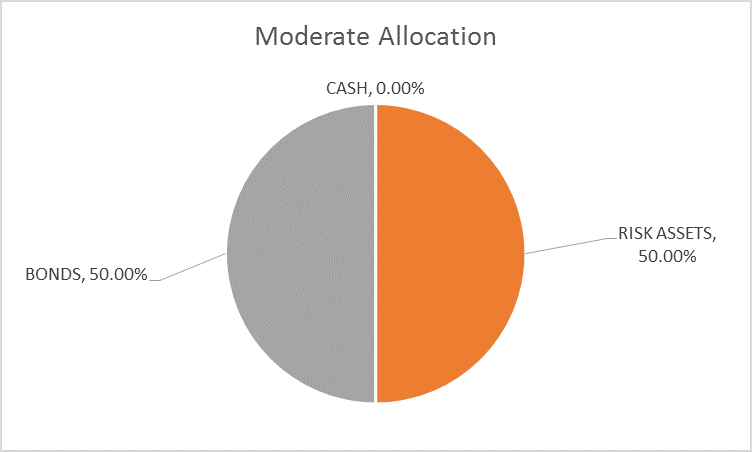

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs.

Read More »

Read More »

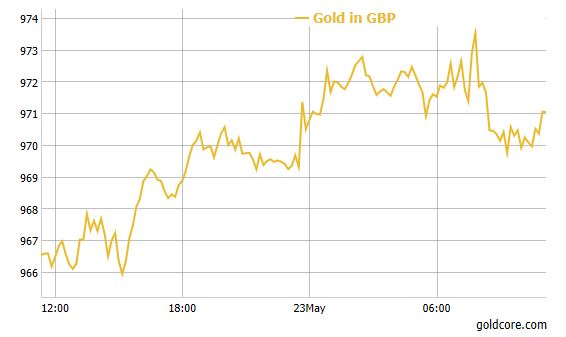

FX Daily, May 26: Anxiety Levels Rise Ahead of Weekend

The markets are unsettled. It is not so much in the magnitude of moves as the breadth of the move. The nearly 1% rally in gold is a tell, but also the inability of equity market to follow the lead of the US markets, where the S&P 500 and NASDAQ set new records. US yields are softer, and the yen is the strongest of the major currencies, up 0.7% against the greenback.

Read More »

Read More »

Poor not being pushed out of Swiss cities

It is widely believed that as the price of real estate climbs those on low incomes are forced out of city centres. A study by the University of Geneva, commissioned by the Swiss Federal Statistical Office focused on the period between 2010 and 2014, shows this is not true in Switzerland.

Read More »

Read More »

Great Graphic: OIl and the S&P 500

The fluctuation of oil prices is often cited as an important factor driving equities. Our work shows that this is not always the case and that the correlation between the price of oil and the S&P 500 continues to ease.

Read More »

Read More »

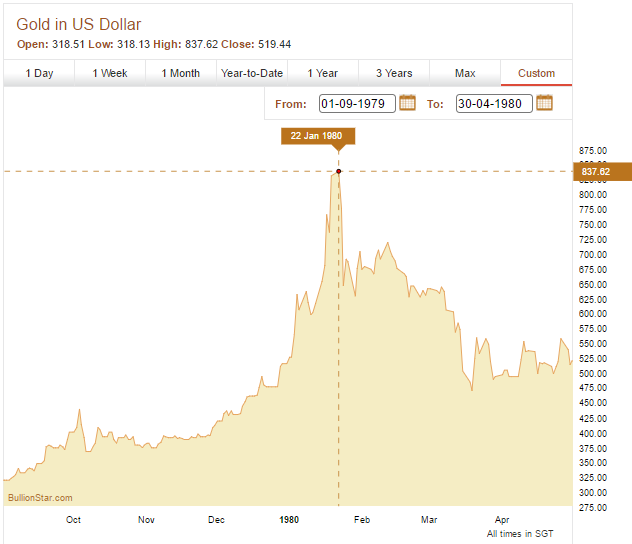

New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil

This is Part 2 of a two-part series. The series focuses on collusive discussions and meetings that took place between the world’s most powerful central bankers in late 1979 and 1980 in an attempt to launch a central bank Gold Pool cartel to manipulate and control the free market price of gold. The meetings centered around the Bank for International Settlements (BIS) in Basle, Switzerland.

