Tag Archive: newslettersent

Deposit Bail In Risk as Spanish Bank’s Stocks and Bonds Crash

Deposit bail in risk as stocks and bonds of Spanish bank – Banco Popular – crash. Banco Popular stock crashes most on record – down 63% this year to 34 euro cents. Spanish bank tells employees – “Don’t panic”. Risk of Spanish banking crisis as Banco Popular credit curve inverts. Banco Popular needs to find at least €4 billion more capital – analysts.

Read More »

Read More »

The Path to Inflation: “Helicopter Money”

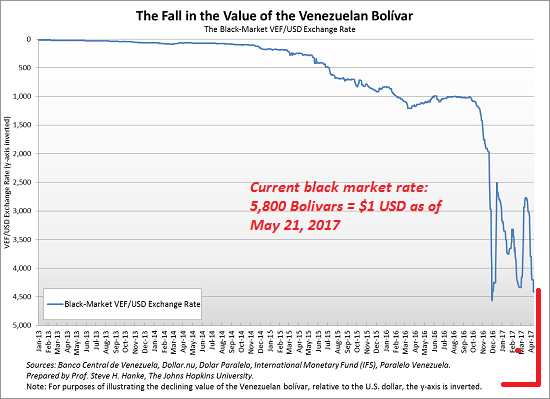

Yet conventional economists are virtually unanimous that deflation is the danger and inflation is a "good thing" we need to spur so servicing existing debt becomes easier for debtors. Due to the deflationary pressures of technology and stagnant wages for the bottom 90%, the consensus sees low inflation as far as the eye can see.

Read More »

Read More »

Great Graphic: Don’t be Misled by Sterling Stability, Investors are Concerned

The Great Graphic, created on Bloomberg, shows the options skew (three-month 25 delta risk reversal) in the white line, and sterling is the yellow line. The takeaway is that the market appears to be more nervous than the relatively firm sterling in the spot market suggests. Typically, one might expect those with sterling exposure to sell calls (and receive funds) rather than buy puts (new expenditure).

Read More »

Read More »

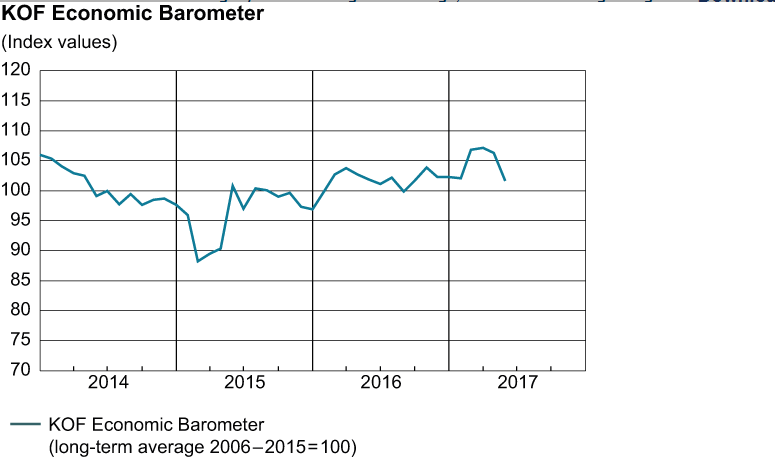

The SNB’s Currency Interventions

On the FT’s Alphaville blog, Matthew Klein reviews Swiss monetary policy over the last years and its effect on the real economy. He concludes that - it seems the SNB’s relentless accumulation of foreign assets has been pointless — at best. More likely, the behaviour qualifies as predatory mercantilism at the expense of the rest of the world, especially Switzerland’s hard-hit neighbours.

Read More »

Read More »

FX Daily, June 05: US Dollar Starts Important Week Mostly Stable to Higher

The US dollar is beginning what promises to be an important week on a steady to firmer note against most of the major currencies. It is a holiday in parts of Europe (e.g.,m Germany and Switzerland). Although excitement is not until Thursday's ECB meeting, UK election, and the testimony of former US FBI Director Comey, there are several developments today to note.

Read More »

Read More »

Switzerland: Man Convicted For “Liking” Apparently Slanderous Facebook Comments

In the United States, a crazed racist is currently facing murder charges for stabbing multiple men who attempted to stop him from harassing two teenage girls. In a court appearance, he justified his murder of two Americans, one a military veteran, by citing “free speech.”

Read More »

Read More »

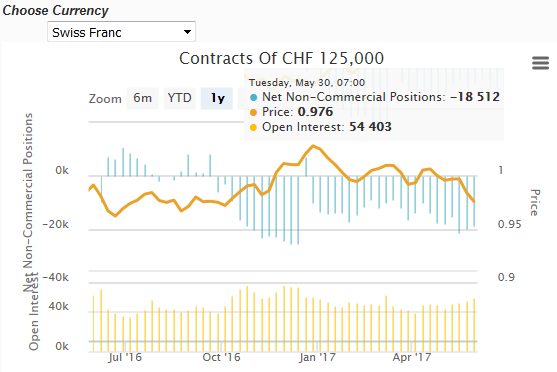

Weekly Speculative Positions (as of May 30): Speculators make Small Adjustments, but Like that Peso

