Tag Archive: newslettersent

Higher Swiss health premiums for those with big deductables

The Swiss government announced plans to reduce the discounts offered to those willing to risk paying the first chunk of their annual medical bills. It also plans to adjust deductibles in line with shifts in medical costs. This will be discussed until 19 October 2017.

Read More »

Read More »

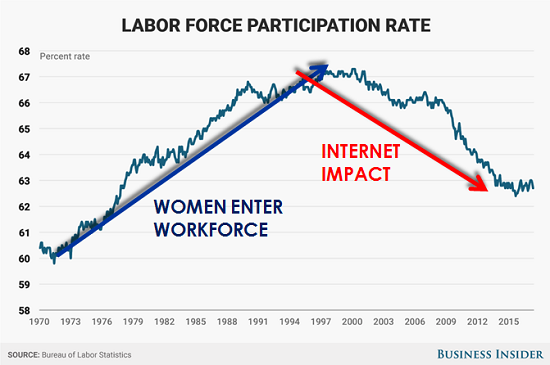

Automation’s Destruction of Jobs: You Ain’t Seen Nothing Yet

Automation--networked robotics, software and processes--has already had a major impact on jobs. As this chart from my colleague Gordon T. Long illustrates, the rise of Internet technologies is reflected in the steady, long-term decline of the labor force participation rate-- the percentage of the populace that is actively in the labor market.

Read More »

Read More »

FX Daily, June 29: Run on Dollar and Yen Continues

The main driver of the foreign exchange market is the continued reassessment of the trajectory of monetary policy in the UK, EMU, and Canada. The OIS market does not show that higher rates are discounted for the next policy meeting (August, September, and July respectively), but rather there is greater confidence that, outside of Japan, peak monetary stimulus is behind us.

Read More »

Read More »

L’apartheid financier, une perversité du Système. Une de plus… Liliane Held-Khawam + Article de la Tribune

Economie de marché et libre-échange constituent, en théorie, les bases du Système commercial international. Ce système est supposé offrir une liberté équivalente à TOUS les agents économiques du marché mondialisé… Ceci est la théorie… Dans la vraie vie, les discriminations entre grandes entreprises et PME, entre l’industrie mondialisée et l’artisanat /agriculture, entre les entreprises industrialisées et celles à capital familial, … n’ont jamais...

Read More »

Read More »

Government considers easing off on traffic offenders

The decision came in response to a parliamentary demand that cabinet reconsider the terms of a road safety program called Via Sicura, introduced in 2013 in a bit to tackle road accidents.

Read More »

Read More »

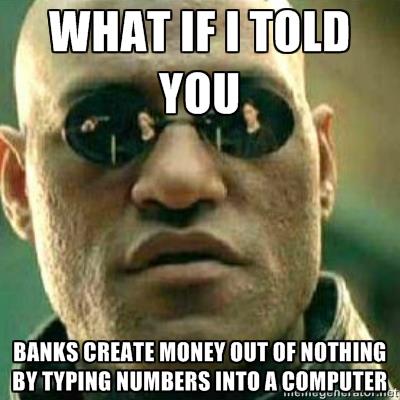

The Ultimate Regulatory Reform: Abolish Fractional Reserve Banking!

The Trump Administration has presented the first part of its plan to overhaul a number of Wall Street financial regulations, many of which were enacted in the wake of the 2008 financial crisis. The report is in response to Executive Order 13772 in which the US Treasury Department is to provide findings “examining the United States’ financial regulatory system and detailing executive actions and regulatory changes that can be immediately undertaken...

Read More »

Read More »

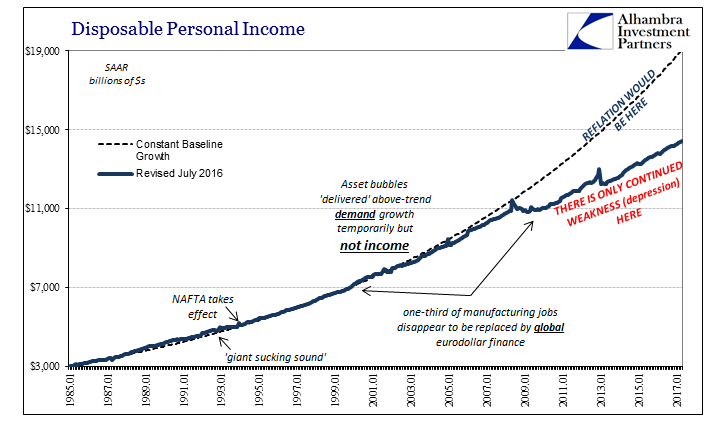

Fading Further and Further Back Toward 2016

Earlier this month, the BEA estimated that Disposable Personal Income in the US was $14.4 trillion (SAAR) for April 2017. If the unemployment rate were truly 4.3% as the BLS says, there is no way DPI would be anywhere near to that low level. It would instead total closer to the pre-crisis baseline which in April would have been $19.0 trillion. Even if we factor retiring Baby Boomers in a realistic manner, say $18 trillion instead, what does the...