Read More »

Read More »

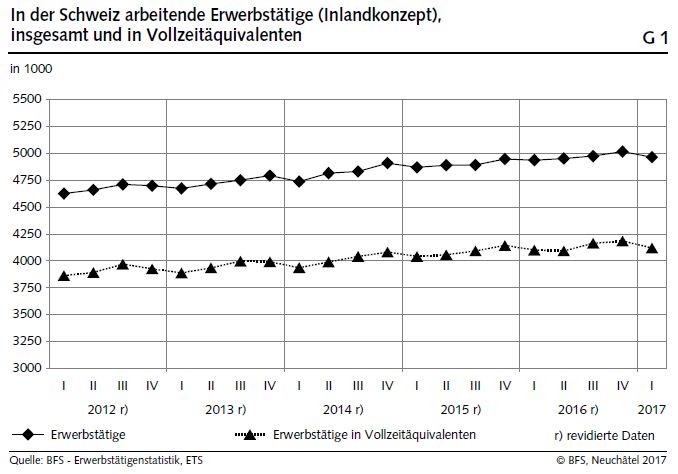

Swiss Labour Force Survey 1th quarter 2017: Number of employed persons +0.6 percent; unemployment rate (ILO) 5.3 percent

The number of employed persons in Switzerland rose by 0.6% between the 1st quarters of 2016 and 2017. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) remained stable at 5.3%. The EU's unemployment rate fell from 9.2 % to 8.4 %. These are some of the results of the Swiss Labour Force Survey conducted by the Federal Statistical Office (FSO). The results of the SLFS 2010-2016 have been revised...

Read More »

Read More »

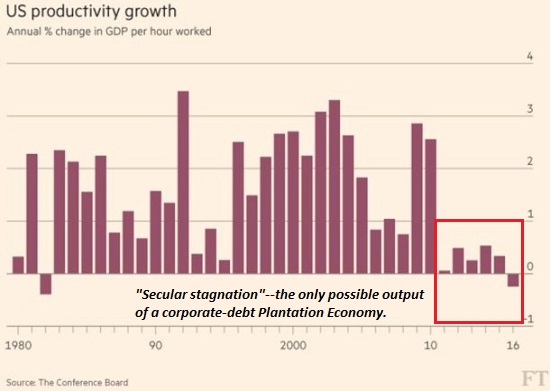

State of Denial: The Economy No Longer Works As It Did in the Past

If there is one reality that is denied or obscured by the Status Quo, it is that the economy no longer works as it did in the past. This is the fundamental economic context of our current slide into political-social disintegration.

Read More »

Read More »

FX Daily, May 25: Euro Strength more than Dollar Weakness

The Dollar Index is heavy, just above the lows set earlier this week set near 96.80. However, this exaggerates the dollar's weakness because the weight of the euro and currencies that shadow it, like the Swiss franc and Swedish krona. As the North American session is about to start, the dollar is higher against the dollar-bloc currencies and the Japanese yen.

Read More »

Read More »

Swiss rated third in health services quality survey

Switzerland has been rated third in a global ranking of the access to and the quality of healthcare systems – a report that shows large gaps between the best and worst ranked countries. The survey, published online on Thursday in the medical journal The Lancetexternal link, looked at healthcare quality in 195 countries.

Read More »

Read More »

Bern train station to expand to meet growing rail traffic

Bern railway station, Switzerland’s second busiest after Zurich, is set to expand with the creation of a new underground rail station serving regional trains between Bern and Solothurn. A pedestrian access area is also planned.Some 202,000 passengers pass through Bern’s main train station – the second largest in Switzerland – every working day of the week.

Read More »

Read More »

Manchester Attack Sees Asian Stocks Fall, Gold Firm

The appalling attack in Manchester overnight in which over 22 people have been killed has led to a slight uptick in risk aversion in markets. Investors are cautious after police said they were treating a bombing at a concert in the Manchester Arena as a “terrorist incident”.

Read More »

Read More »

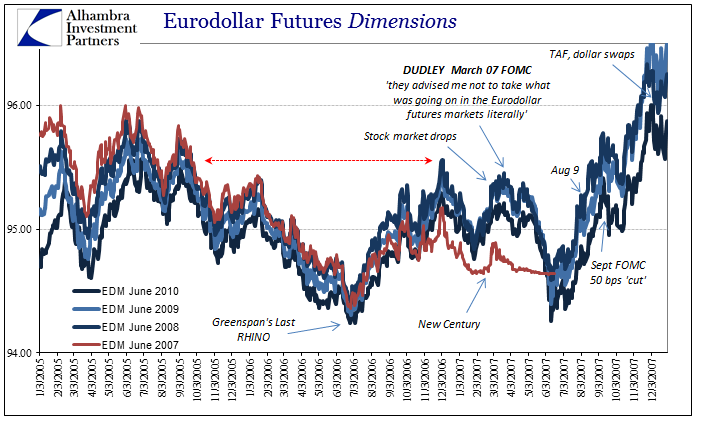

Less Than Nothing

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs.

Read More »

Read More »

