Tag Archive: newslettersent

The Swiss National Bank Owns $80 Billion In US Stocks – Here’s The Catch

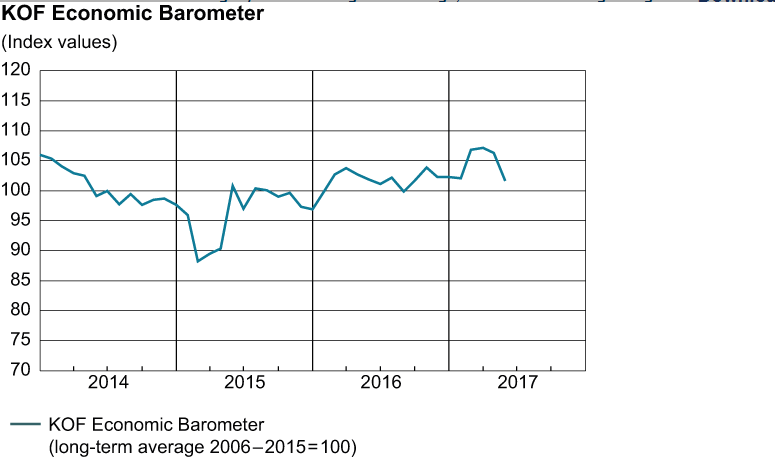

Switzerland is a small country of just 8 million people, but they make an outsized impact on economics and finance and money. Because Switzerland is considered a safe haven and a well-run country, many people would like to hold large amounts of their assets in the Swiss franc. This makes the Swiss franc intolerably strong for Swiss businesses and citizens. So the Swiss National Bank (SNB) has to print a great deal of money and use nonconventional...

Read More »

Read More »

FX Daily, July 03: Dollar Bounces to Start H2

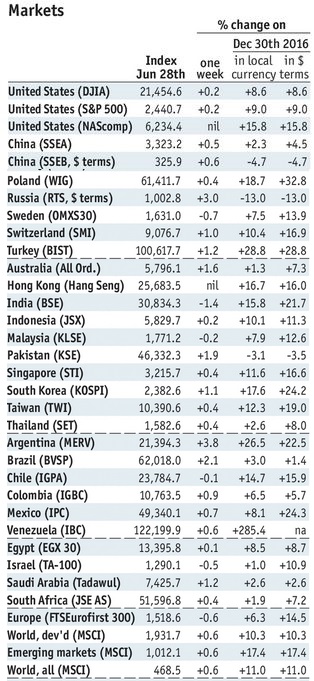

The beleaguered US dollar is enjoying a respite from the selling pressure that pushed it lower against all the major currencies in the first six months of 2017. A measure of the dollar on a trade-weighted basis fell about 5% in the first half after appreciating nearly 8% in Q4 16.

Read More »

Read More »

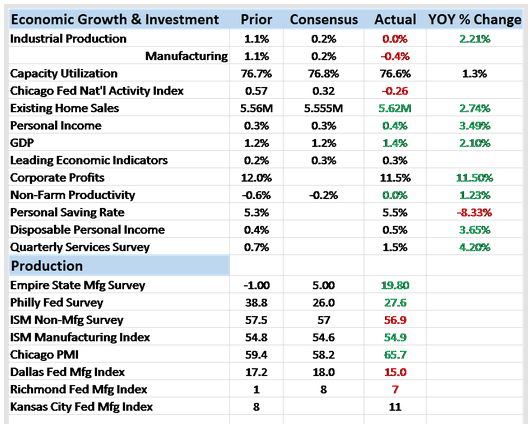

Bi-Weekly Economic Review: Draghi Moves Markets

In my last update two weeks ago I commented on the continued weakness in the economic data. The economic surprises were overwhelmingly negative and our market based indicators confirmed that weakness. This week the surprises are not in the economic data but in the indicators. And surprising as well is the source of the outbreak of optimism in the bond market and the yield curve.