Read More »

Read More »

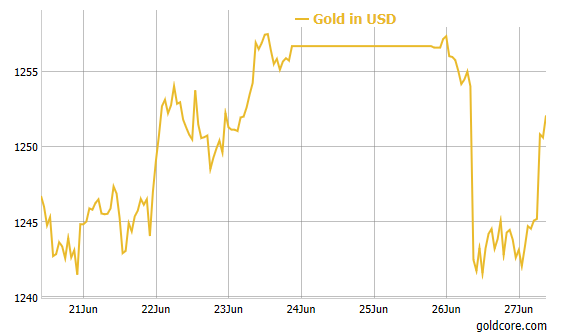

FX Daily, June 28: Draghi’s Sparks Mini Taper Tantrum, Euro Chief Beneficiary

Sounding confident, ECB President Draghi seemed prepared to reduce the asset purchases, and this overshadowed his explicit recognition that substantial accommodation is still necessary. This is very much in line with what many, including ourselves, anticipate: At the September ECB meeting, an extension of the asset purchases into the first part of next year, coupled with a reduction in the amounts being purchased.

Read More »

Read More »

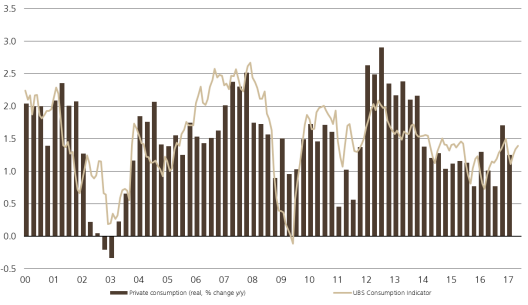

Switzerland UBS Consumption Indicator May: Down slightly

The UBS consumption indicator registered 1.39 points in May, suggesting slightly below-average growth in private consumption. This matches the UBS CIO consumption growth forecast of 1.3% in 2017. The data published in June regarding new car registrations and hotel overnight stays by Swiss residents was robust and supported the consumption indicator.

Read More »

Read More »

Great Graphic: Dollar Breaks Out Against Yen

The dollar is at new lows for the year against the euro and Swiss franc. Draghi's comments earlier that transitory forces are dampening price pressures were seen as broadly similar to the Fed's leadership's assessment about US prices. The implication is that the ECB will announce tapering its purchases as it extends them into next year.

Read More »

Read More »

Swiss companies’ computers held for ransom in global hack attack

Swiss advertising conglomerate Admeira and six other Swiss companies are among those who fell victim to the latest global cyberattack demanding payment in Bitcoin in exchange for the return of hacked files and computer systems. According to Admeira Head of Communications Romi Hofer, the first sign that something was wrong was when “screens went blank” at the company on Tuesday afternoon.

Read More »

Read More »

Great Graphic: US Wage Growth Exceeds Productivity Growth

One of the longstanding challenges to growth US aggregate demand has been that wages have not kept pace with inflation and productivity. The decoupling appears to have taken place in the late 1960s or early 1970s depending on exactly which metric one uses.In my book, the Political Economy of Tomorrow, I argue the decoupling of men's wages from productivity and inflation made it possible and necessary for women to enter the workforce in large...

Read More »

Read More »

Now China’s Curve

Suddenly central banks are mesmerized by yield curves. One of the jokes around this place is that economists just don’t get the bond market. If it was only a joke. Alan Greenspan’s “conundrum” more than a decade ago wasn’t the end of the matter but merely the beginning. After spending almost the entire time in between then and now on monetary “stimulus” of the traditional variety, only now are authorities paying close attention.

Read More »

Read More »

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

FX Daily, June 27: Euro Surges on Draghi, While Yuan Rises on Suspected PBOC Action

ECB President Draghi told the audience at the annual ECB Forum transitory factors were holding back inflation. This was quickly understood to be bullish for the euro, and it rallied from near the session lows below $1.12 to around $1.1260, a nine-day high.

Read More »

Read More »

Activist fund aims to spur ‘staid’ Nestle into action

Mark Schneider, Nestlé chief executive, addressed a conference in Berlin last week. "Size alone won't protect you from change," he told the Consumer Goods Forum and, after listing the challenges facing the industry, added that "status quo is not an option".

Read More »

Read More »

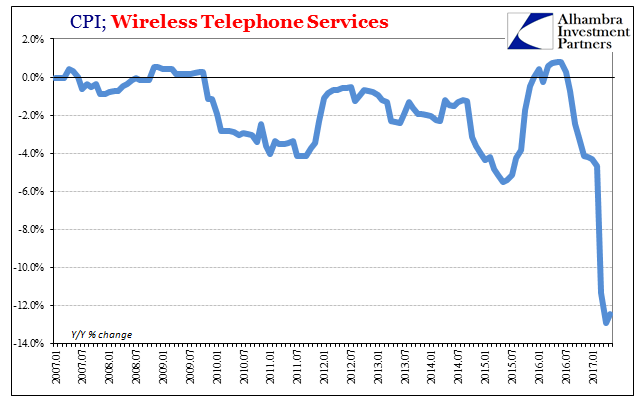

More Pieces of Impossible

On his company’s earnings conference call back on Valentine’s Day, T-Mobile CEO John Legere was unusually feisty. Never known for shyness, Legere had reason behind his bluster. T-Mobile had practically built itself up on price, being left the bottom tier of the wireless space practically to itself. That all changed, however, as both Verizon and Sprint were set to escalate the wireless price war.

Read More »

Read More »