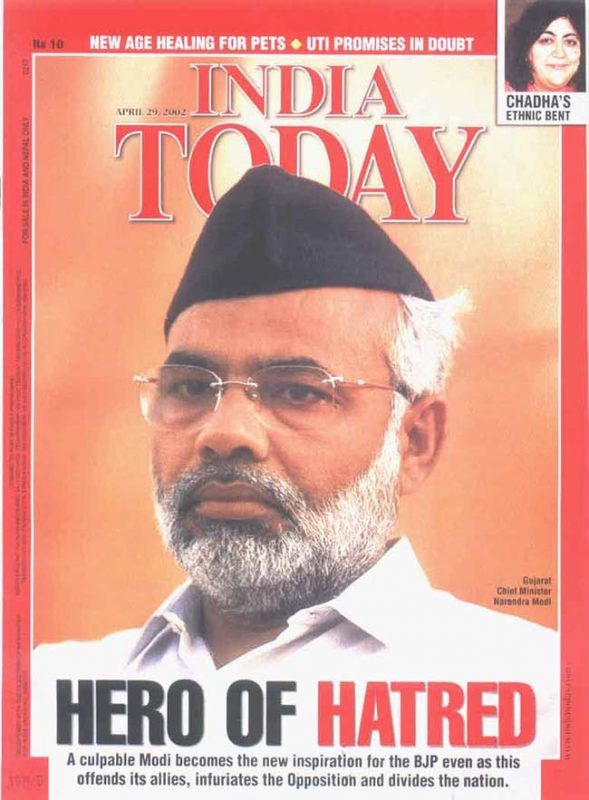

India: Why its Attempt to Go Digital Will Fail

Over the three years in which Narendra Modi has been in power, his support base has continued to increase. Indian institutions — including the courts and the media — now toe his line. The President, otherwise a ceremonial rubber-stamp post, but the last obstacle keeping Modi from implementing a police state, comes up for re-election by a vote of the legislative houses in July 2017.

Read More »

Read More »

FX Daily, May 24: Dollar Consolidates, While Market Shrugs Off China Downgrade

After staging a modest recovery in North America yesterday afternoon, the greenback is consolidating in narrow ranges. Momentum traders, who appeared to dominate activity recently, paused. To be sure, the greenbacks upticks have been modest, and little technical damage has been inflicting on the major foreign currencies.

Read More »

Read More »

Poverty in Switzerland has more to do with age than any other factor

A recent report classifies 570,000 people in Switzerland as poor. This number represents 7% of the population, and relates to 2015. In 2014, the same percentage was 6.6%. The report, which looks only at income, defines as poor a single person with income less than CHF 2,239 per month or a family of four with income below CHF 3,984 per month.

Read More »

Read More »

Four Numbers to Watch in FX

The dollar's downside momentum faded today, but it has not shown that it has legs. Watch 96.45 in the DXY and $1.3055 in sterling. The US 2-year note yield is low, given expectations for overnight money. The US premium needs to widen.

Read More »

Read More »

Novartis to shed 500 jobs in Basel

The Swiss pharmaceutical giant Novartis has announced that it plans to cut 500 jobs at its Basel headquarters in Switzerland over the next 18 months. It says it will also create 350 new posts, mostly in its biotech business. Novartis said in a statement on Thursday that it planned to cut up to 500 jobs in the Basel area or to relocate workers to other sites over the next 18 months.

Read More »

Read More »

Gold Investment Is the Ultimate Guide for Tech Investors In 500 Words

Tech is the umbrella word for all things fashionable to invest in right now. Take the recent flotation of Snap Inc. (parent company of teen and narcissists’ favourite app SnapChat), everyone wanted in on the $20 billion flotation. Snap is likely a sign of a tech bubble that will cost a lot of savers and investors huge amounts of money … again.

Read More »

Read More »

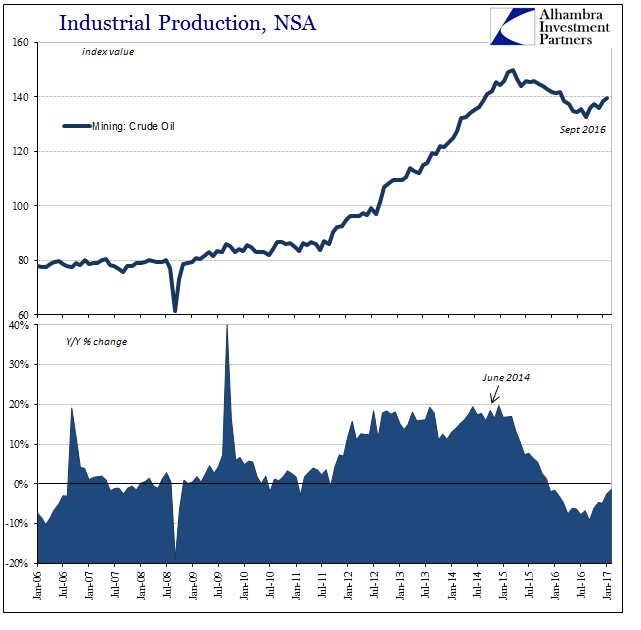

Commodity and Oil Prices: Staying Suck

The rebound in commodity prices is not difficult to understand, perhaps even sympathize with. With everything so depressed early last year, if it turned out to be no big deal in the end then there was a killing to be made. That’s what markets are supposed to do, entice those with liquidity to buy when there is blood in the streets. And if those speculators turn out to be wrong, then we are all much the wiser for their pain.

Read More »

Read More »

FX Daily, May 23: Greenback Remains Soft

The US dollar cannot get out of its own way, it seems. With a light economic schedule, there is little to offset the continued drumbeat of troubling political developments. The latest turn, as reported first in the Washington Post, that President Trump asked heads of intelligence groups to also publicly deny collusion with Russia.

Read More »

Read More »