Read More »

Read More »

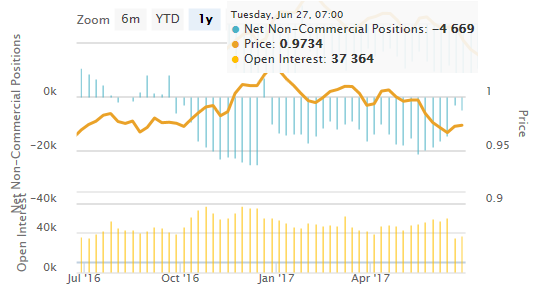

Weekly Speculative Positions (as of June 27): Speculators Scramble to Cover Short Canadian Dollar and Mexican Peso Futures

The net short CHF position has risen from 3k short to 4.7k contracts short (against USD). Speculators bought back previously sold Canadian dollar and Mexican peso futures positions in dramatic fashion in the CFTC reporting week ending June 27.

Read More »

Read More »

FX Weekly Preview: Official Coordination or Is the Market Getting Ahead of Itself?

The consensus narrative sees a coordinated attempt by officials to prepare investors for less accommodative monetary policy. Data from the eurozone and UK may suggest the respective economies are not accelerating. Before getting to the jobs report, the US economic data, like auto sales, may be soft, while the prices paid in the manufacturing ISM may ease.

Read More »

Read More »

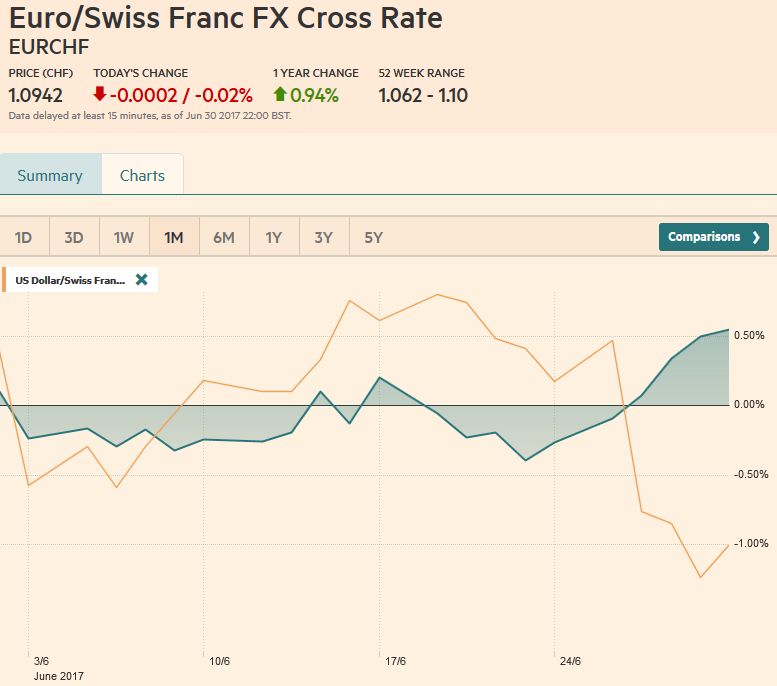

FX Weekly Review, June 26 – July 01: Normalization Ideas Weigh on Greenback

A virus has spread across the markets as the first half drew to a close. Many investors have become giddy. The low vol environment was punctuated by ideas that peak in monetary accommodation is past and that the gradual process of normalization is beginning.

Read More »

Read More »

Chocolate industry makes pact to improve conditions

Switzerland’s chocolate producers have launched the Swiss Platform for Sustainable Cocoa, a joint project to bring about a more sustainable industry and better conditions for cocoa producers.Members of the new sustainable cocoa platform have set and pledged to work towards ten strategic objectives. The key target is one stipulating that by 2025, at least 80% of imported cocoa products should come from sustainable production.The project was...

Read More »

Read More »

Le Système n’est pas libéral. Il est liberticide. Liliane Held-Khawam + les top 5 de la pub en ligne

Cette information est très importante et dépasse le cadre simple du secteur de la publicité en ligne.

Read More »

Read More »

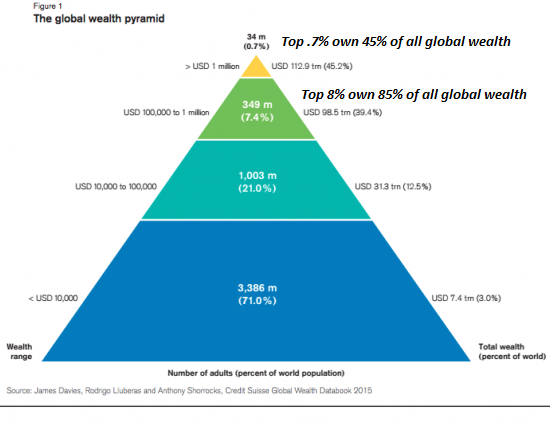

If We Don’t Change the Way Money Is Created, Rising Inequality and Social Disorder Are Inevitable

Centrally issued money optimizes inequality, monopoly, cronyism, stagnation and systemic instability. Everyone who wants to reduce wealth and income inequality with more regulations and taxes is missing the key dynamic: central banks' monopoly on creating and issuing money widens wealth inequality, as those with access to newly issued money can always outbid the rest of us to buy the engines of wealth creation.