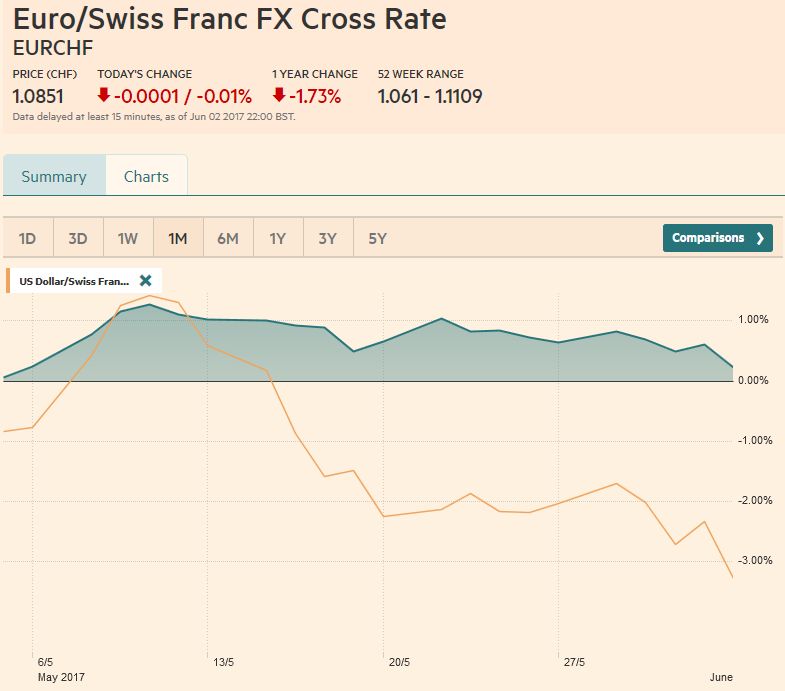

The net short CHF position has fallen from 19.8 short to 18.5K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. Speculators in the future market made mostly minor adjustment in the gross positioning in the currencies.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed last week on a firm note as weak US jobs data supported the notion that the Fed will find it hard to tighten in H2. No major US data will be reported this week and the FOMC embargo for the June 14will be in effect. As such, there is little on the near-term horizon that might help the dollar, so it’s likely to remain on the defensive this week.

Read More »

Read More »

FX Weekly Preview: ECB Meeting and UK Election Key Drivers in Week Ahead

ECB may take a baby step toward the exit of extraordinary monetary policy by confirming rates are unlikely to be cut further and the risks are roughly balanced. UK election is coming down to the wire. In the US, former FBI director Comey is set to testify, and leaks of two Fed appointments overshadow mostly second-tier economic data.

Read More »

Read More »

Sweeteners proposed for revised corporate tax reform

The government will consider a package of voter-friendly sweeteners, including extra child benefits, as it strives to breathe new life into controversial company tax reforms. The new proposals come less than four months after Swiss voters rejected a major overhaul of the corporation tax landscape.

Read More »

Read More »

Switzerland remains competitive despite issues

The strong franc and corporate tax uncertainty have failed to dislodge Switzerland from second place in an annual ranking of the world’s most competitive economies. The alpine state was also judged by the Lausanne-based IMD business school to have the world’s eighth best digital capability. For the second year in a row, Switzerland was only outclassed by Hong Kong in the 2017 IMD World Competitiveness Yearbookexternal link, released on Wednesday.

Read More »

Read More »

Great Graphic: Iron Ore and the Australian Dollar

This Great Graphic, from Bloomberg, shows the correlation between the price of iron ore and the Australian dollar on a rolling 60-day basis over the past year. The correlation is a little more than 0.81. The relationship is the tightest since last August. This is purely directional.

Read More »

Read More »

Uncertainty Thanks to Twitter and UK Elections

Gold hits five-week high. Reaches $1,273.74/oz, highest since April 25th. Sterling recovers after UK polls point towards a hung Parliament. Expected Fed-tightening capped gains. 90-dead in Kabul, further signs of increasing tension in Middle East. Trump expected to pull out of Paris Accord and Trump’s anti-Iran axis already feuding.

Read More »

Read More »

How Debt-Asset Bubbles Implode: The Supernova Model of Financial Collapse

Gravity eventually overpowers financial fakery. When debt-asset bubbles expand at rates far above the expansion of earnings and real-world productive wealth, their collapse is inevitable. The Supernova model of financial collapse is one way to understand this. As I noted yesterday in Will the Crazy Global Debt Bubble Ever End?, I've used the Supernova analogy for years, but didn't properly explain why it illuminates the dynamics of financial...

Read More »

Read More »

FX Weekly Review, May 29 – June 03: Dollar Dogged by Disappointing Data

While the Euro traded in the range between 1.08 and 1.09, the dollar declined by nearly 3%. The technical indicators warn that the US dollar is stretched, but the combination of disappointing auto sales and jobs report may deny it the interest rate support needed to facilitate a resumption of the bull market.

Read More »

Read More »

Emerging Markets: What has Changed

The Indonesian cabinet is discussing revisions to the 2017 state budget. The Thai central bank plans to reform some FX rules. South African President Zuma survived the no confidence vote within his own ANC. Brazil’s central bank signaled a slower pace of easing ahead after it cut 100 bp again. Moody’s cut the outlook on Brazil’s Ba2 rating from stable to negative.

Read More »

Read More »

Mortgage reference rate falls opening way for Swiss rent cuts

Every three months the rate of interest used to set Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time it dropped 0.25% to 1.50%. The interest rate used to set the reference rate was the average rate on Swiss mortgages at 31 March 2017 of 1.61% which rounds to 1.50% under the rounding rules, which round to the nearest quarter of a percent.

Read More »

Read More »

Swiss farmers reject palm oil cow supplements

The Swiss Farmers’ Association has called on members to stop feeding dairy cows supplements that contain palm oil. The revelation has embarrassed the organisation that has been fighting against palm oil imports from Asia.

Read More »

Read More »

Great Graphic: US Rate Curve and the Euro

This Great Graphic was created on Bloomberg. It shows two times series. The yellow line and the left-hand scale show the euro's exchange rate against the dollar for the past year. The white line depicts the spread between the US two-year and 10-year yield.

Read More »

Read More »