Read More »

Read More »

Brazil’s Reasons

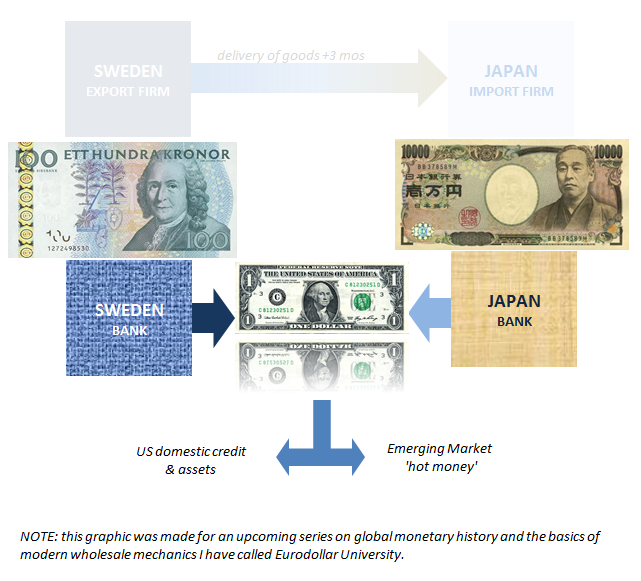

Brazil is another one of those topics which doesn’t seem to merit much scrutiny apart from morbid curiosity. Like swap spreads or Japanese bank currency redistribution tendencies, it is sometimes hard to see the connection for US-based or just generically DM investors. Unless you set out to buy an emerging market ETF heavily weighted in the direction of South America, Brazil’s problems can seem a world away.

Read More »

Read More »

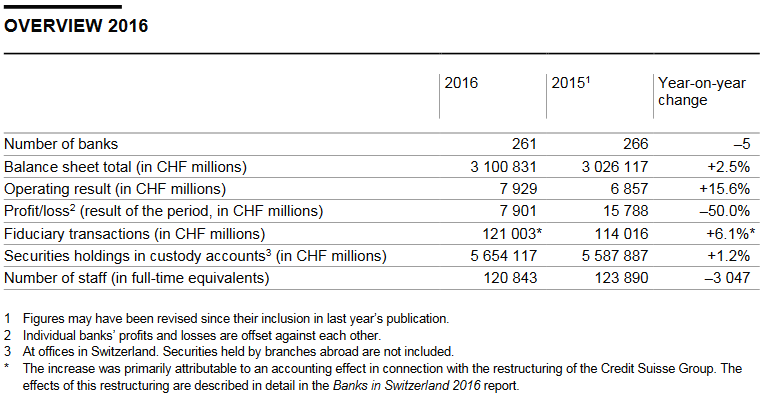

Banks in Switzerland 2016

Summary of the 2016 banking year. In 2016, 226 of the 261 banks in Switzerland reported a profit, taking total profit to CHF 11.8 billion. The remaining 35 institutions recorded an aggregate loss of CHF 3.9 billion. The result of the period for all banks was thus CHF 7.9 billion.

Read More »

Read More »

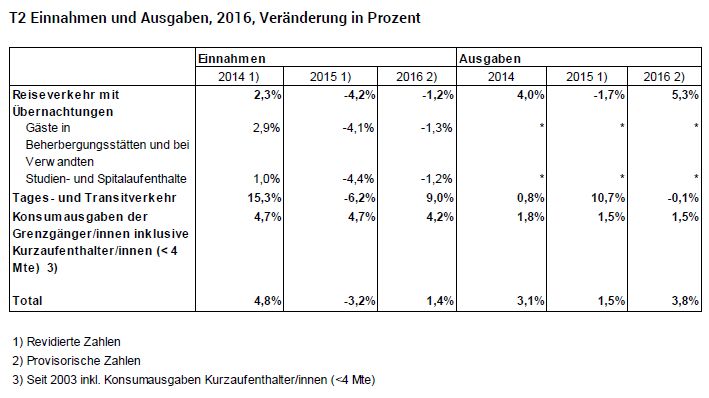

Tourism balance of payments 2016: Negative in 2016

For the first time in its history, the tourism balance of payments was negative in 2016. Expenditure by Swiss residents during visits abroad exceeded the expenditure of non-residents during their stay in Switzerland. The former spent CHF 16.3 billion abroad in 2016, 3.8% more than in 2015. Expenditure by the latter in Switzerland rose by 1.4% to CHF 16 billion. In an economic climate marked by a strong franc, the tourism balance of payments was CHF...

Read More »

Read More »

Emerging Markets: What has Changed

Chinese President Xi visited Hong Kong for the first time. The US has proposed $1.3 bln of arms sales to Taiwan. The Egyptian government raised fuel and cooking gas prices. significantly as part of the IMF program. South Africa’s parliament has scheduled the no confidence vote on President Zuma. Brazil’s central bank lowered its inflation target. Brazil after President Temer was charged with corruption.

Read More »

Read More »

Swiss Rail to launch app that lets you pay when you arrive

Swiss Rail plans to test a new smartphone app that will charge you when you arrive. The app will automatically search for the cheapest fare once the journey has ended, promising users the lowest possible fare. The new app, which will be added to Mobile Preview, will be tested in 2018.

Read More »

Read More »

Basic China Money Math Still Doesn’t Add Up To A Solution

There are four basic categories to the PBOC’s balance sheet, two each on the asset and liability sides of the ledger. The latter is the money side, composed mainly of actual, physical currency and the ledger balances of bank reserves. Opposing them is forex assets in possession of the central bank and everything else denominated in RMB.

Read More »

Read More »

Work is for Idiots

Disproportionate Rewards. The International Monetary Fund reported an unpleasant outlook for the U.S. economy on Wednesday. The IMF, as part of its annual review, believes the U.S. economic model isn’t working as well as it could to generate shared income growth.

Read More »

Read More »

FX Daily, June 30: Greenback Stabilizes

The US dollar has been battered this week amid a shift in sentiment seen in how the market responded to comments mostly emanating from the ECB's annual conference. It is not really clear that Draghi or Carney gave new policy indications.

Read More »

Read More »

Chocolate industry makes pact to improve conditions

Members of the new sustainable cocoa platform have set and pledged to work towards ten strategic objectives. The key target is one stipulating that by 2025, at least 80% of imported cocoa products should come from sustainable production.

Read More »

Read More »

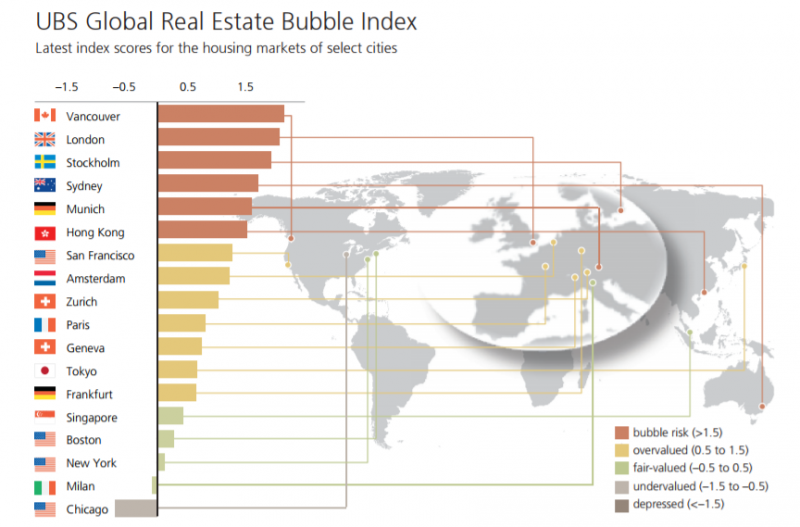

London Property Bubble Bursting? UK In Unchartered Territory On Brexit and Election Mess

Is the London property market heading for tough times? The most recent housing figures and a new Bank of England report suggest it may well be. Recent figures show that 77% of London houses sold in May went at below asking price, up from 72% in April.

Read More »

Read More »